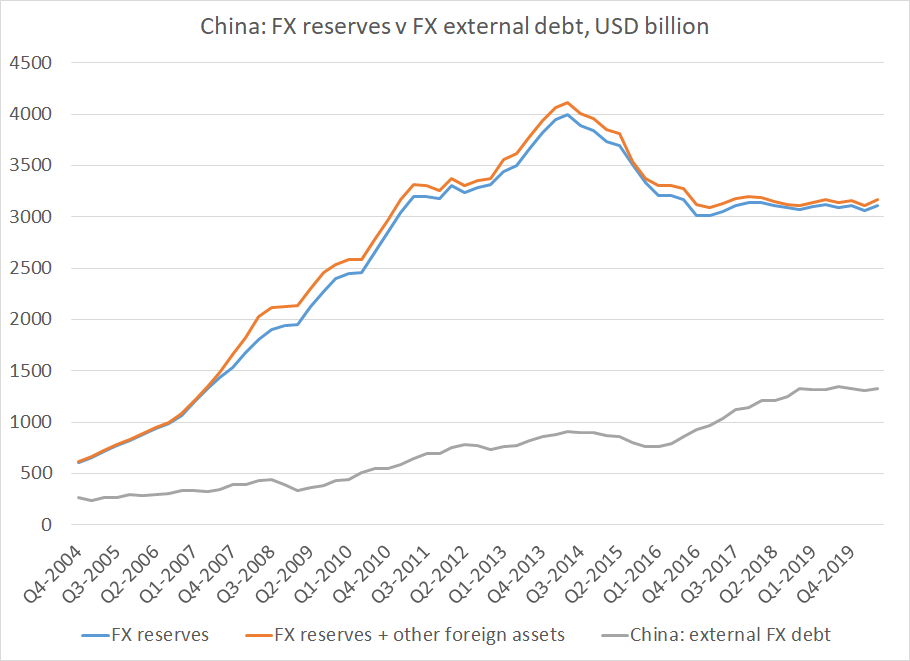

I continue to be surprised by the number of people who think the bulk of China's external bank lending has been funded out of China's reported reserves, and thus the reserves aren't liquid.

The balance of payments actually shows substantial non-reserve foreign assets.

1/2

The balance of payments actually shows substantial non-reserve foreign assets.

1/2

I guess the BoP could be a complete fabrication, but if it is at all accurate, the external loans of Chinese state banks (and their bond purchases) are additional assets that should be added on top of China's reserves (not subtractions from China's reserves)

2/2

2/2

p.s. China does have liabilities too -

but the BoP implies that they are still much smaller than China's external assets

(as one would expect given China's long history of current account surpluses)

but the BoP implies that they are still much smaller than China's external assets

(as one would expect given China's long history of current account surpluses)

For better or worse, I do spend a lot time keep track of these things -- and have a pretty clear idea of how things add up (and when they don't)

• • •

Missing some Tweet in this thread? You can try to

force a refresh