India’s economic normalisation picking up, resilient recovery both on the domestic and external side in Sep and mid Oct. With the festive season round the corner, we enter a critical behavioral phase in the fight against the pandemic.

Latest India macro-update with

@tulsipriya_rk

Latest India macro-update with

@tulsipriya_rk

Growth in active cases consistent negative, recovery rate improving- BH,TN, WB,DL,GJ,AP. CFR declining. Healthy testing progress- particularly in Arunachal, Goa, DL, AS, JK, Tripura and TN. Testing now matches global averages with test positivity rate below WHO standard of 8%

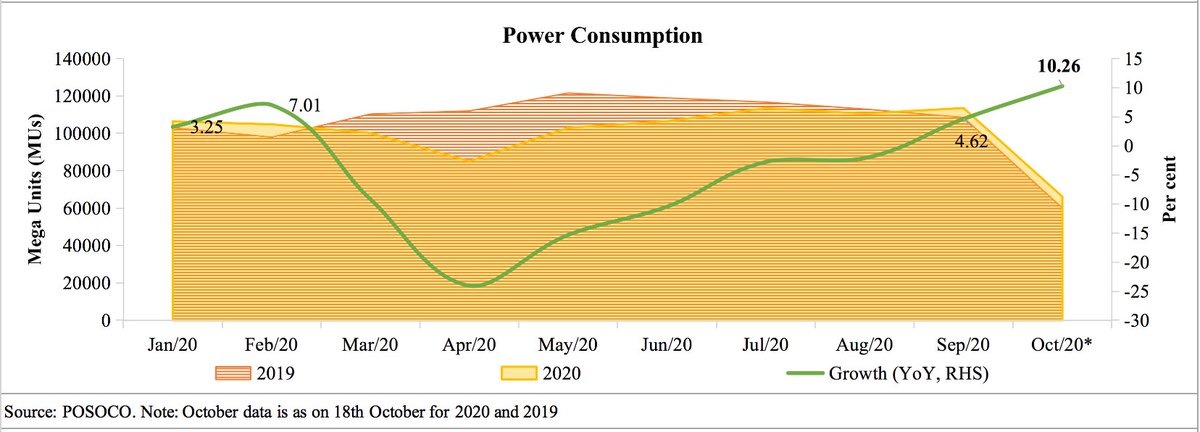

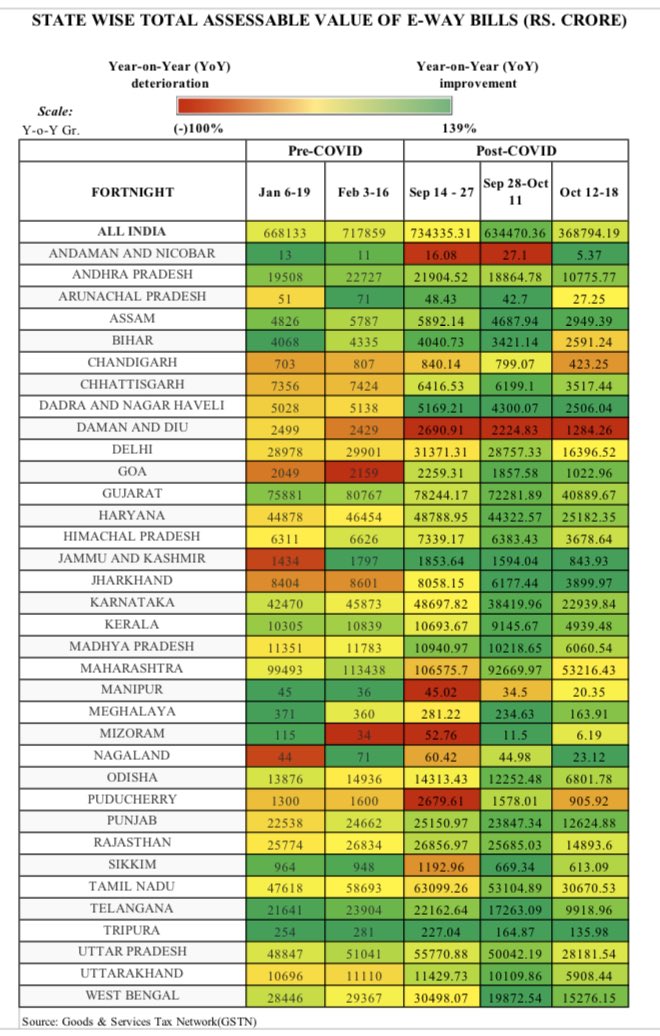

Healthy growth in power consumption, ETC collections and inter and intra E way bills. Augurs well for improved GST collections in upcoming festive months.

Recovery in power consumption in 1-18Oct in all states except Goa, Telangana, MZ, KL, AP and MH. Broad based recovery in E way bills. ETC levels continue to improve except in Delhi and PB, possibly owing to farmer protest induced highest blockages.

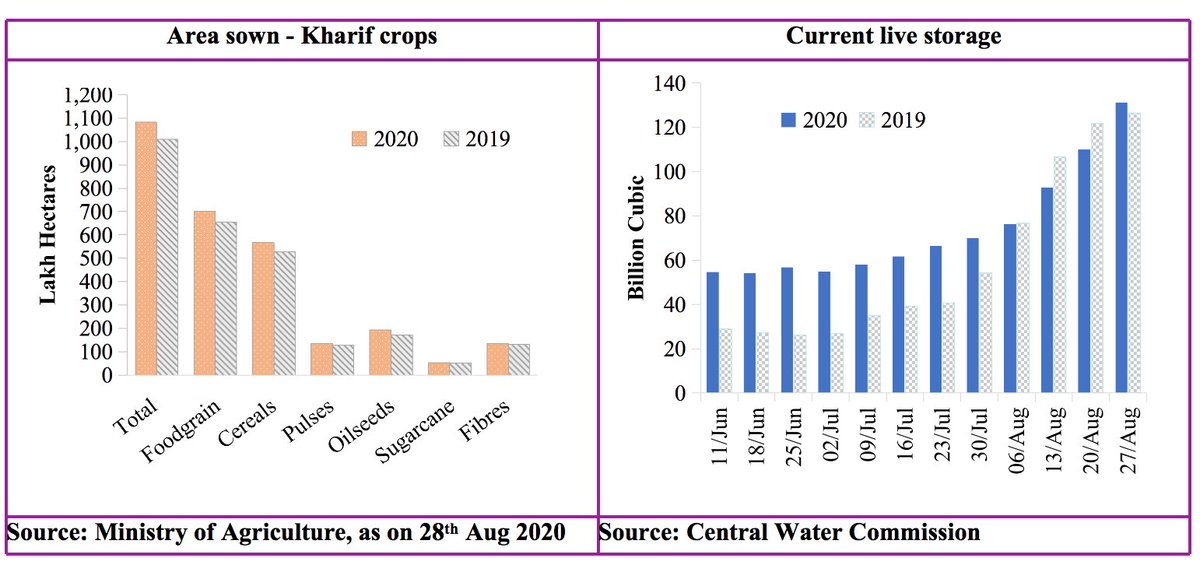

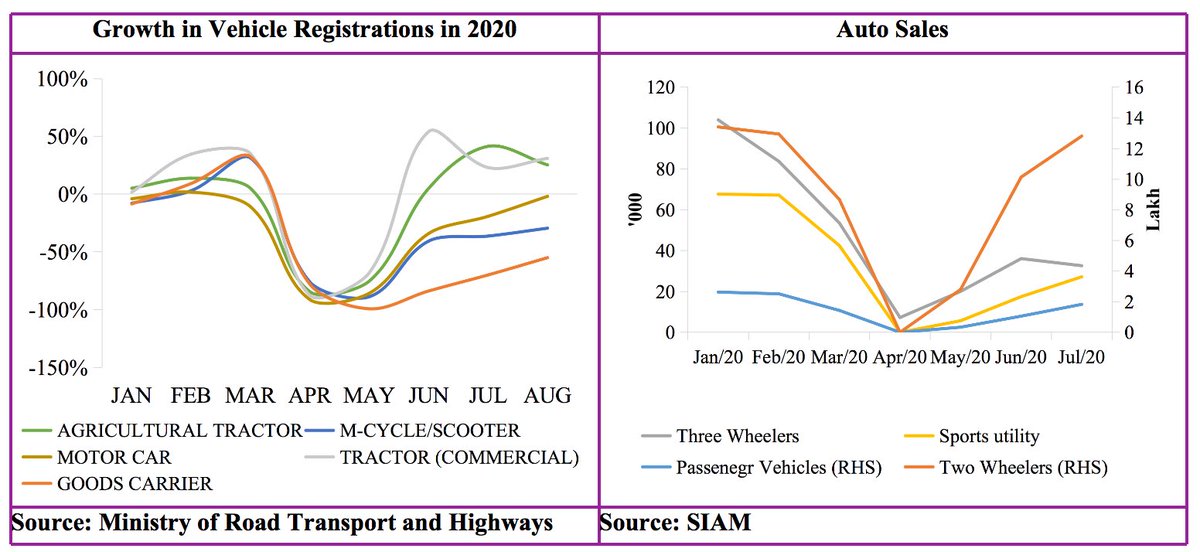

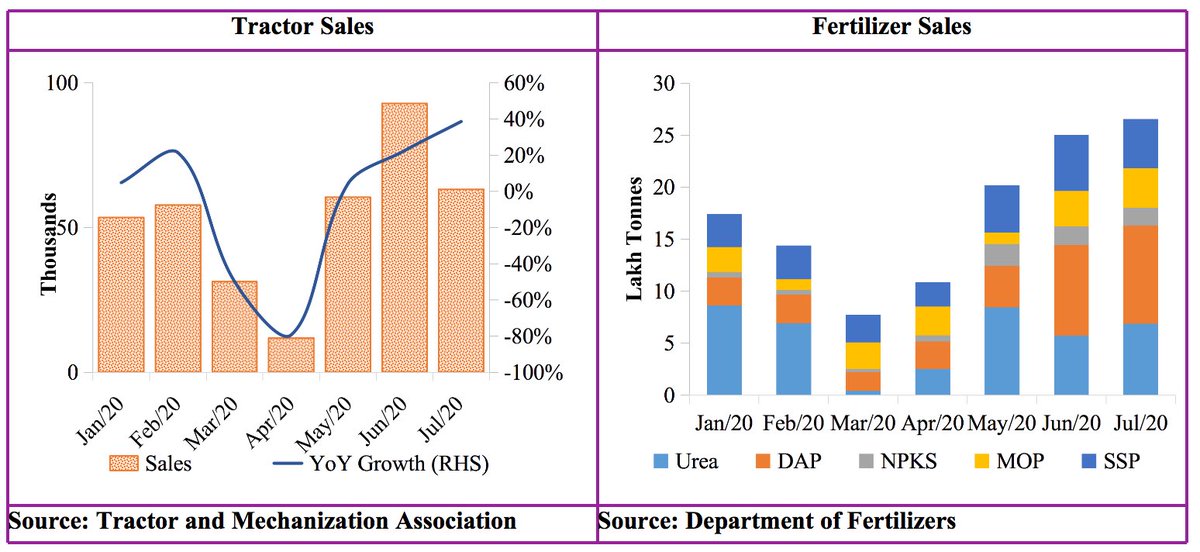

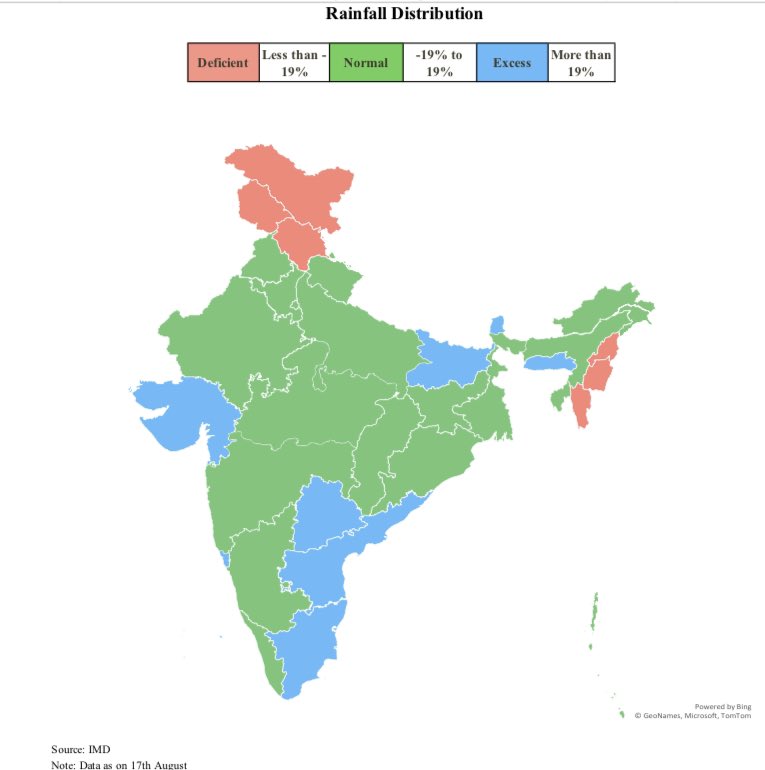

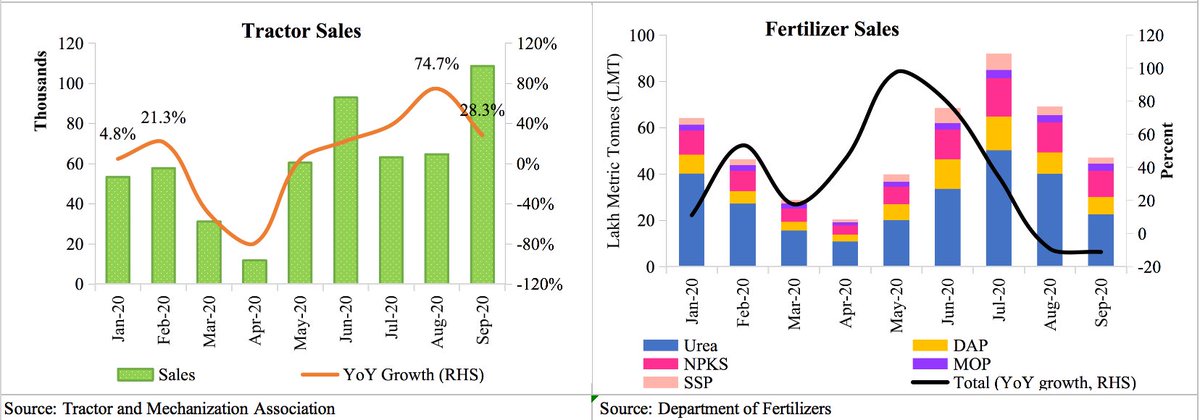

Kharif season comes to a close, bountiful monsoons contributed to healthy kharif sowing, however, large excess rainfall and floods in Oct in five states viz TL,CH,OD,MH and Andaman pose crop damage risks. Healthy tractor sales, particularly in returnee migrant eastern states.

MGNREGA demand fell sharply in August and Sep compared to July levels owing to seasonal farm operations, also possibly hinting at migrant return to cities. With significantly higher budget allocation and spending this year, 55.1% higher YoY person days work created till Sept

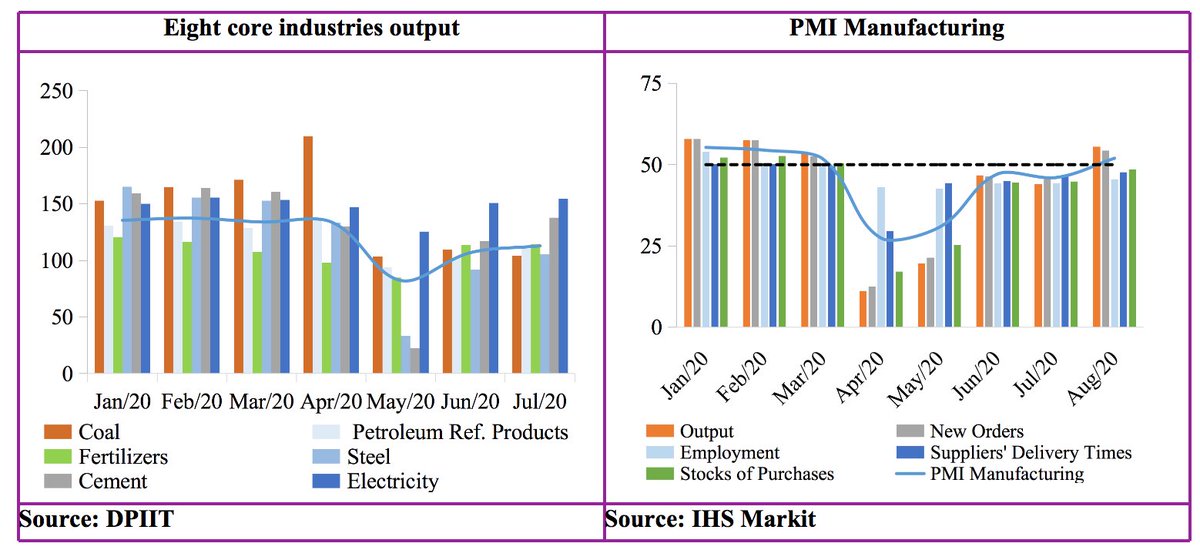

Manufacturing remains bullish. Services, disproportionately affected by lockdown, also nearing expansion in Sept.

Rail freight growth turned around remarkably since August. Domestic aviation activity expected to recover further with onset of festive season as domestic airlines start opening upto 75% of Pre Covid capacity soon, up from existing 65%

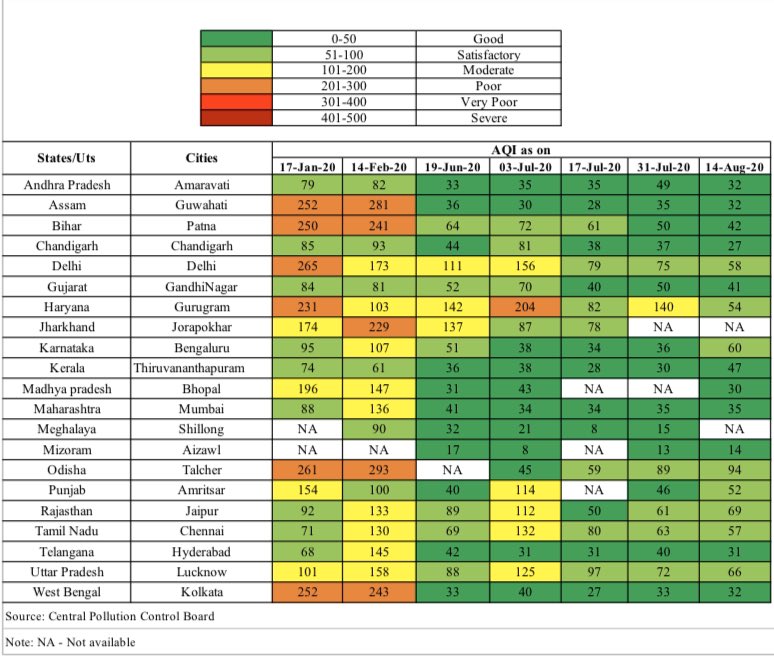

Air quality index improved in most cities in fortnight ending 16 Oct- AP, TL experience good AWI due to heavy rain, air quality worsened to poor in DL, HR with onset of winter season, picking up economic activity and legacy issues.

Inflationary pressure expected to soften as supply chain disruptions ease with unlocking. Mandi arrivals declined YoY in sept with tends continuing in Oct except for onion and groundnut. Retail food prices elevated YoY in Oct, particularly for tur, onion and groundnut.

Sensex and nifty 50 weekly averages improving since last three weeks, nifty volatility picks up and could rise further ahead of US elections, cautionary note for investors. Strong net Foreign inflows in October after our follows in Sept

RBI’s regular dollar purchases kept market volatility in check and rupee range bound around 73.48 in Sept, appreciated to reach 73.32 till 16 Oct owing to strong inflows, encouraging Covid vaccine prospects, improving Chinese recovery, weak dollar and muted oil prices.

Unroll @threadreaderapp

• • •

Missing some Tweet in this thread? You can try to

force a refresh