George Soros gifted the world the concept of reflexivity in the stock market. It's 10x more important in crypto.

Here's the basic concept:

Stock price changes reality

What, ser?

Price creates a feedback loop

More 👇

Here's the basic concept:

Stock price changes reality

What, ser?

Price creates a feedback loop

More 👇

If stock = going up, it brings the company acclaim.

Company gets noticed. Sales increase, profits grow. Stock prices increases.

Rinse. Repeat.

The same happens in reverse.

Price craters. People sneer at mention of company's name. No one uses product anymore.

2/x

Company gets noticed. Sales increase, profits grow. Stock prices increases.

Rinse. Repeat.

The same happens in reverse.

Price craters. People sneer at mention of company's name. No one uses product anymore.

2/x

Sales decline, profits fall, stock price craters further... further... f me... further.

Reflexivity is even more important in crypto for lots of reasons:

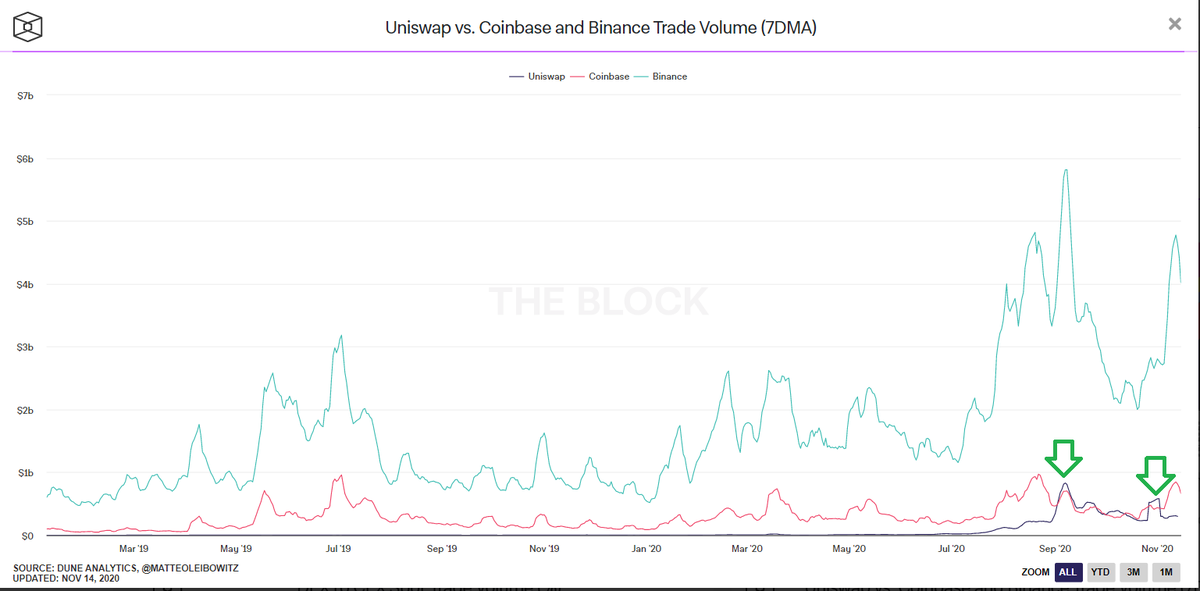

- Price can literally impact the quality of the product (i.e. high $UNI price = more liquidity)

3/x

Reflexivity is even more important in crypto for lots of reasons:

- Price can literally impact the quality of the product (i.e. high $UNI price = more liquidity)

3/x

- Price moves are more dramatic since crypto markets are smaller + less liquid than stock markets. That means crypto price moves can melt holes in abdominal cavities

- Price can attract devs (or repel them)

- Price gets fanbois talking on Twitter (or gets them trashing you)

4/x

- Price can attract devs (or repel them)

- Price gets fanbois talking on Twitter (or gets them trashing you)

4/x

- Fanbois on Twiter help a product capture mindshare. They can quite literally make or destroy a project

Why do I tell thee all this?

Bc there are a few basic investing concepts that have changed my life. Reflexivity is one of them

5/x

Why do I tell thee all this?

Bc there are a few basic investing concepts that have changed my life. Reflexivity is one of them

5/x

Reflexivity explains why moves are often bigger and more dramatic than even your wettest of dreams. And why selloffs are worse than your worst nightmares... like getting depantsed at a party full of hot ladies after you just got out of a very cold pool

6/x

6/x

When I think of reflexivity in stonks, I think of $TSLA. When I think of reflexivity in crypto, lots of names come to mind. $YFI is one. Its moves have helped it attract more devs... and also VCs who have strong, hairy hands

7/x

7/x

The moves have also brought in whales and apes and little fish dreamers like myself who now have at least a modicum of brand loyalty

Ok

If you take one thing away from this, take this: price moves can literally change a project's destiny

8/x

Ok

If you take one thing away from this, take this: price moves can literally change a project's destiny

8/x

If you're going to dilute your users, you do it at your peril. If you're going to add value to your tokens, you do it to seal your fate as crypto demigod

Peace and love

🤡 out

Peace and love

🤡 out

• • •

Missing some Tweet in this thread? You can try to

force a refresh