The Olympique Lyonnais 2019/20 accounts cover a season when Ligue 1 was ended early in March due to COVID-19 with #TeamOL in 7th place. However, they reached the semi-finals of Champions League, Coupe de France and final of Coupe de la Ligue. Some thoughts in the following thread

It is also worth noting the continued success of #TeamOL women’s team, who achieved a clean sweep in 2019/20, winning their 14th consecutive French league title, 7th Champions League, 9th Coupe de France and the first edition of the Trophée des Championnes.

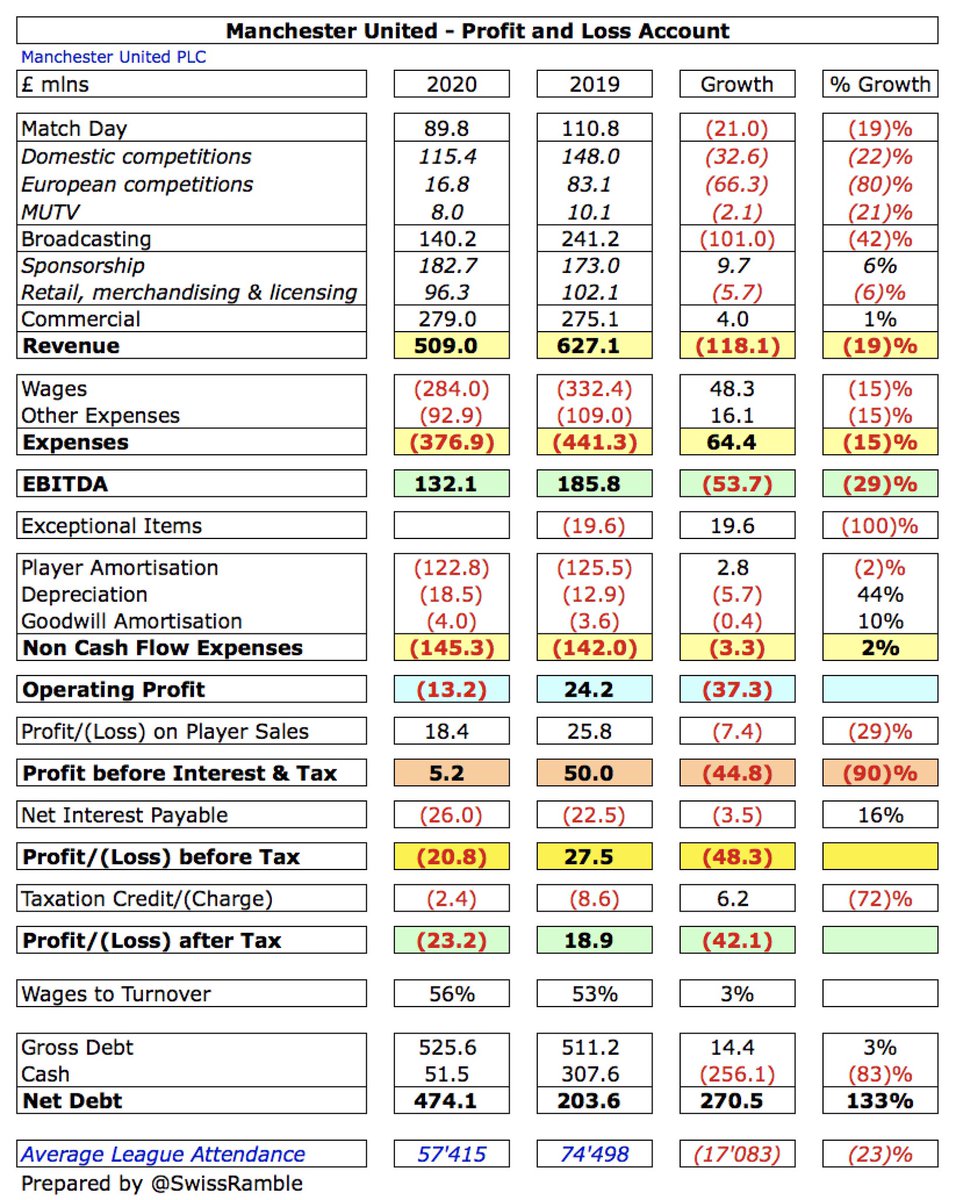

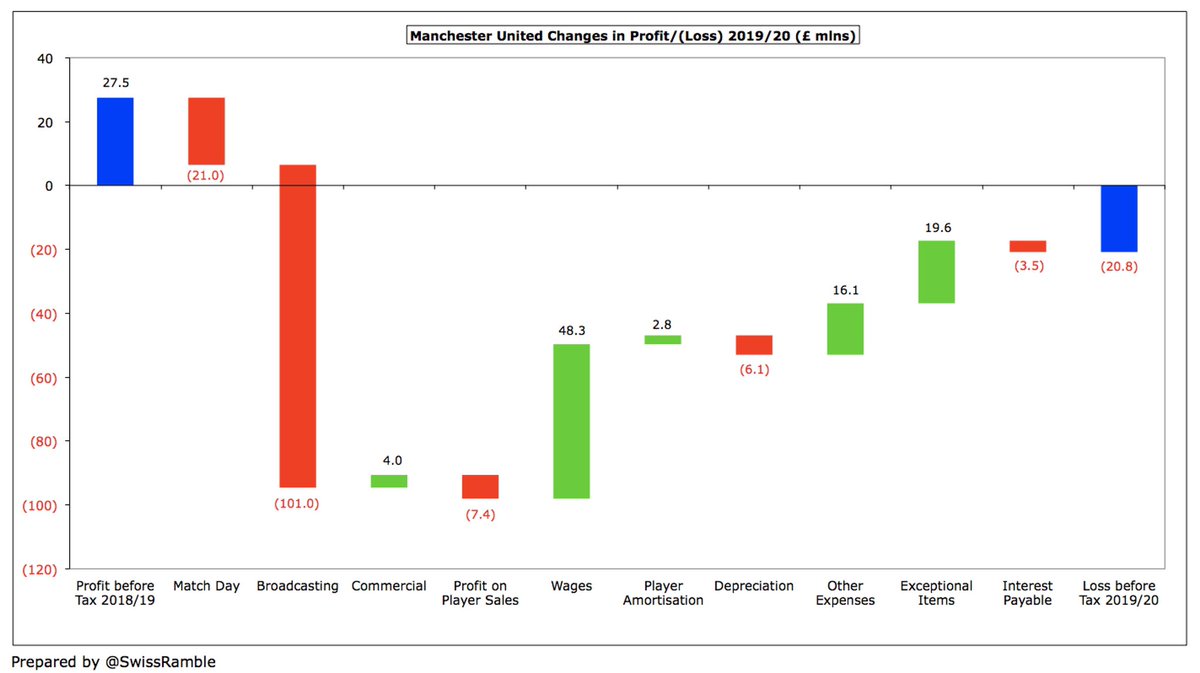

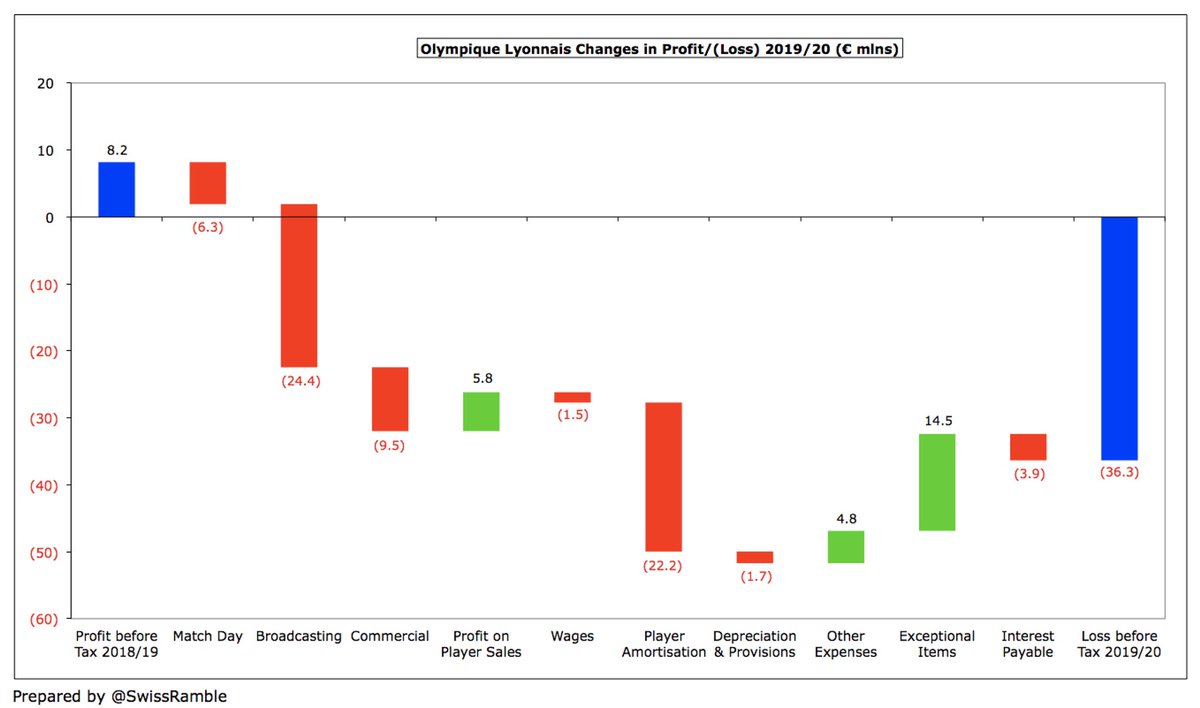

Due to COVID, #TeamOL swung from €8m pre-tax profit to €36m loss, as revenue fell €40m (18%) from €221m to €181m, though partly offset by €13m government aid and profit on player sales rising €6m to €83m. Also adversely impacted by €25m increase in costs.

All three #TeamOL revenue streams were lower, especially broadcasting, which fell €24m (20%) from €122m to €98m. Commercial dropped €10m (17%) from €57m to €47m, while gate receipts were down €6m (15%) from €42m to €36m.

The main driver of #TeamOL cost increase was player amortisation, which grew €22m (69%) from €32m to €55m, while wages were up slightly (€2m) to €132m. Other expenses were cut €5m (5%) to €85m, but net interest payable rose €4m (28%) to €18m.

#TeamOL revenue had risen €42m (19%) to record levels in the first 9 months of 2019/20, but it fell off a cliff in the last 3 months. Club estimates COVID revenue impact as €100m: €50m operating revenue and €50m player sales, as transfer window shifted to 2020/21.

#TeamOL operating loss from COVID estimated as €58m, as €100m revenue reduction (match day €25m, broadcasting €6m, commercial €18m, player sales €50m) was partly offset by €42m cost savings (wages €21m, other expenses €21m).

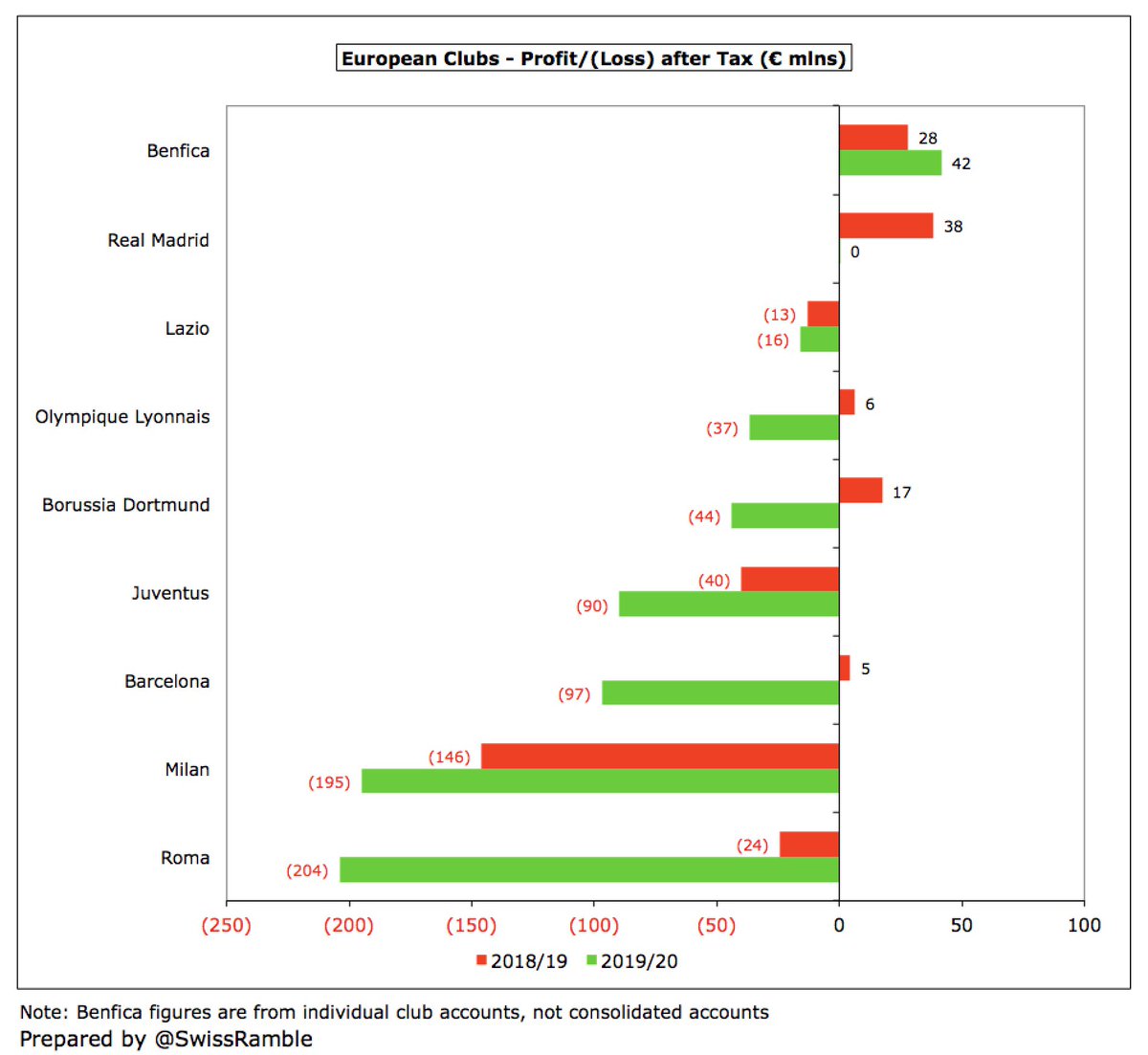

In 2018/19, the last full season for Ligue 1 clubs, #TeamOL profit before tax of €8m was third best in France, only surpassed by Paris Saint-Germain €32m and Toulouse €12m. Even before the pandemic struck, some clubs posted large losses, i.e. Marseille €91m and Lille €67m.

#TeamOL figures were boosted by profit on player sales rising €6m from €77m to €83m, mainly Tanguy Ndombele to #THFC (proceeds €48m), Lucas Tousart to Hertha Berlin (€21m) and Nabil Fekir to Real Betis (€20m). Second highest in France in 2018/19, only behind Monaco €155m.

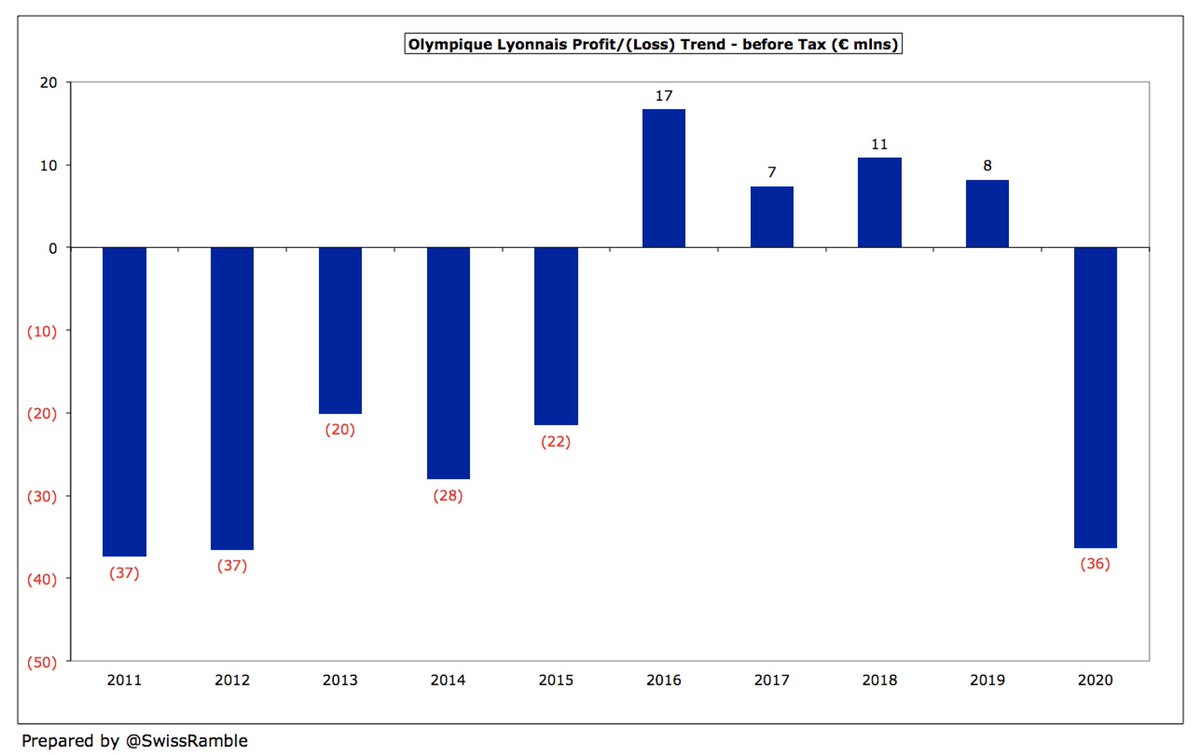

#TeamOL €36m loss in 2019/20 is the first they have reported since 2015. Before that, they had accumulated €43m of profits in the previous four years, though this has now almost completely been offset in a single season. Club expects another loss in 2020/21.

#TeamOL have made significant profits from player sales, including €371m in the last 5 seasons, averaging €74m a year. Their strategy is “based on a top notch academy recruitment of very talented young players and an ability to unlock their sporting and economic potential.”

n fact, the only club that has done better financially in player sales in France is Monaco, who made an incredible €638m in the five years up to 2019. However, #TeamOL €296m is ahead of the rest: PSG €245m, Lille €177m and Marseille €114m.

#TeamOL player sale profits have been based on steady business, as opposed to one mega transaction, with four deals above €40m: Lacazette to #AFC €50m, Ndombele to #THFC €48m, Mendy to Real Madrid €43m & Tolisso to Bayern €41m. Sales proceeds for 2020/21 already above €50m.

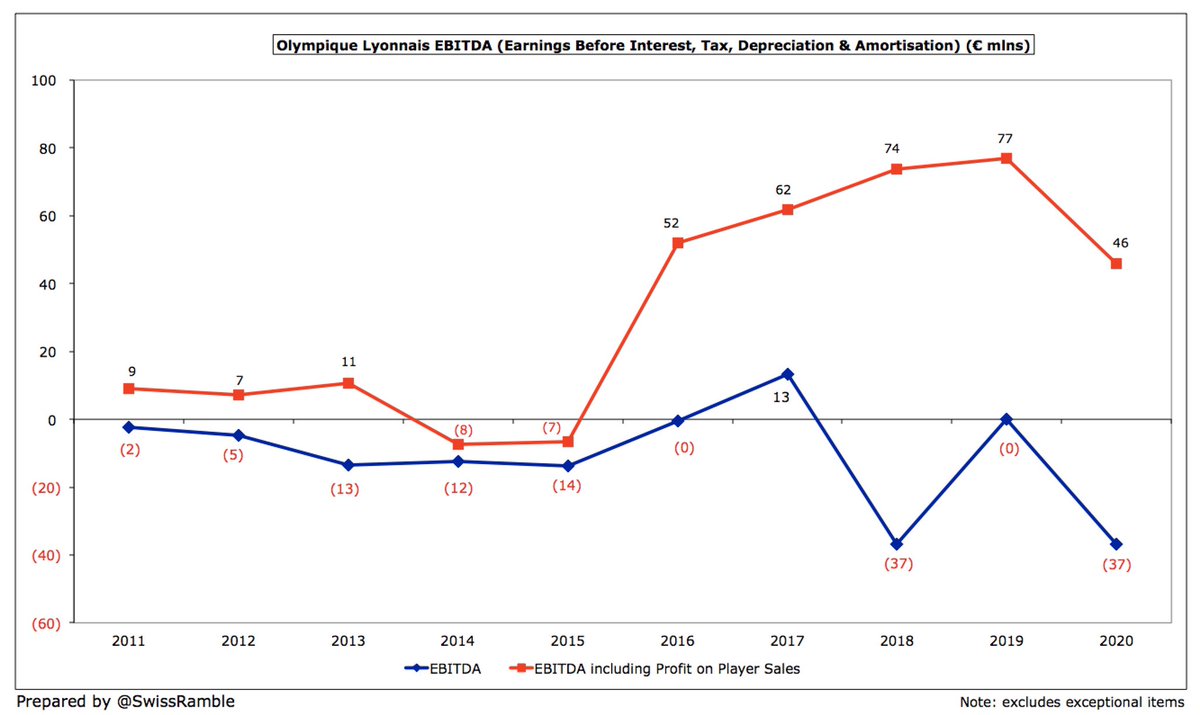

#TeamOL EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation) had steadily risen to €77m, but fell to €46m in 2020, which was not bad given the difficult economic background. Excluding profit on player sales, dropped to minus €37m.

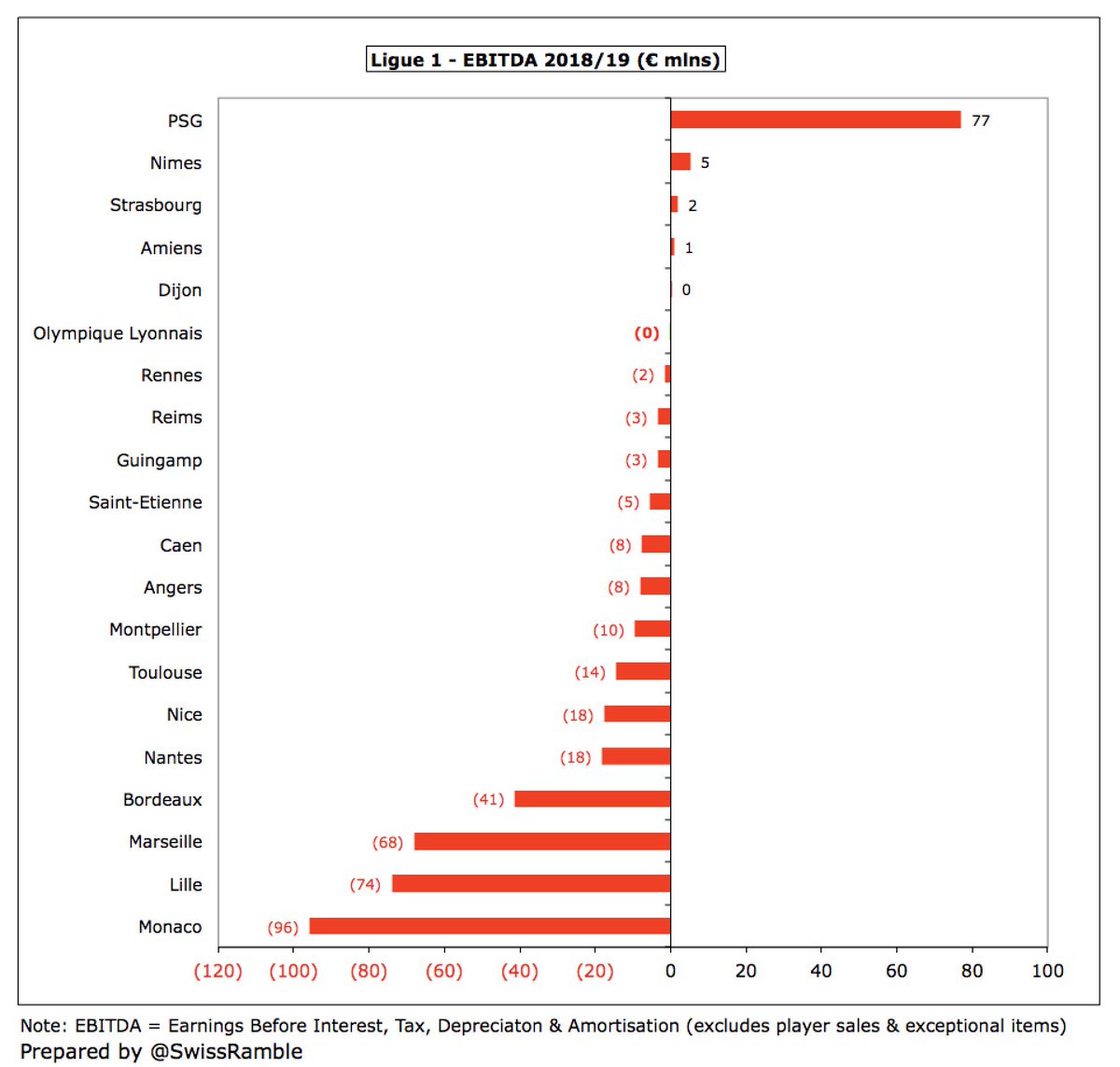

Even in 2018/19, most French clubs posted negative EBITDA (excluding player sales) with Monaco “leading the way” with €(96)m. #TeamOL basically broke-even and were 6th best in Ligue 1. Only PSG had a positive EBITDA higher than €5m with an impressive €77m.

#TeamOL operating loss (excluding player sales) widened from €55m to €101m in 2019/20. In the previous season they were 5th worst in Ligue 1, only beaten by Monaco €153m, Marseille €109m, Lille €95m and Bordeaux €61m. Only one club made an operating profit: Nimes €3m.

Despite the €40m fall in 2019/20, #TeamOL revenue has still grown €84m (88%) in the last 5 years from €96m in 2015 to €181m, mainly driven by broadcasting €52m (Champions League success), match day €24m (impact of moving to new stadium) and commercial €8m.

#TeamOL revenue growth has outpaced Marseille and Monaco, but their challenge is highlighted by PSG’s stratospheric increase since the club was acquired by QSI in 2011. In that year, Lyon’s revenue was €32m higher than PSG, but the shortfall in 2019 was a massive €438m.

That said, #TeamOL €221m in 2018/19 was enough to enjoy a revenue advantage of around €100m over Marseille €130m and Monaco €112m, followed by Rennes €80m, Saint-Etienne €74m, Bordeaux €71m and Lille €64m.

After a six-year absence, #TeamOL returned to the 2018/19 Deloitte Money League, which ranks clubs globally by revenue, with their €221m securing 17th place, just behind AS Roma €231m. Around a third of their Champions League semi-final winners, Bayern Munich €660m.

#TeamOL gate receipts fell €6m (15%) from €42m to €36m, comprising domestic €24m and Europe €12m. Hit hard by termination of Ligue 1 season on 13 March, meaning 6 home games were not played. Champions League quarter-final and semi-final played behind closed doors in Lisbon.

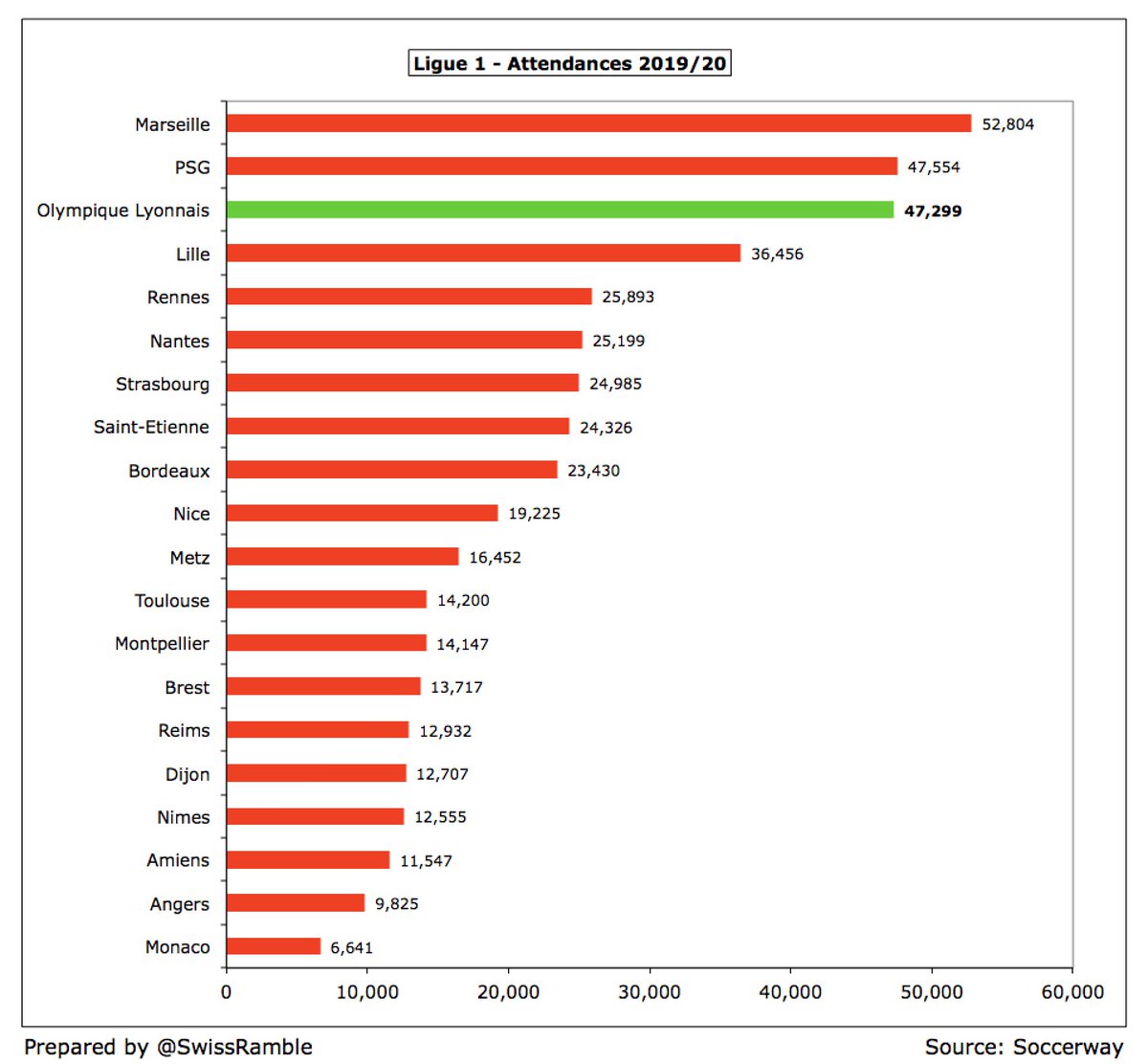

#TeamOL average attendance fell from 49,079 to 47,299, which was the third highest in France, only behind Marseille 52,804 and PSG 47,554. Club moved to the 59,186 capacity Groupama Stadium (Parc Olympique Lyonnais) from the Stade de Garland in January 2016.

#TeamOL TV income fell €24m (20%) from €122m to €98m. Domestic was down €18m (35%) from €51m to €33m, due to rebate to broadcasters and 7th place vs. 3rd. UEFA TV money was down €6m (9%) from €71m to €65m. Only below PSG €157m in France in 2018/19.

#TeamOL earned €48m from Ligue 1 TV deal in 2019, behind PSG €60m, but ahead of Marseille €47m. Money distributed by 50-30-20 rule: 50% equal share (30% fixed, 20% according to club licences); 30% league standing (25% current season, 5% 5 previous seasons); 20% media profile.

Although domestic TV money was hit by the season closing early, #TeamOL did benefit from financial assistance of €12.9m from the French government, reported as an Exceptional Item. This was equivalent to the balance of LFP media rights that the club did not receive.

French TV rights should increase by around 60% in 2020/21 from €830m to €1.3 bln, based on contracts signed by Mediapro, BeIN and Free, which #TeamOL estimate is worth an additional €18m. However, Mediapro want to renegotiate and have not made their second payment this season.

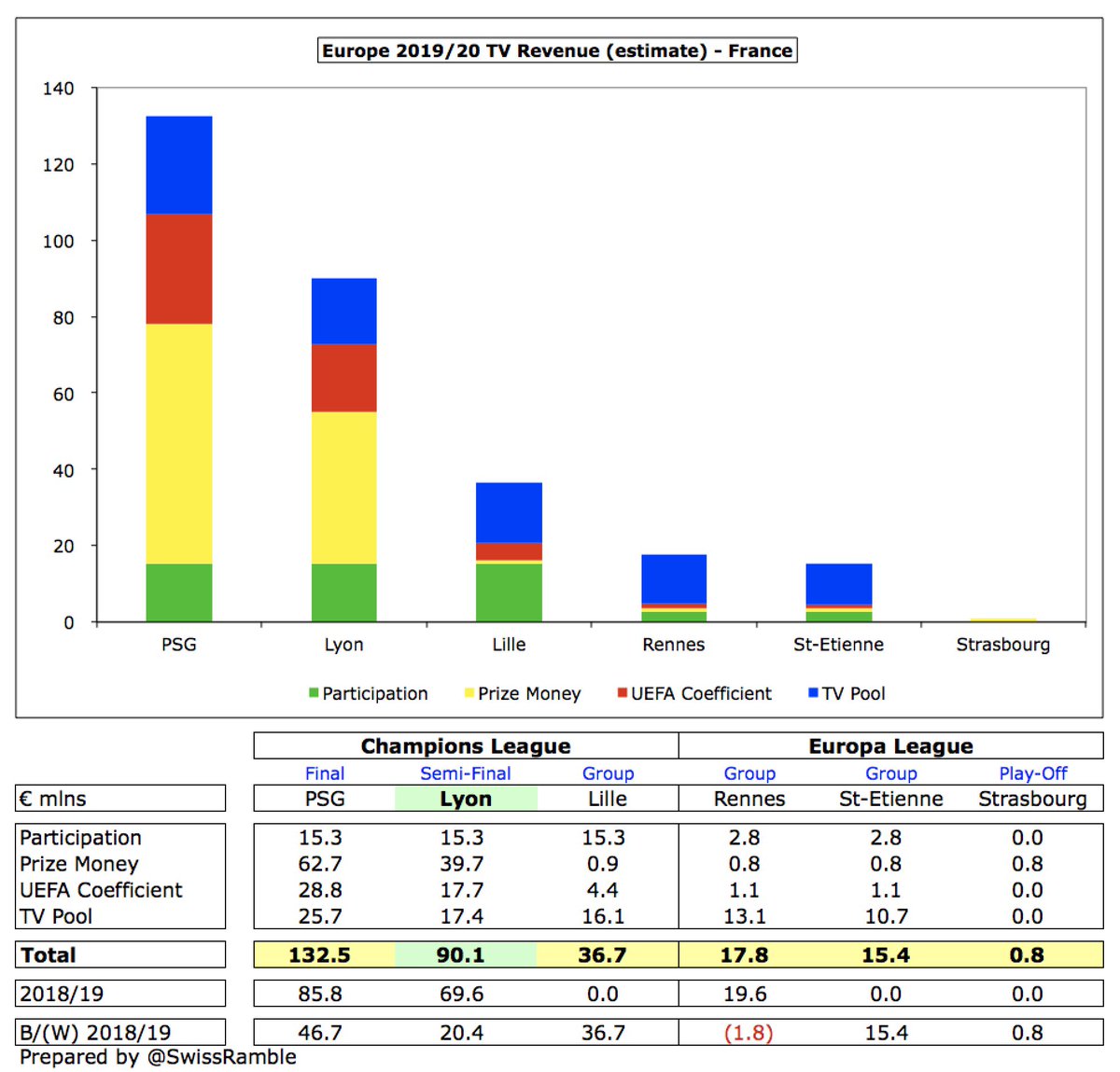

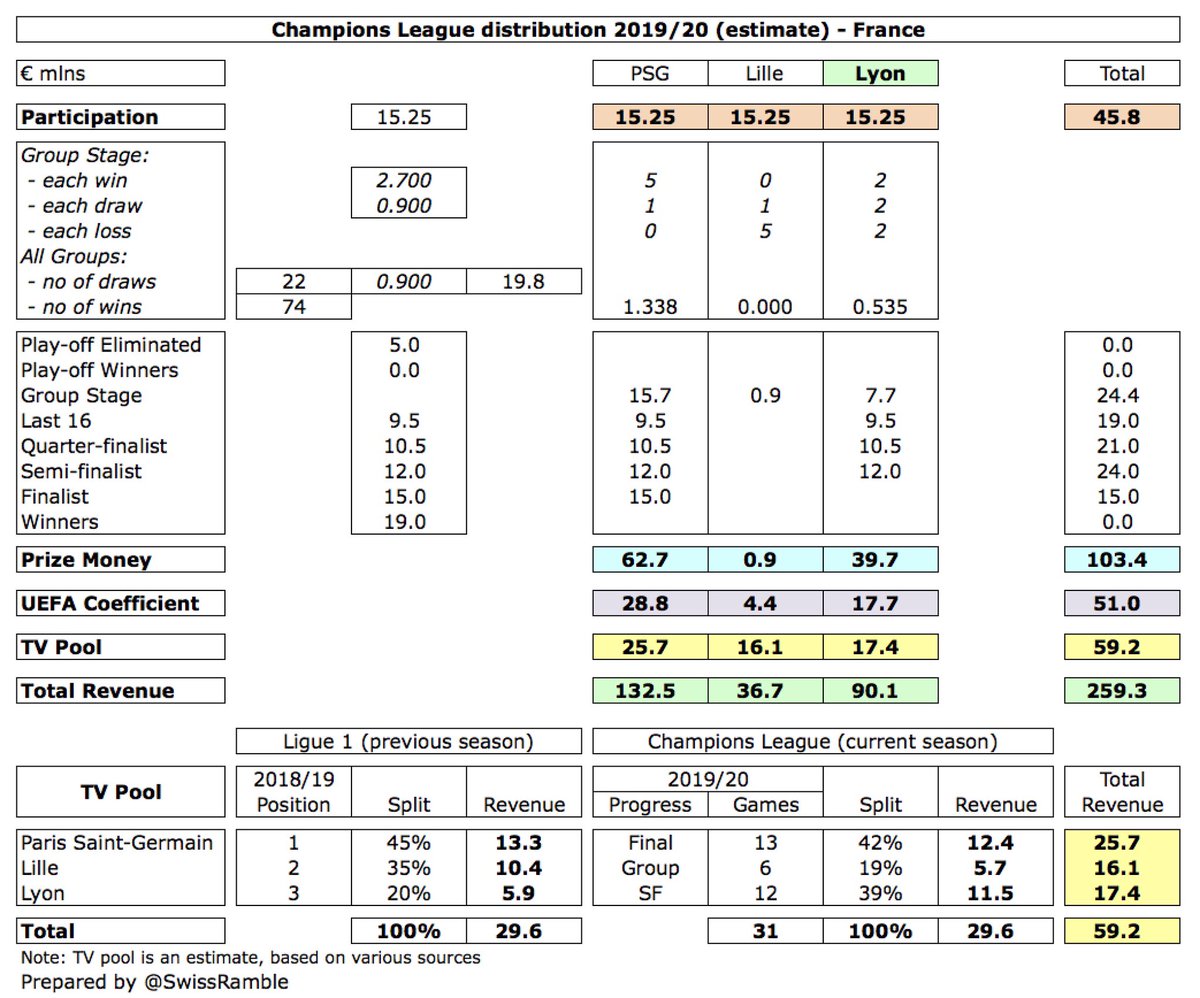

#TeamOL earned €90m after reaching the Champions League semi-final, €20m more than prior season. Other French clubs: PSG €133m, Lille €37m. These figures are before any COVID rebate, while €25m revenue for games played in August has been shifted to 2020/21 accounts.

It is worth noting the influence on Champions League distribution of the UEFA coefficient payment introduced in 2018/19 (based on performances over 10 years), where #TeamOL received around €18m in 2019/20, compared to €29m for PSG and €4m for Lille.

European qualification (particularly Champions League) is extremely important for #TeamOL, who have earned an impressive €262m from Europe in last 5 seasons, only surpassed in France by PSG €406m, but well ahead of Monaco €169m and Marseille €44m.

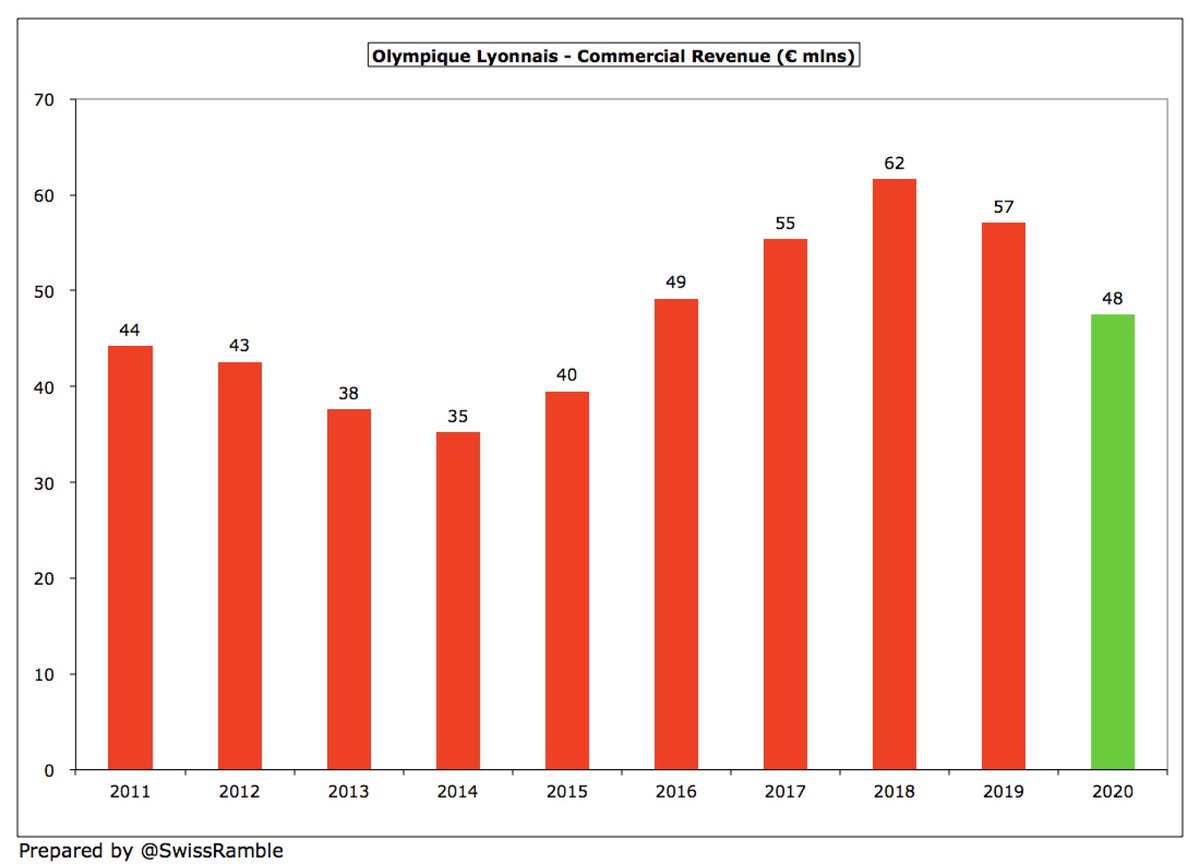

#TeamOL commercial revenue fell €9m (17%) from €57 to €48m, comprising sponsorship & advertising €27m, brand-related revenue €14m and events €7m. Adversely impacted by the mid-March shutdown, including lower merchandising sales and cancelled events.

Before the pandemic struck, #TeamOL commercial income had been steadily rising. In 2018/19 their €57m was ahead of Marseille €50m, Monaco €33m and Saint-Etienne €26m, but, like every other French club, was dwarfed by PSG’s extraordinary €452m.

#TeamOL will benefit from two new 5-year sponsorship agreements in 2020/21: Emirates have replaced Hyundai as shirt sponsor for a reported €20m, while Adidas have extended their kit deal at €10m. Groupama stadium €4m naming rights extended to 2022.

#TeamOL wages rose slightly from €131m to €132m, as the €21m reduction from placing players and other staff on partial unemployment under the French government’s economic support programme did not fully offset the €22m increase from strengthening the squad.

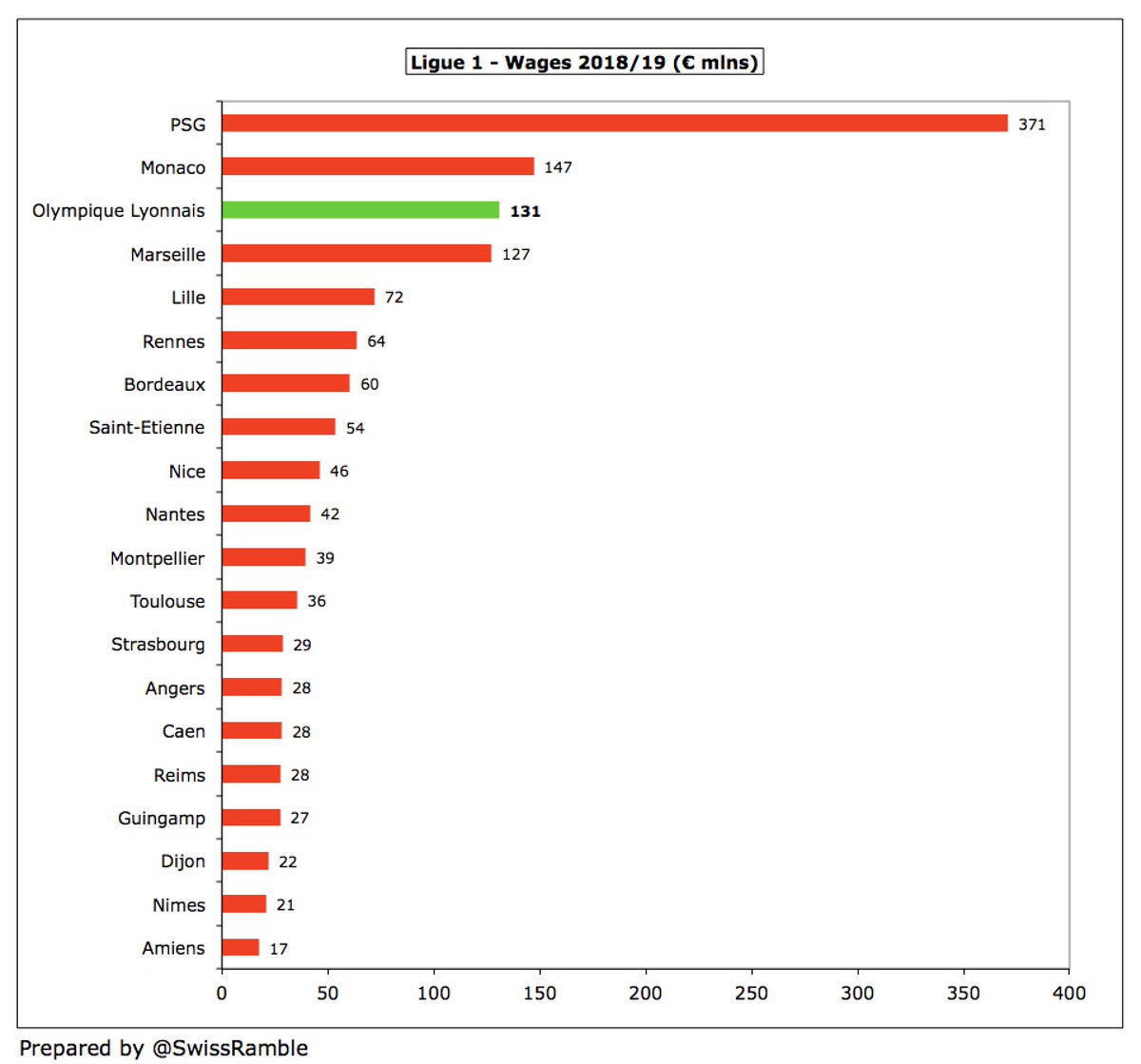

In 2018/19 #TeamOL €131m wages were the third highest in Ligue 1, sandwiched between Monaco €147m and Marseille €127m, but nearly quarter a billion below PSG €371m. That said, there was also a big gap to the other French clubs: Lille €72m, Rennes €64m and Bordeaux €60m.

Following the steep decline in revenue, #TeamOL wages to turnover ratio increased (worsened) from 59% to 73%. Pre-COVID in 2018/19, Lyon had the fourth lowest in Ligue 1 with the only clubs better than them being Amiens 54%, PSG 56% and Strasbourg 59%.

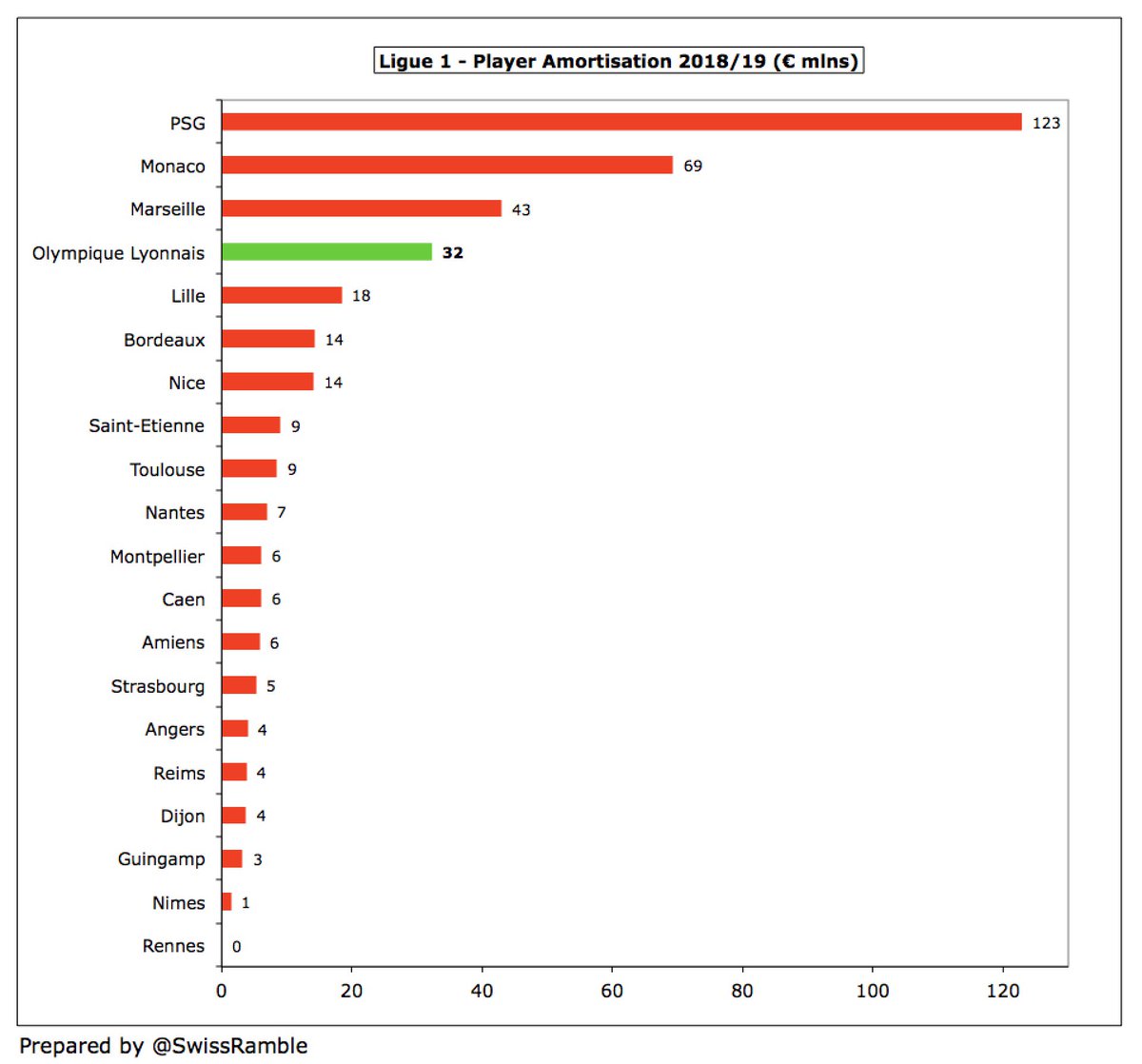

Following an increase in player spend, #TeamOL player amortisation, the annual cost of writing-off transfer fees, increased by €22m (69%) from €32m to €55m, which means that this expense has more than tripled in just three years from just €14m in 2017.

To some extent, #TeamOL have been playing catch-up here with their player amortisation only fourth highest in Ligue 1 in 2018/19, below PSG €123m, Monaco €69m and Marseille €43m.

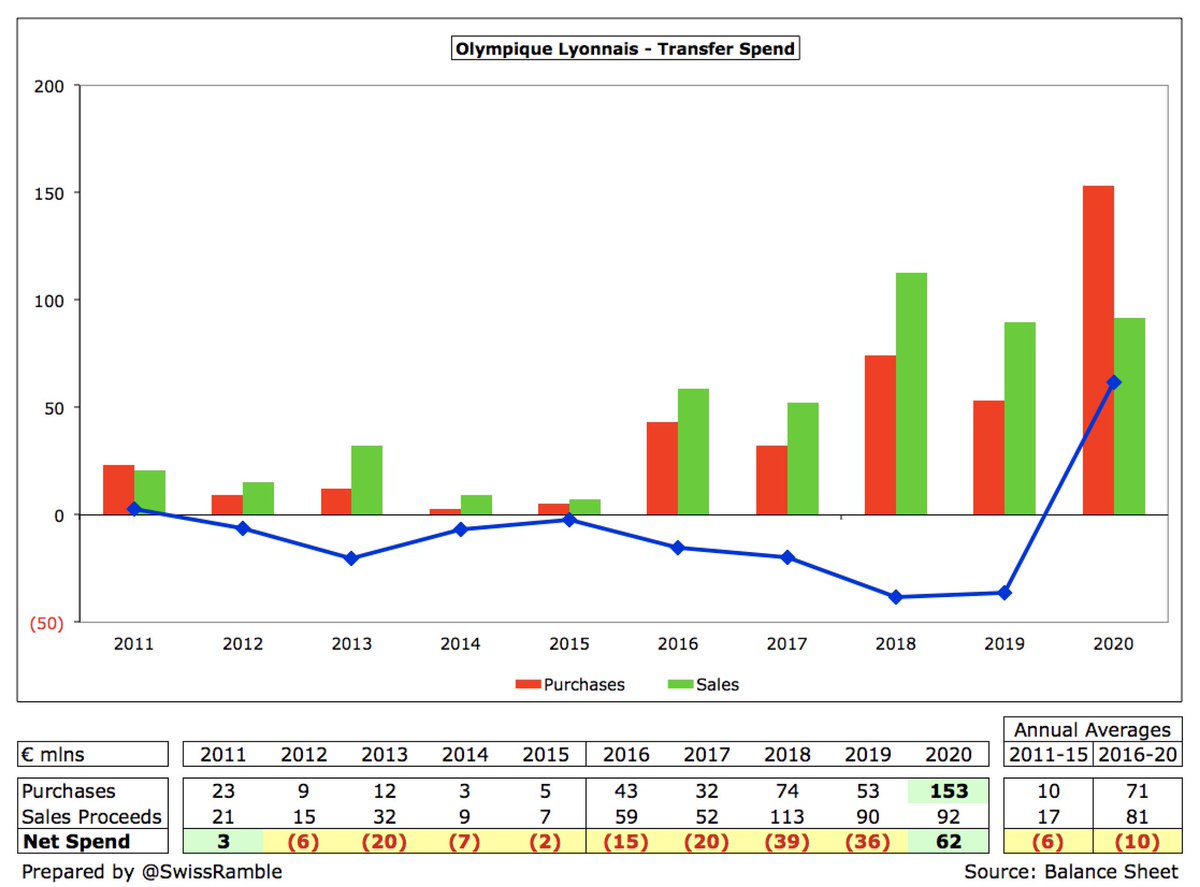

#TeamOL had net spend of €62m in 2020 (purchases €153m, sales €92m), the first time they have not reported net spend since 2011 (and that was just €3m). Big increases in both purchases and sales over last 5 years. Buys included Andersen, Reine-Adelaide, Mendes and Guimaraes.

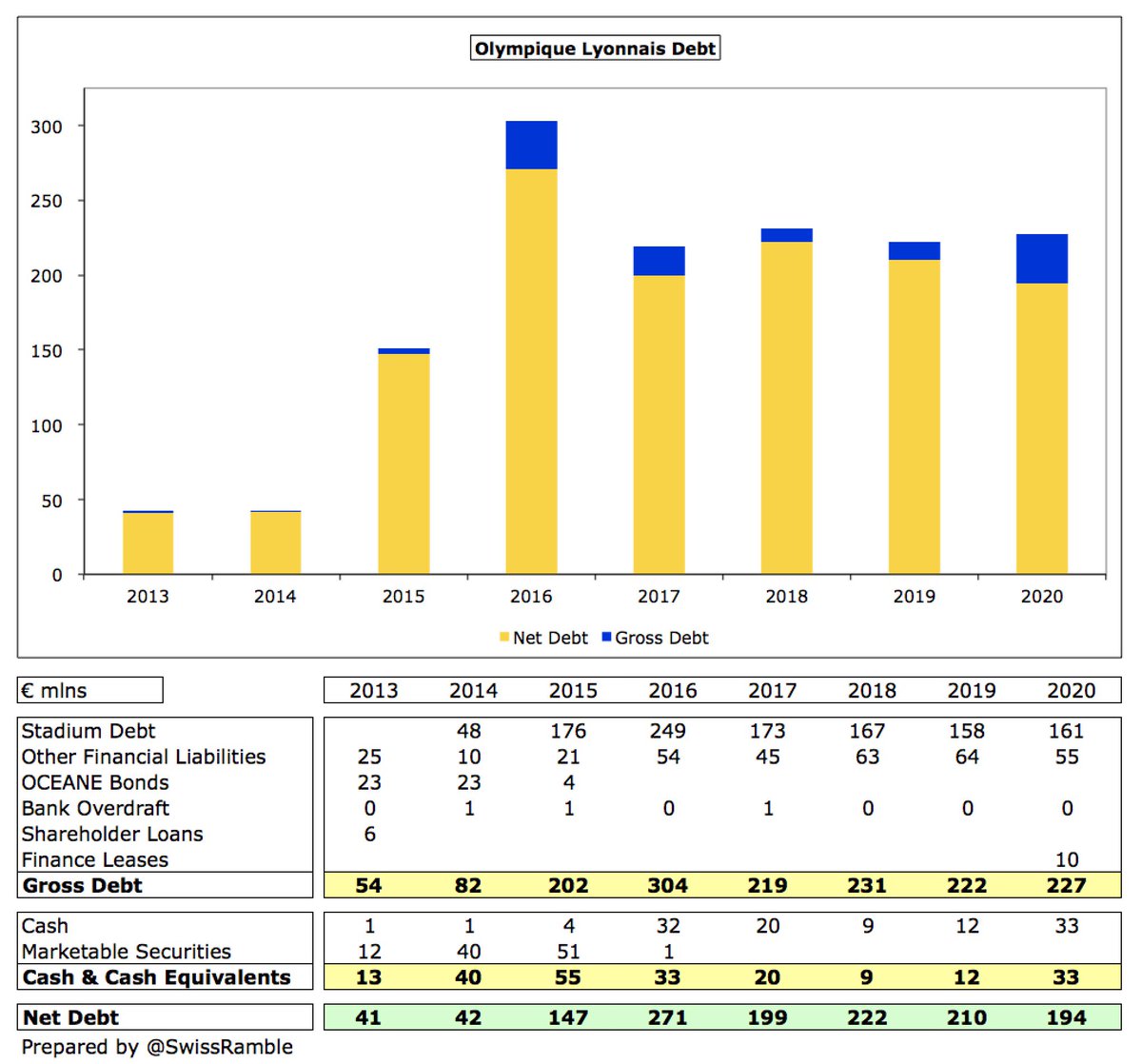

#TeamOL gross debt rose €5m to €227m, as IFRS 16 meant inclusion of €10m finance leases. Stadium debt up €3m to €161m, but other financial liabilities down €9m to €55m. Cash increased €21m to €33m, so net financial debt fell €16m from €210m to €194m.

As a result of investment in the new stadium, #TeamOL gross debt of €222m was by far the highest in France in 2018/19, well ahead of Lille €129m and Bordeaux €38m. The club negotiated €9m of postponements of loan repayments last season due to COVID.

In light of the COVID crisis, #TeamOL has strengthened its liquidity by: (a) increasing its revolving credit facility to €115m; (b) taking out a €93m government guaranteed loan with a 12 months maturity (can exercise a 1-5 year amortisation option).

French clubs often hold a higher cash balance than, say, English clubs, so #TeamOL €12m cash balance in 2018/19 was only mid-table in Ligue 1. However, this rose to €33m in 2019/20, then up to €49m as of 30 September 2020.

However, #TeamOL transfer debt shot up in 2020 from €41m to €136m, while amounts owed to Lyon by other clubs fell from €94m to €34m, resulting in net transfer payables of €101m. This would have been the highest gross transfer debt in France in 2019, ahead of PSG €120m.

#Team OL €21m cash increase in 2019/20 was entirely due to €91m from (net) player sales. This was used to cover a €43m operating loss and €8m capital expenditure, while they also spent €10m on loan repayments and €6m on interest payments.

#TeamOL have benefited from their interest payments steadily falling from a peak of €31m in 2017 to “only” €6m in 2020, thanks to various refinancings. During the last nine years, the club has had to pay nearly €80m in interest.

In the last decade #TeamOL have spent over €400m on infrastructure, including €362m on the new stadium. This has been funded by €226m of new equity and €163m loans. Player sales (net) of €186m largely covered €137m operating losses and €79m interest payments.

#TeamOL “remain confident” of achieving €420-440m revenue (including player trading) and €100 EBITDA in 2023/24, partly based on building a new events venue near the stadium (€140m investment) and developing a leisure & entertainment complex in OL Valley.

Of course, these projections depend on how the COVID crisis develops, so there will be more short-term pain before #TeamOL can resume its growth trajectory. Meanwhile, they have started a court case against the LFP to compensate for losses suffered after ending the season early.

• • •

Missing some Tweet in this thread? You can try to

force a refresh