Thread

Molten Salt Reactors look to be a game-changer

History has always involved progressing up the energy density ladder and MSR technology fits this bill

Six considerations

1. Public perception

2. Safety

3. Cost

4. Efficiency

5. Waste

6. High heat processes

Molten Salt Reactors look to be a game-changer

History has always involved progressing up the energy density ladder and MSR technology fits this bill

Six considerations

1. Public perception

2. Safety

3. Cost

4. Efficiency

5. Waste

6. High heat processes

1. Public perception

Nuclear needs a rebrand & PR makeover

When people hear nuclear the likes of the Chernobyl series or nuclear weapons spring to mind.

MSRs achieve this and address both safety concerns and waste concerns (the two most common nuclear reservations).

Nuclear needs a rebrand & PR makeover

When people hear nuclear the likes of the Chernobyl series or nuclear weapons spring to mind.

MSRs achieve this and address both safety concerns and waste concerns (the two most common nuclear reservations).

2. Safety

MSRs are "walk-away safe"

An operator couldn't melt it down even if they wanted to

MSRs aren't vulnerable to a terrorist attack as they work at atmospheric pressure, so a breach would cause the fuel to solidify without a significant release of radioactivity

MSRs are "walk-away safe"

An operator couldn't melt it down even if they wanted to

MSRs aren't vulnerable to a terrorist attack as they work at atmospheric pressure, so a breach would cause the fuel to solidify without a significant release of radioactivity

3. Cost

By design, they are relatively simple (no containment domes and far fewer moving parts)

This could make them accessible to developing countries

Their small size lends them to factory-based mass production

The fact they can run on nuclear waste is cost saving in itself

By design, they are relatively simple (no containment domes and far fewer moving parts)

This could make them accessible to developing countries

Their small size lends them to factory-based mass production

The fact they can run on nuclear waste is cost saving in itself

4. Efficiency

"Conventional reactors typically use only 3-to-5% of the available energy in their fuel rods before the fuel rods must be replaced due to cracking"

MSR doesn't have this issue and can use up most of the rest of the available fuel in these rods to make electricity

"Conventional reactors typically use only 3-to-5% of the available energy in their fuel rods before the fuel rods must be replaced due to cracking"

MSR doesn't have this issue and can use up most of the rest of the available fuel in these rods to make electricity

5. Waste

Because of this efficiency waste remains radioactive for a relatively short time ~300 years or less (compared to 10,000years for conventional nuclear waste).

This is obviously a huge sell that MSR consume nuclear waste and produce very little themselves.

Because of this efficiency waste remains radioactive for a relatively short time ~300 years or less (compared to 10,000years for conventional nuclear waste).

This is obviously a huge sell that MSR consume nuclear waste and produce very little themselves.

6. High heat processes

The most interesting to me being hydrogen.

MSRs could produce hydrogen using both thermal and electrical energy making the process very efficient

Using 78% thermal energy & 22% electrical its estimated hydrogen could be produced for less than $2kg

The most interesting to me being hydrogen.

MSRs could produce hydrogen using both thermal and electrical energy making the process very efficient

Using 78% thermal energy & 22% electrical its estimated hydrogen could be produced for less than $2kg

This moves humanity up the energy density ladder

Wood < coal < oil <nat gas < hydrogen < nuclear

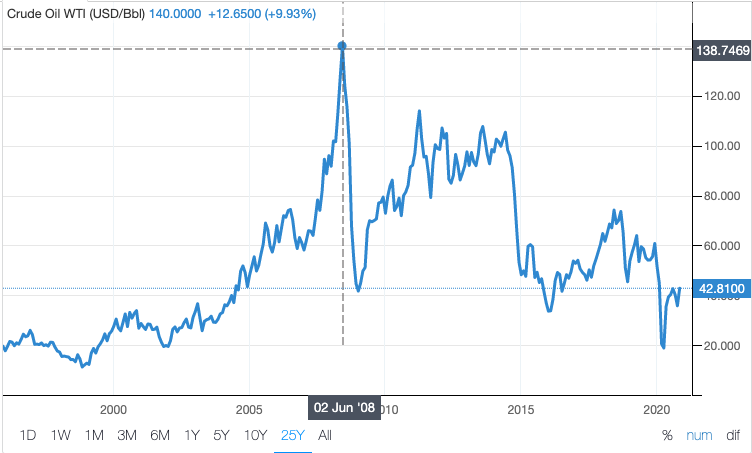

MSRs being as/more economic than coal would cause mass adoption in developing countries which is key with 6.5B people set to increase to ~8.5B by 2050 doubling the energy system.

Wood < coal < oil <nat gas < hydrogen < nuclear

MSRs being as/more economic than coal would cause mass adoption in developing countries which is key with 6.5B people set to increase to ~8.5B by 2050 doubling the energy system.

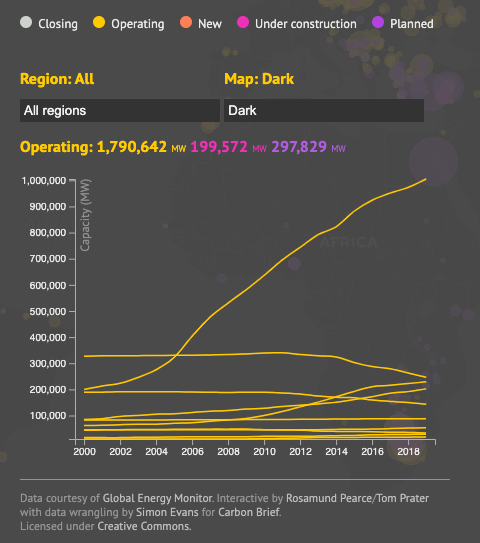

As what we have currently is developed countries 1.3B people pursuing inefficient and uneconomic renewables with predictable results

While developing countries 6.5B people are focused on keeping up with energy demand and increasing their standard of living, not ESG or emissions

While developing countries 6.5B people are focused on keeping up with energy demand and increasing their standard of living, not ESG or emissions

If going to comment that renewables are the answer please read this first: traderferg.com/renewable-deba…

• • •

Missing some Tweet in this thread? You can try to

force a refresh