Can #Fractals be used to find the probable reversal on charts? Can it be used to find probable top and bottoms on #Stock Charts. Alone they might not. But lets dig into this possibility. I promised few days back of another model to find top and bottom. +

@rohit_katwal Fractals refer to a recurring pattern that occurs amid larger more chaotic price movements. Fractals are composed of Three or more bars. The rules for identifying fractals are as follows:

+

+

@rohit_katwal A bearish turning point occurs when there is a pattern with the highest high in the middle and two lower highs on each side.

A bullish turning point occurs when there is a pattern with the lowest low in the middle and two higher lows on each side.

+

A bullish turning point occurs when there is a pattern with the lowest low in the middle and two higher lows on each side.

+

@rohit_katwal Note that many other less perfect patterns can occur, but this basic pattern should remain intact for the fractal to be valid. Fractals are lagging indicators. A fractal can't be drawn until we are two days into the reversal. But can we increase the probability? +

@rohit_katwal We use standard deviation for this purpose. Standard Deviation is a measure of the amount of variation or dispersion of a set of values. Low SD means volatility is significantly low. High SD means volatility is significantly high. But what is significant? +

@rohit_katwal In a randomly distributed dataset :

68.27% of all data will be between +/- 1SD from the mean

95.45% of all data will be between +/- 2SD from the mean

99.73% of all data will be between +/- 3SD from the mean

So +/- 2 SD move from mean is signficant. +

68.27% of all data will be between +/- 1SD from the mean

95.45% of all data will be between +/- 2SD from the mean

99.73% of all data will be between +/- 3SD from the mean

So +/- 2 SD move from mean is signficant. +

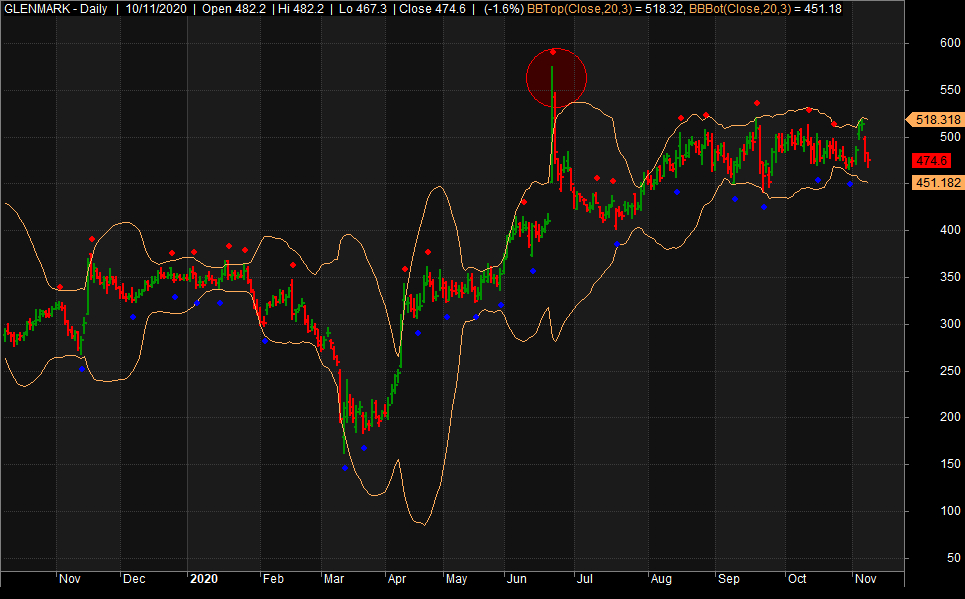

@rohit_katwal Significant because only 4.55% moves happen out of this. Combined with Fractals, this is an excellent tool to predict statistically significant probable tops or bottom. Consider chart of Glenmark for eg. on 19 Jun 2020. This is a 3 SD move followed by fractal. +

@rohit_katwal 3 SD means that this type of price event falls in 0.27% category. Either it will continue or it will fail. Immediately a 3 bar fractal forms. So recent high is a probable top with high as stoploss. Consider same on 13 Mar 2020. Another 3 SD move marking a bottom. +

@rohit_katwal So what are the rules:

For Probable Top:

"Price should form a 3 bar bearish fractal outside 20 Days / 3 SD Bollinger Bands" or "should form a 5 bar bearish fractal outside 20 days / 2 SD BB"

+

For Probable Top:

"Price should form a 3 bar bearish fractal outside 20 Days / 3 SD Bollinger Bands" or "should form a 5 bar bearish fractal outside 20 days / 2 SD BB"

+

@rohit_katwal For Probable Bottom:

"Price should form a 3 bar bullish fractal outside 20 days / 3 SD Bollinger Bands" or "should for a 5 bar bullish fractal outside 20 days / 2 SD BB".

As an Option Writer, if we can get a probable top or bottom, we get an edge in trading. +

"Price should form a 3 bar bullish fractal outside 20 days / 3 SD Bollinger Bands" or "should for a 5 bar bullish fractal outside 20 days / 2 SD BB".

As an Option Writer, if we can get a probable top or bottom, we get an edge in trading. +

@rohit_katwal I can work on n strategies with High/Low as stoploss. My favorite, we can do Diagonal Calendars as much as we want. It gives us a statistical edge to find a significant top or bottom before any indicator with a SL in any kind of instruments.

#Nifty #BankNifty +

#Nifty #BankNifty +

@rohit_katwal Do like, comment and retweet for benefit of trading community. End of educational thread.

Open for comments and discussion.

Open for comments and discussion.

• • •

Missing some Tweet in this thread? You can try to

force a refresh