Earlier this week I posted a thread on the 2018/19 financials for the Big Six Premier League clubs. Today I am going to look at the numbers for the Other 14 clubs #AFCB #BHAFC #BurnleyFC #CardiffCity #CPFC #EFC #FFC #HTAFC #LCFC #NUFC #SaintsFC #WatfordFC #WHUFC #WWFC

Obviously, there will be a significant impact on these numbers in the 2019/20 season (and probably 2020/21 as well) as a result of the COVID-19 lockdown, which has resulted in clubs earning much less revenue for a few months, but how did it look before the pandemic struck?

Other 14 Premier League clubs generated £2.2 bln of revenue, but £2.6 bln of expenses (including £1.5 bln wages and £0.6 bln player amortisation) meant £393m operating loss. This was improved by £241m profit on player sales, offset by £35m interest, giving £188m loss before tax.

After adding back amortisation & working capital moves, Other 14 had £262m operating cash flow, but spent £577m on players (purchases £898m, sales £321m), £93m capex, £21m interest & £8m tax. The £437m shortfall was largely covered by £424m loans, giving £13m net cash outflow.

The Other 14 had an overall £188m loss before tax, but half the clubs actually made money, led by #NUFC £41m, #WWFC £20m and #WatfordFC £10m. That said, the losses were pretty high at the other 7 clubs, including #EFC £112m, #SaintsFC £41m, #AFCB £32m and #WHUFC £28m.

Other 14 clubs fell from £33m profit before tax the prior season to £188m loss, with the largest decrease #EFC £99m. Four clubs went from profit to loss: #SaintsFC, #WHUFC, #BHAFC and #LCFC. On the other hand, #WatfordFC and #CPFC improved from large losses to small profits.

As a technical aside, I have paired the three clubs relegated from the Premier League in 2017/18 with those promoted from the Championship the same season, based on league position, e.g. 18th in Premier League was paired with 1st in Championship; 19th with 2nd; and 20th with 3rd.

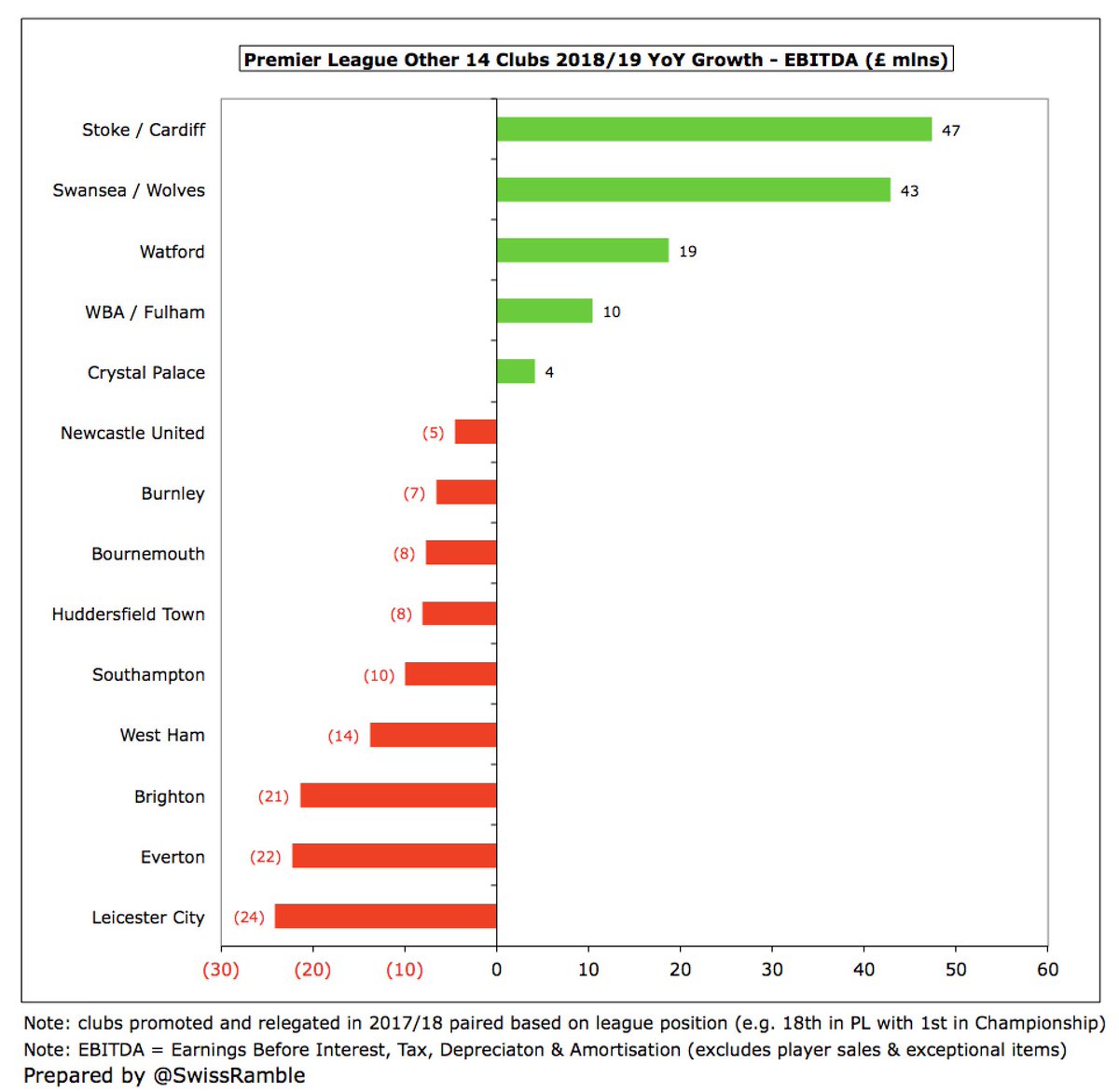

Most of the Other 14 have positive EBITDA, (Earnings Before Interest, Tax, Depreciation & Amortisation), a proxy for cash operating profit, as it excludes player sales and exceptional items, with #NUFC the best at £56m. Only 3 losses here: #EFC £15m, #LCFC £6m and #SaintsFC £4m.

However, most clubs had lower EBITDA than prior season with the largest reductions at #LCFC £24m, #EFC £22m and #BHAFC £21m. The highest YoY growth was due to the promoted clubs (#CardiffCity, #WWFC and #FFC) outperforming the relegated clubs (Stoke City, Swansea City and #WBA).

The Other 14 had a massive £393m operating loss in total with only 4 clubs reporting (small) profits: #NUFC £15m, #WWFC £10m, #CardiffCity £2m & #HTAFC £2m. In stark contrast, there were some large losses with #EFC £127m leading the way, followed by #LCFC £74m & #SaintsFC £60m.

Other 14 operating losses widened by £93m from £300m in 2017/18 to £393m last season. 11 clubs saw their losses grow, especially #LCFC £40m, #BHAFC £34m, #EFC £29m and #WHUFC £29m. #WatfordFC improved by £23m, but still posted a £6m loss.

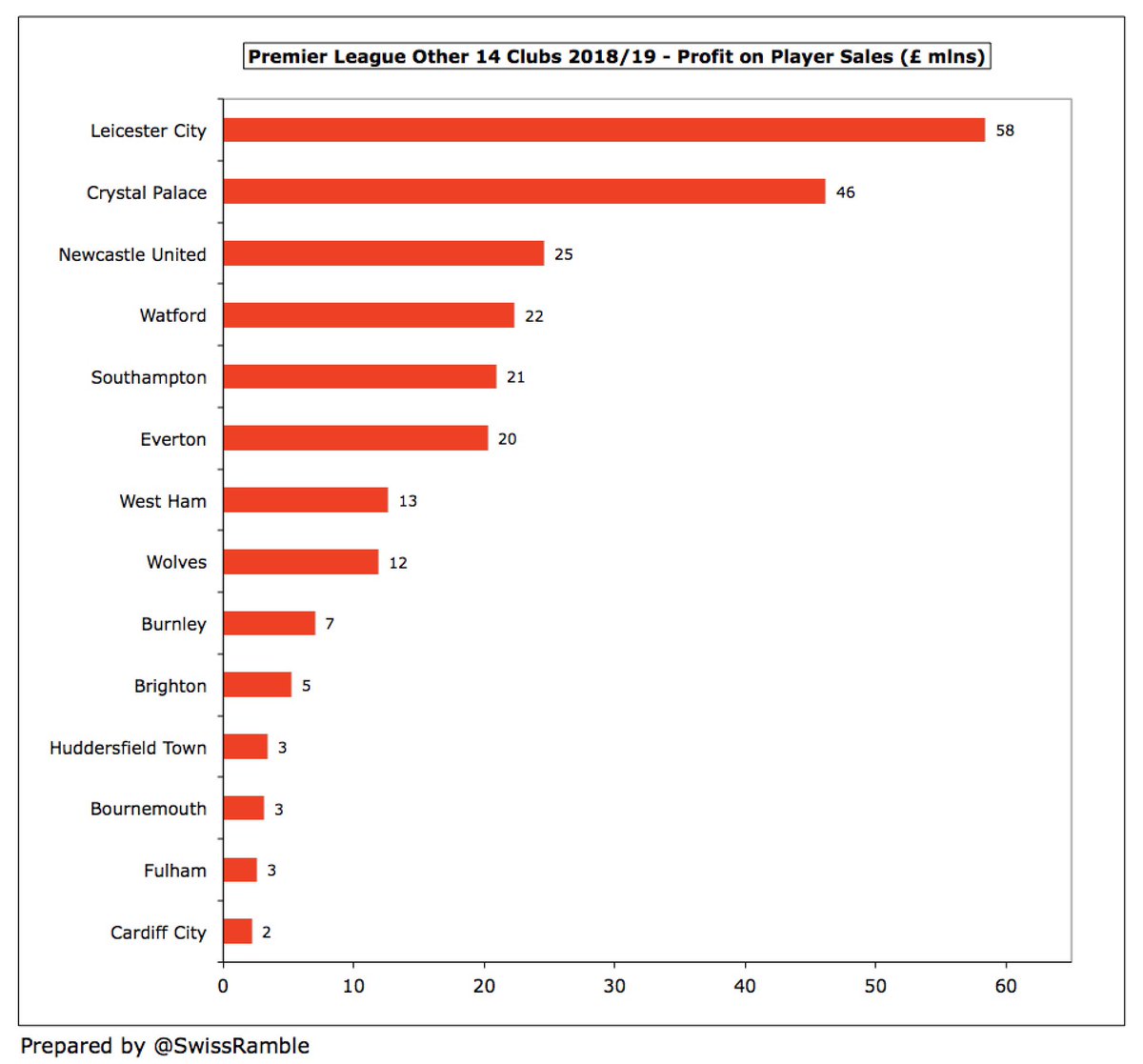

Other 14 bottom line was boosted by £241m profit on player sales with the highest coming from #LCFC £58m (Harry Maguire), followed by #CPFC £46m (Aaron Wan-Bissaka) and #NUFC £25m (Mitovic). Six clubs made less than £10m profit from this activity with #CardiffCity just £2m.

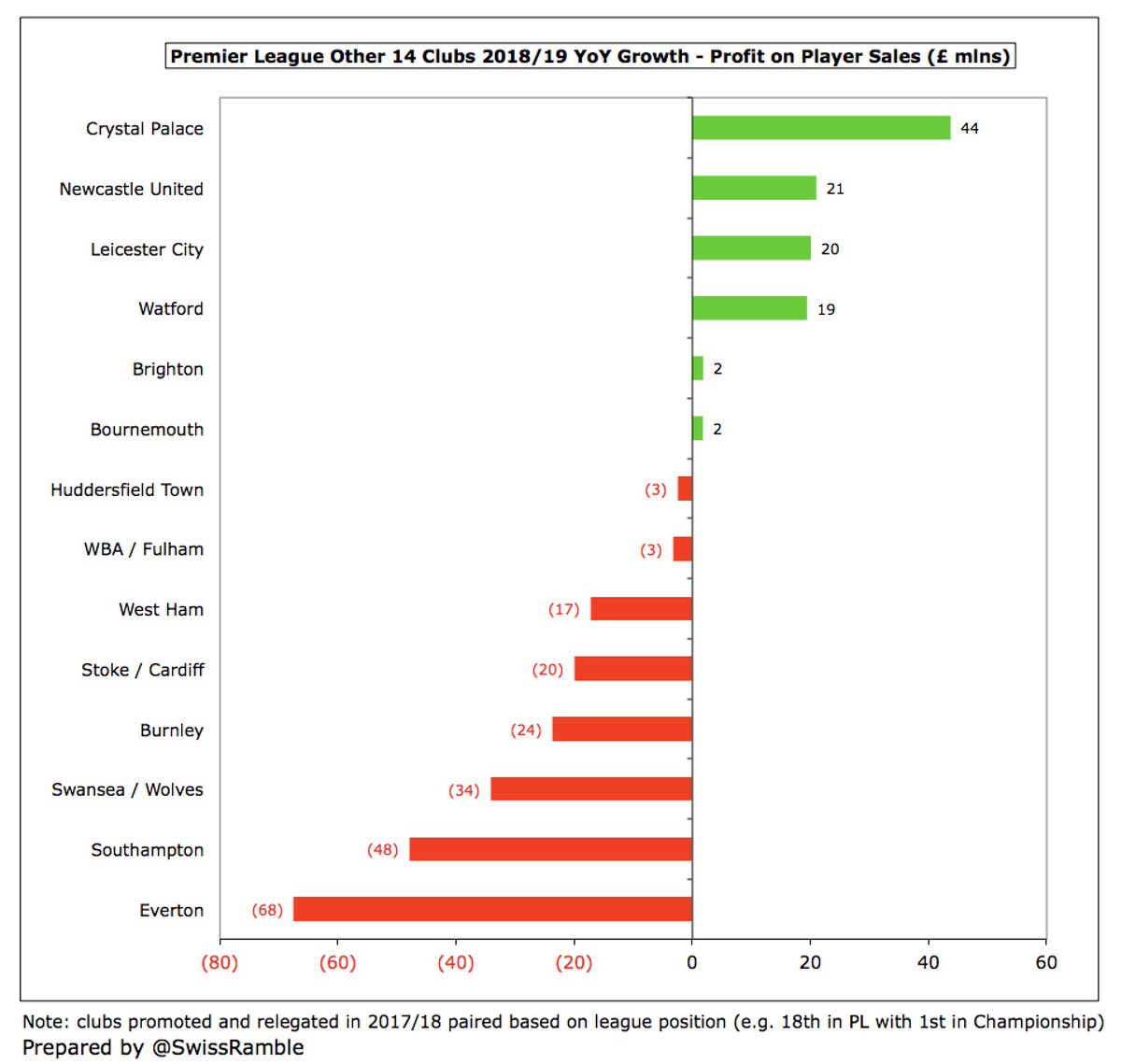

However, much lower profits on player sales was a key reason behind Other 14 reduced profitability, dropping by £108m from prior season’s £349m to £241m. Largest decreases were at #EFC £68m, #SaintsFC £48m and #BurnleyFC £24m. Highest increase was #CPFC, up £44m to £46m.

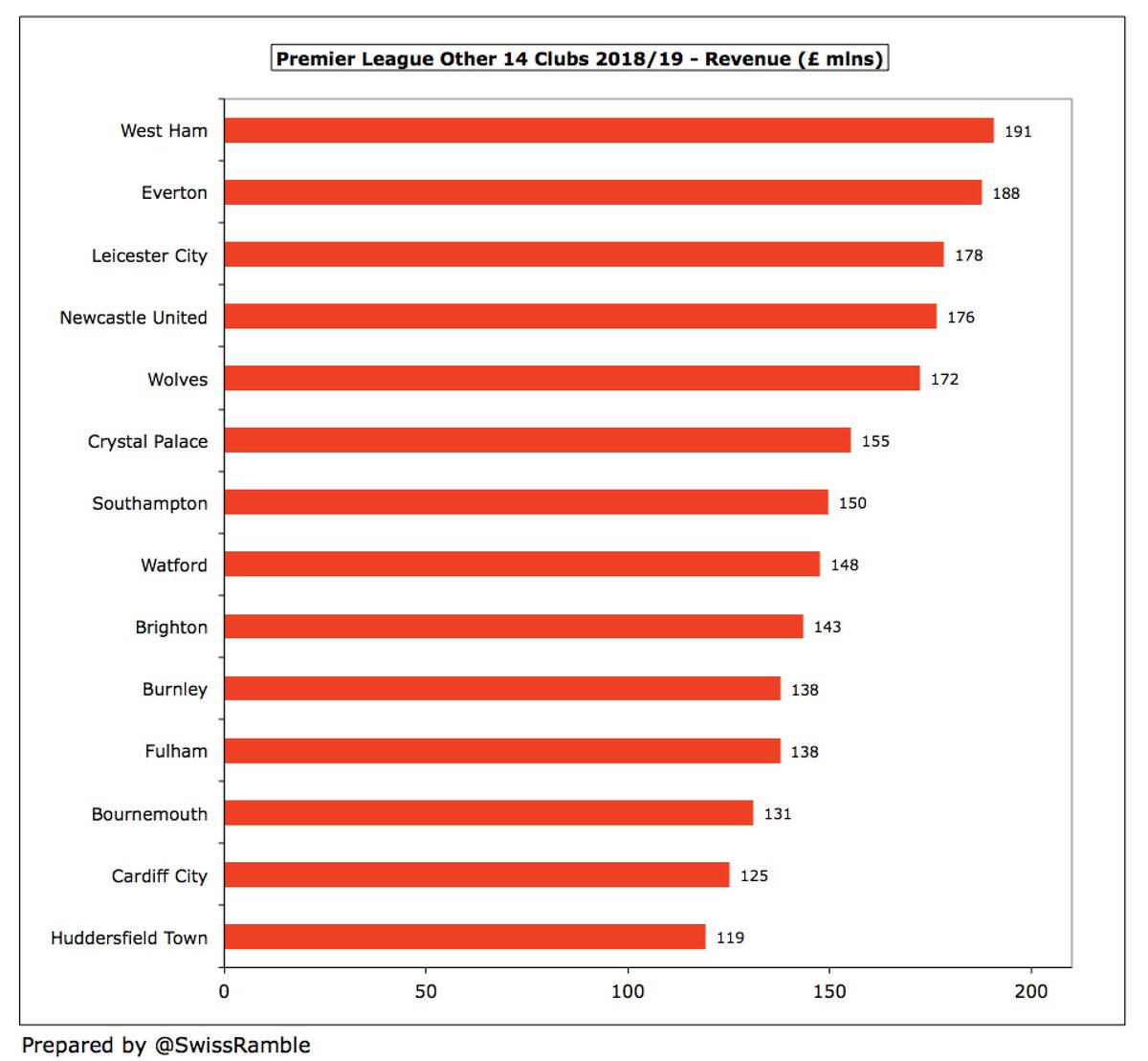

The Other 14 had £2.2 bln revenue with #WHUFC leading the way with £191m, followed by #EFC £188m, #LCFC £178m, #NUFC £176m and #WWFC £172m. Lowest was #HTAFC £119m. Highest YoY growth was #WWFC replacing Swansea £46m, then #LCFC £20m and #WatfordFC £19m.

Five of the Other 14 were in the Deloitte Money League, which ranks clubs globally by revenue, though #NUFC would also have been there (in 23rd) if they had submitted their figures. Highest ranked were #WHUFC in 18th, followed by #EFC 19th, ahead of Napoli, Milan, Ajax & Benfica.

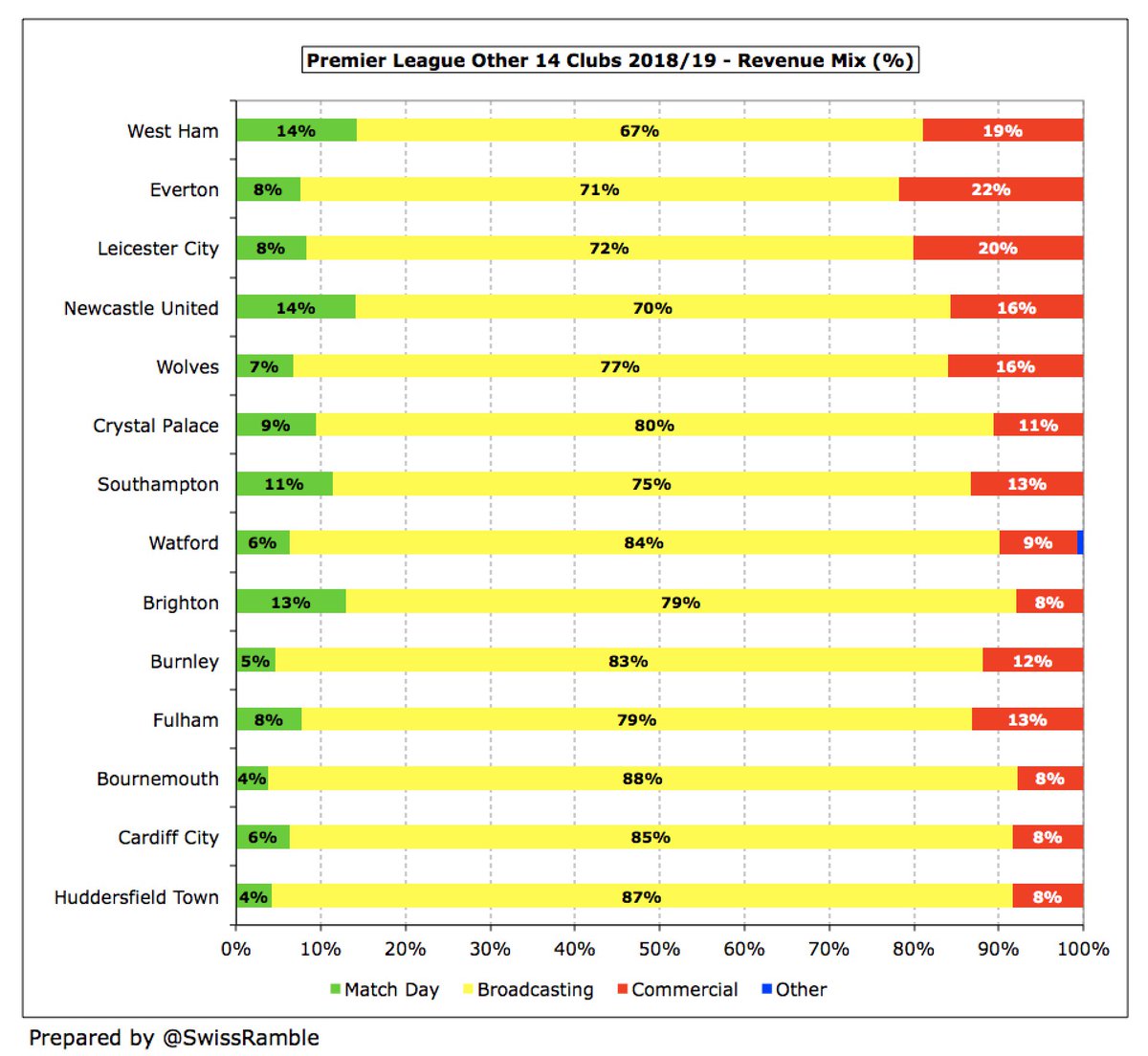

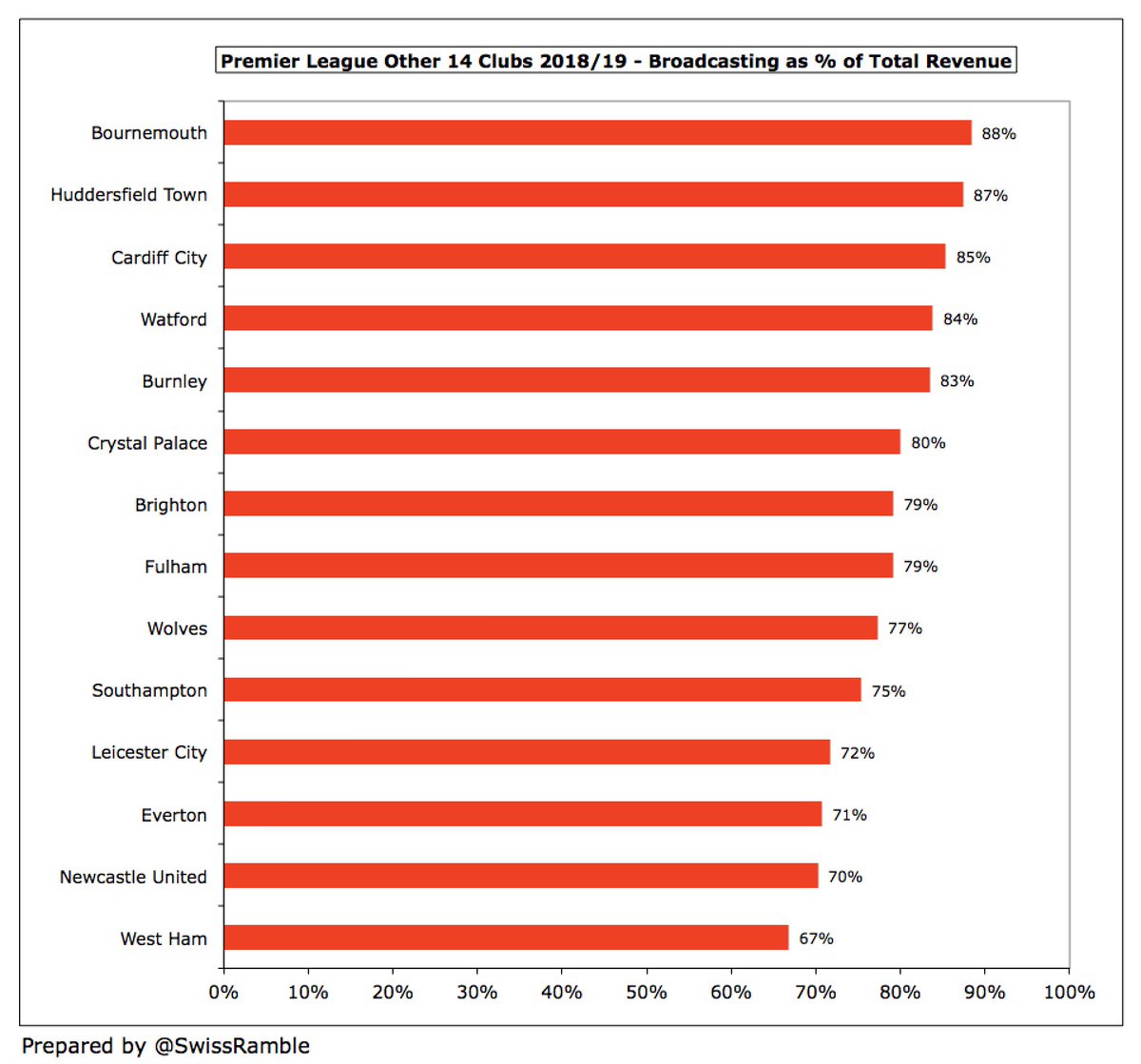

Most important revenue stream in Other 14 is broadcasting £1.7 bln (78%), followed by commercial £0.3 bln (14%) and match day £0.2 bln (9%). Revenue grew £103m (5%) with the largest increases due to commercial £47m and TV £44m (mainly domestic £55m), while match day was up £11m.

Broadcasting accounts for more than 80% of total revenue at 6 of the Other 14 clubs with #AFCB leading the way at 88%. All except #WHUFC are above 70%. Highest revenue was #WWFC £133m, just ahead of #EFC £133m and #LCFC £128m. Even bottom club #HTAFC earned £104m TV money.

TV revenue movement against prior year is dictated by position in the Premier League, as European TV money is monopolised by Big 6. Therefore, largest increase was #WWFC (compared to Swansea), thanks to their 7th place. #EFC decrease was due to playing in Europa League in 17/18.

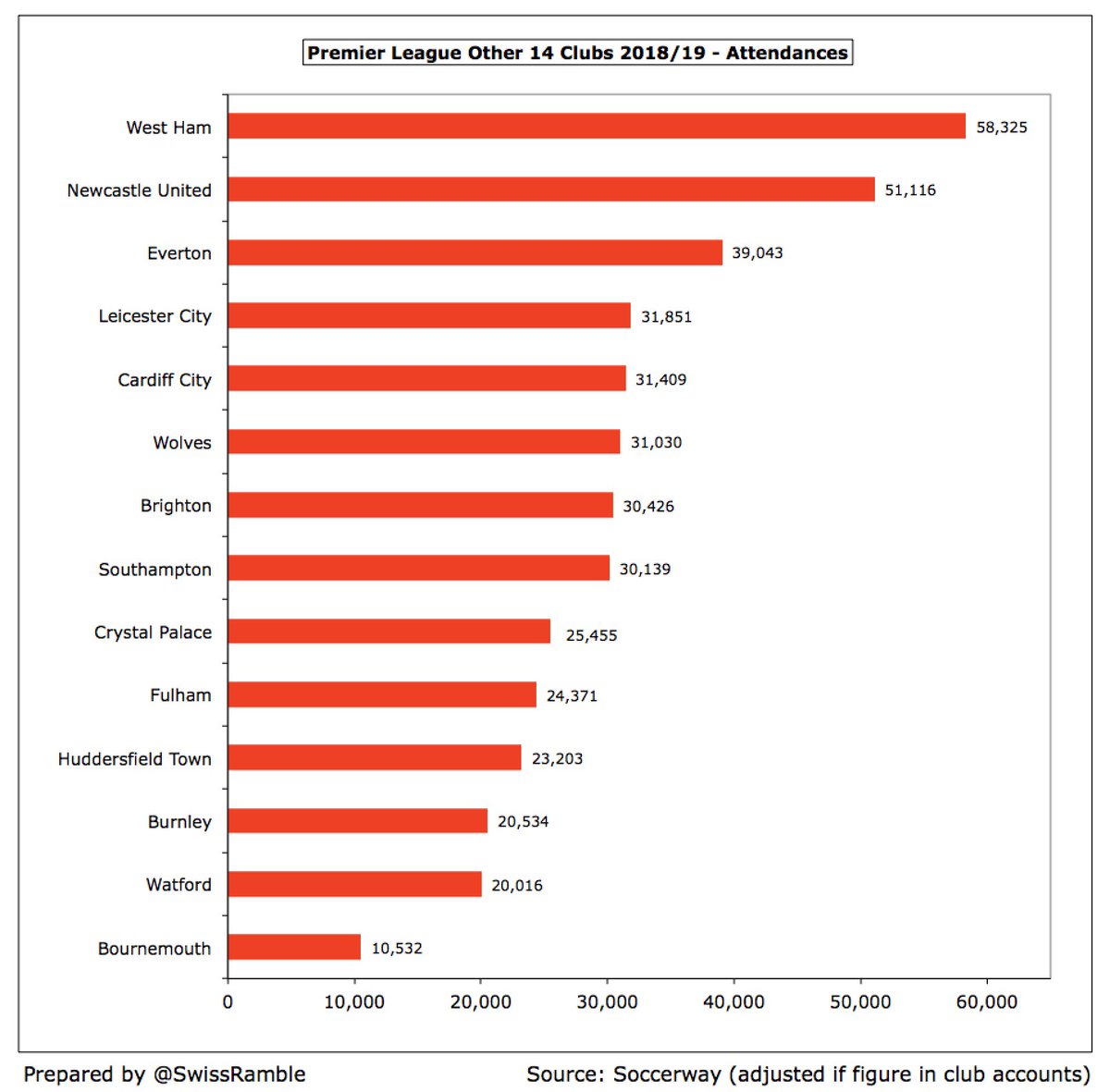

Although match day is smallest revenue stream for Other 14, it is still important, particularly at #WHUFC £27m (14% of total revenue), #NUFC £25m (14%) and #BHAFC £19m (13%). Five clubs revenue below £10m, including #HTAFC and #AFCB £5m. Very little growth year-on-year.

The highest attendances by far in the Other 14 clubs are #WHUFC 58,300 and #NUFC 51,100, followed by #EFC 39,000. The lowest attendances came at #AFCB 10,500, then #WatfordFC 20,000 and #BurnleyFC 20,500.

Commercial is particularly important for #EFC £41m (22% of total revenue), #LCFC £36m (20%), #WHUFC £36m (19%). The first two benefit from large sponsorship deals with their owners, namely USM and King Power, which is also the main reason for their high growth over prior season.

Based on shirt sponsorships for 2019/20, the 3 best deals in Other 14 are all gambling companies: #WHUFC £10m (Betway), #EFC £9.6m (SportPesa) & #WWFC £8m (ManBetX). The lowest deal, #BHAFC Amex, has reportedly increased from £1.5m to £8.5m (including stadium naming rights).

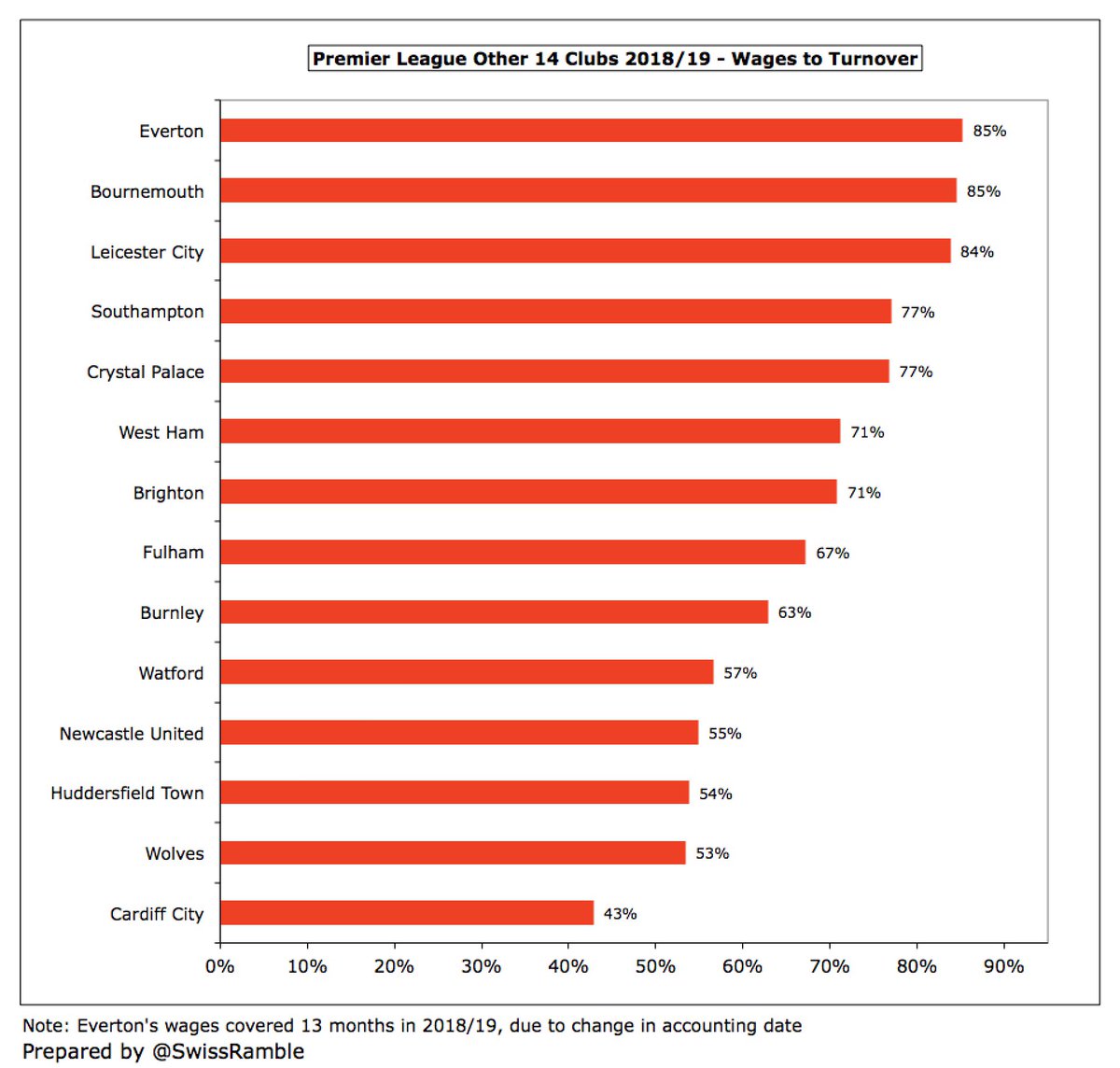

The highest wage bills in Other 14 are #EFC £160m (13 months), #LCFC £150m and #WHUFC £136m, who also had 3 of 4 highest YoY club growth (plus #BHAFC). The 2 clubs with lowest wages were both relegated (#CardiffCity £54m and #HTAFC £64m), partly due to no bonuses for staying up.

Seven of the Other 14 clubs had wages to turnover ratios above UEFA’s recommended 70% limit, though overall this was 68% (up from 67%). The highest were #EFC 85%, #AFCB 85% and #LCFC 84%. In contrast, #CardiffCity were only 43%. Highest growth was #BHAFC 15% and #WHUFC 10%.

Highest paid director in Other 14 was #CPFC Steve Parish £2.6m, though any payment in excess of basic salary was reinvested into the club’s Academy. Four others over £1m: #AFCB £1.9m, #BHAFC £1.5m, #FFC £1.4m and #WHUFC £1.1m. No #BurnleyFC directors received remuneration.

Player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, reflects transfer market spend. As a result, #EFC have the highest with £95m, followed by #LCFC £64m and #WHUFC £57m. The lowest by far is #CardiffCity with just £15m.

Depreciation is quite low in the Other 14 clubs with the highest being #EFC £7m, followed by #BHAFC £6m (Amex stadium investment) and #WatfordFC £4m. Eleven clubs had depreciation of £3m or less, highlighting limited investment in infrastructure.

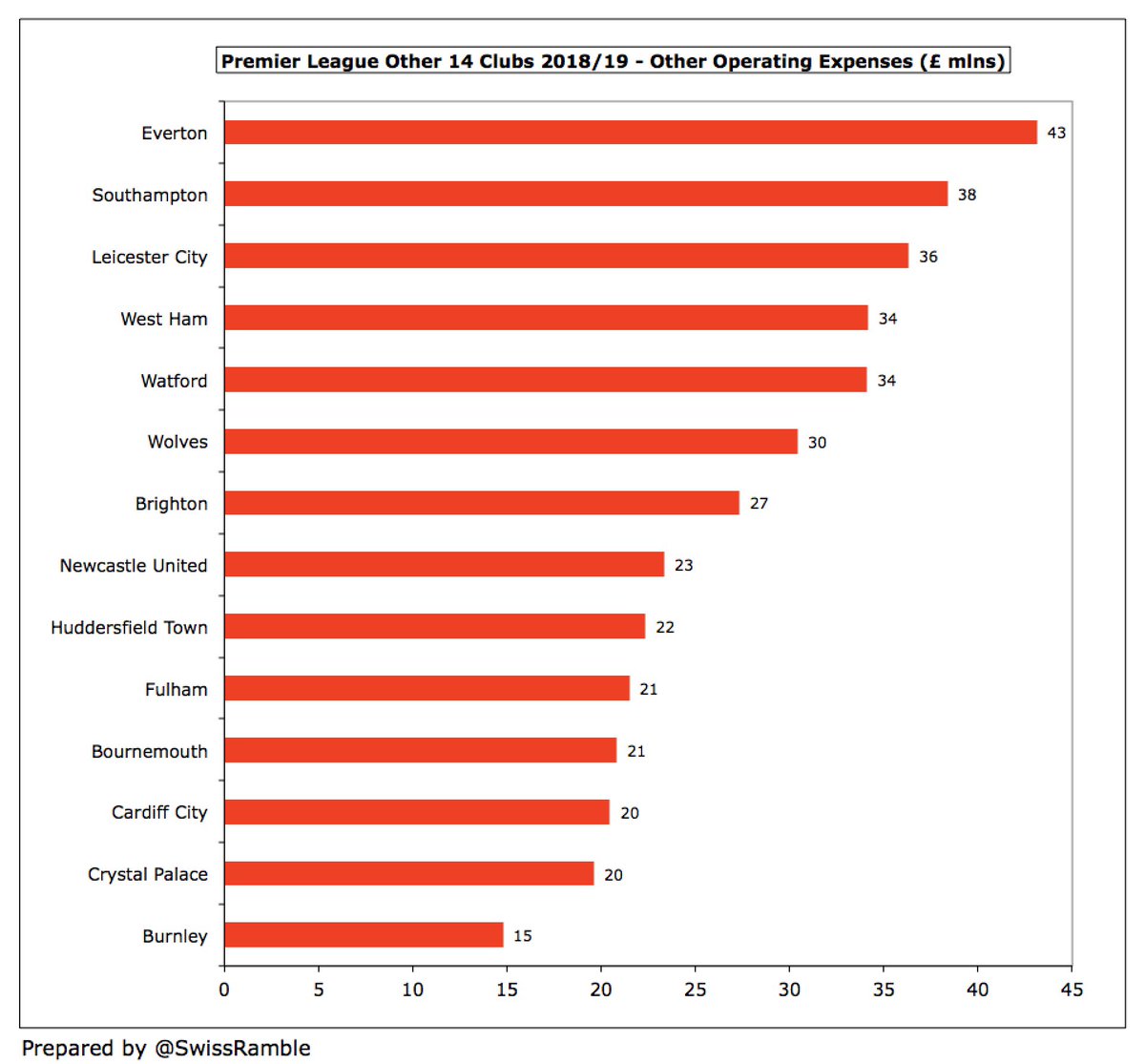

Other operational expenses (everything except wages, player amortisation and depreciation) ranged from £43m at #EFC to #15m at #BurnleyFC. Unfortunately, these costs are not detailed in the accounts, so it is difficult to understand the drivers of any growth (up £26m in 2019).

Two of the Other 14 clubs had exceptional expenses. #CardiffCity booked a £20m provision for poor Emiliano Sala’s transfer fee, while #EFC had £8m new stadium costs, which can be capitalised once planning permission is granted.

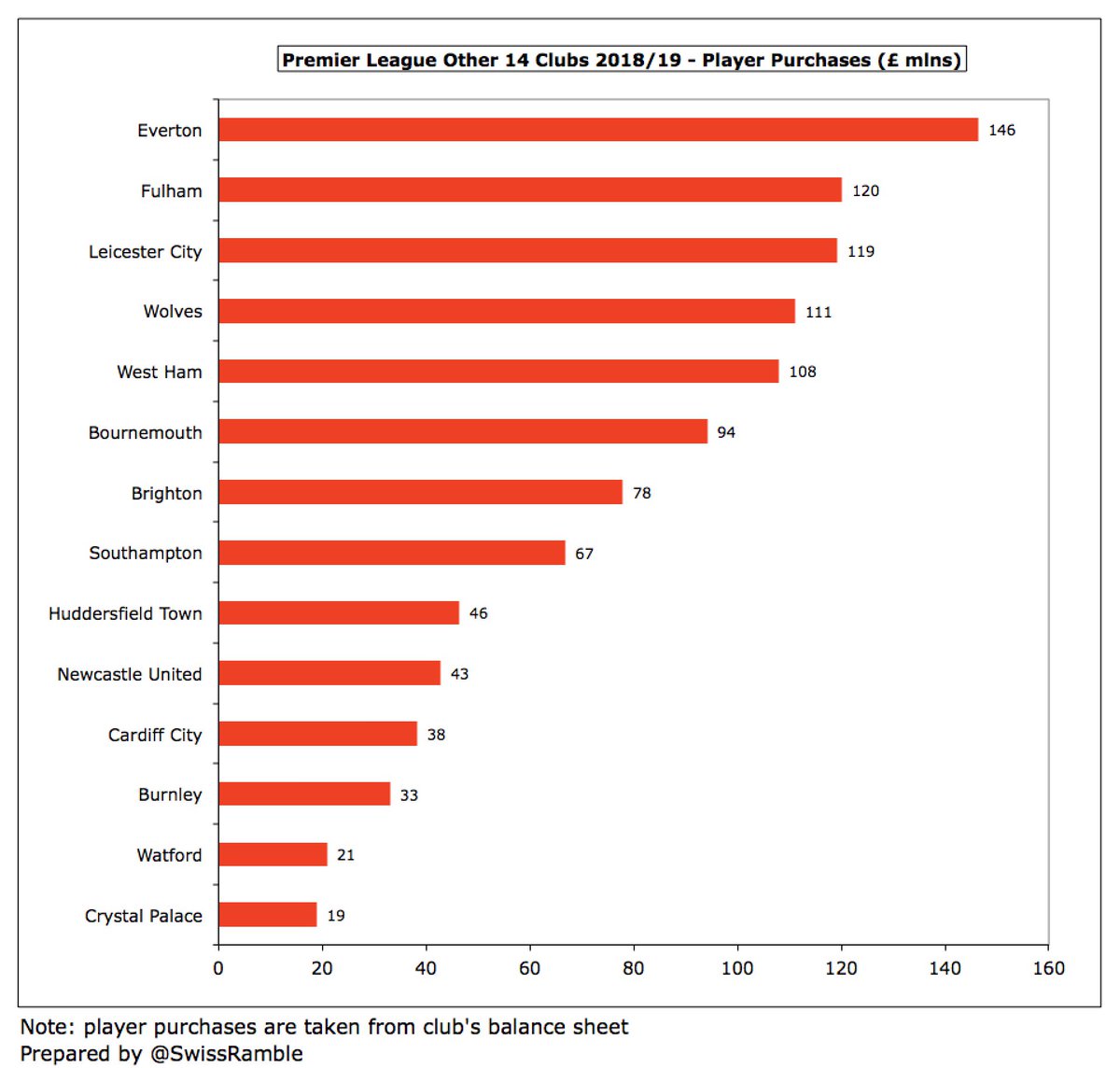

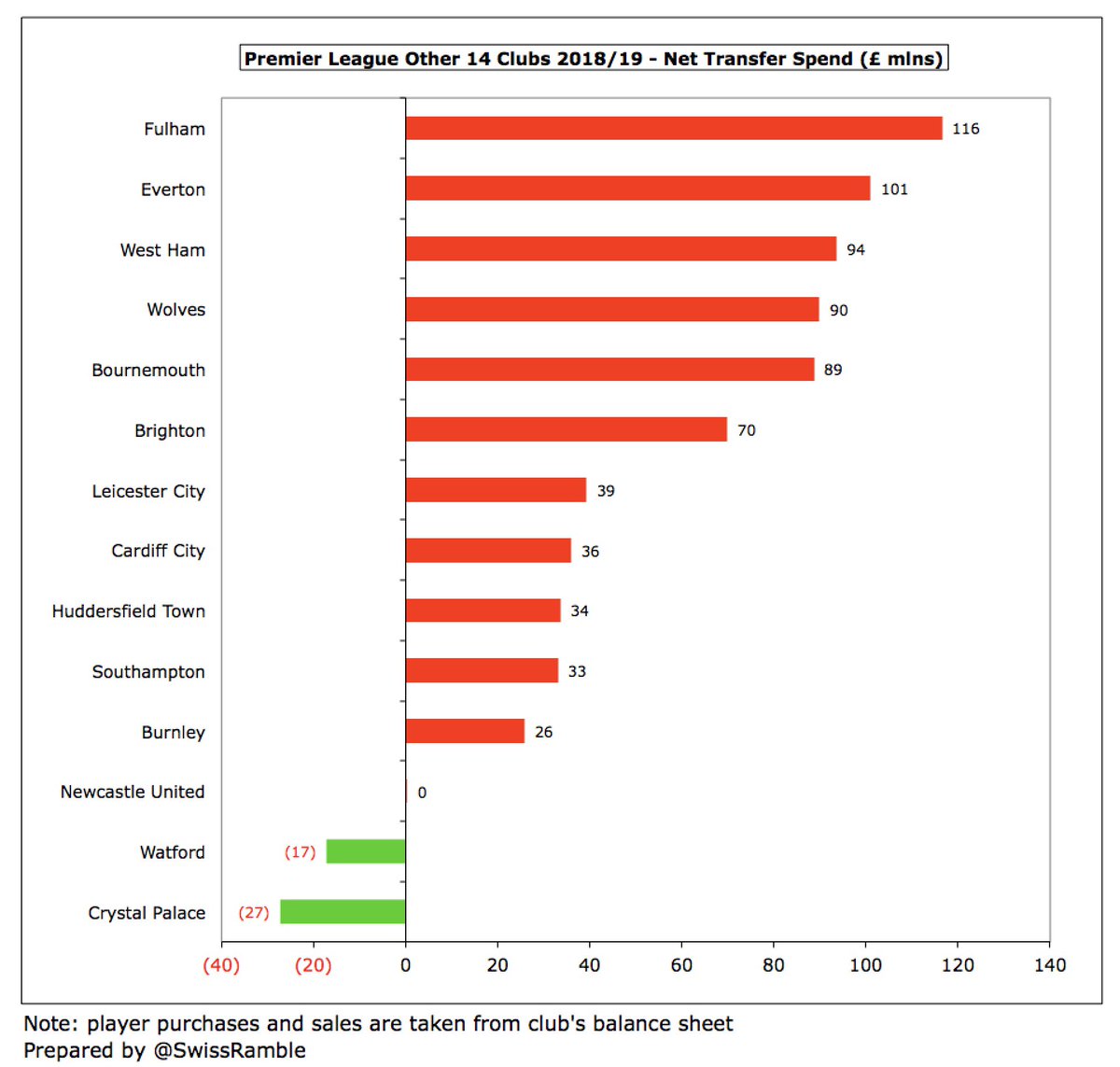

Other 14 spent £1 bln on player purchases, ranging from #EFC £146m to #CPFC £19m, though recouped £360m from player sales (highest #LCFC £80m), so £683m net spend. #FFC net spend of £116m was not enough to save them from relegation. Two clubs had net sales: #CPFC & #WatfordFC.

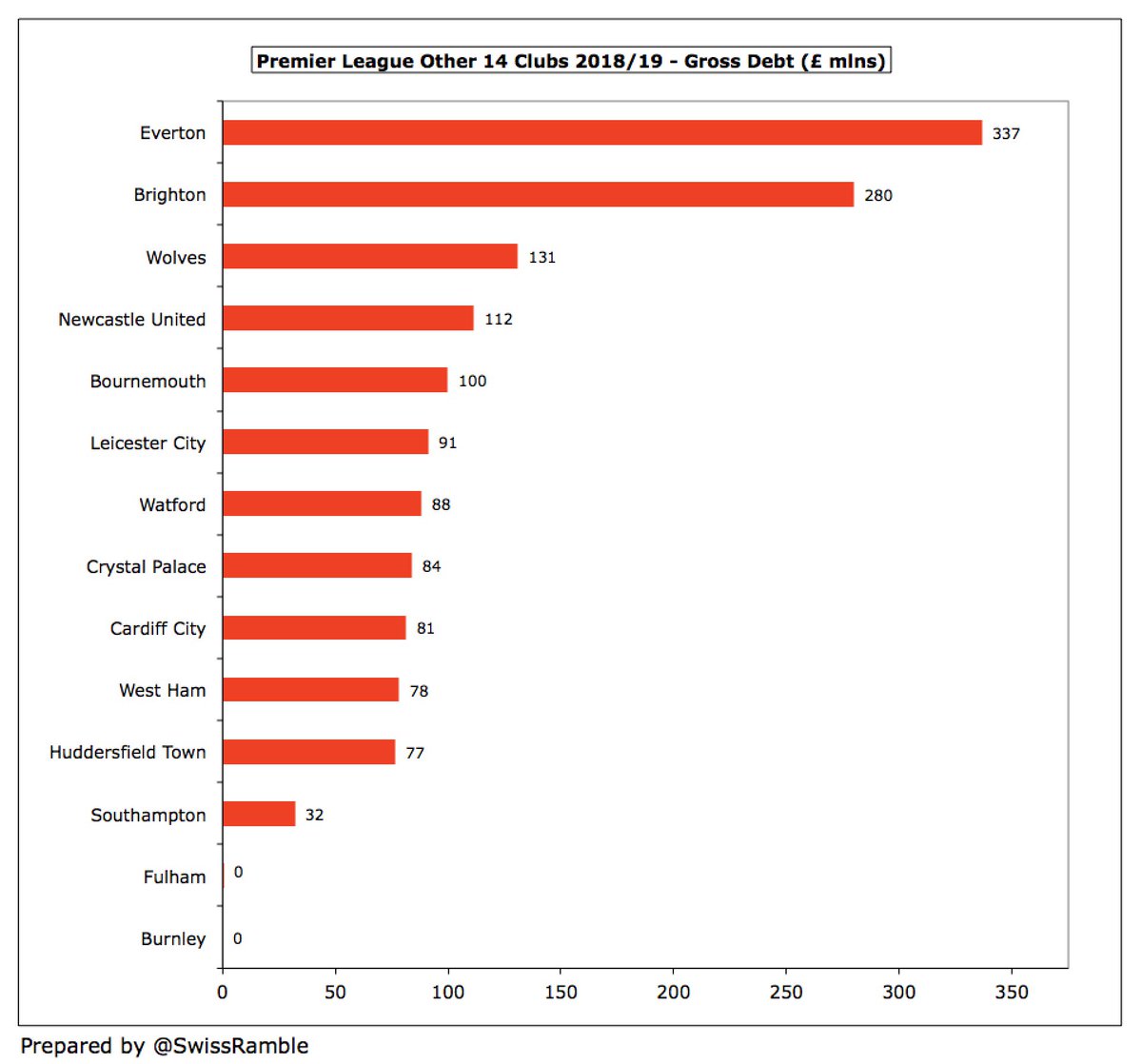

Other 14 had £1.5 bln gross debt with the highest at #EFC £337m (squad investment), #BHAFC £280m (new stadium), #WWFC £131m and #NUFC £112m. Almost all of this has been provided by owners. #BurnleyFC and #FFC are debt-free, the latter after substantial debt to equity conversion.

Other 14 paid £22m in interest in 2019 with 60% at just two clubs: #WHUFC £6.8m and #WatfordFC £6.2m. Only two other clubs paid more than £2m interest. Many owners’ loans are interest-free, so these clubs pay no interest, even if the loans are quite sizeable.

Only four of the Other 14 clubs had cash above £25m: #SaintsFC £47m, #BurnleyFC £42m, #WWFC £28m and #EFC £27m. #BHAFC only had £1m. Current balances will be much lower with little revenue coming in during the lockdown, so likely that clubs have taken on additional debt.

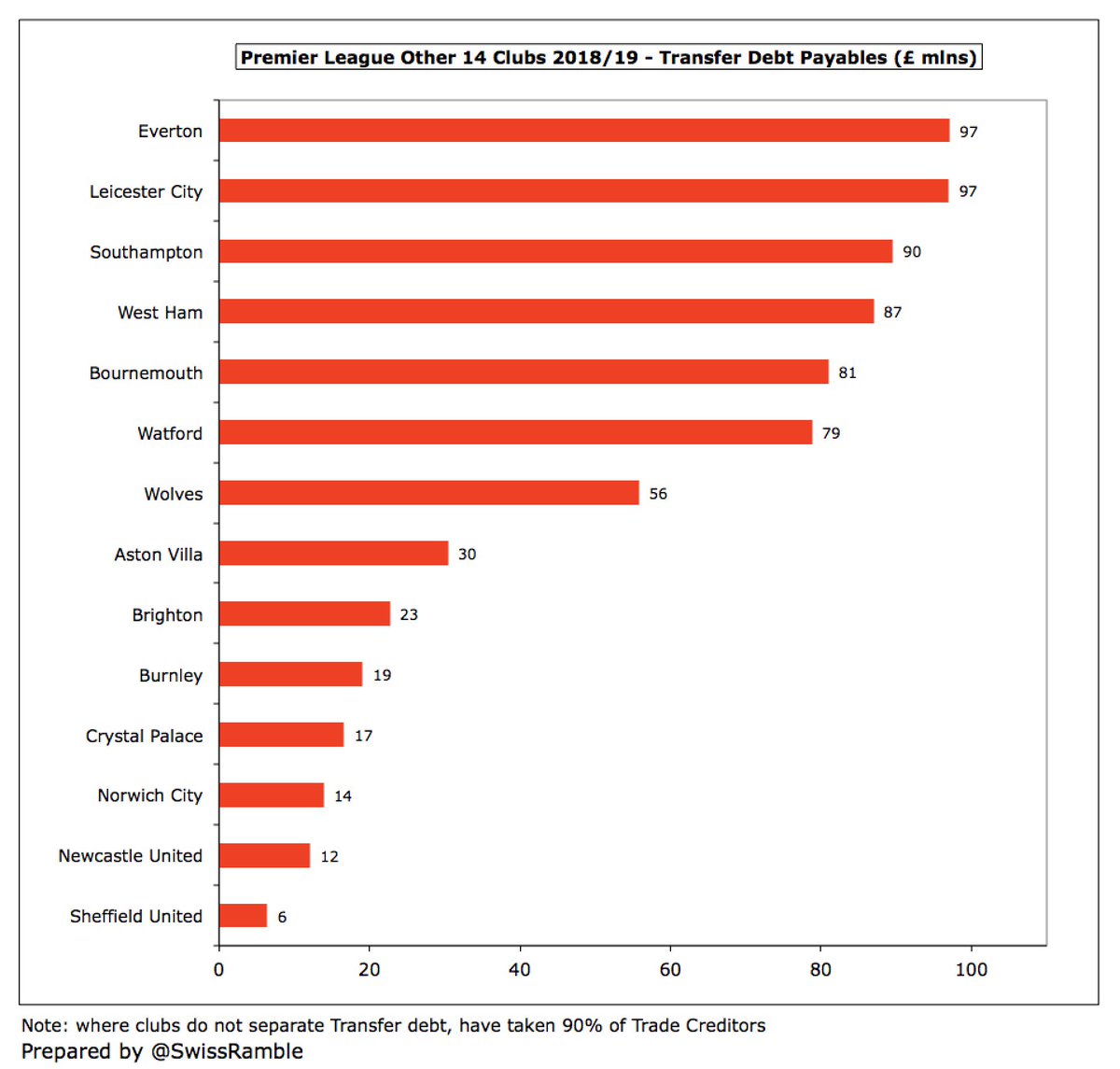

Other 14 also owed £708m in transfer payments (highest #EFC & #LCFC £97m), but were owed £345m from other clubs (highest #EFC £72m & #LCFC £53m), meaning £363m net transfer debt. The highest was #AFCB £76m, followed by #WHUFC £70m. Three clubs with net receivables (#NUFC £36m).

To complete the analysis, we will also be publishing a comparison between the Big 6 clubs and Other 14 clubs in the Premier League. Among other things, this will allow us to see the extent of the leading clubs’ financial dominance and whether the rich are getting richer.

• • •

Missing some Tweet in this thread? You can try to

force a refresh