#TradingQNA #Nifty #BankNifty #OptionsTrading

Q. What are some basic points that we must know before going for options trading?

Here are few pointers before you start option trading: -

1. Option Trading is a game of probabilities and money management.

...1/n

Q. What are some basic points that we must know before going for options trading?

Here are few pointers before you start option trading: -

1. Option Trading is a game of probabilities and money management.

...1/n

@rohit_katwal 2. There is no such thing as unlimited profit and unlimited risk in option trading. Unlimited profit is same as hitting a lottery and we all know what happens to lottery buyers. There is no unlimited risk if you know what you are doing.

...2/n

...2/n

@rohit_katwal 3. Buy Calls when bullish. Sell Calls when bearish.

4. Buy Puts when bearish. Sell puts when bullish.

5. Either put a SL to your trade or do a 100% hedge for risk-management.

6. Hedging is used to save your self from potential losses. Learn it.

...3/n

4. Buy Puts when bearish. Sell puts when bullish.

5. Either put a SL to your trade or do a 100% hedge for risk-management.

6. Hedging is used to save your self from potential losses. Learn it.

...3/n

@rohit_katwal 7. Option prices moves based on underlying and futures. Analyzing the underlying is as important.

8. Every Chart Setup has a different trading strategy. Execute the trades only when you know what is the R:R, worst case and best case scenario.

...4/n

8. Every Chart Setup has a different trading strategy. Execute the trades only when you know what is the R:R, worst case and best case scenario.

...4/n

@rohit_katwal 9. In #OptionsTrading #IndiaVix below 16 signifies stability. Above 16 it signifies volatility. If India Vix increases, markets generally fall and become volatile. If India Vix falls, markets tend to stabilize. Before major events like elections, vix jumps.

...5/n

...5/n

@rohit_katwal 10. Learn the difference between equity options and index options. There is no limit to equity prices falling. Index on the other hand has a circuit limit.

11. Trade only liquid options. Every paisa saved on bid offer matters.

...6/n

11. Trade only liquid options. Every paisa saved on bid offer matters.

...6/n

@rohit_katwal 12. Option Selling, if done properly is always rewarding. Option buying is always losing. You can win for a while, but in the long run, you will lose.

13. When taking option spreads, execute both legs at the same time.

14. Do not trade naked options without SL.

7/n

13. When taking option spreads, execute both legs at the same time.

14. Do not trade naked options without SL.

7/n

@rohit_katwal 15. Never deploy all capital in one go. Despite all technical, fundamental analysis or a call from God, things can go wrong. Deploying money in tranches for different scenario is the key.

16. In a bear market, do not catch a falling knife.

...8/n

16. In a bear market, do not catch a falling knife.

...8/n

@rohit_katwal 17. Learn to identify when the market are sideways. Sideways market can eat up profit from all the bull or bear runs.

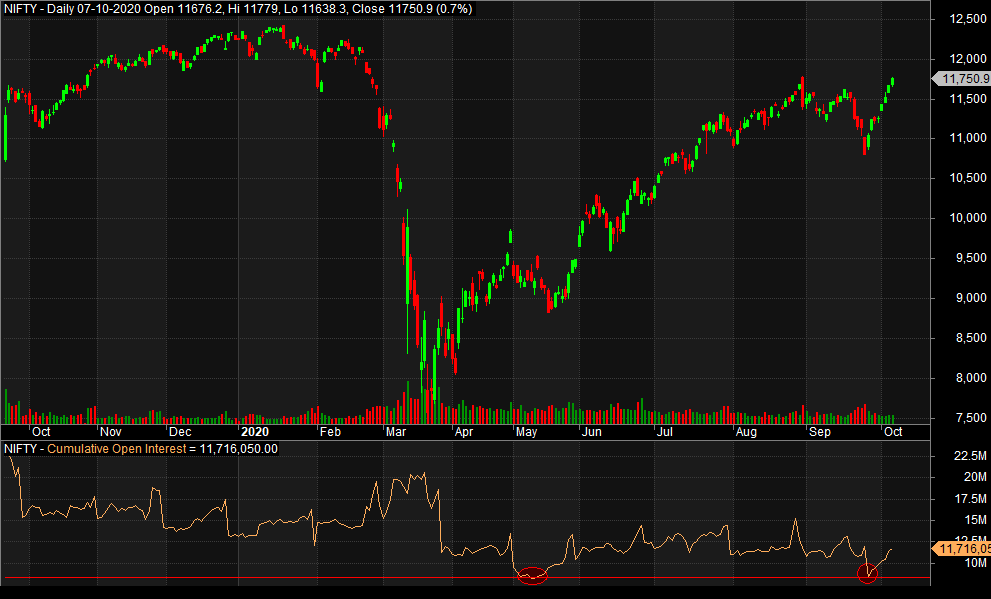

18. Open Interest is an interesting aspect of option trading. Learn it.

19. Avoid trading when some major news is pending like US elections.

..9/n

18. Open Interest is an interesting aspect of option trading. Learn it.

19. Avoid trading when some major news is pending like US elections.

..9/n

@rohit_katwal Last - Every Trade Can result in:

1. Big Win

2. Small Win

3. Break-Even

4. Small Loss

5. BIG LOSS

If you can avoid no. 5, you will eventually be profitable.

Will keep adding more to the thread.

Please share your own Options Learning here.

1. Big Win

2. Small Win

3. Break-Even

4. Small Loss

5. BIG LOSS

If you can avoid no. 5, you will eventually be profitable.

Will keep adding more to the thread.

Please share your own Options Learning here.

• • •

Missing some Tweet in this thread? You can try to

force a refresh