Thread on #coal

Thermal Coal Demand

The narrative is that thermal coal is in terminal decline & will be replaced by renewables and nat gas moving forward

Coals in decline in developed countries, but we often overlook the fact that developed countries are the minority globally

Thermal Coal Demand

The narrative is that thermal coal is in terminal decline & will be replaced by renewables and nat gas moving forward

Coals in decline in developed countries, but we often overlook the fact that developed countries are the minority globally

Coal still accounts for almost 40% of global electricity production

It pays to remember is that developed countries comprise of 1.3B people while developing is 6.5B people which based on demographics is on the way to 8-8.5B people by 2050.

This doubles the energy system.

It pays to remember is that developed countries comprise of 1.3B people while developing is 6.5B people which based on demographics is on the way to 8-8.5B people by 2050.

This doubles the energy system.

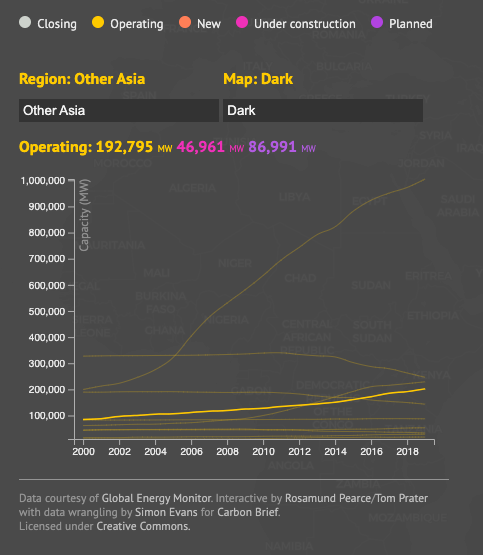

Where does coal demand stand currently?

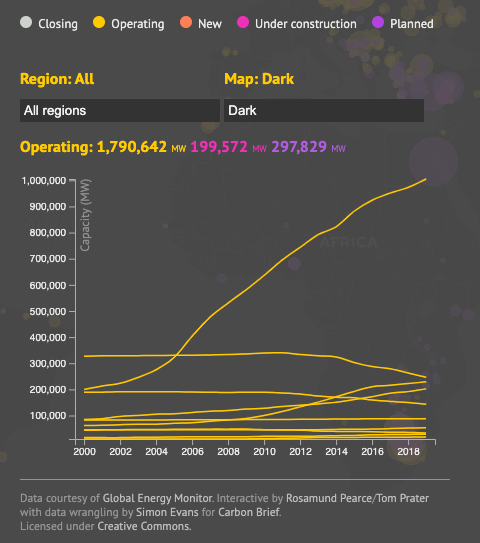

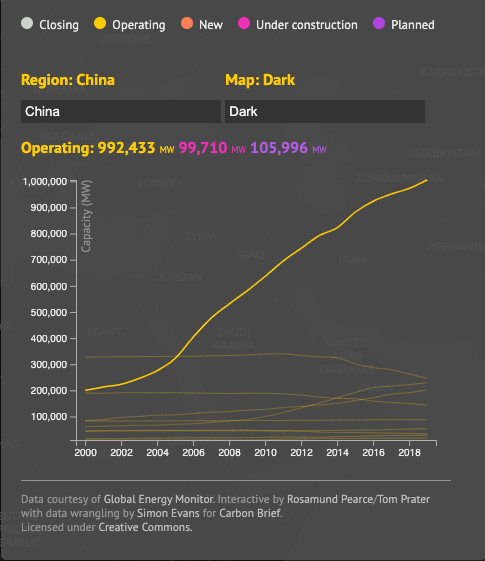

There is 1,790,642 MW operating globally (1m MW is in China)

There is 199,572 MW under construction or +11%

There is 297,829 MW planned or +17%

So in total, this means adding nearly 1/3 to the current global coal plants

Decent growth..

There is 1,790,642 MW operating globally (1m MW is in China)

There is 199,572 MW under construction or +11%

There is 297,829 MW planned or +17%

So in total, this means adding nearly 1/3 to the current global coal plants

Decent growth..

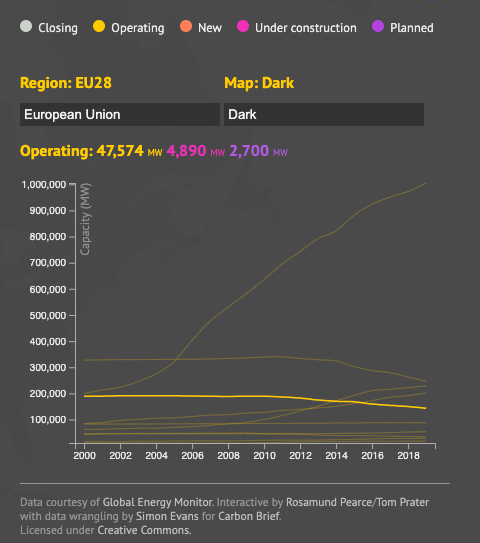

The European Union has 47,574 MW of coal in operation

Other Asia has an equivalent amount under construction

India also has an equivalent amount under construction

China has 2x this under construction & 4x this planned

A total of 4x Europes coal plants are under construction!

Other Asia has an equivalent amount under construction

India also has an equivalent amount under construction

China has 2x this under construction & 4x this planned

A total of 4x Europes coal plants are under construction!

Hence why what happens in developed countries to coal is largely irrelevant for demand.

Developing countries is a growth story and will be for some time yet.

Take the time to have a play on carbon briefs interactive website: carbonbrief.org/mapped-worlds-…

Developing countries is a growth story and will be for some time yet.

Take the time to have a play on carbon briefs interactive website: carbonbrief.org/mapped-worlds-…

• • •

Missing some Tweet in this thread? You can try to

force a refresh