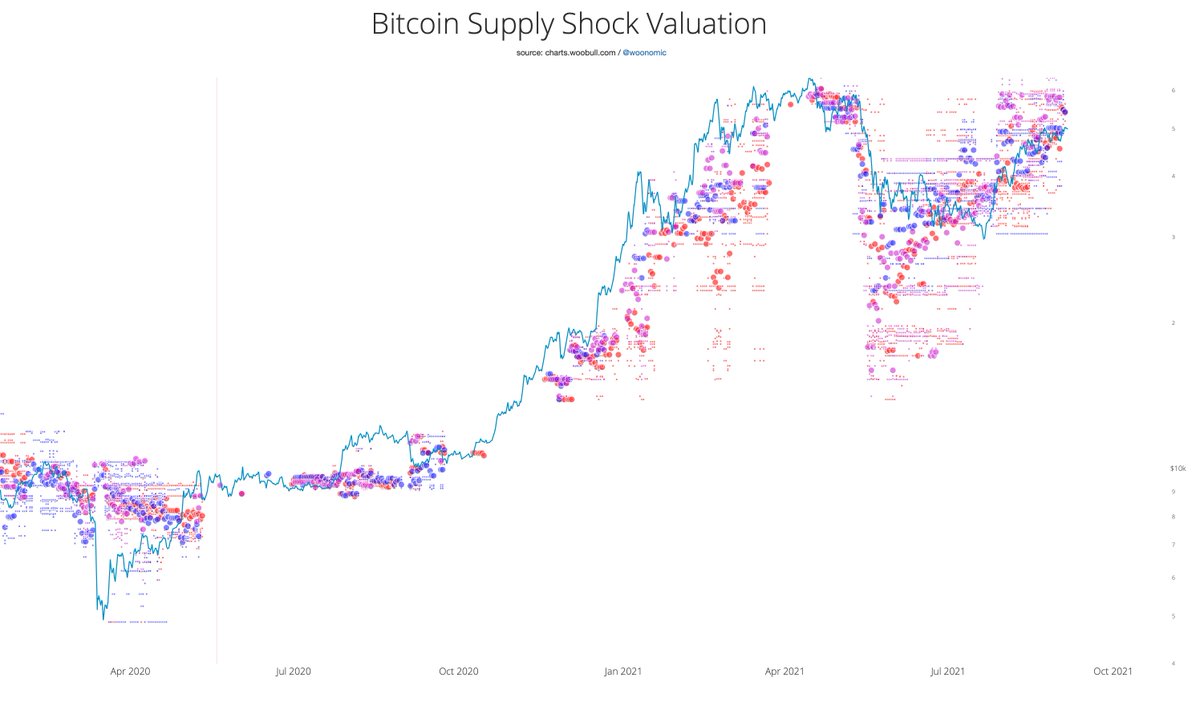

Supply Shock valuation model.

Uses a look-back algo to determine what the market priced BTC at prior demand and supply situations.

Currently puts BTC above $55k.

It's conservative as one of the SS metrics, exchange SS, is now above all-time-high so no look-back is possible.

Uses a look-back algo to determine what the market priced BTC at prior demand and supply situations.

Currently puts BTC above $55k.

It's conservative as one of the SS metrics, exchange SS, is now above all-time-high so no look-back is possible.

Data source for model via @glassnode.

- liquid supply

- exchange balances

- total network circulating supply

- historical price

- liquid supply

- exchange balances

- total network circulating supply

- historical price

• • •

Missing some Tweet in this thread? You can try to

force a refresh