#WarrenBuffett

#Apple

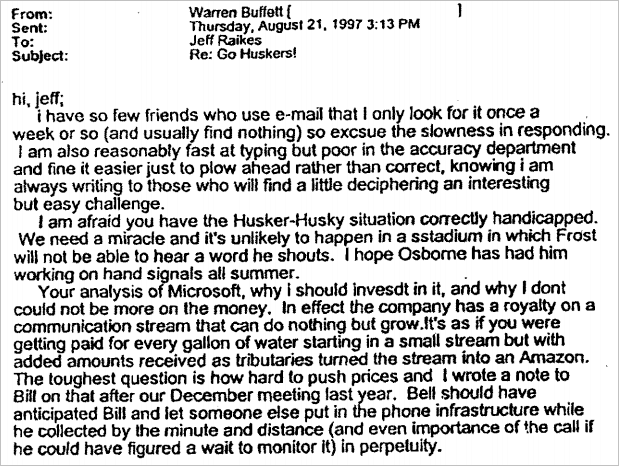

Why #WarrenBuffett missed the transformation from Hard assets to Soft assets , Why the legend never understood the transition to Software and it’s future and he underestimated the Internet to a very vast extent

The cost of this service provided by Google was NIL

Warren couldn’t read the thesis behind this kind of income Google generated

He himself had switched his loyalties from Alta Vista to Google but did not realise the potential of the Google business

Warren and Berkshire though were aware of the progress made by Amazon till 2017

Warren had exposure to Amazon bonds between 2001 -02 till 2005-06. His exposure was on basis on Junk credit price it was available after dot com bubble burst

Since than Berkshire has been buying and occasionally selling Apple ended up net buying of $35 Billion and and now by 2020 is worth $122 billion which is 25 % value of entire Berkshire market cap

It took Berkshire only about one year to realize a $40 billion unrealized gain on its $36 billion investment in 5.4% of Apple

@threadreaderapp

Unroll