I’ve had a couple of requests to update the two-page “executive summary” for leading Dutch clubs, so this thread includes 2019/20 financial overviews for #Ajax #PSV #Feyenoord and #AZ. Note: the Dutch season ended early in April due to COVID-19.

#Ajax pre-tax profit fell €42m from €69m to €27m, mainly due to revenue dropping €37m (19%) from record €199m to €162m and expenses increasing by €17m, partly offset by profit on player sales rising €12m to €84m. Debt now includes €151m financial leases due to IFRS 16.

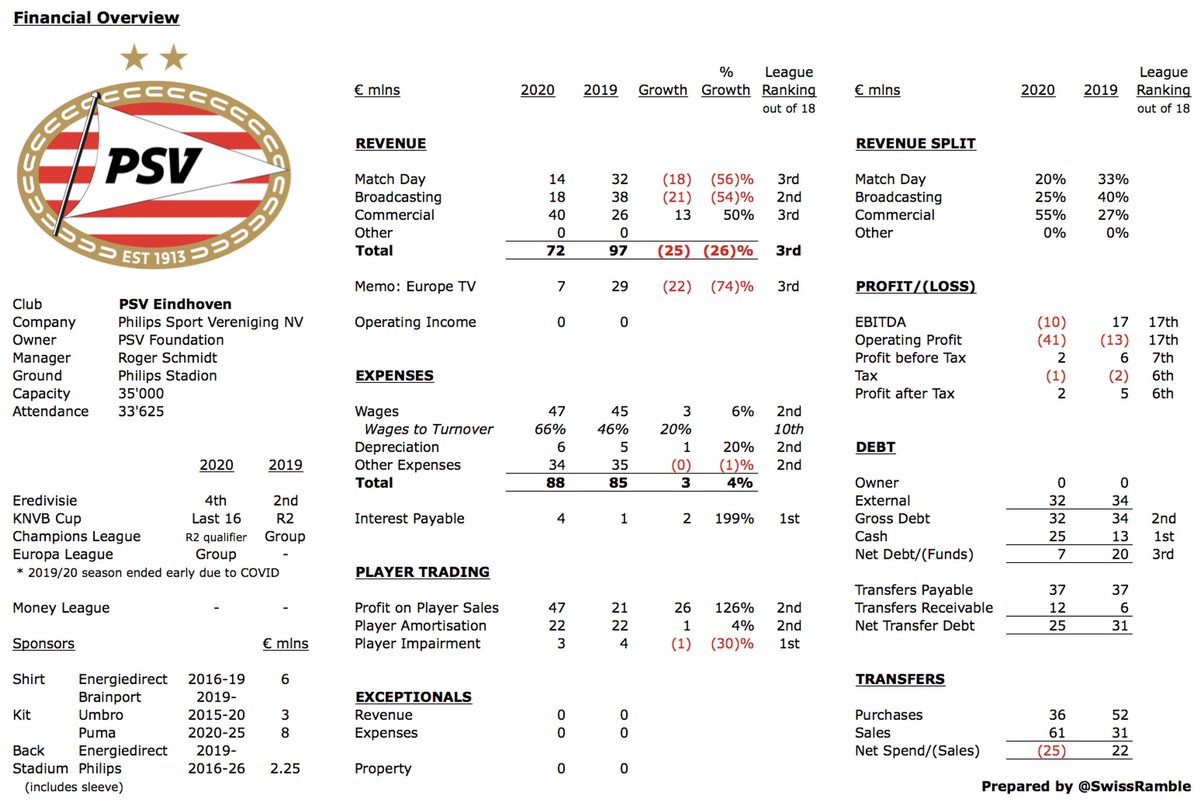

#PSV revenue fell €25m (26%) from €97m to €72m, as they competed in Europa League, rather than Champions League in prior season. As a result, operating loss widened to €41m, but pre-tax profit only fell from €6m to €2m, due to profit from player sales rising €26m to €47m.

#Feyenoord revenue up 4% to €73m thanks to reaching Europa League group stage. However, pre-tax loss slightly worse at €9m, highest in the Eredivisie, as profit from player sales fell from €8m to €4m. Wages up €3m to €38m, but 51% wages to turnover ratio lowest in league.

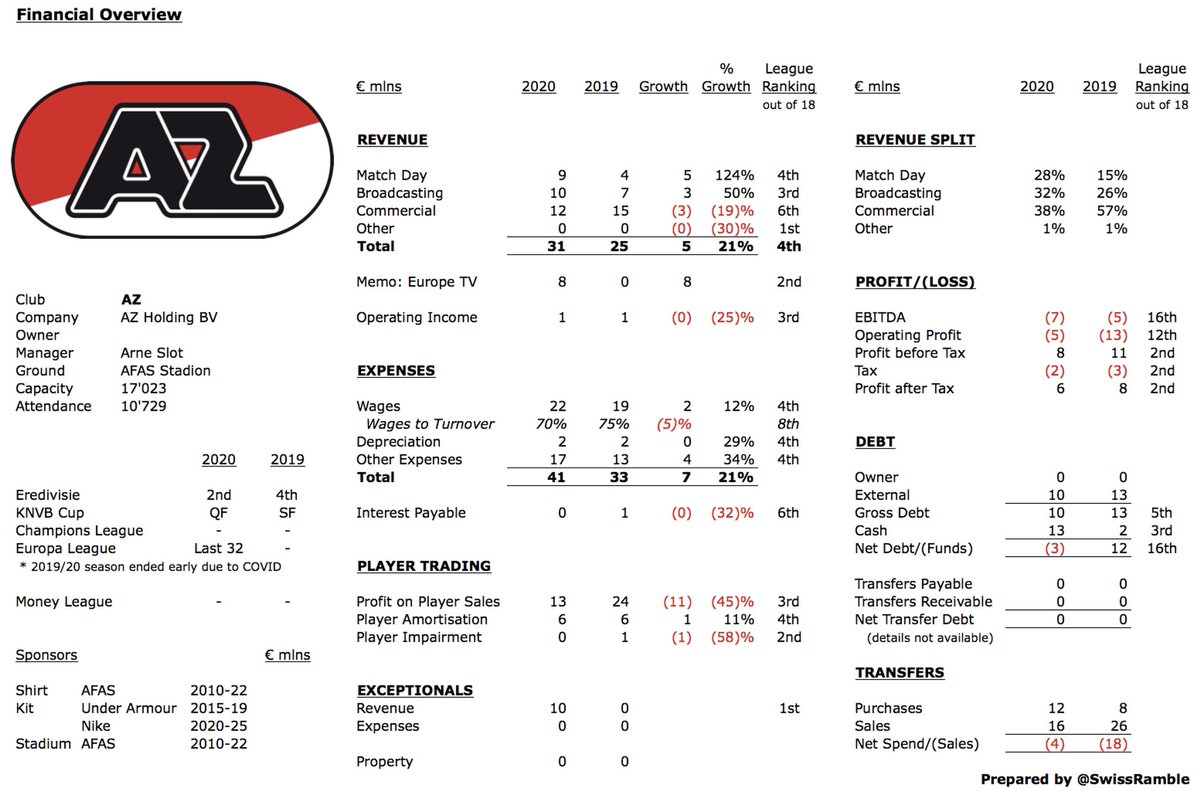

#AZ had second highest pre-tax profit in Netherlands of €8m, despite profit on player sales falling from €24m to €13m. Revenue up 21% to €31m after reaching Europa League last 32. Wages increased 12% to €22m. Included €10m insurance payment for damaged stand roof.

• • •

Missing some Tweet in this thread? You can try to

force a refresh