#RangersFC 2019/20 financial results cover a season when Scottish football was ended early in March due to COVID-19, though they were awarded second place in the Premiership based on average points. They also reached the last 16 of the Europa League. Some thoughts follow.

#RangersFC pre-tax loss widened from £11.4m to £17.8m, despite revenue rising £5.9m (11%) to £59.0m, though profit on player sales fell £2.4m to £0.7m. This was due to £11.5m (18%) increase in operating expenses, as the club invested in the first team. After tax loss was £17.5m.

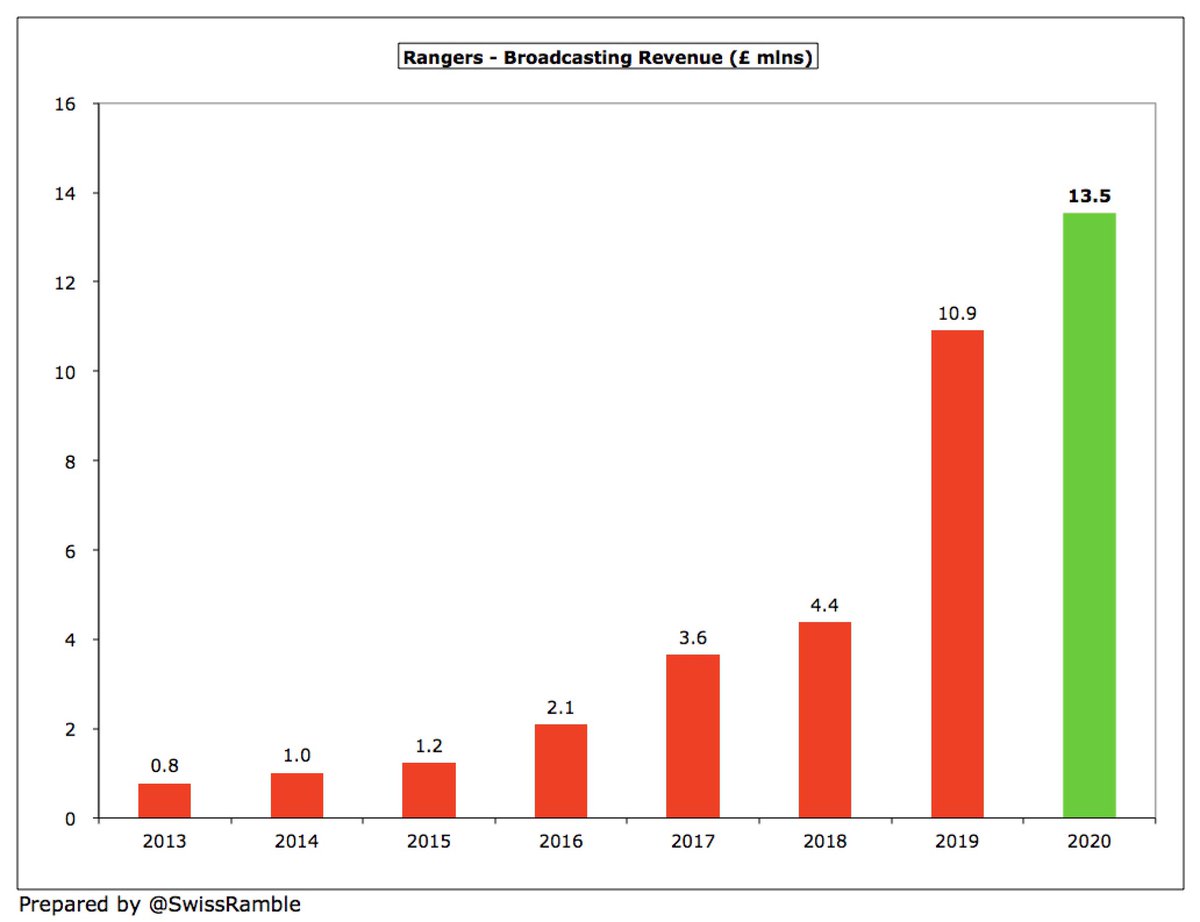

The main driver of #RangersFC revenue increase was the Europa League, which was worth £20.7m compared to £14.3m prior year. This led to growth in gate receipts, up £3.7m (12%) to £35.7m, and broadcasting, up £2.6m (24%) to £13.5m. Commercial fell £0.5m (5%) to £9.8m.

However, #RangersFC wage bill surged £8.9m (26%) to £43.3m, while player amortisation & impairment rose £1.2m (16%) to £8.4m and other expenses increased £1.2m (6%) to £23.4m. Other operating income up £1.4m to £2.0m, including £1.25m insurance payment for COVID interruption.

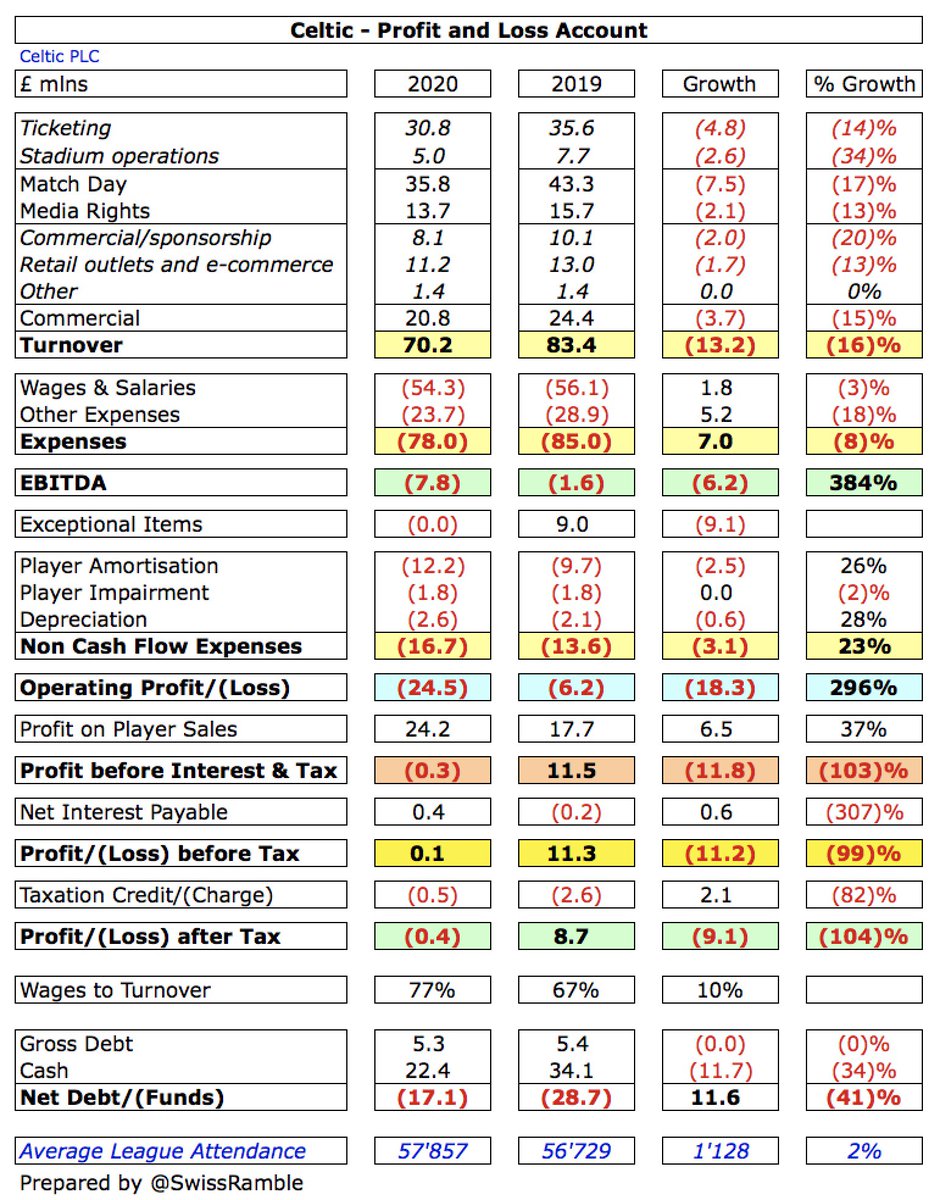

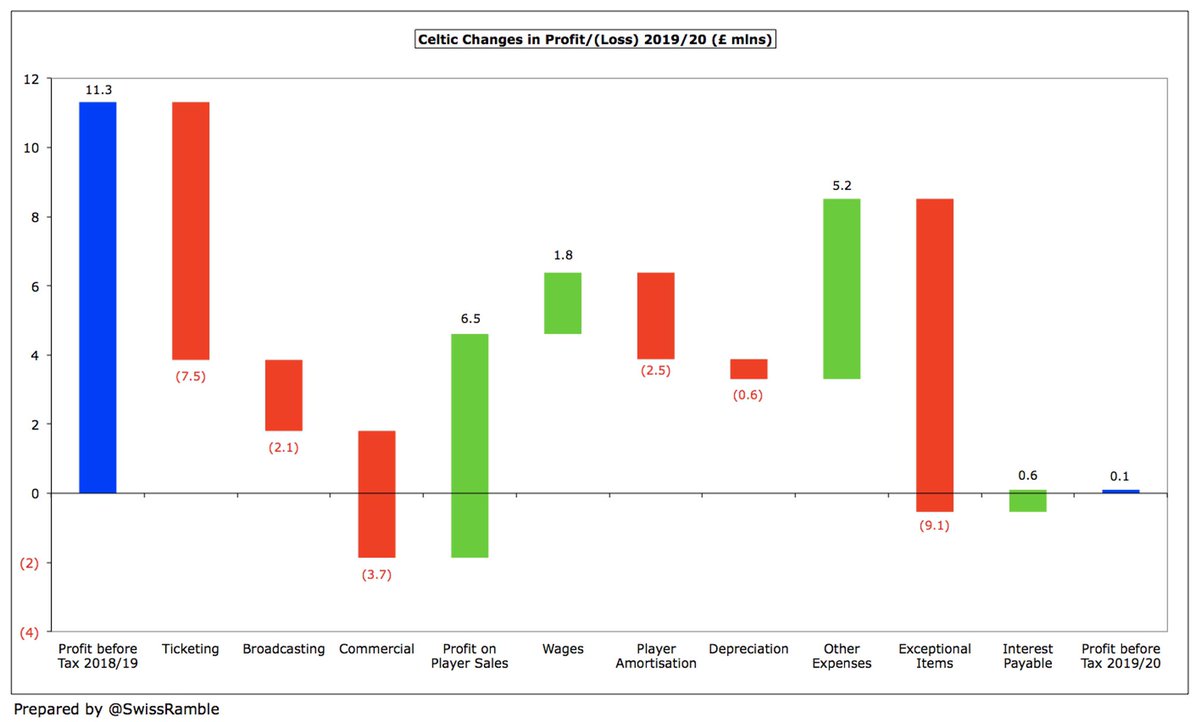

Most Scottish Premiership clubs aim for break-even, so #RangersFC £17.5m loss (after tax) is a big outlier, especially compared to Celtic’s small £0.4m deficit, though the club from the blue side of Glasgow is very focused on an investment strategy to catch-up their neighbours.

Clearly, COVID has significantly impacted finances in 2019/20 with many clubs posting horrific losses, e.g. Roma £184m, Milan £176m, Inter £90m, Barcelona £87m and Juventus £81m. These are all much worse than #RangersFC £17m. Benfica and Ajax both boosted by large player sales.

Indeed, player trading is main reason that Celtic’s figures are better, due to £24m sale of Tierney to #AFC, in contrast to #RangersFC £0.7m profit. As manager Steven Gerrard said, “The numbers could have looked very different if we had accepted a bid for one of our big assets.”

That said, #RangersFC have consistently lost money in recent times, aggregating £70m of losses in the last seven years. The £18m loss in 2029/20 is the largest in that period, partly due to the investment in the squad, but also adversely impacted by the pandemic.

#RangersFC revenue was obviously affected by the curtailment of the 2019/20 season, which meant that from March to June there was no football, or corresponding match day revenue, while retail sales, conferences and other events were also hit.

#RangersFC did post a small profit of £1.2m in 2012/13, but this was only due to a £20.5m release of negative goodwill. Last season included £3.1m provision for the legal dispute with Sports Direct, which is presumably why other expenses rose despite it being a curtailed season.

#RangersFC have made very little from player sales, making only £6m from this activity in the last 8 years, while they received just £1m after accounts closed. In future, will have to sell more profitably to be sustainable. Likely suspects include Morelos, Kent and Barisic.

In stark contrast, player sales have made a big difference to Celtic’s bottom line. In the last eight years they have generated £102m profit from player trading, compared to only £6m in the same period at #RangersFC.

#RangersFC operating loss (i.e. excluding player sales) widened from £11.6m to £15.9m in 2019/20, down from a £1.8m profit in 2012/13. This is obviously not great, though fans will note that it is around £9m better than Celtic’s £24.5m deficit.

In last 2 years #RangersFC revenue has grown by impressive 81% (£26m) from £33m to £59m with all 3 revenue streams up: match day £13m (55%), broadcasting £9m (209%) and commercial £4m (84%). However, matches behind closed doors likely to mean £10m revenue loss this season.

Celtic have enjoyed a substantial revenue advantage over #RangersFC in recent times, but the gap has considerably narrowed over the last three years from £69m in 2018 to £11m in 2020.

The Old Firm generate significantly more revenue than other Scottish clubs. For example, #RangersFC £59m is around four times as much as Hearts £15m and Aberdeen £14m, followed by Hibernian £11m, Kilmarnock £7m, Motherwell £5m and St. Mirren £4m.

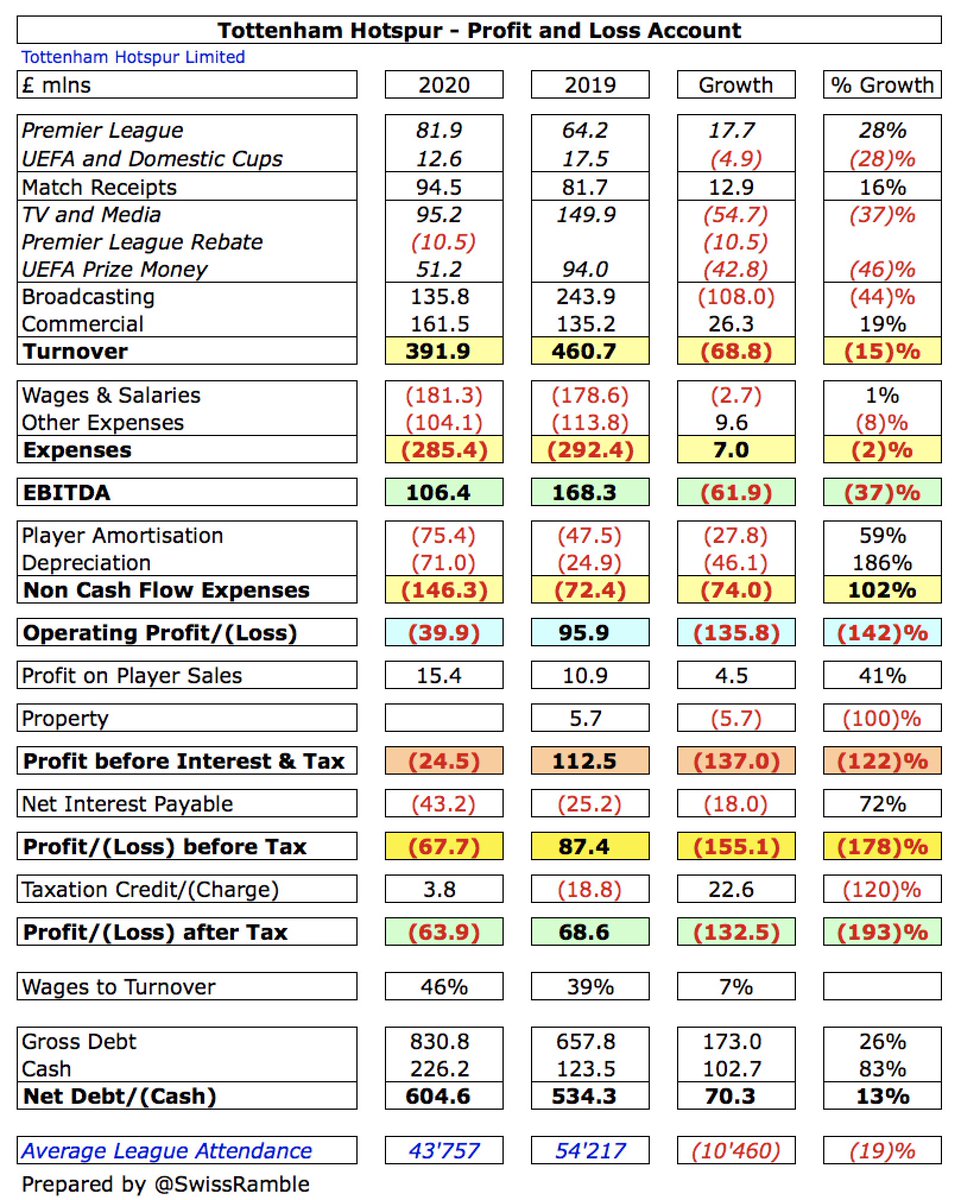

For #RangersFC to increase their revenue by £6m (11%) in a COVID impacted season is a noteworthy achievement, especially considering the hefty reductions in most other leading clubs, e.g. #MUFC £118m (19%), Barcelona £102m (13%), Juventus £77m (18%) and #THFC £69m (15%).

However, to highlight the magnitude of #RangersFC challenge, despite the growth, their £59m revenue is still £95m below the £154m required to be in the Top 30 European clubs, as shown in the Deloitte Money League. Their recent Europa League opponents Benfica had £174m revenue.

This might seem like a somewhat spurious comparison, but the fact is that in 2006 #RangersFC were placed as high as 18th in the Money League. Since then, their revenue has actually fallen by £8m, while the club in 20th place has increased by £124m and the top club by £539m.

This is at the heart of #RangersFC issue. Even if they win in Scotland, they would be the proverbial big fish in a small pond. In 2018/19 the SPFL generated £240m revenue, miles below England £5.9 bln and Spain £3.4 bln, but also behind Belgium £344m and Austria £256m.

For some more perspective, #RangersFC £59m is only around half as much as the bottom club in the Premier League, namely Huddersfield Town with £119m in 2018/19.

Of course, that comparison is a bit misleading, as English clubs benefit from huge TV money. For example, if we compare #RangersFC with West Ham, the club with 7th highest revenue in England, the vast majority of the £132m difference is broadcasting (£123m).

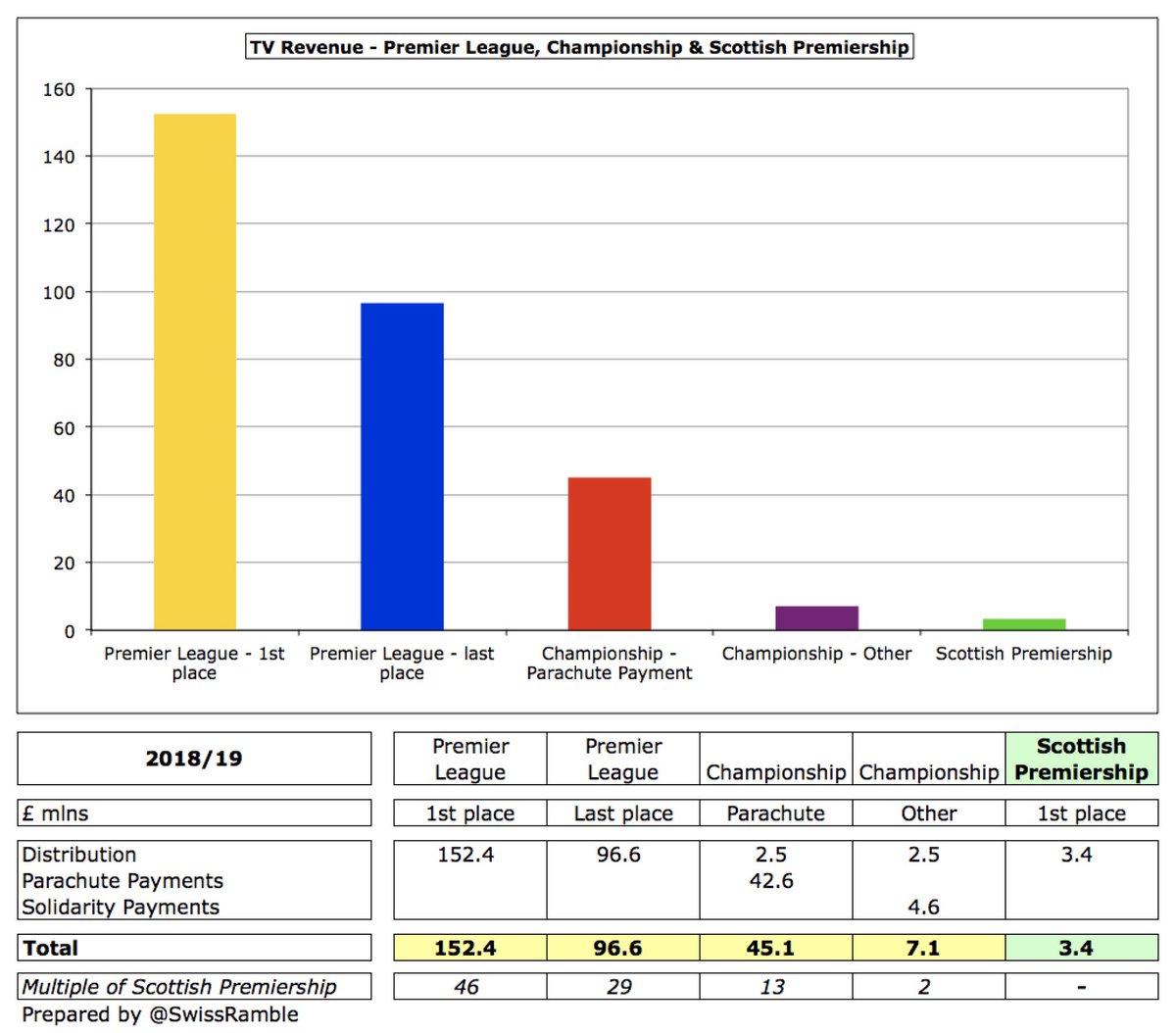

In contrast, Scottish Premiership TV deal is very low, so #RangersFC only received £2.4m. To give this some context, Premier League winners got £152m, while last place was worth £97m. Even a Championship club (no parachute payments) got twice as much (£7m) as Scotland’s winners.

There is a new five-year Scottish Premiership TV deal with Sky Sports worth £30m a year from 2020/21, but this is not really going to move the needle. For example, it’s still only around half of Poland’s Ekstraklasa £58m.

In total, #RangersFC broadcasting revenue rose £2.6m (24%) from £10.9m to £13.5m with all the growth coming from the Europa League, up from £6.4m to £8.9m. More SPFL central funds were offset by the rebate from League finishing early, so domestic TV flat at £4.6m.

Per my estimate, #RangersFC earned €10.1m from reaching Europa League last 16, split between starting fee €2.75m, prize money €5.0m, UEFA coefficient €0.9m and TV pool €1.4m. This is around €3.5m more than prior season’s €6.6m, when they did not get out of the EL group.

European qualification is very important for #RangersFC, as seen by €17m from the Europa League driving the improvement in revenue in the last 2 years. However, in the last 5 years Celtic have earned €98m, including over €30m from the Champions League in both 2017 and 2018.

It is therefore significant that recent good performances in Europe by #RangersFC and Celtic have improved Scotland’s UEFA coefficient, meaning there’s a decent chance that the 2021/22 Scottish champions will automatically qualify for the Champions League group stage.

#RangersFC match day income rose £3.7m (12%) from £32.0m to £35.7m, despite 5 Premiership home games not played after season’s early closure, thanks to Europa League progress and 5% ticket price increase. Just below Celtic £35.8m, then big drop to Hearts £6.0m and Aberdeen £3.7m.

#RangersFC average attendance fell slightly from 49,563 to 49,238, though season tickets again sold out at 45,664, as they have done for this season, even though the expectation is many games will be played behind closed doors. Around 9,000 below Celtic’s 57,857.

Match day revenue is hugely important for Scottish clubs, given the low TV deal. Per Deloitte, this accounts for an incredible 48% of total revenue in Scotland with the next highest being Belgium 26%. Many fans have left their money with the club after being offered refunds.

#RangersFC commercial revenue fell £0.5m (5%) from £10.3m to £9.8m, comprising sponsorship & advertising £3.1m, commercial £3.9m and other income £2.8m. This is less than half of Celtic’s £20.8m, so there is room for improvement here.

So it is good news that #RangersFC have signed a 5-year kit deal with Castore, reportedly worth £4m a season from 2020/21, up from Hummel’s £3m. Shirt sponsor 32Red has extended its deal by 2 years until end of this season, while back-of-shirt sponsor Utlita has done the same.

#RangersFC wage bill grew by £8.8m (26%) from £34.5m to £43.3m, mainly due to a £6.7m rise in first-team salaries, as “the board continued to invest in the team as we strive for success on the pitch”. This means that wages have more than tripled from £13m since promotion in 2016.

Similar to revenue, #RangersFC have closed the wages gap to Celtic in the last 3 years from £35m in 2018 to £11m in 2020. There remains an abyss between the Old Firm and the other Scottish clubs, e.g. the next highest are Aberdeen £10m, Hearts £8m and Hibernian £6m.

#RangersFC wages to turnover ratio increased from 65% to 73%, better than Celtic 77%, but worse than Aberdeen 68%. All of these clubs are around UEFA’s recommended upper limit of 70%.

Just for a bit of fun, a comparison with the Premier League shows that #RangersFC £43m wage bill was lower than every club, over £10m below Cardiff City £54m. The English “Big Six” wages were 4-8 times as much (#MUFC £332m, #THFC £179m).

As a result of squad investment, #RangersFC player amortisation, the annual cost of writing-off transfer fees, increased by £1.9m (34%) from £5.6m to £7.6m, up from only £0.8m in 2016. Also booked £0.8m impairment charge to reduce the value of certain players in the accounts.

As a rule, Scottish clubs do not pay big money to sign players, meaning that their player amortisation charge is normally very low. In fact, only the Old Firm clubs book more than £500k a year, though Celtic’s £12.2m is much more than #RangersFC £7.6m.

#RangersFC spent £11m on player purchases, mainly Ryan Kent and Filip Helander, but only around half of Celtic’s £21m. Much more than other Scottish clubs, e.g. Aberdeen £1.3m, Hibernian £1.1m & Hearts £0.6m. Spent £15.4m since year-end, mainly Roofe, Itten and (presumably) Hagi.

As a result, #RangersFC have invested £41m in their squad since 2017, averaging £10m a year, compared to only £4m in the preceding 4 years. However, they only had one year with net spend in that period (£7m in 2017). Since then, they have had £30m net sales in total.

#RangersFC gross debt increased from £14.5m to £19.3m, comprising investor loans £15.3m, other commercial loans £2.9m and lease agreements £1.0m. Would have been much higher without investors converting £34m of debt into equity in last 2 seasons, including £17.7m in 2019/20.

#RangersFC £19.3m gross debt is more than all the other Scottish Premiership clubs combined (£16m) with the next highest being Celtic £5.3m, Hearts £4.3m and Dundee £1.6m. However, Rangers’ cash rose from £1.0m to £11.1m (only surpassed by Celtic £22m), so net debt was £8.1m.

As chairman Douglas Park noted, #RangersFC progress is “underpinned by significant investment from directors and shareholders”. Indeed, since year-end they have provided further £4.5m of loans and converted £13.3m to equity (£48m in 3 years), leaving “only” £6.5m investor debt.

However, #RangersFC have also “funded” their investment in new players by increasing transfer debt, i.e. paying transfer fees in instalments, from just £0.3m in 2016 to £14.3m in 2020. The club is only owed £0.3m by other clubs for player sales.

#RangersFC basically broke-even on operating activities in cash terms, boosted by increase in creditors, but then spent £8.1m (net) on new players, £2.8m on infrastructure, while paying £0.7m interest. This was funded by net new investor loans of £21.3m, increasing cash by £10m.

Since 2013 #RangersFC available cash of £84m all came from investor funding: (a) £49m from loans (b) £34m from issuing share capital. Most of this has been used to cover operating losses £29m, £22m on players (net), £12m capital expenditure and £7m purchase of trade & assets.

#RangersFC board have stated that the club will need additional debt or equity funding of £8.8m in 2020/21 and a further £14.4m in 2021/22. That would take total funding from investors up to a hefty £109m since 2013. All loans are interest-free except Dave King (0.8%).

This led to the auditors warning of a “material uncertainty which may cast significant doubt as to the club’s ability to continue as a going concern”. However, the directors have confirmed that they will provide financial support as required, which they have done to date.

Under Steven Gerrard, #RangersFC have clearly made a lot of progress on the pitch, supported by significant investment from directors. This funding will have to continue until the club qualifies for the Champions League group stage – or starts selling some of its talent.

• • •

Missing some Tweet in this thread? You can try to

force a refresh