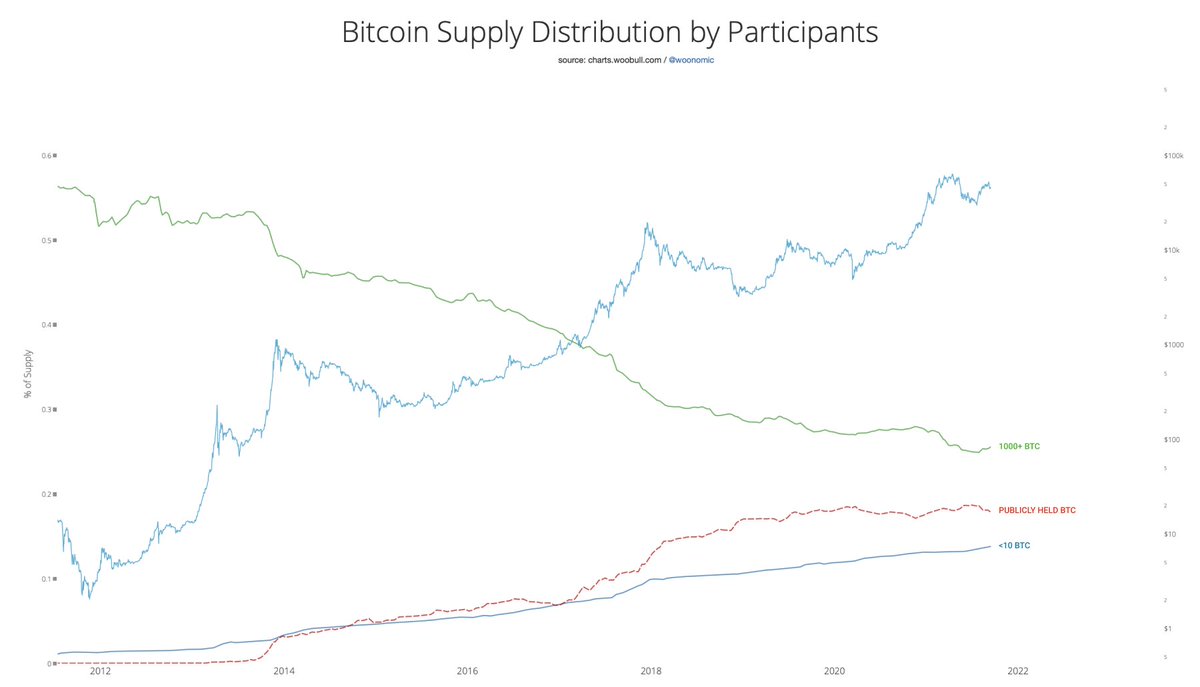

When coins on spot exchanges drop, it's a sign that new buyers are coming in to scoop coins off the markets and moving them into cold storage HODL, we are seeing new HODLers right now. Very macro bullish.

First scoop up of coins coincided with WSJ press coverage of Bitcoin as a legitimate investment vehicle off the back of the Winklevoss ETF news. It fueled the 2017 bull market.

The latest coincides with @michael_saylor's timeline of research into buying Bitcoin for $MSTR.

The latest coincides with @michael_saylor's timeline of research into buying Bitcoin for $MSTR.

Data by @glassnode

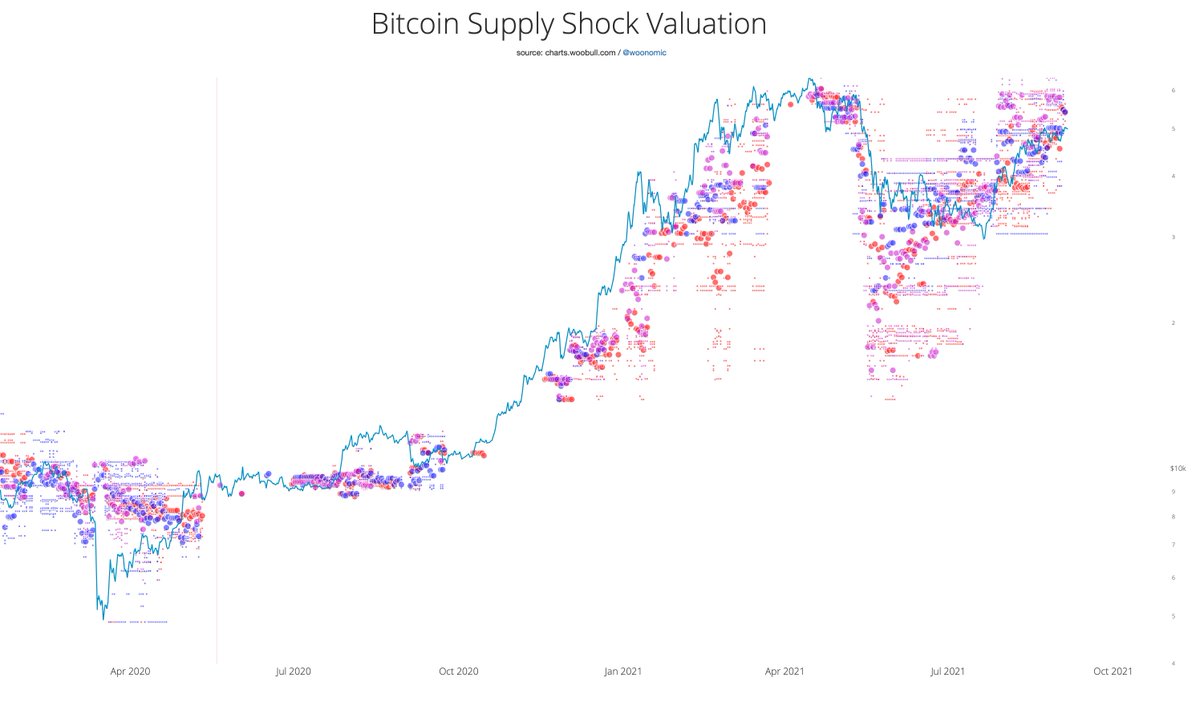

No it's not DeFi. This is Bitcoin. Wrapped BTC for DeFi only have volume starting in late June 2020.

https://twitter.com/rambo1stbld/status/1313807339095420928?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh