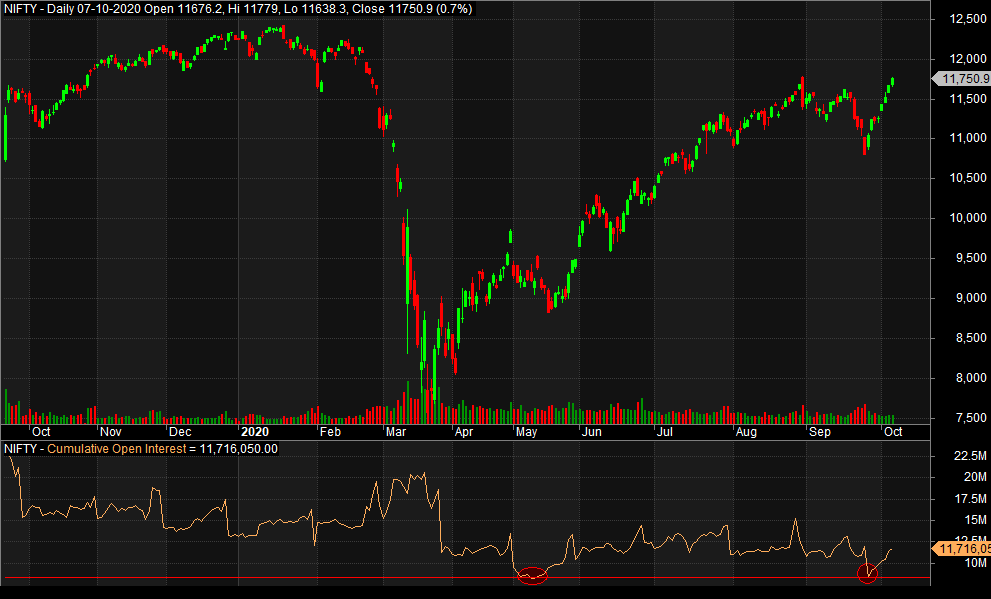

As far as charts are considered, I do not look for Volume Interpretation when we are in a sideways channel. But once we are out of channel, I do give it importance.

Reason: Any symbol follows general rule of market. Trend>Accumulation/Distribution>Trend.

1/n

Reason: Any symbol follows general rule of market. Trend>Accumulation/Distribution>Trend.

1/n

Now, this may vary from time frame to time frame and may have different interpretation when combining lower and bigger time frames. Once I spot a channel, volume and its interpretation inside it is irrelevant. Only the breakout.

2/n

2/n

Over period I have observed that a good sideways channel is with 50 to 60 plus bars with support and resistance break test of at least 3 times. Between that multiple tests will be done for a shakeout to either side. In rare cases we have V shaped or n-down movements.

3/n

3/n

For that extra ordinary case, we have stop-loss or adjustment methods. But this is the rule I follow. This may not be relevant to all. Open for discussion and improvements.

• • •

Missing some Tweet in this thread? You can try to

force a refresh