1/ Many people have asked me for my response to @haydenzadams' hot take on #Chainlink $LINK

I think he's misconstruing what Sergey is saying about market coverage and not providing the full context on oracle security and the Uniswap TWAP

Thread for context below 👇

I think he's misconstruing what Sergey is saying about market coverage and not providing the full context on oracle security and the Uniswap TWAP

Thread for context below 👇

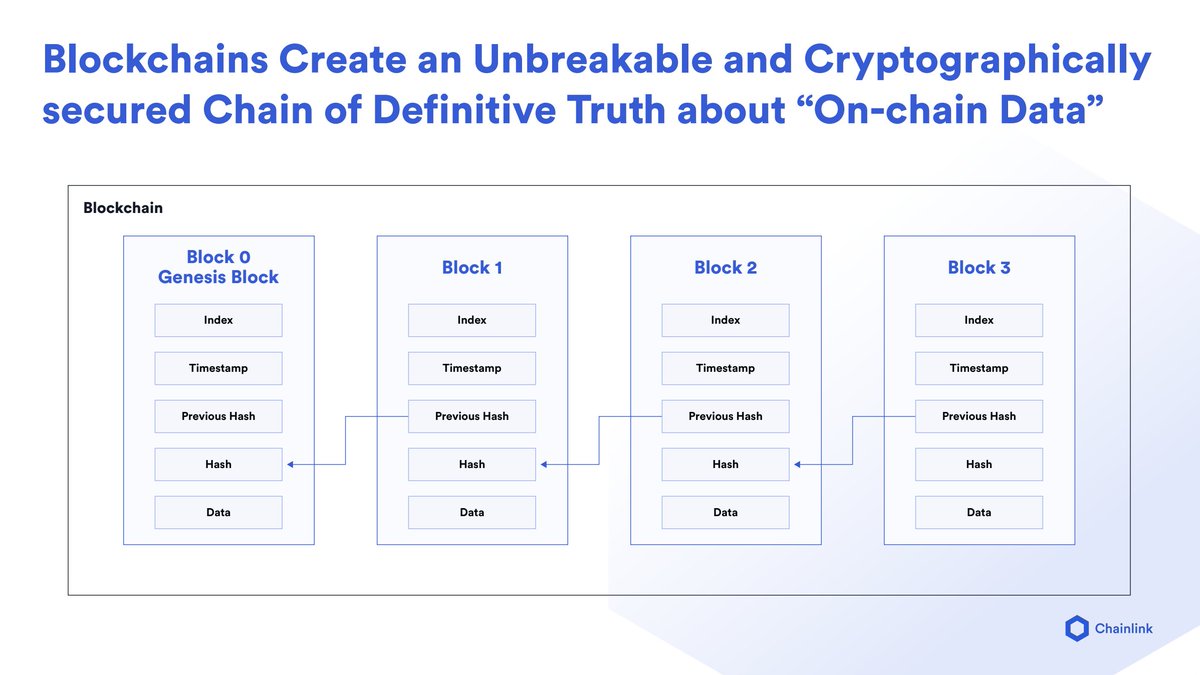

2/ Sergey was emphasizing the importance of proper market coverage

This does not mean taking a simple median or mean across exchanges

But instead aggregating data from all trading environments by taking into account liqudity, volume, time and other differences across exchanges

This does not mean taking a simple median or mean across exchanges

But instead aggregating data from all trading environments by taking into account liqudity, volume, time and other differences across exchanges

3/ Market coverage is important because it ensures price data reflects the true global market-wide price and not just that of one or a small number of exchanges

Chainlink covers this topic of market coverage and data quality extensively in this blog post

blog.chain.link/the-importance…

Chainlink covers this topic of market coverage and data quality extensively in this blog post

blog.chain.link/the-importance…

4/ Hayden seems to be misconstruing what Sergey is saying

It's true there is natural exchange concentration and it's exactly why we need proper market coverage

Single source price feeds may provide coverage initially, but there is no guarantee it will be maintained over time

It's true there is natural exchange concentration and it's exactly why we need proper market coverage

Single source price feeds may provide coverage initially, but there is no guarantee it will be maintained over time

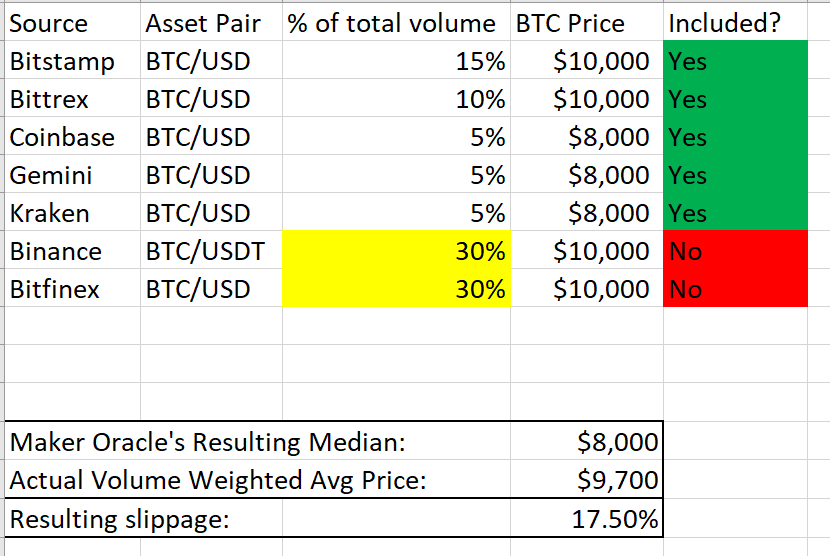

5/ If done correctly, tracking more exchanges will only ever increase the manipulation resistance of the price oracle, not lower it like Hayden suggests

Below examples are what I believe Hayden is talking about, but this is not how Chainlink achieves market coverage

Below examples are what I believe Hayden is talking about, but this is not how Chainlink achieves market coverage

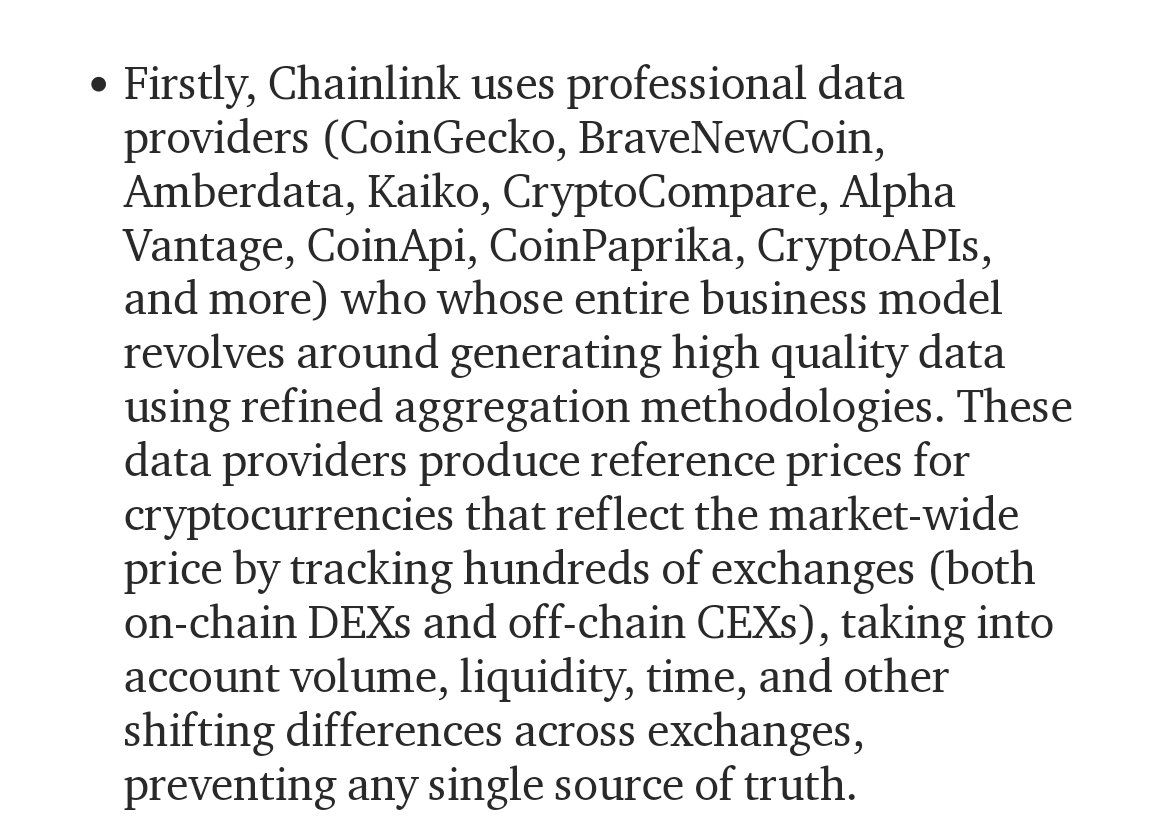

6/ Chainlink price feeds are able to achieve full market coverage because data is fetched from numerous professional data aggregators who track all venues and have full time monitoring teams with 24/7 alerts

This smooths outliers and ensures the true market wide price is used

This smooths outliers and ensures the true market wide price is used

7/ Without proper market coverage, you lower the cost of manipulation dramatically and allow for inaccurate prices to be published

This is exactly what happened with Compound, which only tracked a single exchange Coinbase and was manipulated because of it

chainlinkgod.medium.com/proposal-for-c…

This is exactly what happened with Compound, which only tracked a single exchange Coinbase and was manipulated because of it

chainlinkgod.medium.com/proposal-for-c…

8/ I'm emphasizing this point because I think it's important to understand why market coverage is so important

Price feeds that lack market coverage have already been exploited time and time again, with now over $100M in user loses in DeFi

decrypt.co/49867/defi-fla…

Price feeds that lack market coverage have already been exploited time and time again, with now over $100M in user loses in DeFi

decrypt.co/49867/defi-fla…

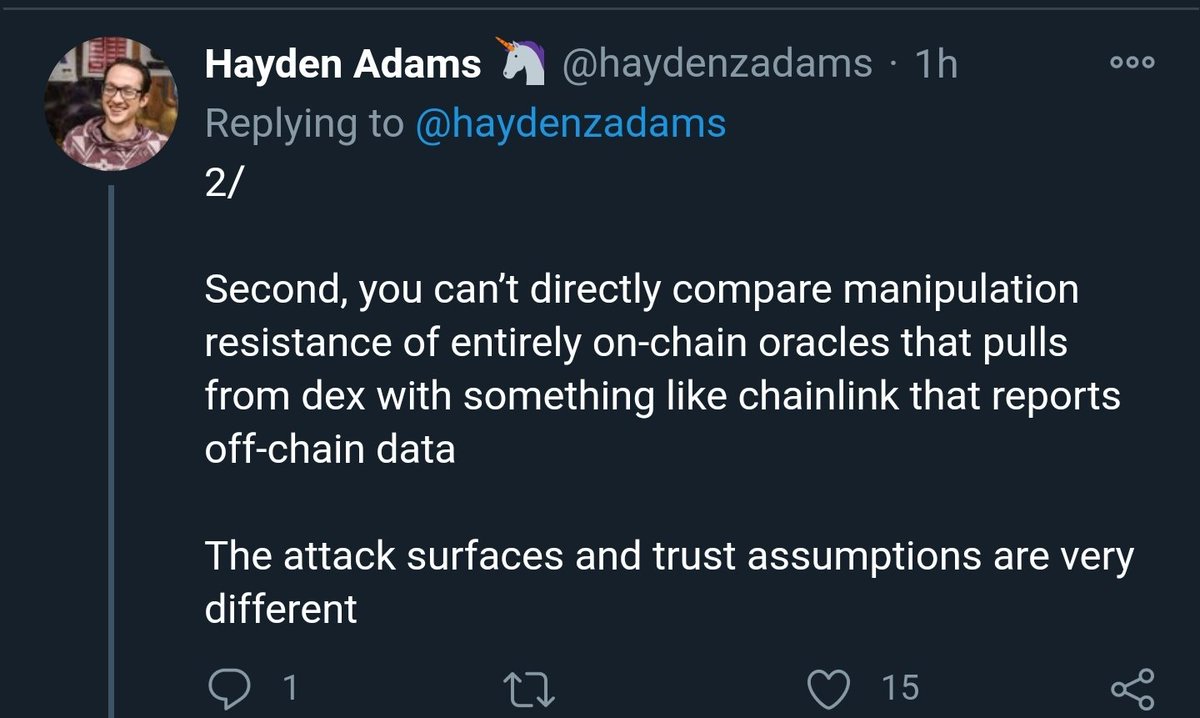

9/ Market coverage is important regardless of where the data is sourced

While it's true there are different attack vectors, you can absolutely compare the differences between a price oracle with market coverage to one without the proper coverage

While it's true there are different attack vectors, you can absolutely compare the differences between a price oracle with market coverage to one without the proper coverage

10/ Now this is where I believe Hayden is being a bit misleading to readers

The Uniswap Time Weighted Average Price (TWAP) oracle only provides data that is accurate according to the Uniswap market, and NOT the market wide price which protocols need

An important distinction

The Uniswap Time Weighted Average Price (TWAP) oracle only provides data that is accurate according to the Uniswap market, and NOT the market wide price which protocols need

An important distinction

11/ Uniswap TWAP oracles are better than the Uniswap spot price (no more flash loan issues)

However, it still only tracks data from a single exchange and does not provide adequate market coverage, which as I described above lowers the cost of manipulating the price oracle

However, it still only tracks data from a single exchange and does not provide adequate market coverage, which as I described above lowers the cost of manipulating the price oracle

12/ Providing data of a single exchange isn't useful if that exchange is out of sync with the rest of the market

It's the same "garbage in; garbage out" problem that market coverage solves

Pulling data from just a single exchange always ends up with lower quality data

It's the same "garbage in; garbage out" problem that market coverage solves

Pulling data from just a single exchange always ends up with lower quality data

13/ Also of note, TWAP oracles are not a replacement for the VWAP or Spot price

TWAP is a lagging indicator that becomes inaccurate during times of high volatility and requires a fundamental trade-off of tamper-resistance versus freshness, an undesirable property for users

TWAP is a lagging indicator that becomes inaccurate during times of high volatility and requires a fundamental trade-off of tamper-resistance versus freshness, an undesirable property for users

14/ With the increase of MEV, Uniswap TWAP is not as highly tamper-proof against manipulation as stated

With enough value at stake, it can become profitable for miners to manipulate the ordering of transactions and inter blocks to manipulate a TWAP snapshot

With enough value at stake, it can become profitable for miners to manipulate the ordering of transactions and inter blocks to manipulate a TWAP snapshot

15/ The mixture of low market coverage and the inability to scale price oracle security without sacrificing accuracy makes the Uniswap TWAP oracle a niche offering

It is not the general purpose price oracle people think it is and not a replacement for Chainlink price feeds

It is not the general purpose price oracle people think it is and not a replacement for Chainlink price feeds

16/ Chainlink is secured through its cryptoeconomic security where malicious oracles experience a large opportunity cost in the form of lost future income

Oracles are also public entities with their reputation on the line, which is fundamental to their business model

Oracles are also public entities with their reputation on the line, which is fundamental to their business model

17/ Chainlink oracle nodes are operated by data providers and professional DevOps teams that rely upon their good reputation for revenue

Being malicious means they forfeit their entire business as they would lose all user trust as well as their delegators/stakers/clients/users

Being malicious means they forfeit their entire business as they would lose all user trust as well as their delegators/stakers/clients/users

18/ Additionally, Chainlink's cryptoeconomic security is why its price feeds are able to operate even during extreme network congestion, the profitability provides both a high opportunity cost for maliciousness as well an incentive to provide the most reliable services possible

19/ This point is incredibly misleading as Chainlink price feeds combine data from a multitude of data aggregators, who each track hundreds of exchanges (both CEXs + DEXs)

Chainlink is decentralized at the node operator & data source levels to prevent any single source of truth

Chainlink is decentralized at the node operator & data source levels to prevent any single source of truth

20/ Decentralization is achieved when you combine multiple independent components and becomes no longer centralized, which is what Chainlink does

Additionally, Market coverage means you need to aggregate from ALL types of exchanges and not just one particular ones you like

Additionally, Market coverage means you need to aggregate from ALL types of exchanges and not just one particular ones you like

21/ I love DEXs, especially Uniswap, but the reality is that CEXs and custodial exchanges are not going away any time soon

Proper market coverage doesn't care about your prefered form of trading, but needs to track all environments that users choose to deploy their liqudity into

Proper market coverage doesn't care about your prefered form of trading, but needs to track all environments that users choose to deploy their liqudity into

22/ Again, this is missing the importance of proper market coverage

AMMs will improve no doubt, but that doesn't change the fact that price oracles that pull data from a single exchange are cheaper/easier to manipulate than those that aggregate from all exchanges

AMMs will improve no doubt, but that doesn't change the fact that price oracles that pull data from a single exchange are cheaper/easier to manipulate than those that aggregate from all exchanges

23/ A specific AMM may be more expensive to manipulate than a specific CEX, but will still inherently be cheaper to manipulate than the global market-wide price

With volume shifts across exchanges, pulling from a single exchange is simply reckless for high value contracts

With volume shifts across exchanges, pulling from a single exchange is simply reckless for high value contracts

24/ I don't think the ad hominem attacks were needed here, we're all adults here

Hayden has already blocked me for simply disagreeing with him on this topic of oracles, which is unfortunate, but I will continue to educate about the risks of single source price oracles

Hayden has already blocked me for simply disagreeing with him on this topic of oracles, which is unfortunate, but I will continue to educate about the risks of single source price oracles

25/ I hope this thread provided you some important context into the naunced topic of oracles

While I still deeply and fundamentally disagree with Hayden and his approach to oracles, I still wish him all the best and am interested to see what Uniswap v3 will bring

Cheers frens

While I still deeply and fundamentally disagree with Hayden and his approach to oracles, I still wish him all the best and am interested to see what Uniswap v3 will bring

Cheers frens

• • •

Missing some Tweet in this thread? You can try to

force a refresh