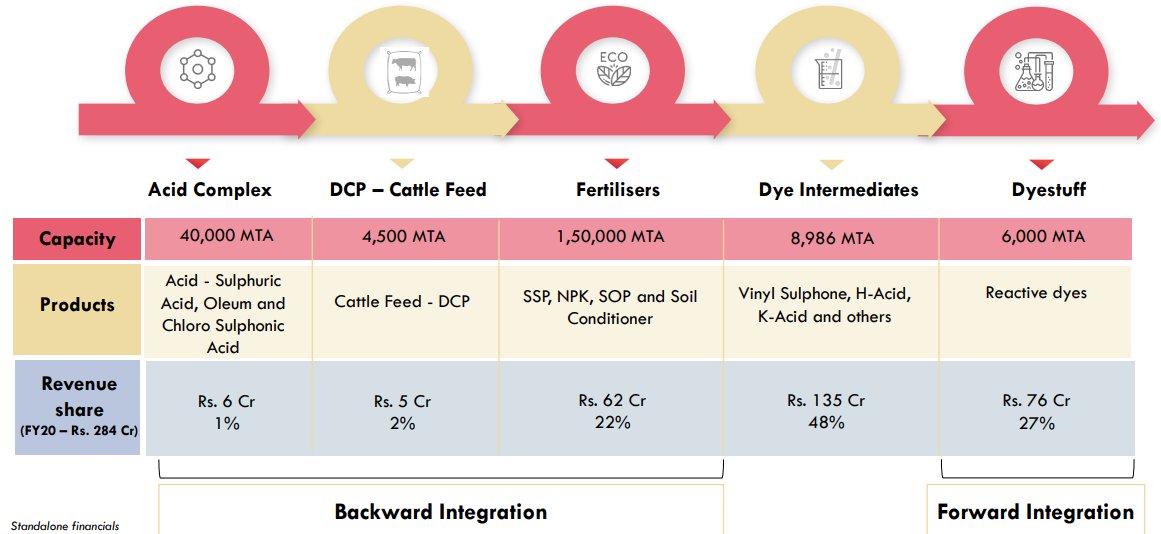

Shree Pushkar #Chemicals & #Fertilizers Ltd is engaged in the business of manufacturing and trading of chemicals, #dyes and dyes intermediate, cattle feeds, fertilizers and soil conditioner.

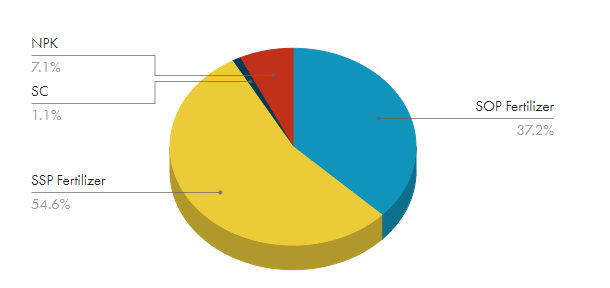

1.#Potassium Sulphate: 27% Capacity.

2.#NPK (Nitrogen Phosphate Potash): 12% Capacity

3.#Dyes Intermediates: 69% Capacity

4.#Chemicals: 28% Capacity

5.Single Super phosphate: 33% Capacity

smefutures.com/india-chemical…

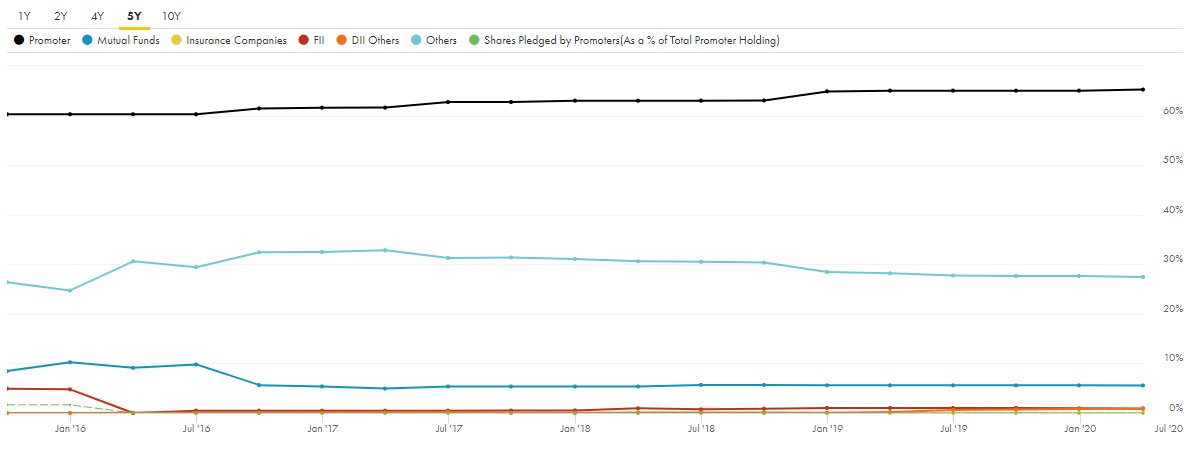

Coming to #Valuations. 52 Week high / low is 143.5 – 56.30, Stock P/E is 9.37 & P/B is 0.99. Average P/E has also been 15 (5 Years Historical). PEG Ratio is 0.33 which means growth at attractive valuation.