1/ Published a new piece that shows how we quantify the amount of #Bitcoin supply held by long-term investors and short-term traders.

Here's how these metrics currently point to the $BTC bull market.

(All data and live charts available on @glassnode.)

A thread 👇👇👇

Here's how these metrics currently point to the $BTC bull market.

(All data and live charts available on @glassnode.)

A thread 👇👇👇

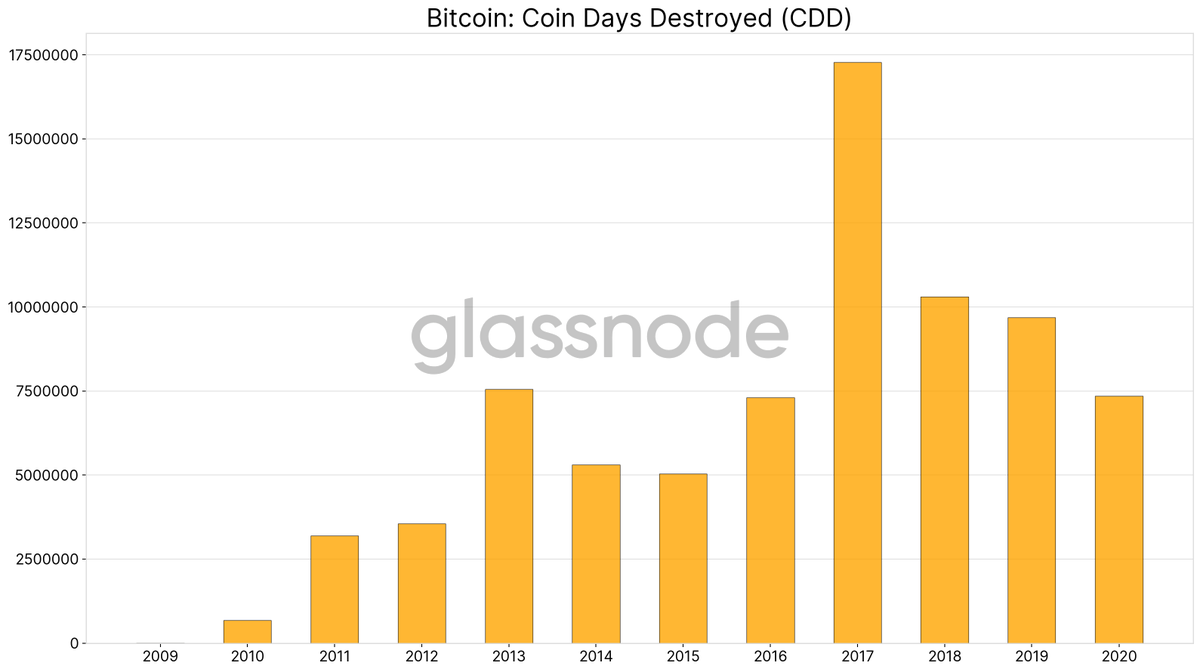

2/ After a monthslong increase, the total #Bitcoin supply held by long-term holders has recently started to decline – while $BTC appreciates.

A common pattern seen in previous bull markets, when HODLers start moving coins to take some profits.

Chart: studio.glassnode.com/metrics?a=BTC&…

A common pattern seen in previous bull markets, when HODLers start moving coins to take some profits.

Chart: studio.glassnode.com/metrics?a=BTC&…

3/ Long-Term Holder Net Position Change makes this movement of hodled coins more apparent.

This metric denotes the 30-day change in HODLer #Bitcoin supply – it has been negative (and decreasing) for the past month.

Current value: -310,000 $BTC.

Chart: studio.glassnode.com/metrics?a=BTC&…

This metric denotes the 30-day change in HODLer #Bitcoin supply – it has been negative (and decreasing) for the past month.

Current value: -310,000 $BTC.

Chart: studio.glassnode.com/metrics?a=BTC&…

4/ Side note: Our new Hodler Net Position Change metric is an improvement over the traditional metric.

The latter is based on #BTC's Liveliness, and its positive values tend to be capped. Our new metric is unbounded, therefore providing a better signal.

studio.glassnode.com/metrics?a=BTC&…

The latter is based on #BTC's Liveliness, and its positive values tend to be capped. Our new metric is unbounded, therefore providing a better signal.

studio.glassnode.com/metrics?a=BTC&…

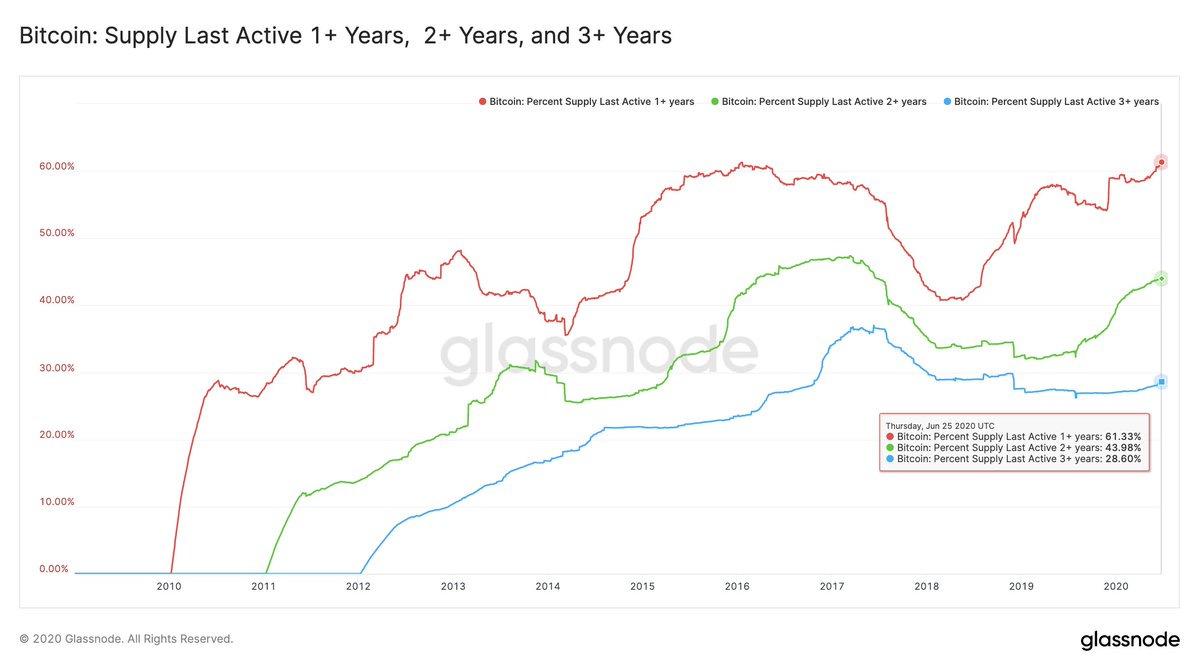

5/ The amount of #Bitcoin supply held by short-term traders increases as $BTC's price appreciates – a clear indication of older bitcoin stashes being reactivated in bull markets for trading.

This supply has increased by ~700,000 BTC since July.

Chart: studio.glassnode.com/metrics?a=BTC&…

This supply has increased by ~700,000 BTC since July.

Chart: studio.glassnode.com/metrics?a=BTC&…

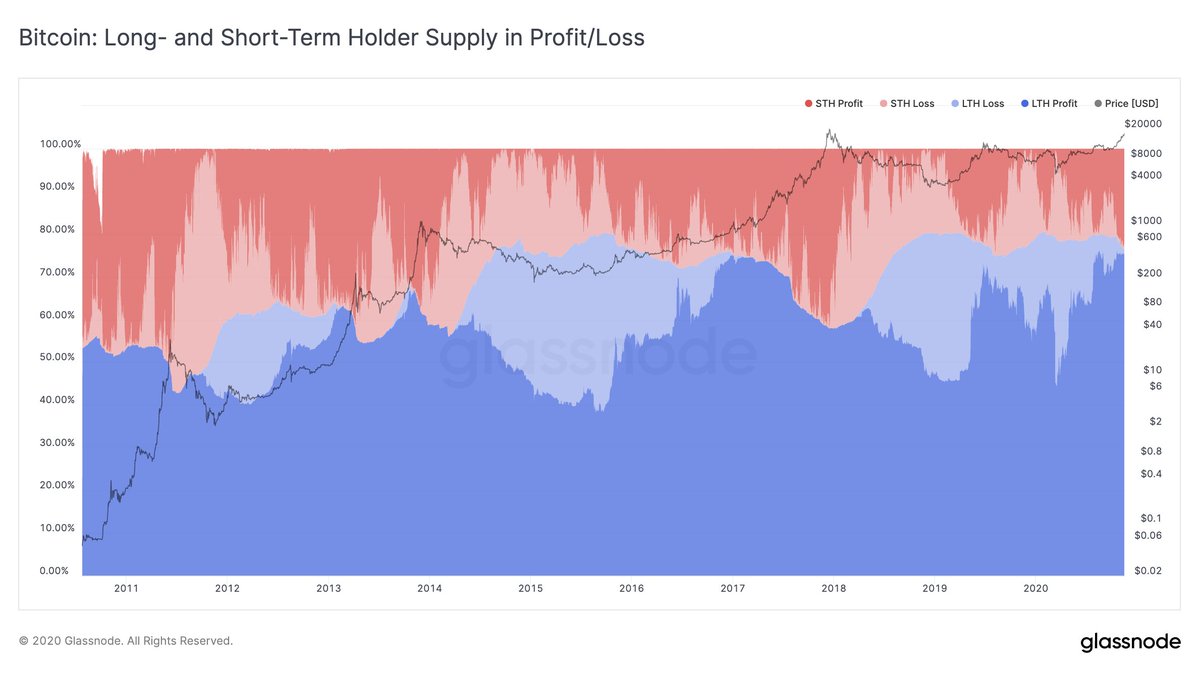

6/ The total #Bitcoin long-term holder supply can be divided up into the amount that is in profit or loss.

This metric shows a regular global pattern forming the "valleys of loss", that increase as bear markets confirm, and close in $BTC bull markets.

studio.glassnode.com/metrics?a=BTC&…

This metric shows a regular global pattern forming the "valleys of loss", that increase as bear markets confirm, and close in $BTC bull markets.

studio.glassnode.com/metrics?a=BTC&…

7/ All #Bitcoin metrics presented here are live available on @glassnode Studio:

studio.glassnode.com/metrics?a=BTC&…

For a detailed explanation of our methodology and the metrics presented here, please read our latest article 👇

insights.glassnode.com/quantifying-bi…

studio.glassnode.com/metrics?a=BTC&…

For a detailed explanation of our methodology and the metrics presented here, please read our latest article 👇

insights.glassnode.com/quantifying-bi…

• • •

Missing some Tweet in this thread? You can try to

force a refresh