A thread on Uniswap $UNI

The rationale for owning $ETH as an investment is that Ethereum is a clear market leader, w/ strong growth/usage, & tangible fee generation even though none of this value accrues to ETH token holders yet.

This is actually the same bull case for $UNI 👇

The rationale for owning $ETH as an investment is that Ethereum is a clear market leader, w/ strong growth/usage, & tangible fee generation even though none of this value accrues to ETH token holders yet.

This is actually the same bull case for $UNI 👇

Uniswap is the clear market leader in DEX trading. Like "ETH vs smart contract protocols", there's not even a close second to $UNI in DEX Trading (courtesy of @DuneAnalytics)

With $ETH, EIP-1559 & ETH 2.0 are constantly in "the future", but the $UNI "Fee Switch" is happening w/ near certainty Feb 16, 2021 (180 days after governance began).

$UNI will then join a small list of tokens like $HXRO $MKR $FTT $BNB that accrue real value from earnings

$UNI will then join a small list of tokens like $HXRO $MKR $FTT $BNB that accrue real value from earnings

Expected annual earnings for Uniswap: $380mm

(based on $360mm avg daily trade volume @ 0.30% fee)

-> $66mm distributed to $UNI token holders after the fee switch (1/6th of fees)

-> 13% divd yield

-> 1.30x Price/Sales

-> 7.5x Price to distributed CFs

That's really cheap!

(based on $360mm avg daily trade volume @ 0.30% fee)

-> $66mm distributed to $UNI token holders after the fee switch (1/6th of fees)

-> 13% divd yield

-> 1.30x Price/Sales

-> 7.5x Price to distributed CFs

That's really cheap!

For comparison, the S&P 500 trades at 25x forward P/E & 1.7% divd yield

I'd argue anything in #DeFi (and digital assets in general), warrants a much higher multiple than an overextended equity market during a recession.

I'd argue anything in #DeFi (and digital assets in general), warrants a much higher multiple than an overextended equity market during a recession.

As soon as market participants start giving $UNI the same benefit of the doubt that they give $ETH in terms of future value accrual, $UNI will be viewed as the single cheapest asset in all of digital assets and certainly all of #DeFi.

Here are 5 reasons someone could give for not owning $UNI:

1) Selling pressure from farming outweighs demand -- but with only 770k UNI released per day, that is easily absorbed by value investors once the yield from the fee switch kicks in (and farming might end Nov 18th).

1) Selling pressure from farming outweighs demand -- but with only 770k UNI released per day, that is easily absorbed by value investors once the yield from the fee switch kicks in (and farming might end Nov 18th).

2) You believe Uniswap will not remain the market leader and volumes will drop or be competed away (just like the "ETH killers")

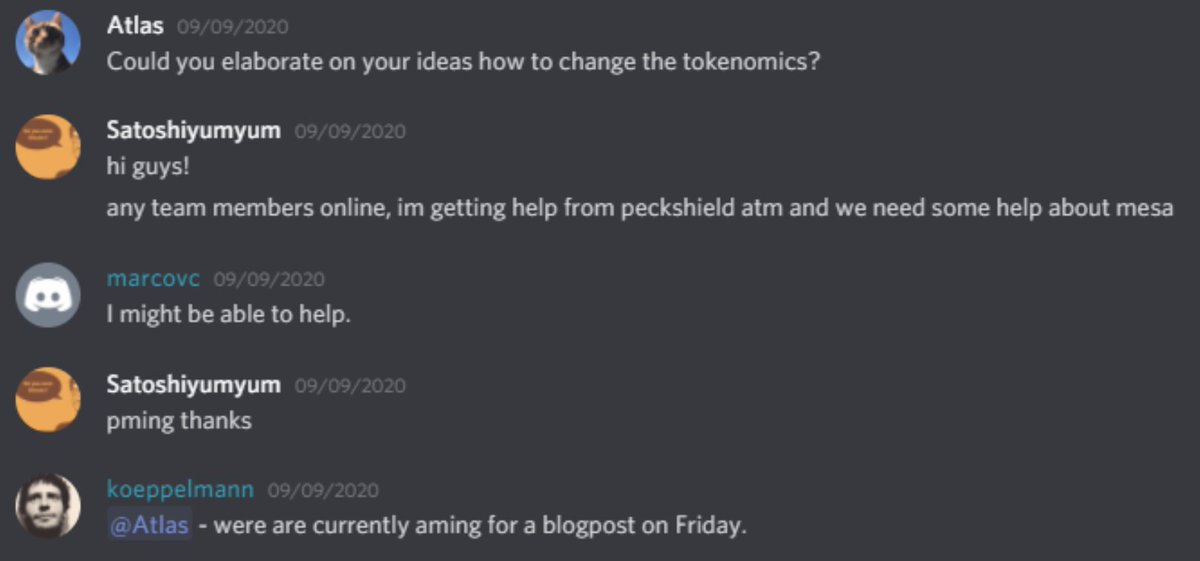

3) You don't believe the "fee switch" will happen (or you don't even know the fee switch exists)

3) You don't believe the "fee switch" will happen (or you don't even know the fee switch exists)

4) You believe the fee switch will happen, but since it is still 3 months away, you are waiting to buy until closer to the date (Game of chicken)

5) $UNI is simply part of #DeFi, and DeFi is out of favor

Argument 1 is real; 2-5 seem incredibly short-sighted

5) $UNI is simply part of #DeFi, and DeFi is out of favor

Argument 1 is real; 2-5 seem incredibly short-sighted

Uniswap is one of only a few companies/projects in digital assets that have real usage & product market fit.

Oddly, digital asset buyers continue to value projects with unproven futures (L1 protocols) over projects w/ actual traction today.

Oddly, digital asset buyers continue to value projects with unproven futures (L1 protocols) over projects w/ actual traction today.

Uniswap ($UNI) investors would benefit from a history lesson too.

Remember the botched Facebook $FB IPO? Priced at $40, went sub-$20, & everyone freaked out that it was overpriced as weak hands sold (Chart 1).

Smart investors don't bet against bellwethers (Chart 2).

Remember the botched Facebook $FB IPO? Priced at $40, went sub-$20, & everyone freaked out that it was overpriced as weak hands sold (Chart 1).

Smart investors don't bet against bellwethers (Chart 2).

UNI is being misrepresented as a "governance" token, and the market has shown that governance has no value.

But in reality, UNI is a pass-thru token -- where revenues will be passed thru to token holders. $UNI holders are about to earn a very large revenue stream in Feb 2021.

But in reality, UNI is a pass-thru token -- where revenues will be passed thru to token holders. $UNI holders are about to earn a very large revenue stream in Feb 2021.

All Governance tokens will eventually need to become pass through tokens. That's the main reason voting matters -- to direct fund flows.

$UNI is just the only token where voting actually matters because Uniswap generates enough revenues worth voting for control of.

$UNI is just the only token where voting actually matters because Uniswap generates enough revenues worth voting for control of.

Betting against this type of growth seems crazy in an industry where real growth has been hard to come by.

End thread

https://twitter.com/jdorman81/status/1321813749020254209?s=20

End thread

• • •

Missing some Tweet in this thread? You can try to

force a refresh