GBTC Premium to BTC at 8.67%. Significantly lower than the historical average.

How GBTC arbitrage works? 👇

How GBTC arbitrage works? 👇

GBTC gives an option for investors to contribute "in-kind". This means that you can buy BTC at market price and convert into an instrument that trades at a premium. This premium oscillates but it's been >20% recently. So, theoretically investors could "arb" this spead.

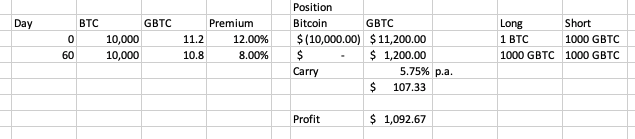

In summary, at trade date 0, investor would for example:

1) Buy $10,000 worth of BTC

2) Short ~$10,000 + premium worth of GBTC

How do you short GBTC?

1) Buy $10,000 worth of BTC

2) Short ~$10,000 + premium worth of GBTC

How do you short GBTC?

You can borrow shares at some of the large brokerage houses and sell them at market. This usually costs a daily borrow rate (currently around 6% per annum).

So, when BTC is converted to GBTC the investor would be long GBTC at 10,000 and short at 10,000 + premium - carry cost. Rough example below.

Notice that the investor is indifferent if BTC goes up or down. His bet is purely on spread.

Notice that the investor is indifferent if BTC goes up or down. His bet is purely on spread.

To close the trade the investor would sell his newly converted GBTC and buy GBTC to close his short.

A low premium means that there are many investors arbing this spread. At 8% it doesn't seem to be profitable when including transaction costs and cost of carry to short GBTC.

A low premium means that there are many investors arbing this spread. At 8% it doesn't seem to be profitable when including transaction costs and cost of carry to short GBTC.

Is this bullish or bearish for BTC?

Unclear. Historically a low GBTC premium has coincided with short term bottoms in price but I'm unsure why.

Unclear. Historically a low GBTC premium has coincided with short term bottoms in price but I'm unsure why.

Chart Source:

ycharts.com/companies/GBTC…

ycharts.com/companies/GBTC…

Many asked about the reasons behind the premium and if it should exist. I've written another thread that may be helpful:

https://twitter.com/alphaazeta/status/1262385112106389504?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh