Commenters didn’t like these objective data points and missed the point that stablecoins are increasingly used for transmission of funds and securitising trade settlement.

It’s not just used for hedging from bearish crypto price action like the old days.

It’s not just used for hedging from bearish crypto price action like the old days.

https://twitter.com/woonomic/status/1286031442326073346

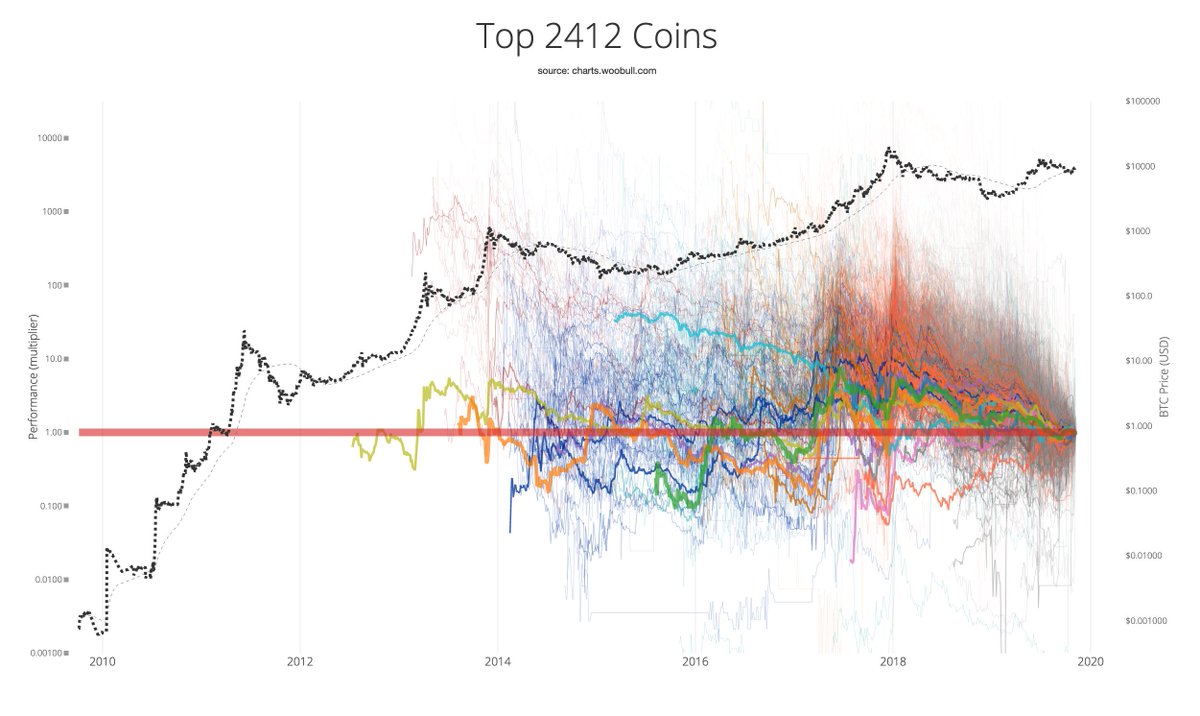

Bitcoin’s cap is tiny next to demands of global remittance and trade. Here you get a sense of just how small and early Bitcoin in its life cycle compared to where it needs to be to serve the finance world in a meaningful sense.

On a markets analysis note, some of us have been using USDT cap vs BTC cap as an oversold / overbought fundamental macro indicator, this signal is likely to be less effective in future given the changing use cases of Tether.

And on a personal note, I can’t help but notice how crypto’s tribalism and maximalism is blinding people from what’s in front of them.

• • •

Missing some Tweet in this thread? You can try to

force a refresh