1)

📌Can a Leveraged Company be Investable ?

Yes - Which One to Consider?🧐

No - Which One to Avoid? 🔥

Read the #Thread for my Thought Process on this !

Can transform it into #Screener if you want to know the stocks.

Who All Wants ?

Let me Know by your Likes & Retweets💞

📌Can a Leveraged Company be Investable ?

Yes - Which One to Consider?🧐

No - Which One to Avoid? 🔥

Read the #Thread for my Thought Process on this !

Can transform it into #Screener if you want to know the stocks.

Who All Wants ?

Let me Know by your Likes & Retweets💞

2)

Before deep dive, lets ask a simple question with ourselves ->

Why do businesses borrow in Ist place❓

Ans - They need Capital for 1000's of business purposes but ultimate goal of all purposes is to Grow business itself.

Business growth simply means Revenue/Sales Growth.

Before deep dive, lets ask a simple question with ourselves ->

Why do businesses borrow in Ist place❓

Ans - They need Capital for 1000's of business purposes but ultimate goal of all purposes is to Grow business itself.

Business growth simply means Revenue/Sales Growth.

3)

Common sense - If a Company borrows capital but unable to grow it's Sales & Profits it should be Avoided.

There could be several reasons for this-

Bad Business environment

Govt/Regulatory hurdles

Bad Capital Allocation

Competition

Inefficient Management etc

Common sense - If a Company borrows capital but unable to grow it's Sales & Profits it should be Avoided.

There could be several reasons for this-

Bad Business environment

Govt/Regulatory hurdles

Bad Capital Allocation

Competition

Inefficient Management etc

4)

Common sense - If Company borrows money & able to considerable grow Sales & Profits it could be considered for Investment.

Time Frame is important. Debt is utilized over a period of time so Business growth should be measured over 5 to 10 yrs time-frame.

Common sense - If Company borrows money & able to considerable grow Sales & Profits it could be considered for Investment.

Time Frame is important. Debt is utilized over a period of time so Business growth should be measured over 5 to 10 yrs time-frame.

5)

📌Correlation between Debt & Sales

Is just growing Sales enough ?

NO

📌Check Debt growth & Sales growth over 5 to 10 yrs

📌Consider businesses where Sales growth has been substantially (read multiple times) higher than Debt growth.

📌Correlation between Debt & Sales

Is just growing Sales enough ?

NO

📌Check Debt growth & Sales growth over 5 to 10 yrs

📌Consider businesses where Sales growth has been substantially (read multiple times) higher than Debt growth.

6)

📌Cost of Capital

It simply means Cost of Company's fund which includes both Debt & Equity (including preferential).

If company doesn't get Return on Capital greater than Cost of Capital consistently over a period of time it could be a trap. Please avoid it.

📌Cost of Capital

It simply means Cost of Company's fund which includes both Debt & Equity (including preferential).

If company doesn't get Return on Capital greater than Cost of Capital consistently over a period of time it could be a trap. Please avoid it.

7)

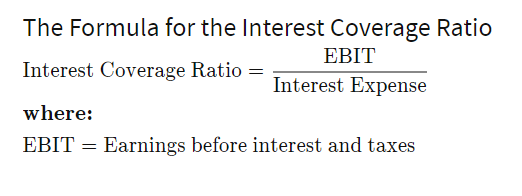

📌Solvency

Avoid companies with likely Solvency issues which can be gauged from Interest Coverage Ratio & Altman Z-score.

Interest Coverage Ratio determines if company is in comfortable position to pay it's Interest on Debt

ICR = EBIT/Interest. Avoid score below 3.

📌Solvency

Avoid companies with likely Solvency issues which can be gauged from Interest Coverage Ratio & Altman Z-score.

Interest Coverage Ratio determines if company is in comfortable position to pay it's Interest on Debt

ICR = EBIT/Interest. Avoid score below 3.

8)

📌Altman Z-score

Credit-strength test, accounts for profitability, leverage, liquidity, solvency and activity ratios.

Basically how to avoid likely bankrupt companies.

<1.8 is likely bankruptcy. Avoid it.

1.8 to 2.5 still not out of wood.

>2.5. I prefer this.

📌Altman Z-score

Credit-strength test, accounts for profitability, leverage, liquidity, solvency and activity ratios.

Basically how to avoid likely bankrupt companies.

<1.8 is likely bankruptcy. Avoid it.

1.8 to 2.5 still not out of wood.

>2.5. I prefer this.

9)

📌Liquidity

Current Ratio - most widely used

Quick Ratio

It's good if both >=1.

I mostly use Current Ratio because of business dynamics it makes more sense, Quick Ratio feels little too strict.

📌Liquidity

Current Ratio - most widely used

Quick Ratio

It's good if both >=1.

I mostly use Current Ratio because of business dynamics it makes more sense, Quick Ratio feels little too strict.

10)

Contingent Liabilities

In few cases Contingent Liabilities are very high. It may come to bite in future. It's good to keep an eye on it.

You may add it to Debt while calculating Debt to Equity just for safe side.

For now I would treat it as optional.

Contingent Liabilities

In few cases Contingent Liabilities are very high. It may come to bite in future. It's good to keep an eye on it.

You may add it to Debt while calculating Debt to Equity just for safe side.

For now I would treat it as optional.

11) So I would invest in a High Debt or Leveraged Company only if

~ Sales Increase > Debt Increase (Multiple times)

~ Cost of Capital (WACC) > ROCE & ROIC

~ Interest Coverage Ratio > 3

~ Altman Z-Score > 2.5

~ Current Ratio > 1

Any one criteria missing, I would STAY AWAY.

~ Sales Increase > Debt Increase (Multiple times)

~ Cost of Capital (WACC) > ROCE & ROIC

~ Interest Coverage Ratio > 3

~ Altman Z-Score > 2.5

~ Current Ratio > 1

Any one criteria missing, I would STAY AWAY.

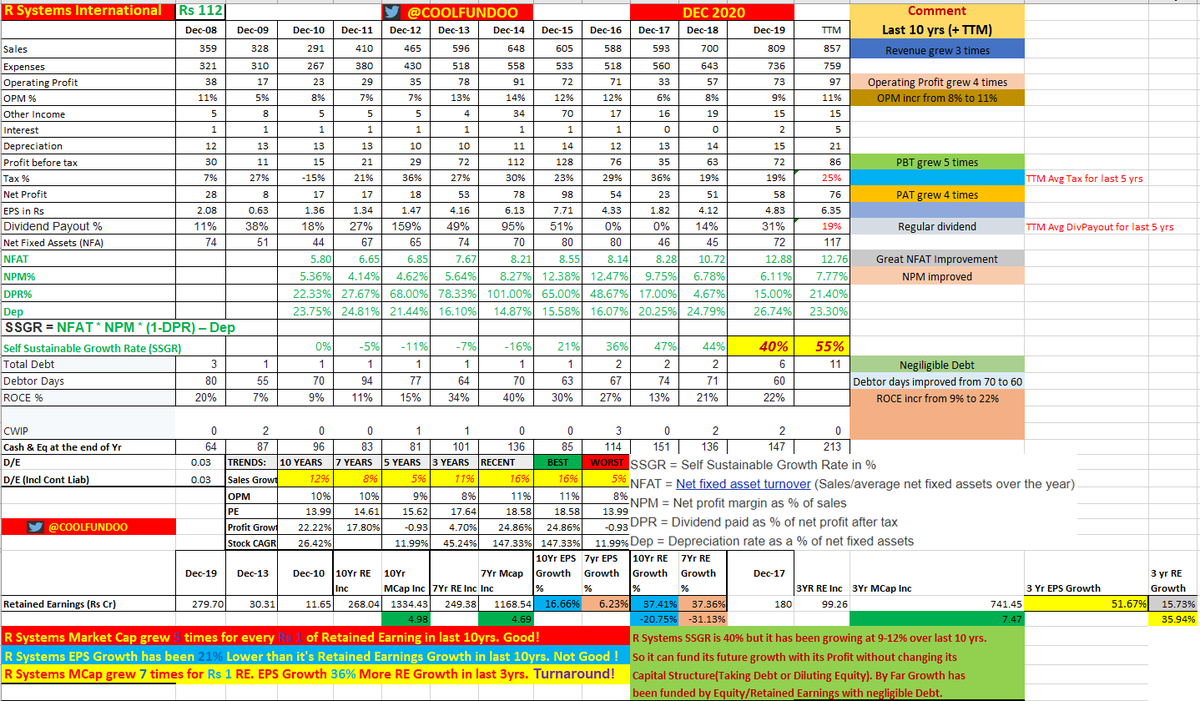

12) Let's understand this with few examples

📌Sterlite Technologies D/E = 1.34

Avoid for me ->

~ 10yr Sales growth ÷ 10yr Debt growth < 3

~ Interest Coverage Ratio < 3

~ Altman Z-score < 2.5

📌Sterlite Technologies D/E = 1.34

Avoid for me ->

~ 10yr Sales growth ÷ 10yr Debt growth < 3

~ Interest Coverage Ratio < 3

~ Altman Z-score < 2.5

13)

📌Bharti Airtel D/E = 1.92

Avoid for me -> Failed on ALL

Did you notice -ive Sales (Yes Sales declined from what was 10yrs ago) ❓

People may give me hard time (about 2 player & future hopes) but that's OK.

I look for Strong Business then do Hope not other way round.

📌Bharti Airtel D/E = 1.92

Avoid for me -> Failed on ALL

Did you notice -ive Sales (Yes Sales declined from what was 10yrs ago) ❓

People may give me hard time (about 2 player & future hopes) but that's OK.

I look for Strong Business then do Hope not other way round.

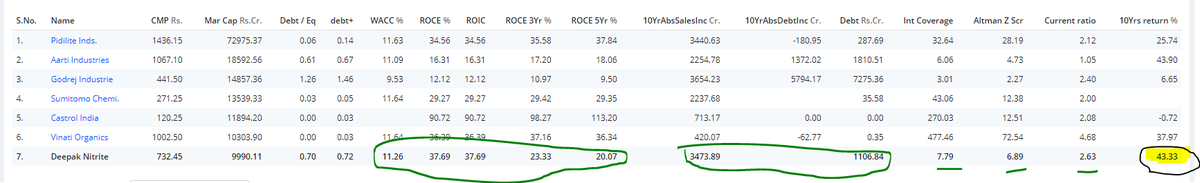

14)

📌Deepak Nitrite

Pass on ALL Parameters.

It was debt free company 10yrs ago. Took Debt. Grew Sales by more than 3 times its Debt increase in last 10yrs.

Maintained it's ROCE/ROIC substantial above Cost of Capital.

Awesome Ratios.

Result 43.33% Stock CAGR.👏

📌Deepak Nitrite

Pass on ALL Parameters.

It was debt free company 10yrs ago. Took Debt. Grew Sales by more than 3 times its Debt increase in last 10yrs.

Maintained it's ROCE/ROIC substantial above Cost of Capital.

Awesome Ratios.

Result 43.33% Stock CAGR.👏

Correction !

~ ROCE & ROIC > Cost of Capital (WACC)

~ ROCE & ROIC > Cost of Capital (WACC)

• • •

Missing some Tweet in this thread? You can try to

force a refresh