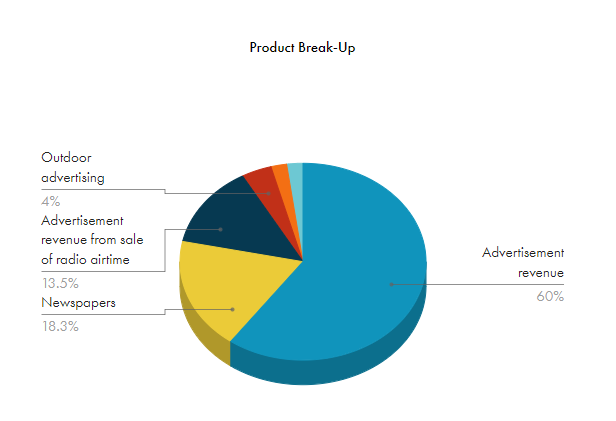

Jagran Prakashan is engaged primarily in printing and publication of #Newspapers and #Magazines in India.

The other activities of the company comprise outdoor advertising business, event management and activation services and digital business.

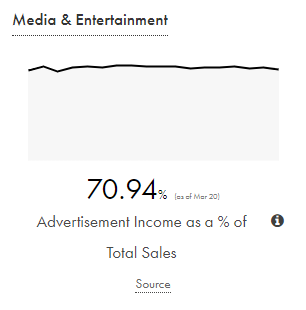

Advertising revenues will start showing return to normalcy from Q2/Q3 FY 2021.