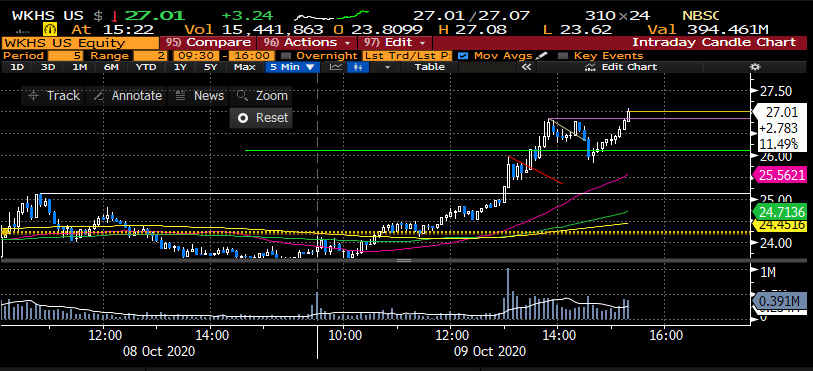

#StockMarket WE update: recent Demark 13 sell I posted this wk marked the swing high & choppiness ensued. Fri was ugly but could be opex related so for now just expecting more of the same unless stimulus resolution breaks us out or down. set up seems bullish but needs to confirm

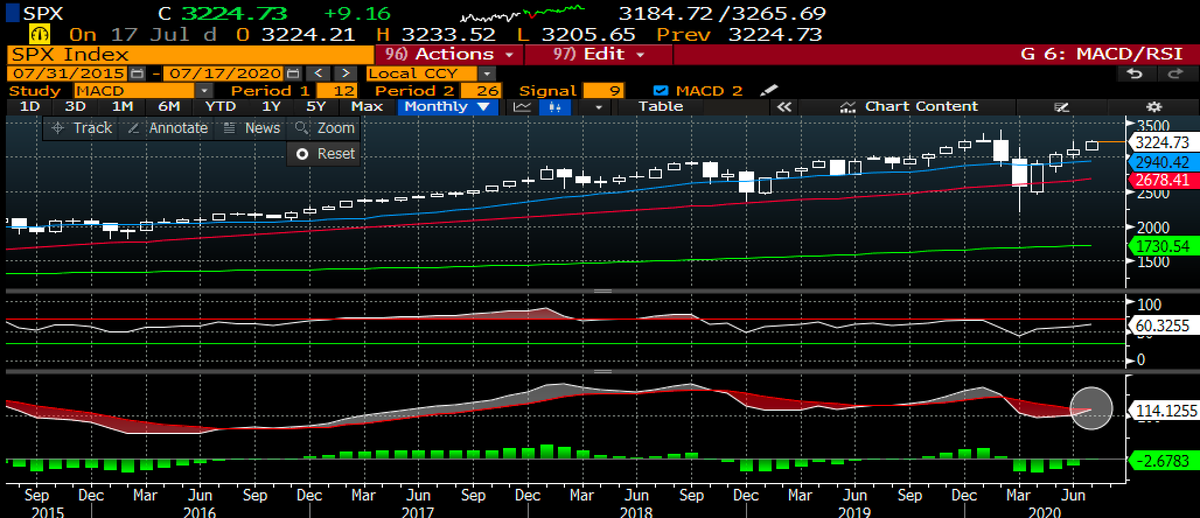

#stockmarket Demark Trendfactor lvls continue to be a good guide. 13 sell peaked @ 1x up lvl, & found support on 1/2 lvl down. see white boxes for up lvls & blue for down lvls in chart above. daily #SPX chart below also showing a close right @ 5 day EMA on Fri....

#stockmarket #SPX $SPY weekly chart ended w/ a doji candle which shows indecision, & intuitively makes sense given the impasse over stimulus. To me this chart is intermediate term bullish - Large C&H w/ resistance at the B/O point. could it break down from here? sure...

#stockmarket #SPX $SPY monthly chart is constructive as it seems to be consolidating after a rough Sept although near the top of the megaphone pattern from '09 low. sideways is usually bullish in an uptrend - right now working on an inside month....

#stockmarket #SPX $SPY weekly Demark chart also now w/ 2nd wk of price flip up post the 9 sell @ the beginning of Sept. Slo sto is also starting to curl back up. notice last 2x its crossed this year, favorable mkt returns ensued....

#stockmarket switching gears to the #Dow & the picture is a bit more cloudy w/ pot'l for a big Double top or a break out to test the top of the channel around 30k.

Time will tell. But the weekly much like #SPX looks bullish - Doji candle right at C&H resistance....

Time will tell. But the weekly much like #SPX looks bullish - Doji candle right at C&H resistance....

#stockmarket #Dow Demark chart still has a propulsion up tgt thats active w/ 29526 tgt. This may also coincide w/ an incomplete combo 13 sell (11 count from Sept high). Recent Demark 13 sell still in play & risk lvl associated w/ it @ 28978 was the recent swing high = cloudy....

#stockmarket interesting that the #SPX #NASDAQ #Dow all found support this past week at the top of the ichimoku cloud....

#stockmarket Smartmoney Index has been trending lower and has been one of the indicators that has kept me cautious & continues to struggle. BUT, new Demark Seq 13 buy as early as tomorrow at the lower end of my channel. turning up would be bullish....

#stockmarket MACD for each of the indices #SPX #Nasdaq #Dow also have all crossed + and back above the zero line on the daily charts = bullish....

#stockmarket Although the RSI for each of the indices #SPX #nasdaq #Dow has been losing momentum and somewhat negatively diverging....

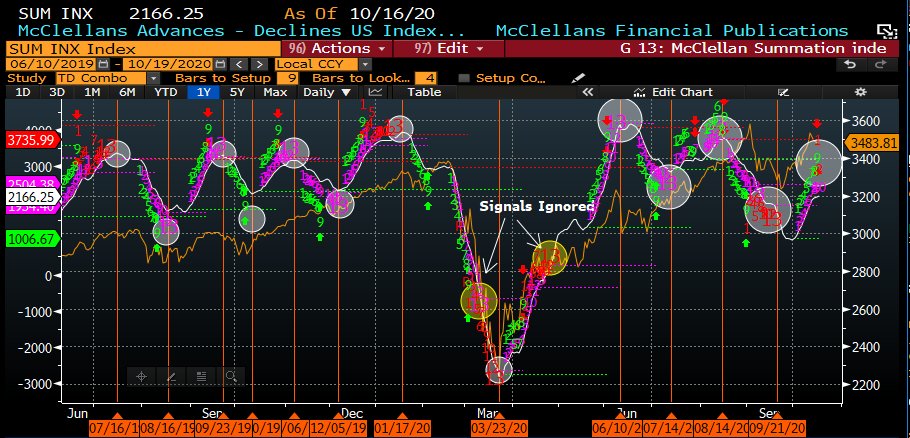

#stockmarket and the McLellan Summation Index overlaid w/ Demark signals, which called the trough in the indices again 3 weeks ago, now approaching pot'l exhaustion this week, w/ new 9 sell and pot'l for a combo 13 sell in 3 days. needs to be monitored.....

#stockmarket also the Ad/Decline w/ a new Demark combo 13 sell last wk & a new 13 possibly this wk. Turning down here would be bearish...

#stockmarket $Vix short positioning overlaid w/ Demarks now showing an 11 buy count on the daily w/ likely 13 printing this wk. Last 5x this happened, volatility events ensued but timing here is difficult. $VXX hedge here probably not a bad idea....

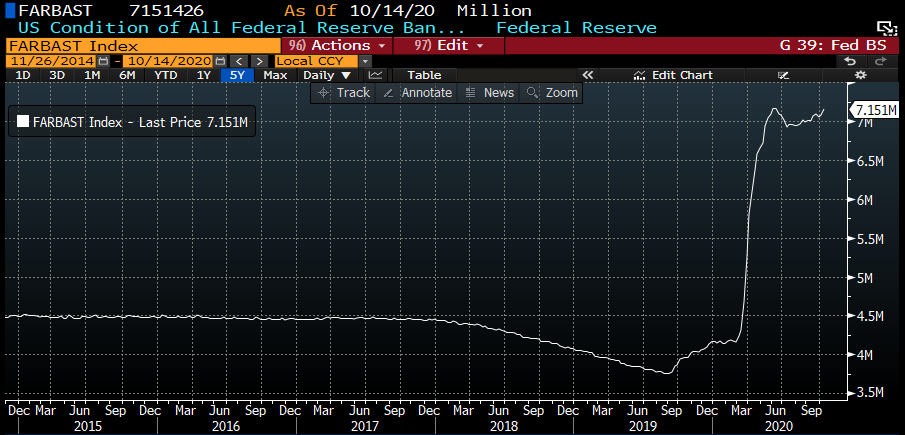

#stockmarket but ultimately the flood of Fed liquidity isnt compressing, its expanding, so LT bear thesis IMO is hard as long as this is trending up....

#stockmarket Consumer discretionary vs staples (risk indicator) continues to look bullish to me and implies risk on...

#stockmarket and the Value Line index, while still struggling at an important juncture, showing a series of higher lows despite the UTL break over the summer. break out here would scream bullish to me....

#stockmarket concl: chop fest likely continues until some stimulus resolution, which could come this wk. I see reasons to be intermediate term bullish, but also some issues in the ST. I continue to advocate a less is more approach, tight stops, hedges and cash. buy dips sell rips

@threadreaderapp unroll

• • •

Missing some Tweet in this thread? You can try to

force a refresh