Part 2: Thread on #OptionBasics for #Nifty #BankNifty or #Stocks for beginners

In Part 1 we understood Intrinsic/Extrinsic Value, Theta Decay and IV.

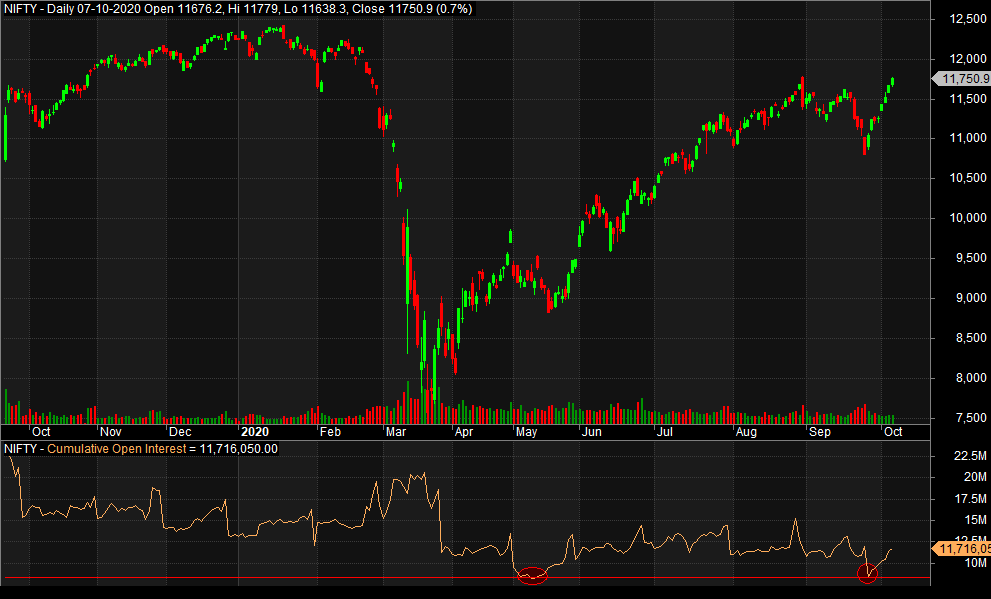

Now we need to understand another aspect of IV. Volatility is mean reverting. It means if Volatility is high, it tends..

...1/n

In Part 1 we understood Intrinsic/Extrinsic Value, Theta Decay and IV.

Now we need to understand another aspect of IV. Volatility is mean reverting. It means if Volatility is high, it tends..

...1/n

@rohit_katwal to decline and if Volatility is low, it tends to rise. So when deciding on Option Strategy we should consider IV. If it is low, we should buy debit spreads so that we benefit from rise in IV. If IV is high, we should sell credit spreads so that we benefit from...2/n

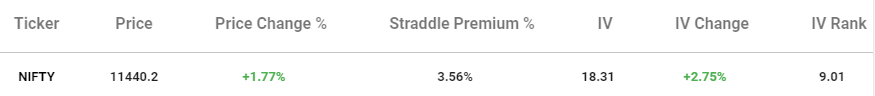

@rohit_katwal fall in volatility. Lets look at IV or Nifty and Bank Nifty in the given image it is: 18 and 29 respectively. Now how do we decide which IV is low or which is high? I prefer to use IV Rank method for it.

...3/n

...3/n

@rohit_katwal The solution is to compare each stock's IV against its historical IV levels. We can accomplish this by converting a stock's current IV into a rank. Formula is attached here. You can learn in detail about IVR on google or projectoption.com/iv-rank-vs-iv-…

...4/n

...4/n

@rohit_katwal But to put it in simple words, I consider IVR>20 as high and IVR<20 as low. So when IVR is less than 20, we should initiate a debit spread hoping volatility will increase and do a credit spread when IVR is greater than 20 hoping the IVR will decrease.

...5/n

...5/n

@rohit_katwal We know how to deploy strategy using IV so now we need to construct a strategy using Option Greeks. We have to make it Delta and Theta Neutral. Let us suppose we are bullish on #Nifty (forgetting technical analysis) and IVR is 9, so we create debit spread.

6/n

6/n

@rohit_katwal Nifty is at 11416 when I am writing this. Let us construct a Bull Call Debit Spread. In Bull Call Debit Spread, we buy a lower strike call and sell an upper strike sell. Debit we pay is the max loss. Spread Size - Debit = Max Profit.

7/n

7/n

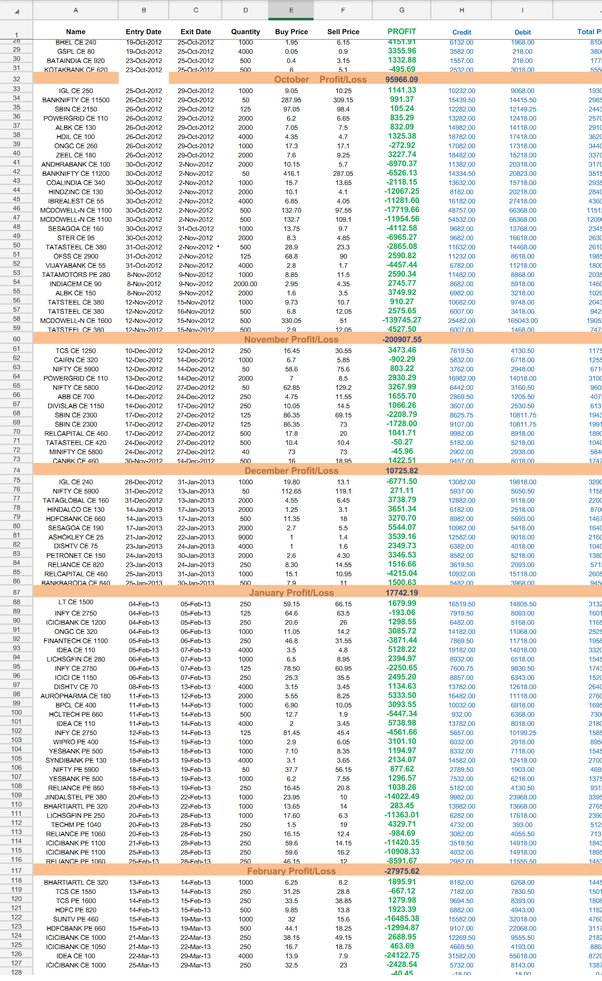

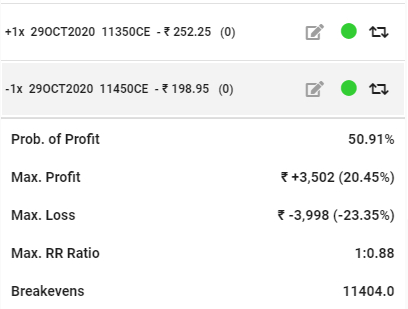

@rohit_katwal So if I initiate a buy on 11350 CE monthly at 252 &

sell on 11450 CE monthly at 198, then

Max Loss = 252-198 = 54 points

Max Profit = 100 - 54 = 96 points if #Nifty expires above 11450.

Now lets look at greeks. We need Delta and Theta Neutral Strategy.

8/n

sell on 11450 CE monthly at 198, then

Max Loss = 252-198 = 54 points

Max Profit = 100 - 54 = 96 points if #Nifty expires above 11450.

Now lets look at greeks. We need Delta and Theta Neutral Strategy.

8/n

@rohit_katwal 11350 CE, delta is +0.5788

11450 CE, delta is -0.5013

So total delta is 0.0755 i.e. positive if market moves up which we need.

11350 CE, theta is -3.8597

11450 CE, theta is +3.9157

Total Delta is 0.056 i.e. we gain with passage of time. Neutralized.

9/n

11450 CE, delta is -0.5013

So total delta is 0.0755 i.e. positive if market moves up which we need.

11350 CE, theta is -3.8597

11450 CE, theta is +3.9157

Total Delta is 0.056 i.e. we gain with passage of time. Neutralized.

9/n

@rohit_katwal Even the Vega (volatility is also neutralized). So with Option Greeks we have made a strategy in which we are delta and theta neutral.

Purpose of this exercise was to show how Option Traders use Option Greeks to construct strategies.

...10/n

Purpose of this exercise was to show how Option Traders use Option Greeks to construct strategies.

...10/n

@rohit_katwal Similarly, based on your market view, you can use multiple legs of an option to create Delta, Theta, Gamma or Vega neutral strategies. You can use different combination to achieve that. If IVR is greater than 20, I would have used a Bull Put Spread.

...11/n

...11/n

@rohit_katwal One thing you must understand is that we can mitigate the Delta / Theta loss with the help of Option Greeks, but we cannot mitigate the Directional Loss which might occur due to technical analysis. So everything is to be used carefully. 12/n

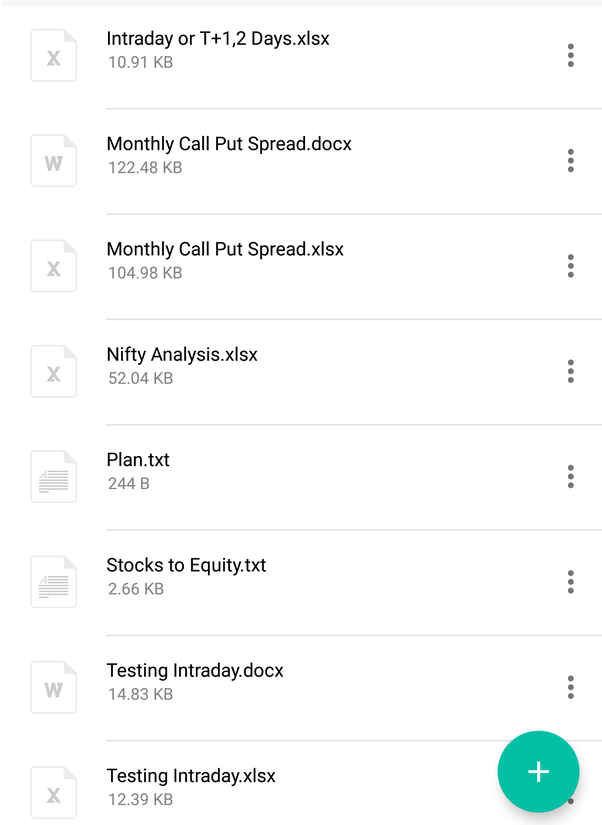

@rohit_katwal For homework, you can try for looking in more details at IVR, Delta, Theta, Gamma and Vega of Options. In my next Saturday thread, I will discuss using Debit/Credit Strategy with SL and trailing SL and rules for that.

Happy Trading. Open of discussion.

Happy Trading. Open of discussion.

• • •

Missing some Tweet in this thread? You can try to

force a refresh