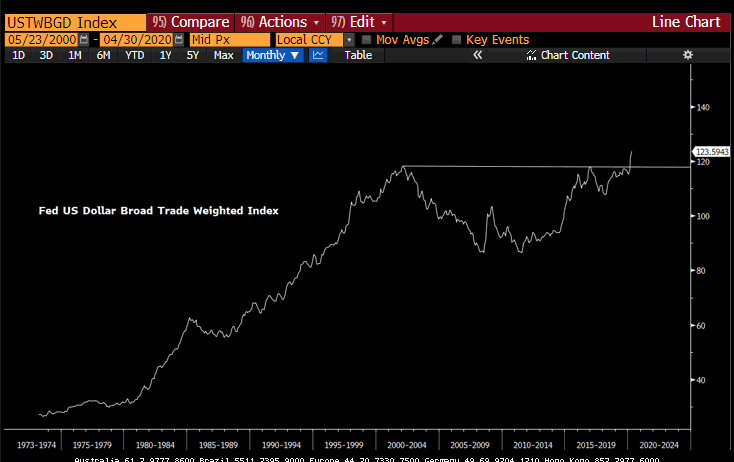

The US Economy fell from 40% of World GDP in 1960 to just 25% today.

However, 79.5% of all world trade is conducted in US dollars.

84% of all non-domestic debt globally is US Dollar debt.

Around $100trn of global debts are denominated in US Dollars.

The Fed balance sheet is currently $7 trn.

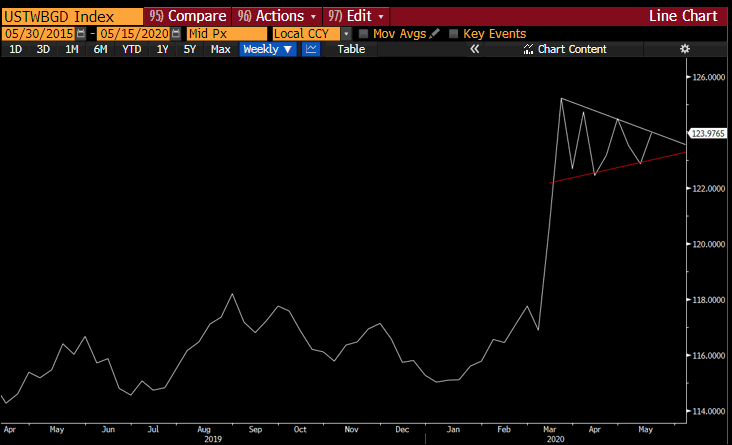

If this recession is morphing into a global solvency event (which by definition is a slow miserable grind, not a shock and awe event, which is a liquidity event),

So the Fed print more money to try to replace cash flows via fiscal stimulus. Velocity of moneys falls

All other central banks print more to offset their own systemic strains.

Dollar rises since $1 of QE from ECB is worth 4x in liquidity adjusted terms as $1 from the Fed. The Fed can't win.

And that in turn slows global growth, making the dollar shortage

So the Fed print more money to try to replace cash flows via fiscal stimulus. Velocity of moneys falls.

Dollar rises since $1 of QE from ECB is worth 4x ...

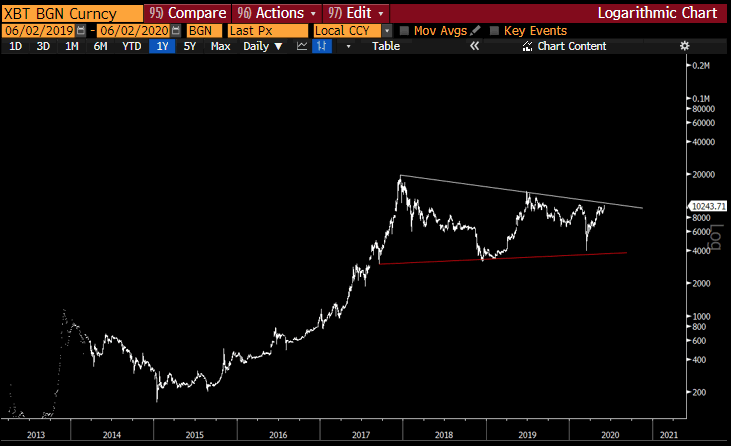

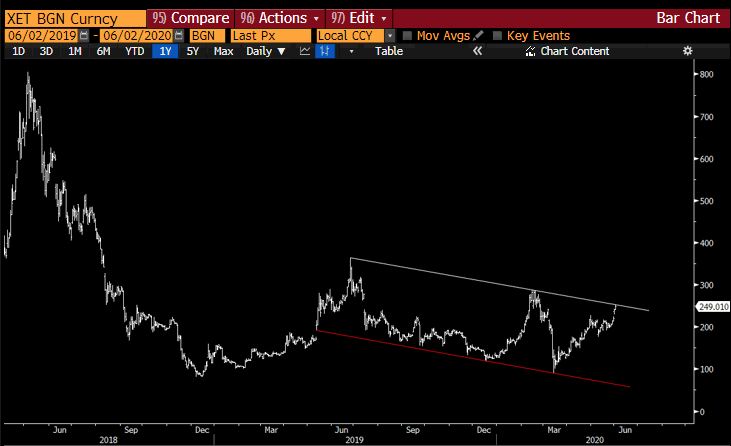

Then figure out a new Non-US Dollar dominated currency system.

This is not a low probability outcome, but it's clearly not a certainty either. But I give it higher odds than most do.