Deep inside baseball for on-chain analysts...

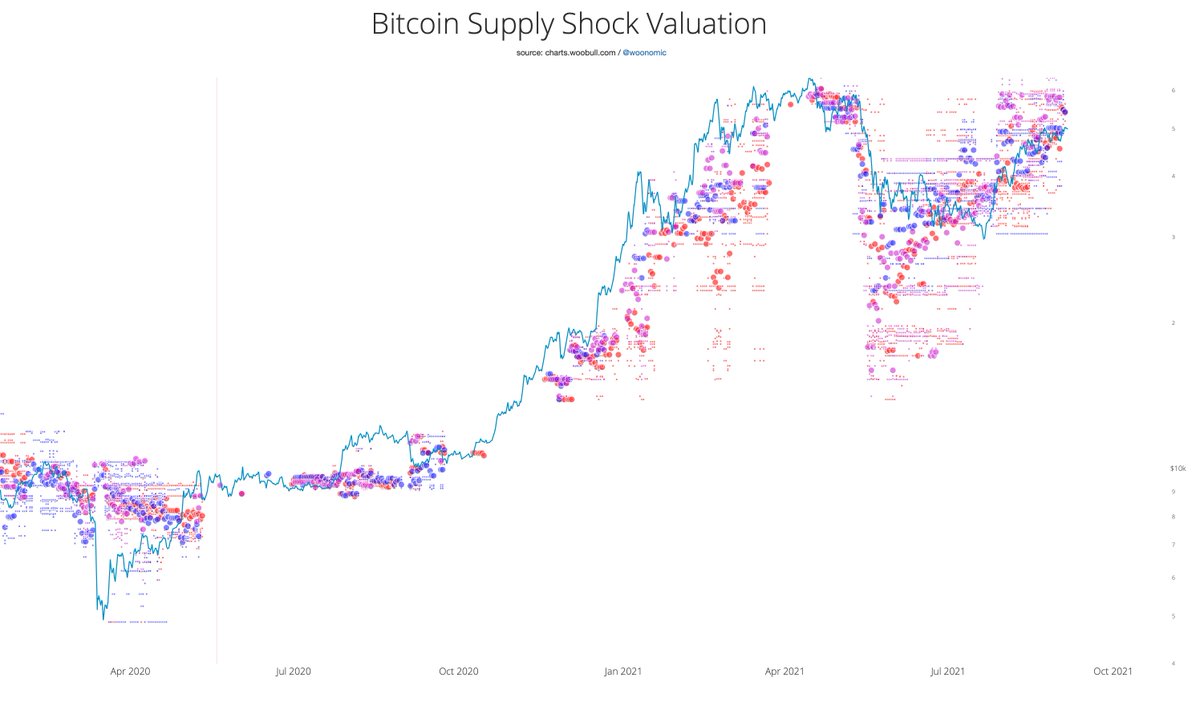

This is @glassnode's Illiquid Supply adjusted for drift.

The implication is that the raw data will give overly bullish signals, in reality we are NOT at all time highs of Illiquid Supply.

This is @glassnode's Illiquid Supply adjusted for drift.

The implication is that the raw data will give overly bullish signals, in reality we are NOT at all time highs of Illiquid Supply.

https://twitter.com/mskvsk/status/1442539556457361412

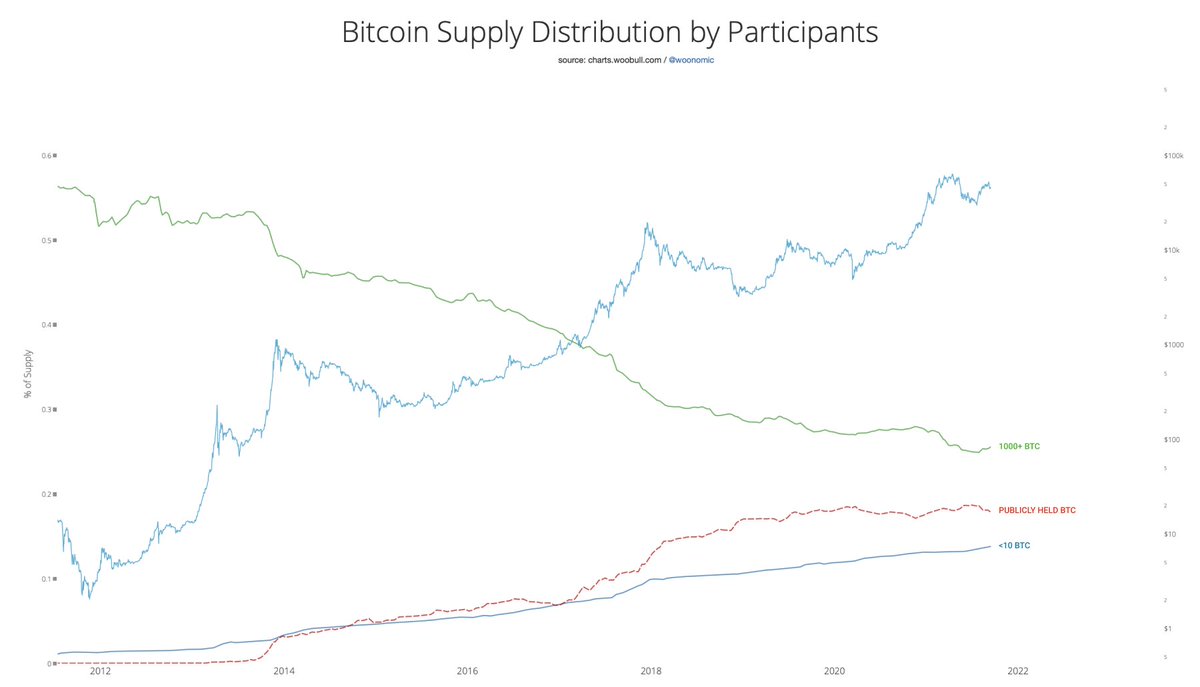

Primer... there's 3 classification of owners:

Illiquid - coins owned by "Rick Astley", the people who buy without much selling activity.

Liquid - coins owned by HODLers who buy and sell

Highly Liquid - coins owner by highly speculative people who mainly trade

Illiquid - coins owned by "Rick Astley", the people who buy without much selling activity.

Liquid - coins owned by HODLers who buy and sell

Highly Liquid - coins owner by highly speculative people who mainly trade

The reason why Illiquid Supply is over estimated lies in how Illiquid Supply is derived.

It uses heuristics to cluster wallet addresses together into distinct owners (entities).

As more data comes in, more knowledge comes to light...

It uses heuristics to cluster wallet addresses together into distinct owners (entities).

As more data comes in, more knowledge comes to light...

When coins first move to a virgin address (for example coins bought on an exchange and withdrawn to an HD wallet) there's no historical data on that address, so the heuristics will assume it's a new owner.

That new owner is classified as "illiquid" because that single address only has a history of buying (that single incoming transaction of coins coming from the exchange).

Later on, that address may interact with other addresses to give clues that the owner is actually an existing owner so the address merges with the old cluster of addresses designated to that owner.

Thus as time progresses coins in these previously virgin addresses will go from illiquid to whatever the owner's behaviour has been.

Hence the Illiquid Supply for any given day will slowly drop and stabilise over time as more data comes in.

Hence the Illiquid Supply for any given day will slowly drop and stabilise over time as more data comes in.

It takes 4 years for complete stabilisation. Though most of the stabilisation happens in the first 3 months.

This has been the results of this week's research. I'll be updating my Supply Shock metrics (on-chain demand and supply) to adjust for this drift for this very shortly. New issue of TBF incoming.

• • •

Missing some Tweet in this thread? You can try to

force a refresh