False analogy.

Asian pegs collapsed back in 1997 because external short-term fx debts exceeded reserves, not because of high m2 to reserves.

I (literally) wrote a book about it

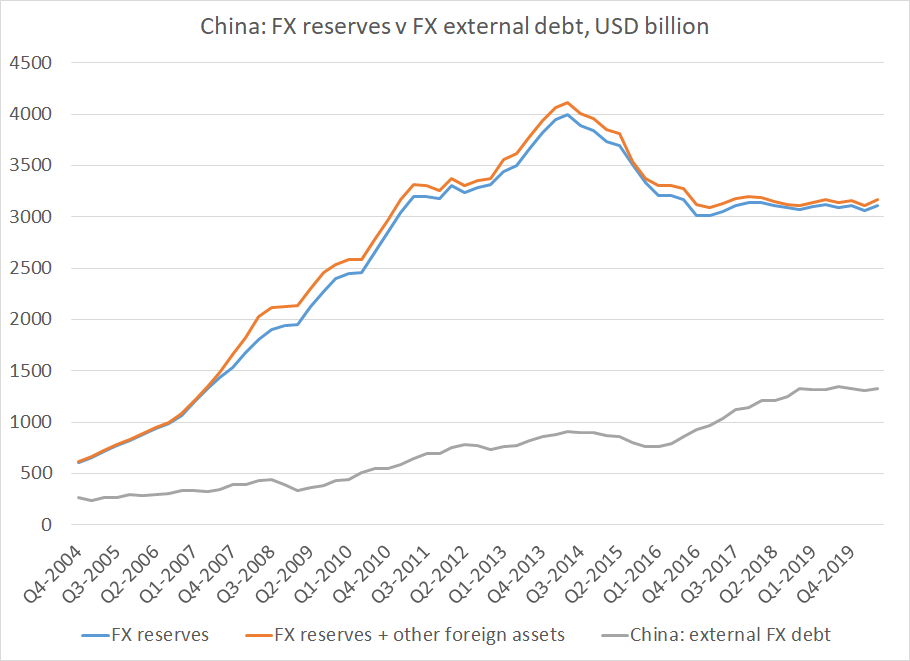

Chinese fx reserves still far exceed its external debt, let alone its short-term external debt

Asian pegs collapsed back in 1997 because external short-term fx debts exceeded reserves, not because of high m2 to reserves.

I (literally) wrote a book about it

Chinese fx reserves still far exceed its external debt, let alone its short-term external debt

https://twitter.com/mnicoletos/status/1318623464845045760

China still has far more more visible fx reserves than it has fx denominated external debt (let alone short-term external debt), and the smart money (I hope) knows that China has some hidden non-reserve assets too

A high M2 ratio is correlated with a big domestic banking system with lots domestic deposits -- a strength, not a weakness as far as I am concerned.

It also tends to correlate with current account surpluses not deficits

(and China still has controls too ... )

It also tends to correlate with current account surpluses not deficits

(and China still has controls too ... )

Everyone has their obsessions.

The right (and wrong) way to measure China's reserve adequacy is one of mine.

Reserves to M2 is wrong for China, and most of the world.

This is a hill I will die on ...

cfr.org/blog/dangerous…

The right (and wrong) way to measure China's reserve adequacy is one of mine.

Reserves to M2 is wrong for China, and most of the world.

This is a hill I will die on ...

cfr.org/blog/dangerous…

• • •

Missing some Tweet in this thread? You can try to

force a refresh