Lowered the minimum loan size for certain loans to $500,000

federalreserve.gov/newsevents/pre…

New: $500K Minimum Loan Size

Priority: Ditto

Expanded: $10M Minimum Loan Size & up to a TON!

New: Max = lesser of $25M or 4x 2019 EBITDA

Priority: Max = lesser of $25M or 6x 2019 EBITDA

&

for all 3, payments deferred for yr 1

Loan Facility=MSELF"

On May 15, Federal Reserve: "The Board continues to expect that the MSELF will not result in losses to the Federal Reserve." I too will not blame MSELF!

federalreserve.gov/publications/f…

The SPV will buy 95% participations in Eligible Loans from

Eligible Lenders. Those Lenders will keep 5% of each Loan.

federalreserve.gov/monetarypolicy…

The Business must EITHER have (a) 15,000 employees or fewer, or (b) 2019 annual revenues of $5B or less.

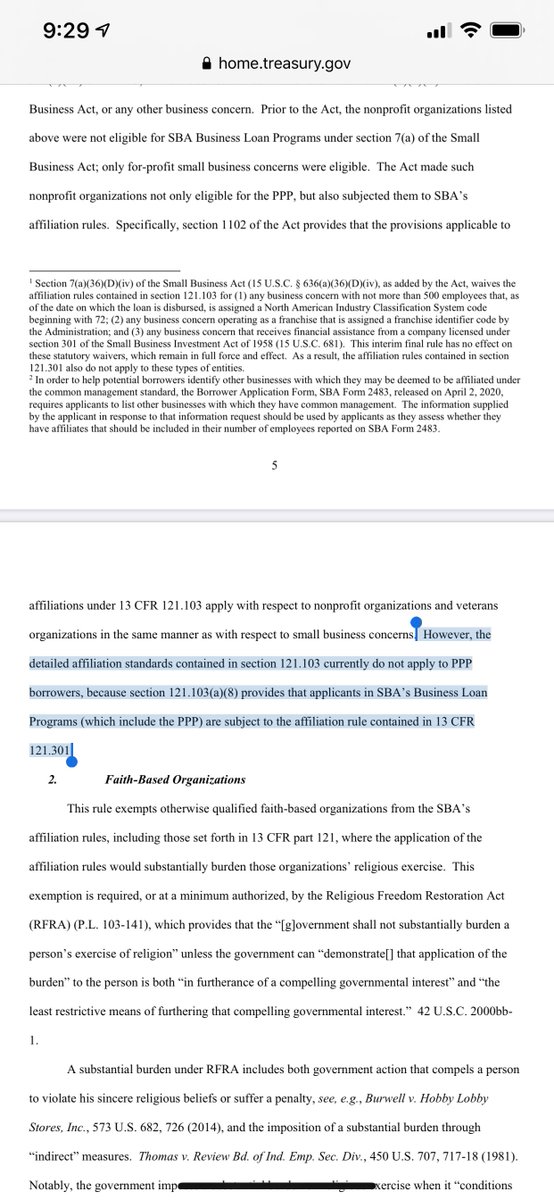

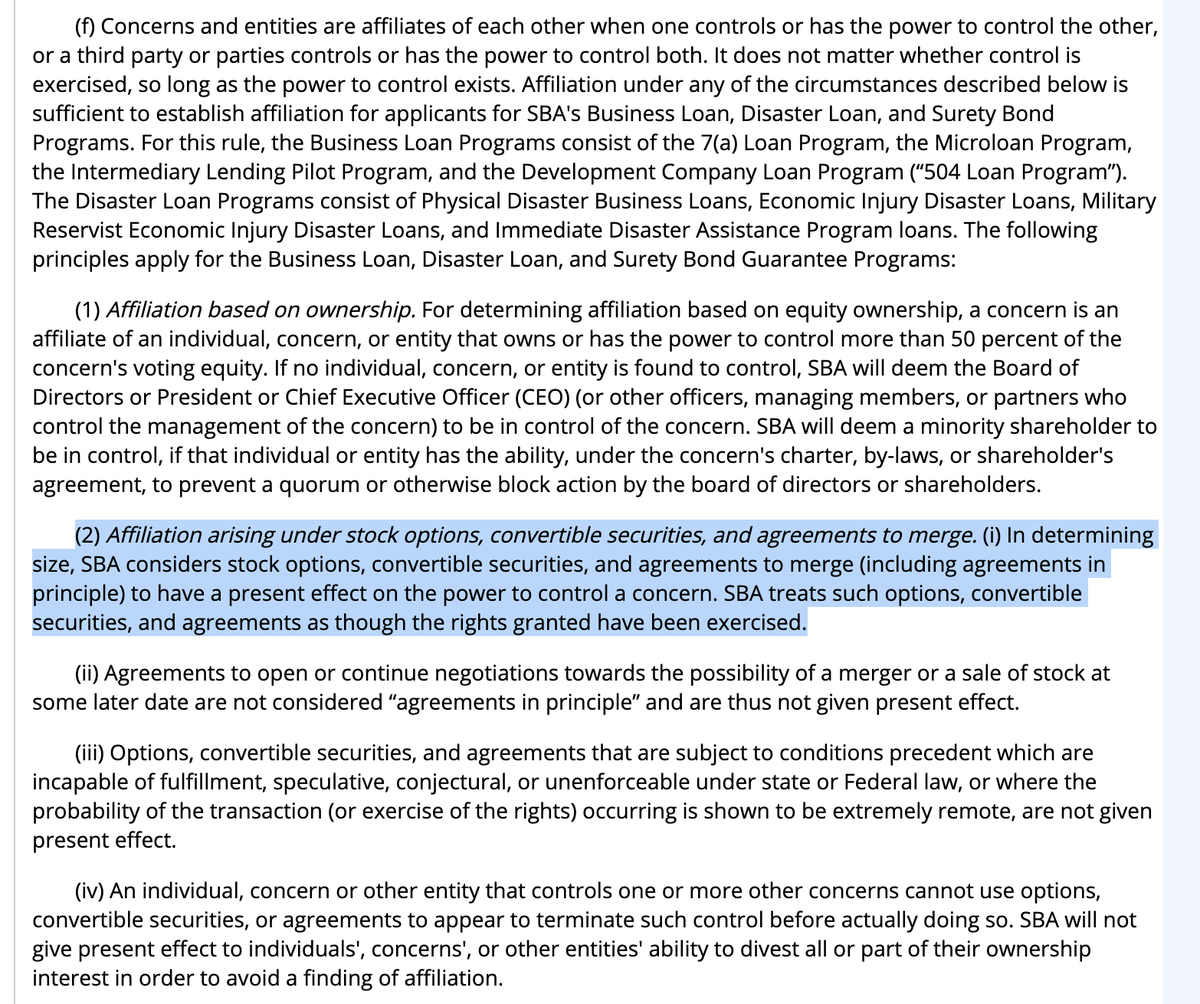

YOU MUST "aggregate with the employees & revenues of its AFFILIATED entities"

outstanding." Remember - these are 4 year loans!

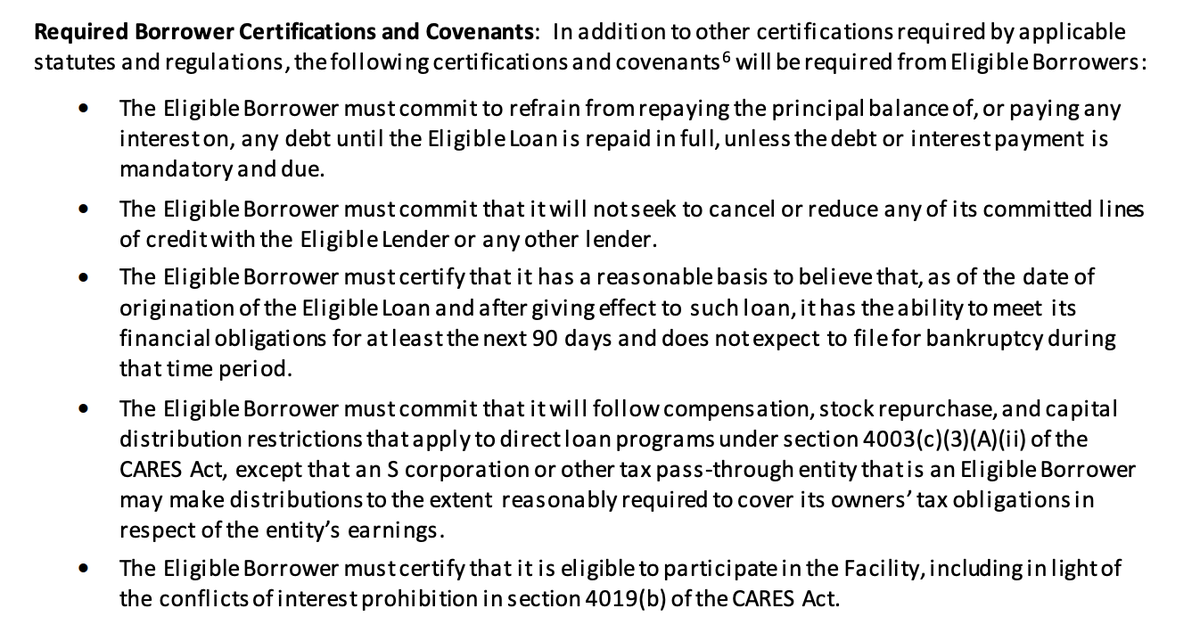

certifications & covenants, as well as any subsequent self-reporting by the Eligible Borrower." So we will also have some compliance issues...

federalreserve.gov/monetarypolicy…

underwriting metric required for #MSNLF #MSPLF & #MSELF" so #nonprofits are out for now & they're figuring out what to do about "asset-based borrowers"

Calculating outstanding debt has some twists & turns, & is also discussed in FAQ G

"Existing outstanding & undrawn available debt should be calculated as of the date of the loan application."

#MSNLF=1/3 each @ end of yrs 2,3&4

#MSPLF & #MSELF=15% of principal due @ end of each of years 2&3,& 70%🎈balloon payment at maturity (end of year 4)

All 3 loans may be secured or unsecured, but

"An MSELF Upsized Tranche MUST be secured if the underlying loan is secured." If secured, any

collateral securing the underlying loan "must

secure the MSELF Upsized Tranche on a pro rata basis"

open.spotify.com/track/1j1HxIXx…

"in light of its capacities, the economic environment, its available resources, and the business need for labor."

FAQ G8

"Borrowers that've already laid-off/furloughed workers as a result of disruptions from COVID-19 are eligible to apply for #MainStreetloans"

mandatory&due"

& you can refi maturing debt