#stockmarket WE update. As I've been discussing for wks, the mkt would remain choppy into the election & it has. resolution feels closer but not there yet. Friday was constructive but still some issues ST. $SPY now bumping up against the Asc Triangle & back above key MA's...

#stockmarket #Nasdaq is similar & held an important level. threatening to break the Asc Triangle formation and also above key MA's...

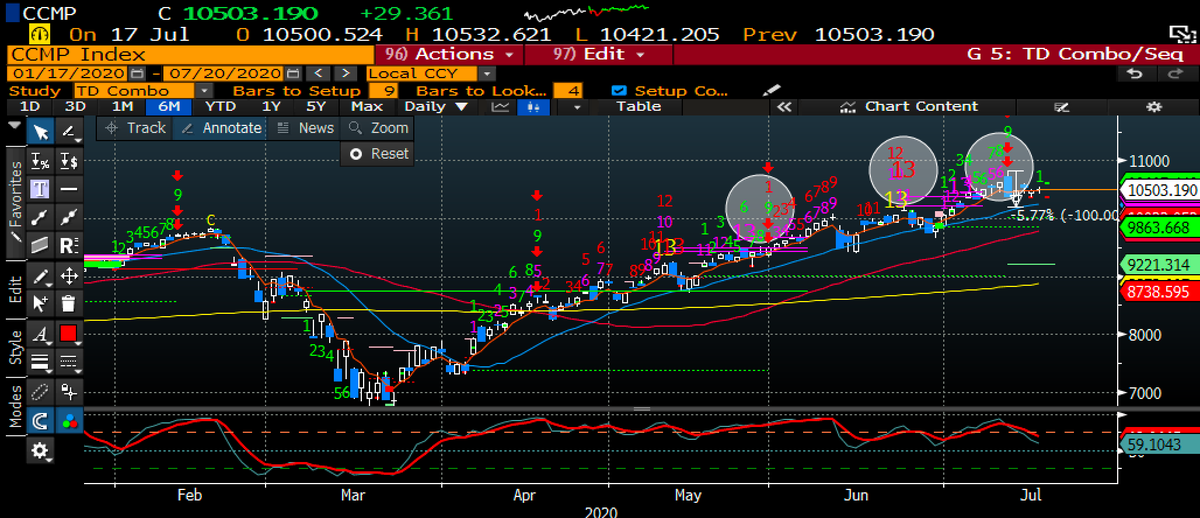

#stockmarket fly in the ointment for tech and the #NASDAQ is that a weekly Demark 13 did print last week to go with the $NDQ 13 sell last wk. not much on the daily. keep in mind these signals can be good for 12 weeks so doesn't mean we will turn down immediately but we can.....

#stockmarket Smart money Index looks awful and fairly concerning for bulls as it broke my channel to the downside. That said, new 13 Demark buy so turning up here could add fuel to the next rally....

#stockmarket Daily Bollinger bands for #SPX #NASDAQ both look fairly healthy as it tested Mid BB and now closed above the 8day EMA....

#stockmarket Daily RSI for the #SPX & the #NASDAQ also look healthy to me, backtesting the breakdown level and bouncing....

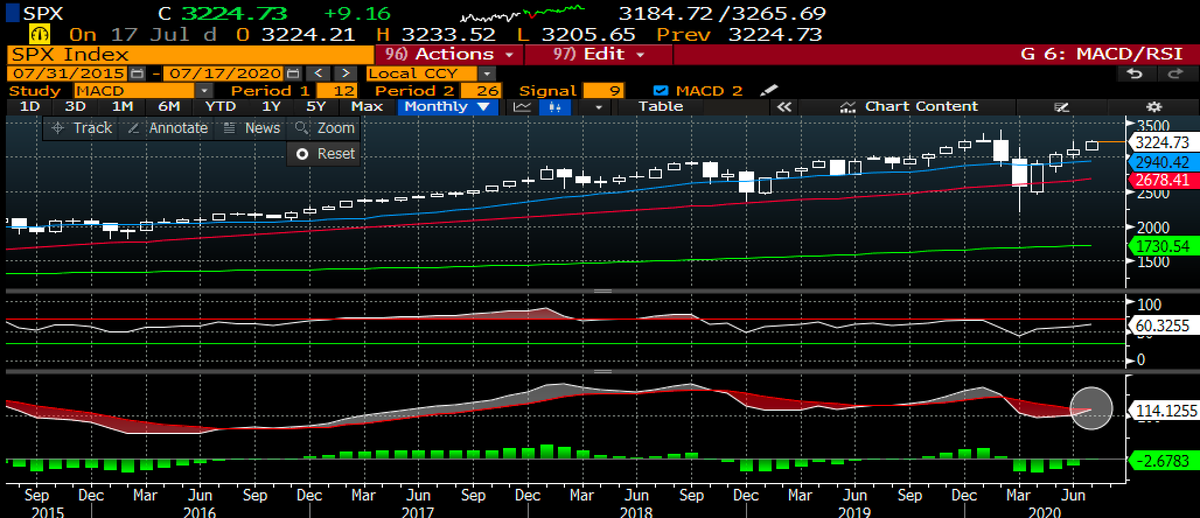

#stockmarket no surprise though the momentum is fading and now the MACD's for the #SPX and #NASDAQ threatening to cross down....

#stockmarket clearly the AD/Decline breaking out to new highs is bullish, BUT new Demark 13 sell on Friday so a turn down here could start a retracement....

#stockmarket HiLo Index backed off considerably & is understandable given the recent mkt weakness. Overlaid w/ Demarks & the 9 sell caught the recent swing high and now a 9 buy. maybe this starts to lift which would obviously be bullish....

#stockmarket DMI's for both the #SPX and #NASDAQ are uninspiring, w/ a new neg cross & the ADX making new lows. Basically this means the mkt is non-trending, BUT from such a depressed ADX lvl, usu you see reversion but timing here is suspect & trend direction is unclear....

#stockmarket I posted this chart last week as a reason to be Intermediate term bullish as it continues to trend upward. $XLY vs $XLP - measure of risk in the mkt. still looks good to me....

#stockmarket I also posted this chart of the Valueline index which is battling an important level. a break higher would be very bullish and rotation theme supportive. Zoom in and it seems like it broke the bull flag. Unfortunately, it also printed a new Demark Combo 13 sell...

#stockmarket equal weight #SPX has outperformed lately and threating to break this consolidation its been in since March. Unfortunately, it also has a new Demark seq 13 sell. Turning down here would put some cold water on that rotation theme gaining traction...

#stockmarket Concl: I wish I had better things to say. mkt seems like it wants to break higher but we are also at the mercy of stimulus headlines & election noise. I have bullish indicators flashing, but also bearish ones. this wk, better to remain light, take trades & be patient

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh