Celtic’s 2019/20 accounts cover a season when Scottish football was ended early in March due to COVID-19, though they were declared champions for the 9th consecutive season based on average points. They also reached the last 32 of Europa League. Some thoughts follow #CelticFC

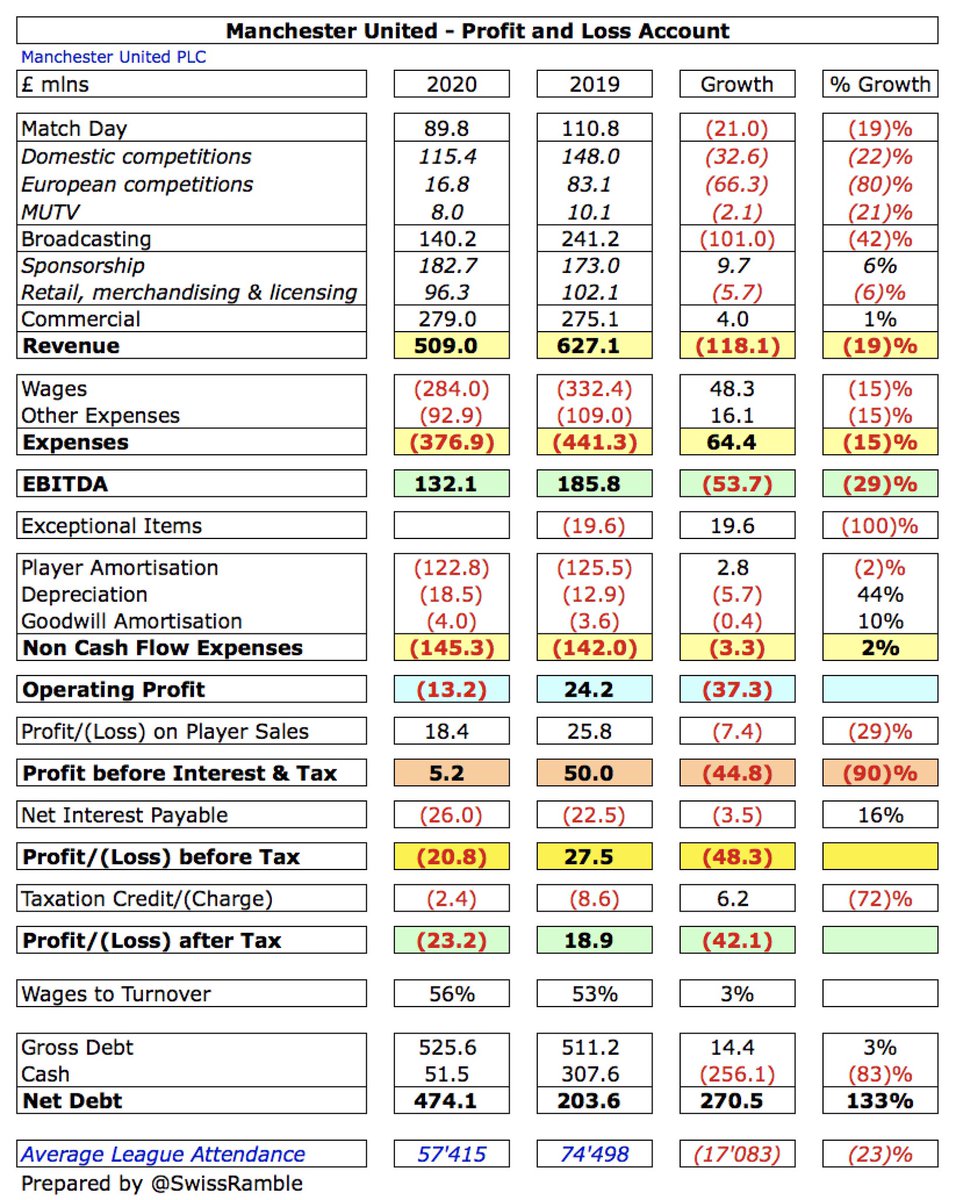

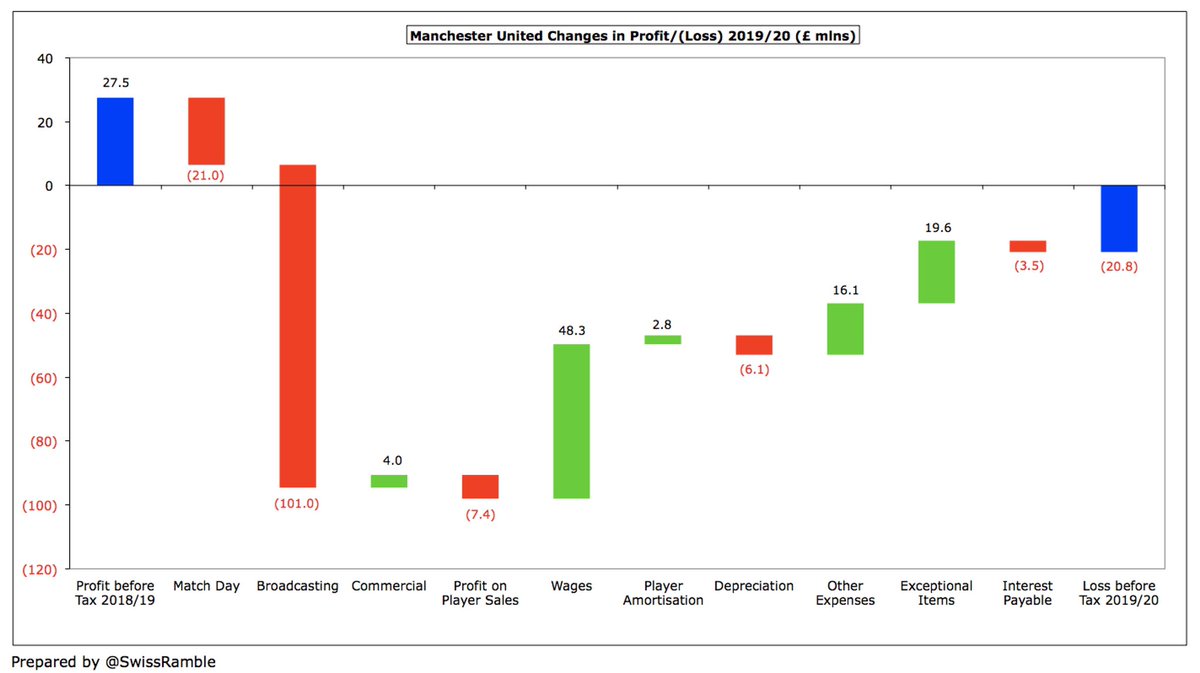

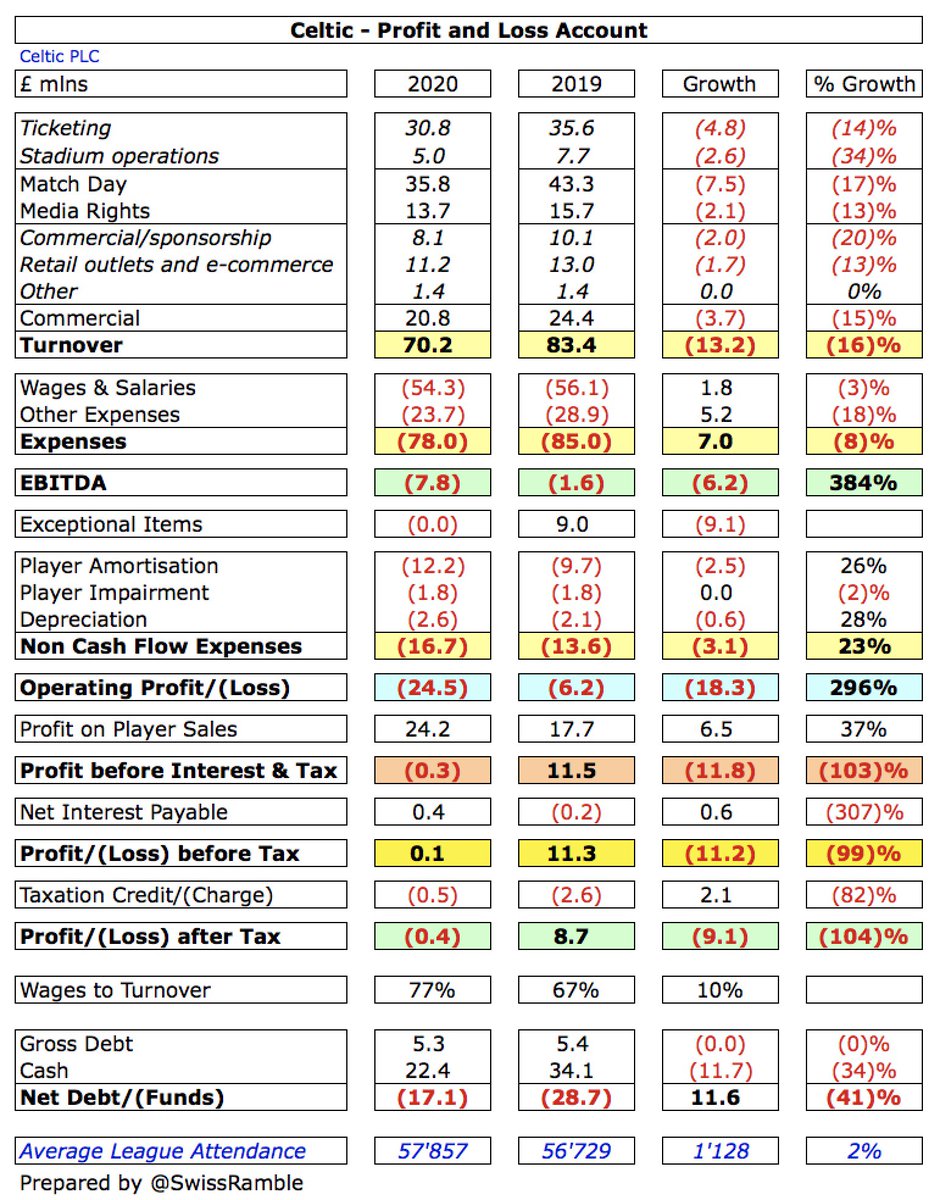

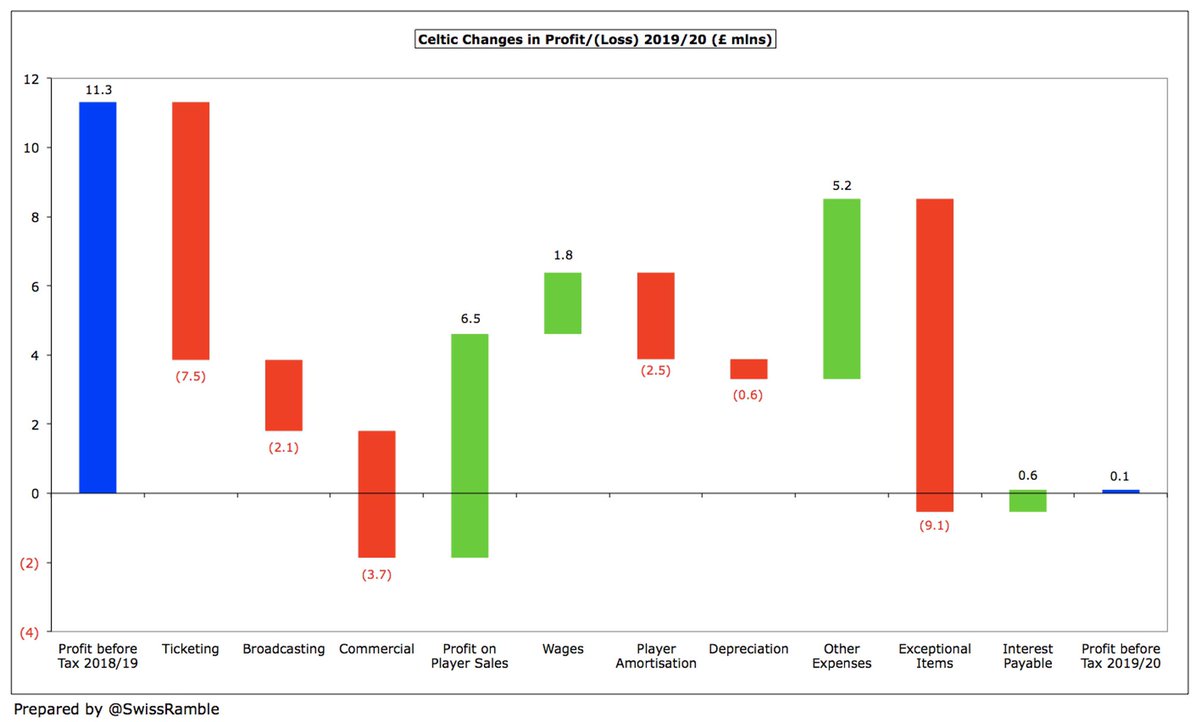

Due to COVID, #CelticFC pre-tax profit dropped from £11.3m to £0.1m, as revenue fell £13m (16%) from £83m to £70m, offset by £6m increase in profit on player sales to £24m and £4m reduction in expenses. However, no repeat of prior season’s £9m compensation for Brendan Rodgers.

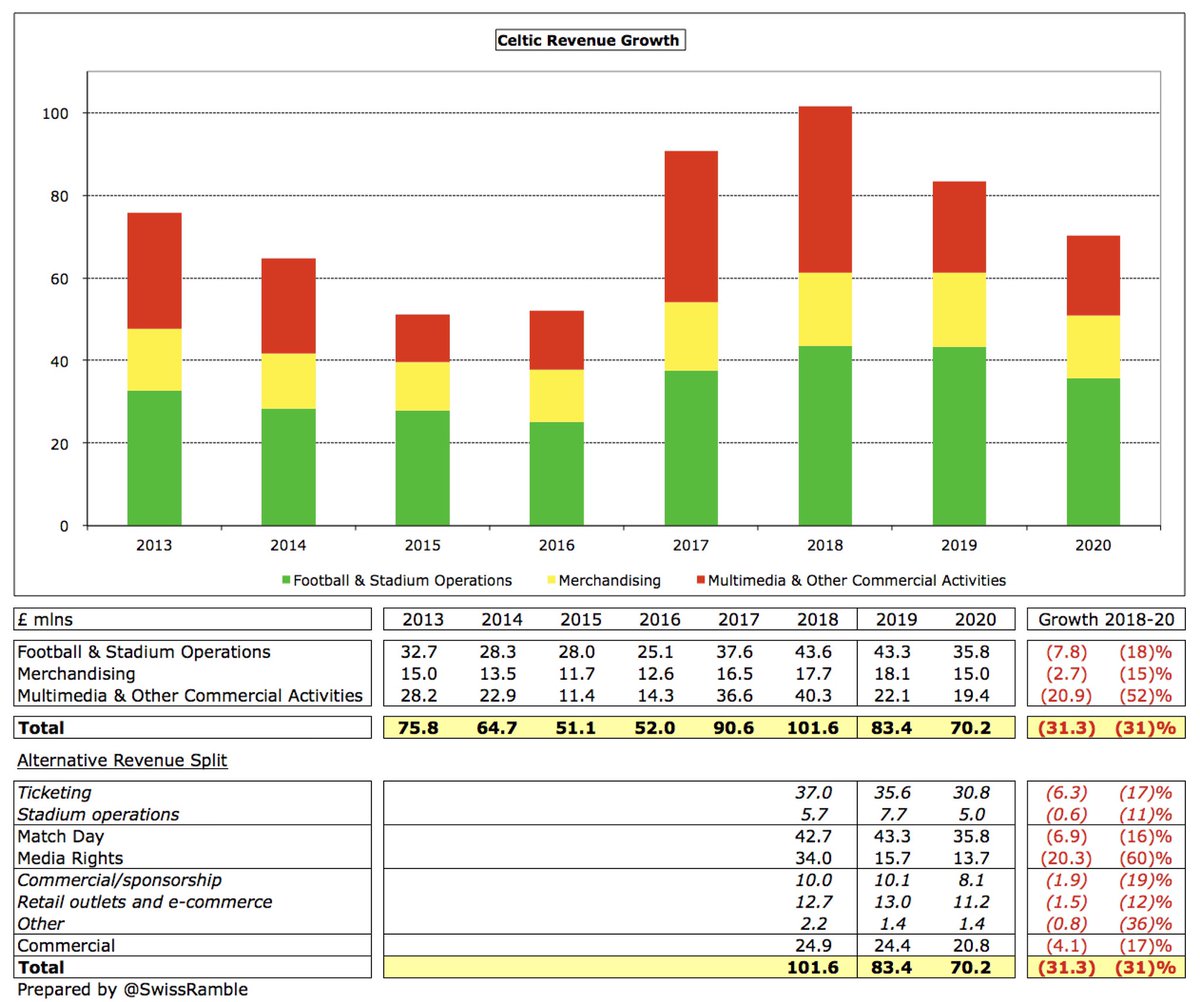

All three #CelticFC revenue streams were lower, especially match day, which fell £7.5m (17%) from £43.3m to £35.8m. Commercial dropped £3.6m (15%) from £24.4m to £20.8m, while broadcasting was also down £2.0m (13%) from £15.7m to £13.7m.

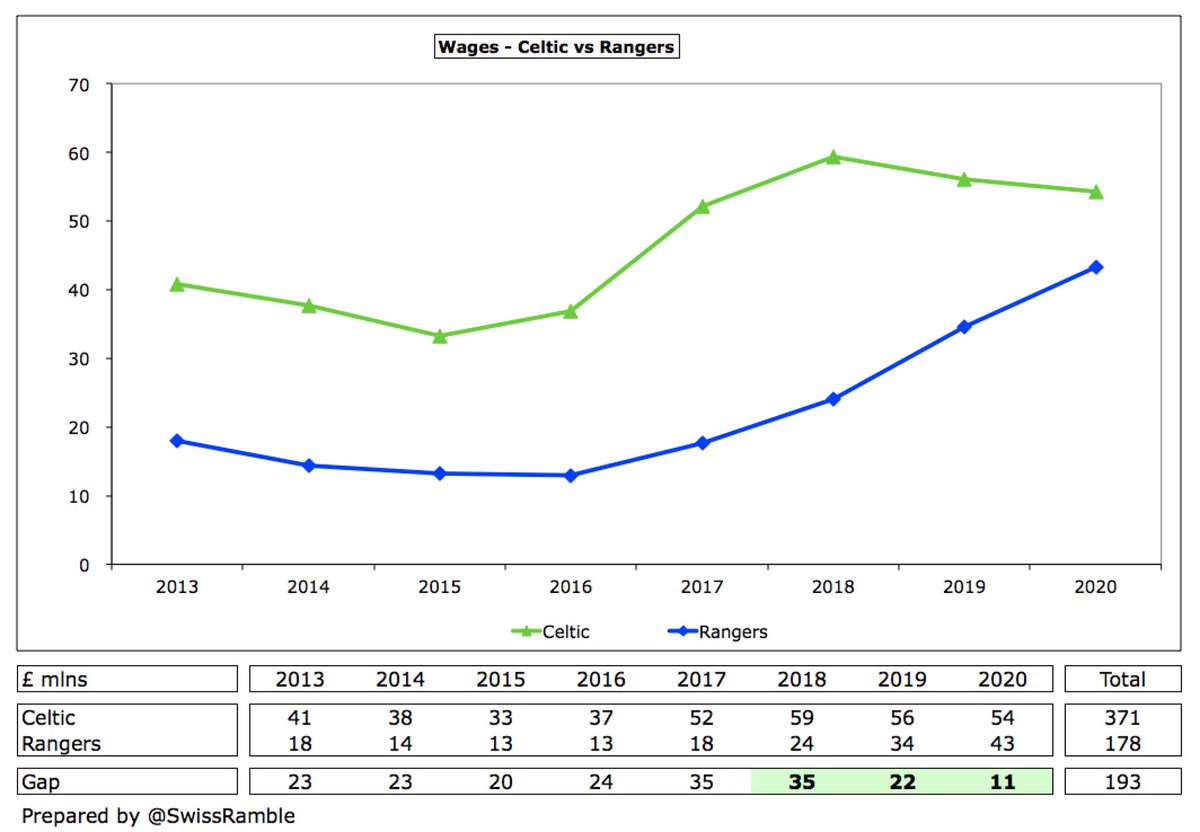

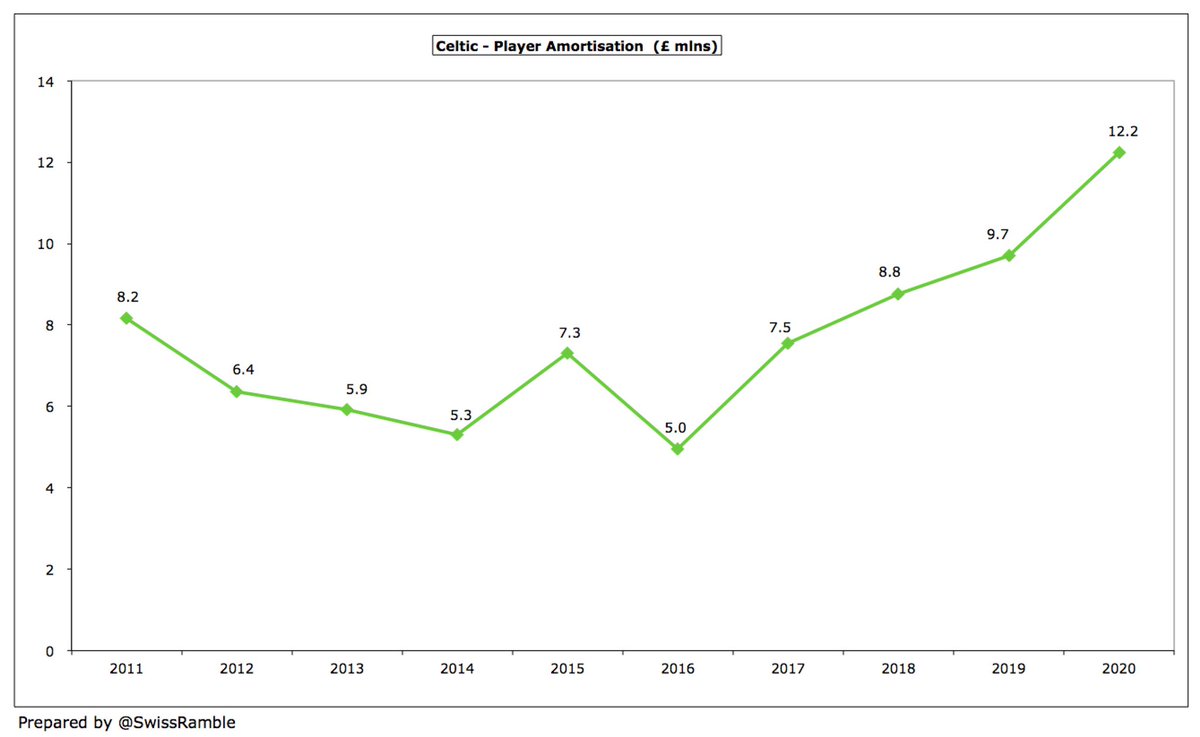

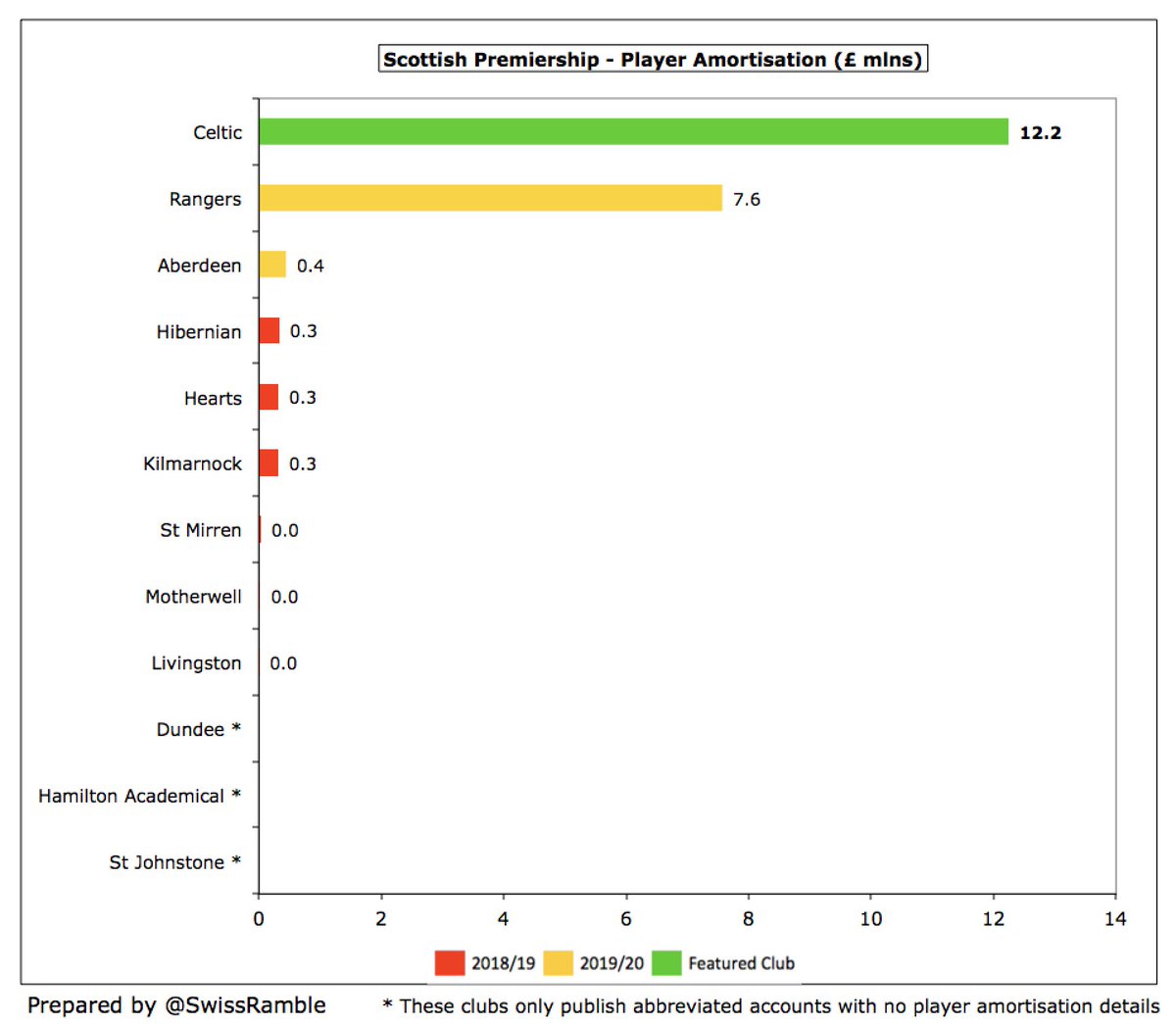

#CelticFC wages fell £1.8m (3%) from £56.1m to £54.3m, while other costs were cut £5.2m (18%) from £28.9m to £23.7m, due to less activity. However, non-cash flow expenses increased: player amortisation rose £2.5m (26%) to £12.2m, while depreciation was up £0.6m (28%) to £2.6m.

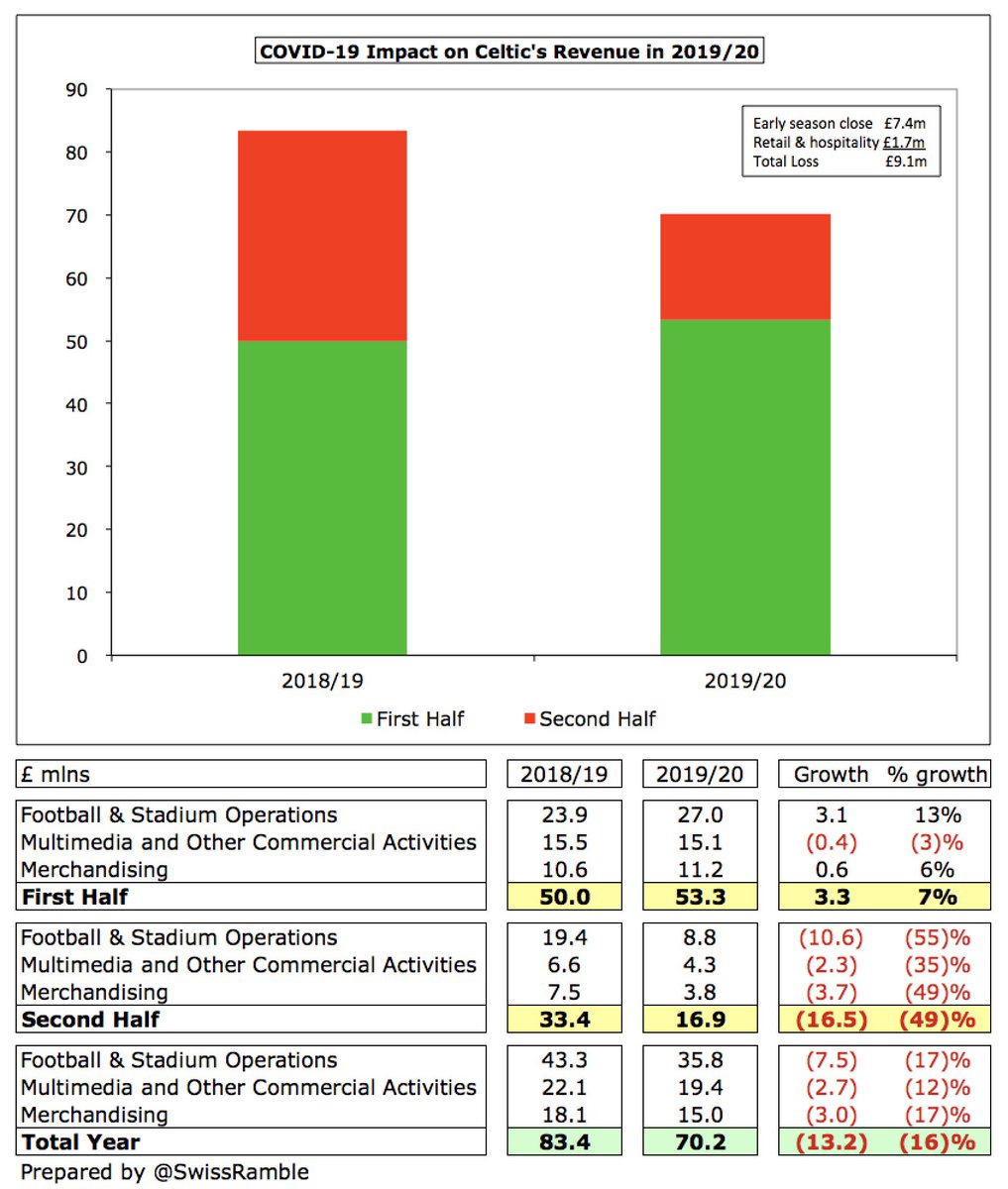

#CelticFC revenue had risen £3m (7%) from £50m to £53m in the first half of 2019/20, but it fell £16m (49%) from £33m to £17m in the second half of the season. Club estimates COVID revenue impact as £9.1m: £7.4m due to early season close and £1.7m retail and hospitality.

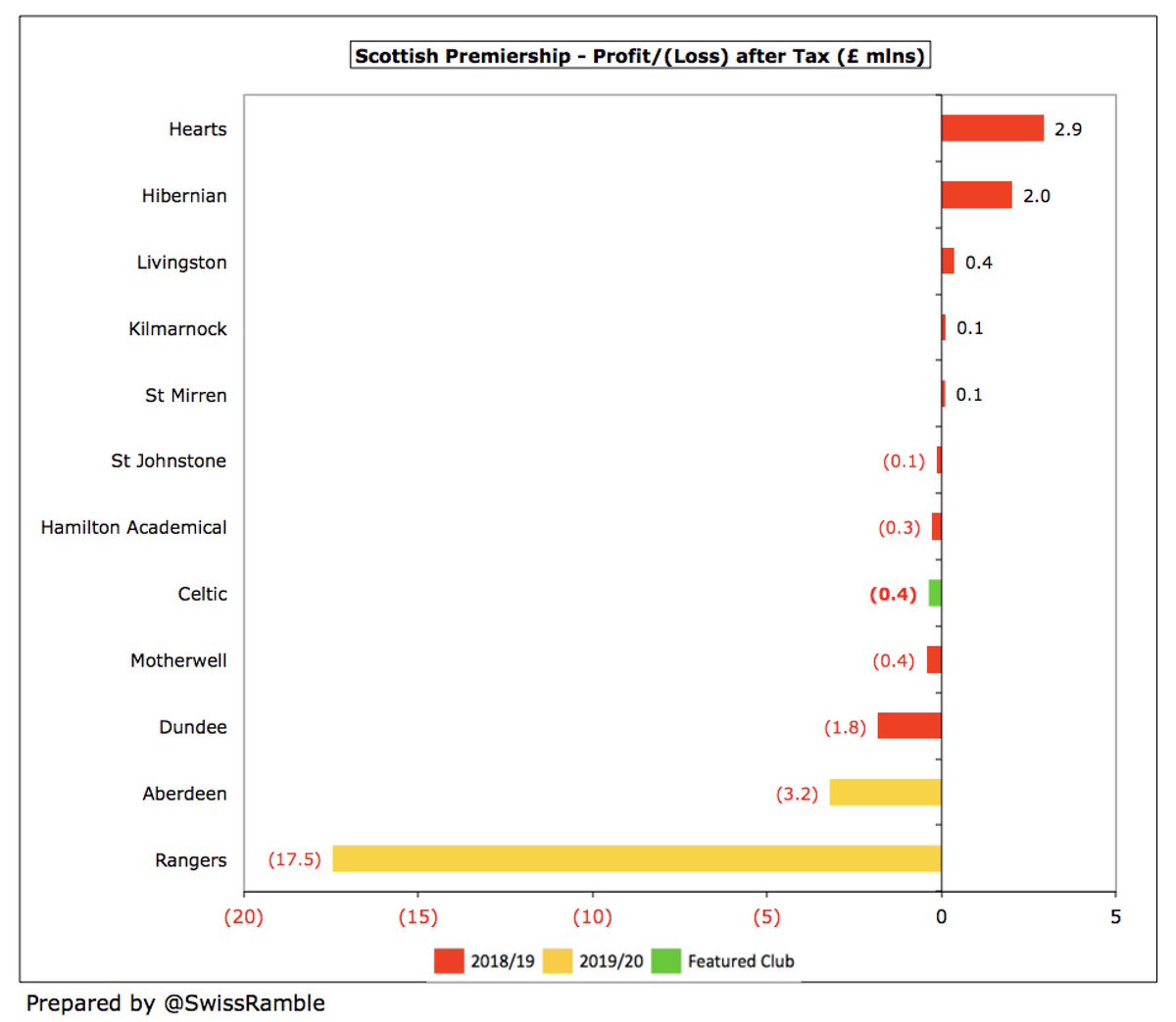

#CelticFC chairman Ian Bankier said, “These results are satisfactory in the circumstances”. Given the impact of the pandemic, a £0.1m profit (£0.4m loss after tax) is a fine achievements, especially compared to the £17.8m loss (£17.5m after tax) reported by Rangers.

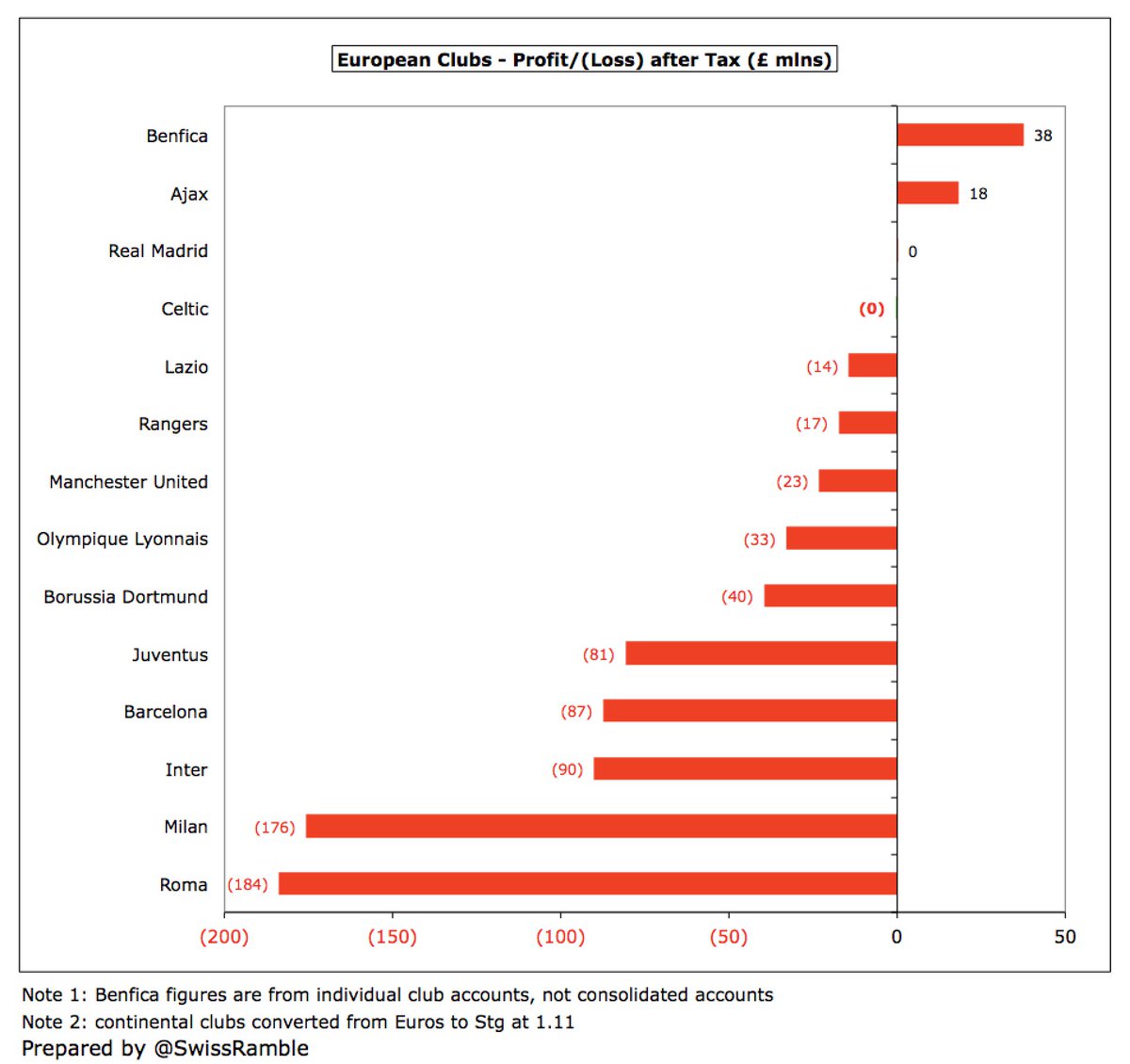

COVID has significantly impacted finances in 2019/20 with many leading clubs posting horrific losses, e.g. Roma £184m, Milan £176m, Inter £90m, Barcelona £87m and Juventus £81m. In contrast, #CelticFC “demonstrated the sustainable nature and flexibility of the business model.”

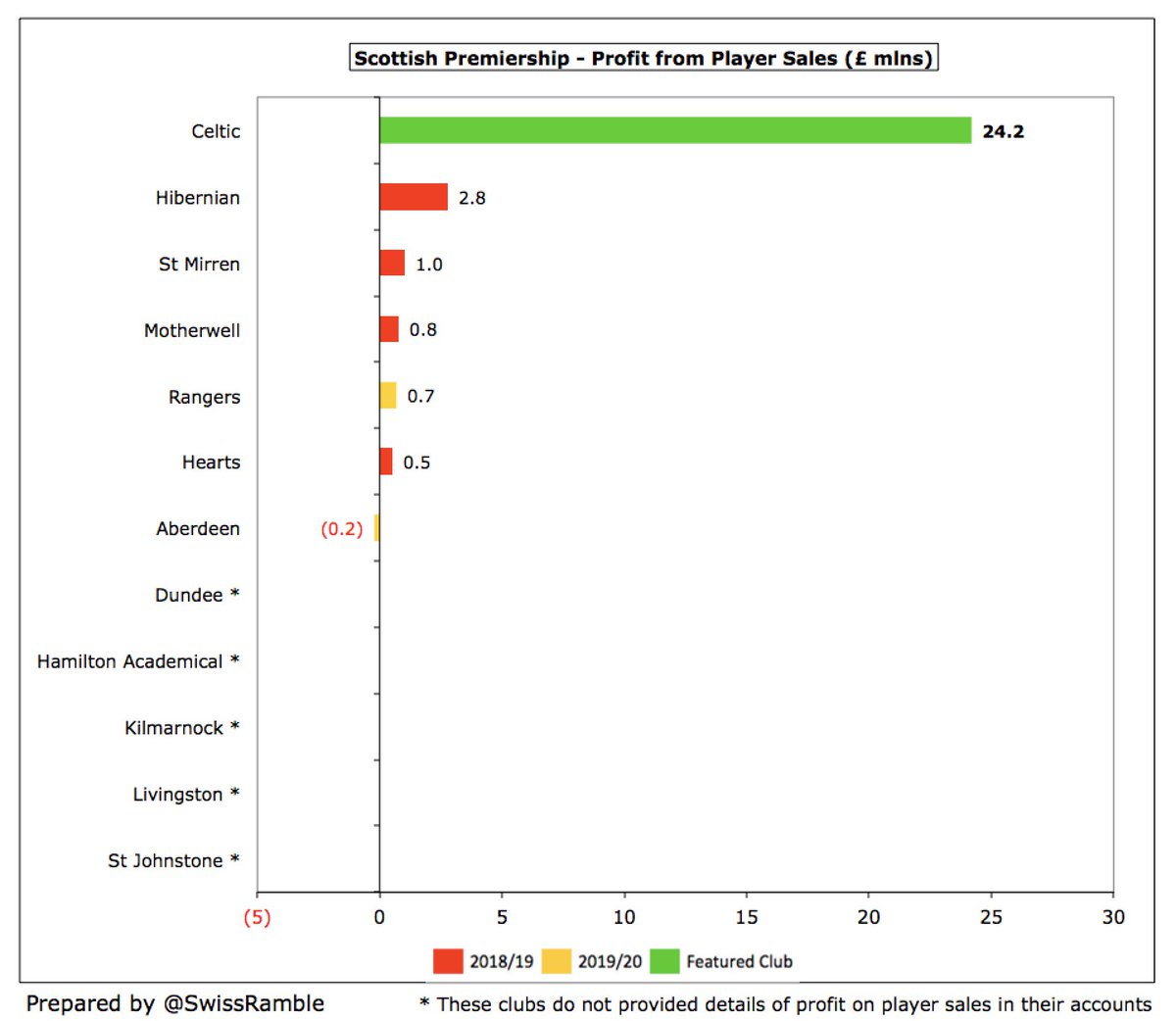

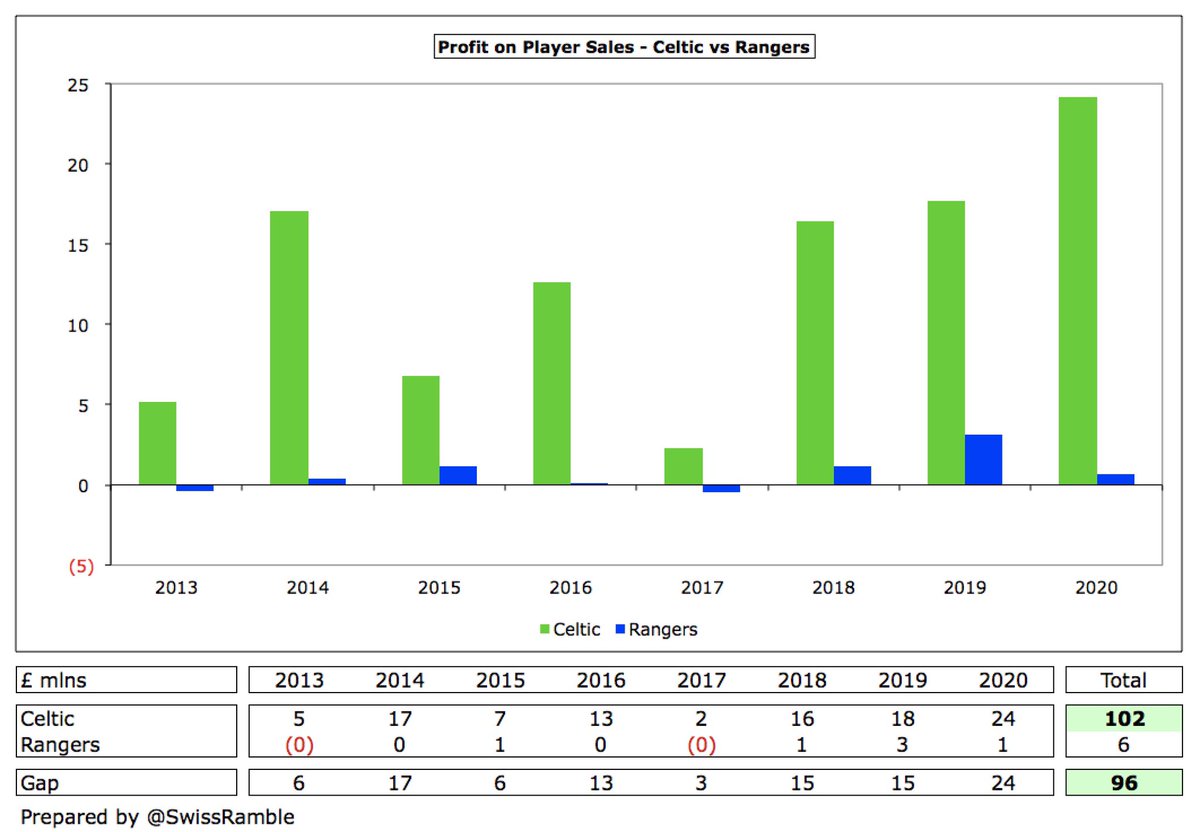

However, #CelticFC figures greatly benefited from £24m profit from player sales, up £6m (37%) from previous season’s £18m, mainly Kieran Tierney to Arsenal. This was significantly higher than other Scottish clubs, e.g. Rangers only made £0.7m from this activity.

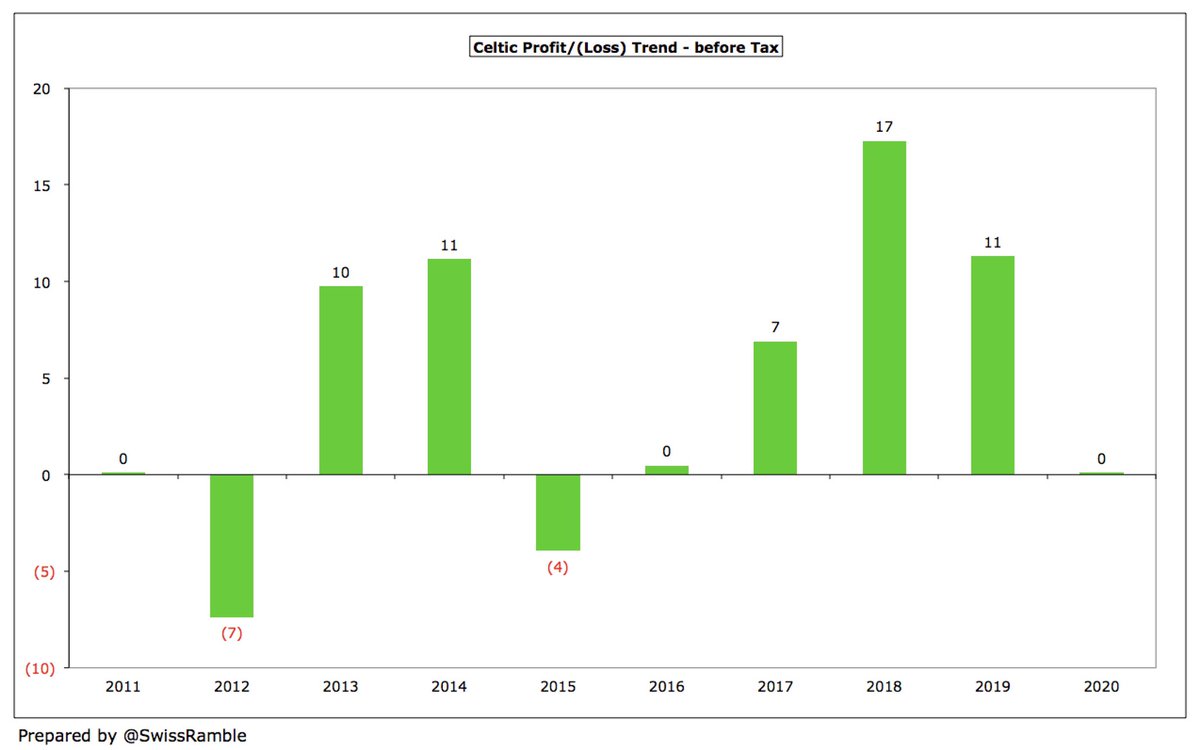

#CelticFC have posted pre-tax profits five years in a row, amounting to a £36m surplus in that period. In fact, they have generated profits in seven of the last eight seasons with the sole loss in 2014/15 being only £4m.

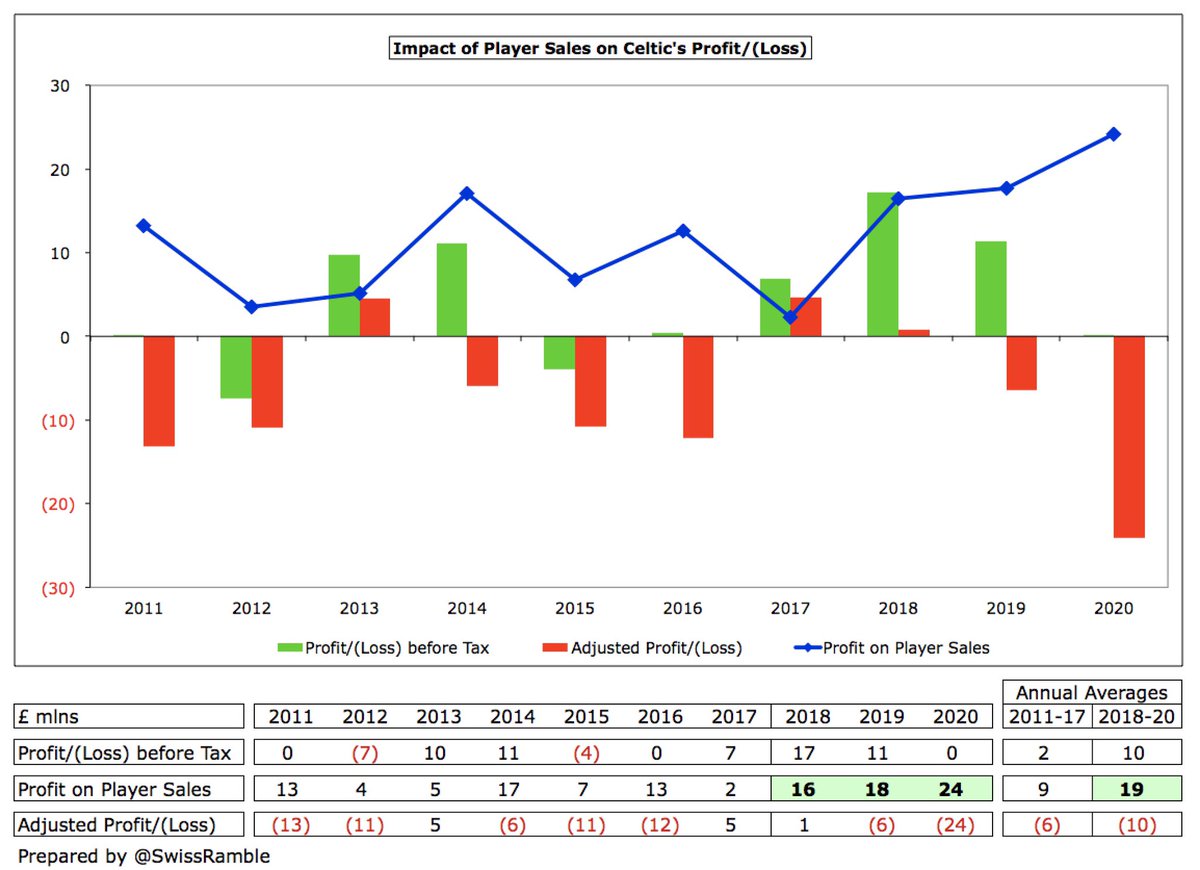

#CelticFC strategy has become increasingly reliant on player trading with profits from player sales averaging £19m a season in the last 3 years. Money earned does not only include the initial sales proceeds, but also sell-on fees, e.g. Virgil van Dijk from Southampton to #LFC.

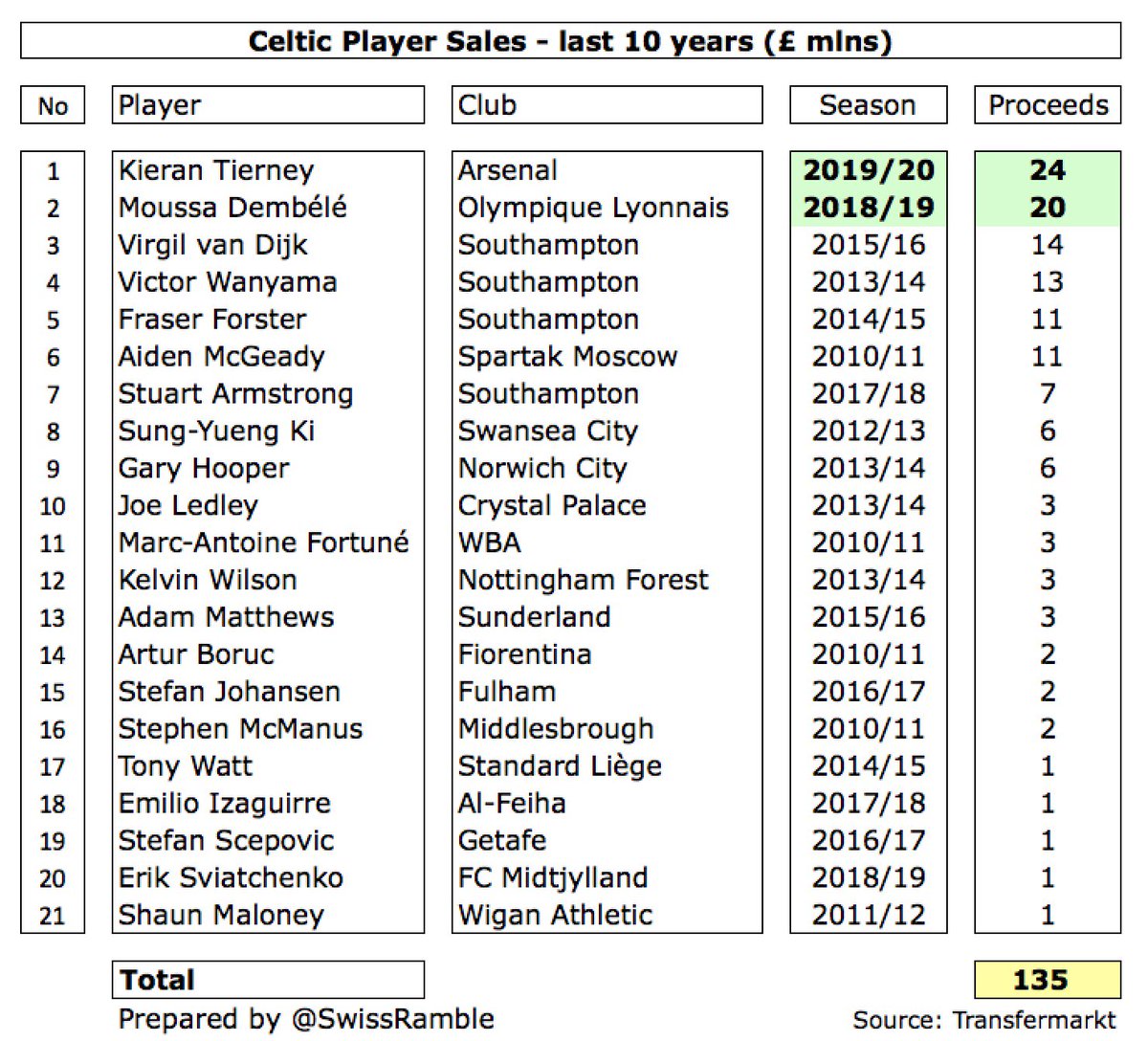

The two #CelticFC player sales that have generated the highest proceeds both came in the last two seasons: Tierney to Arsenal £24m and Moussa Dembélé to Lyon £20m. Southampton have proved a lucrative market with four sales over £7m to the South coast club.

Profits from player sales have made a big difference to #CelticFC bottom line. In the last eight years they have generated £102m profit from player trading, compared to just £6m in the same period at Rangers.

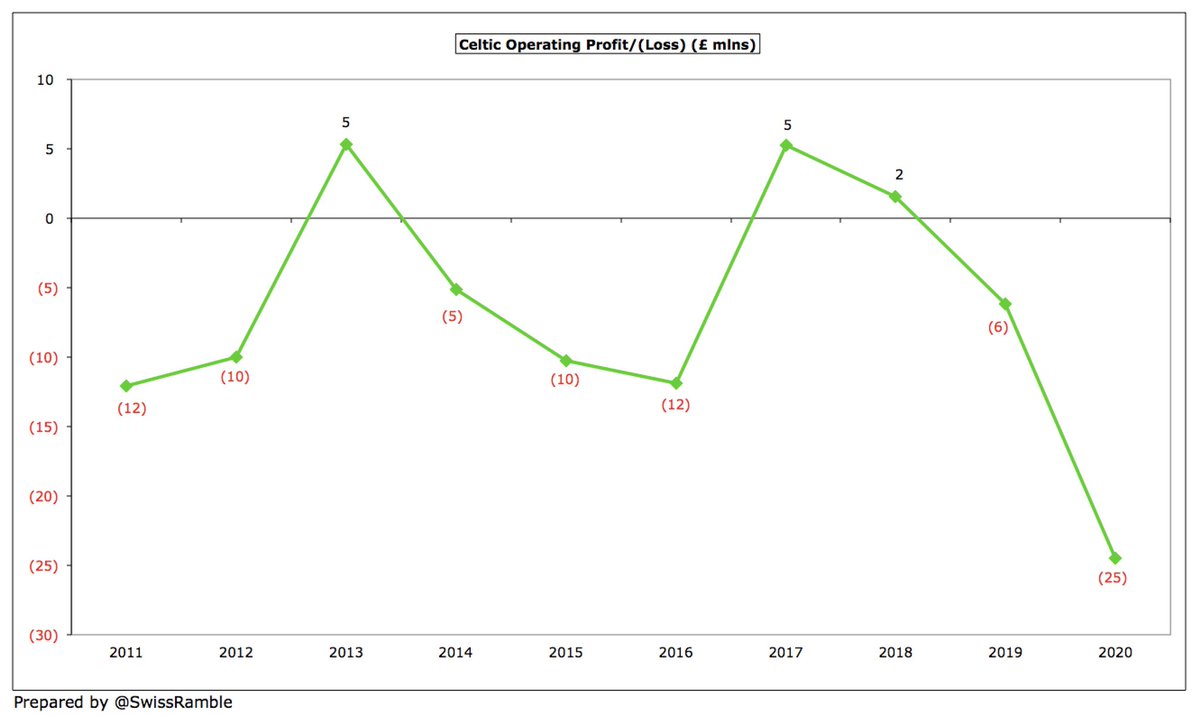

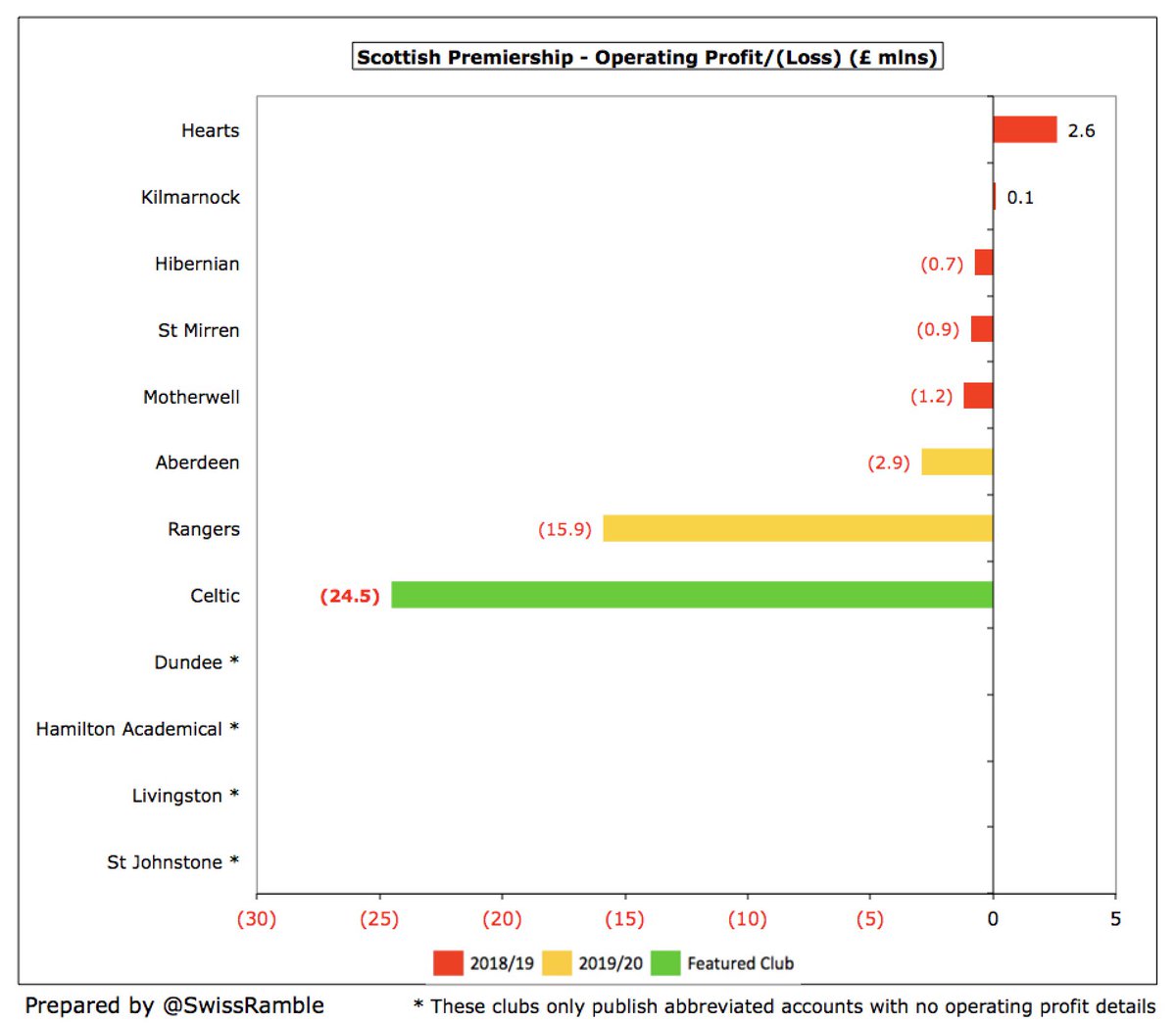

#CelticFC operating loss (i.e. excluding player sales) widened from £6.2m to £24.5m in 2019/20, down from a £5m profit in 2016/17. Although most clubs post operating losses, this is the highest in Scotland, around £9m worse than Rangers’ £15.9m deficit.

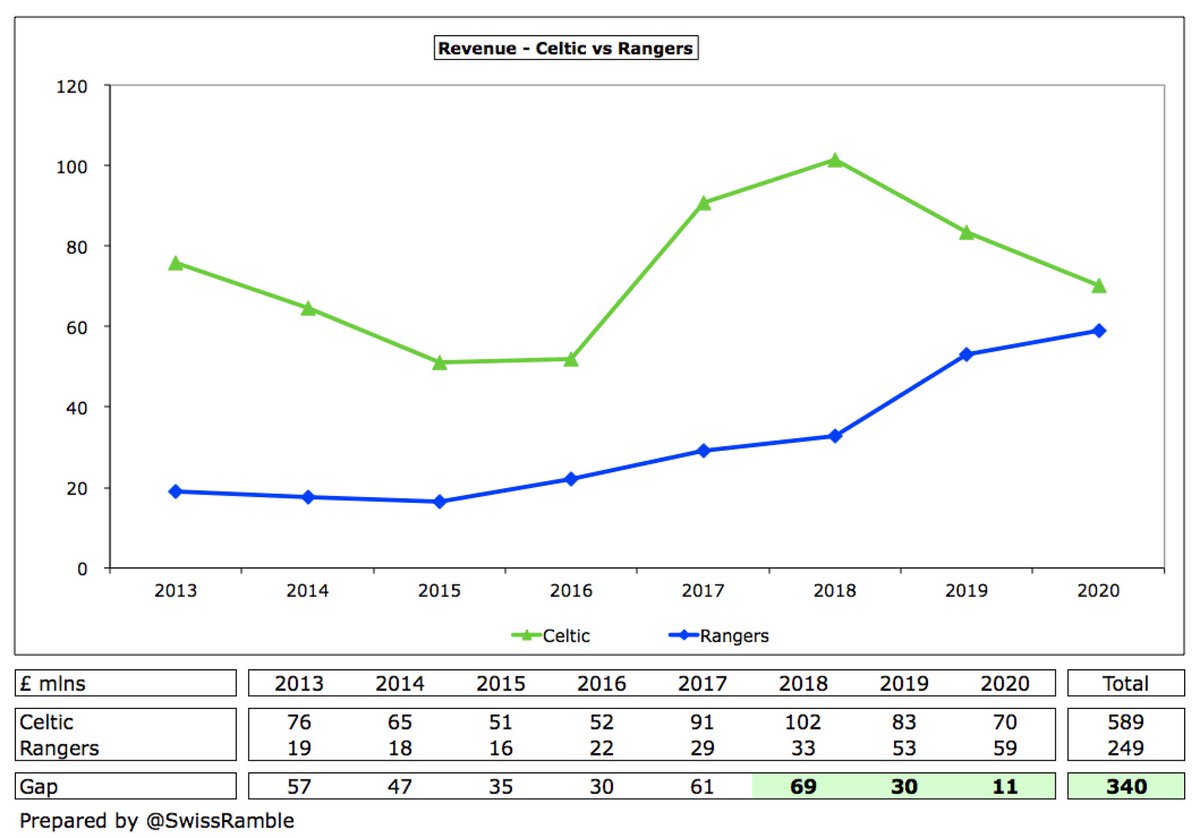

#CelticFC revenue has now fallen £31m from the £102m high two years ago to £70m, mainly driven by £20m media rights, but also match day £7m and commercial £4m. On the other hand, revenue is up by more than a third (£18m) from £52m in 2016.

#CelticFC have enjoyed a substantial revenue advantage over their rivals Rangers in recent times, but the gap has narrowed over the last three years from £69m in 2018 to £11m in 2020.

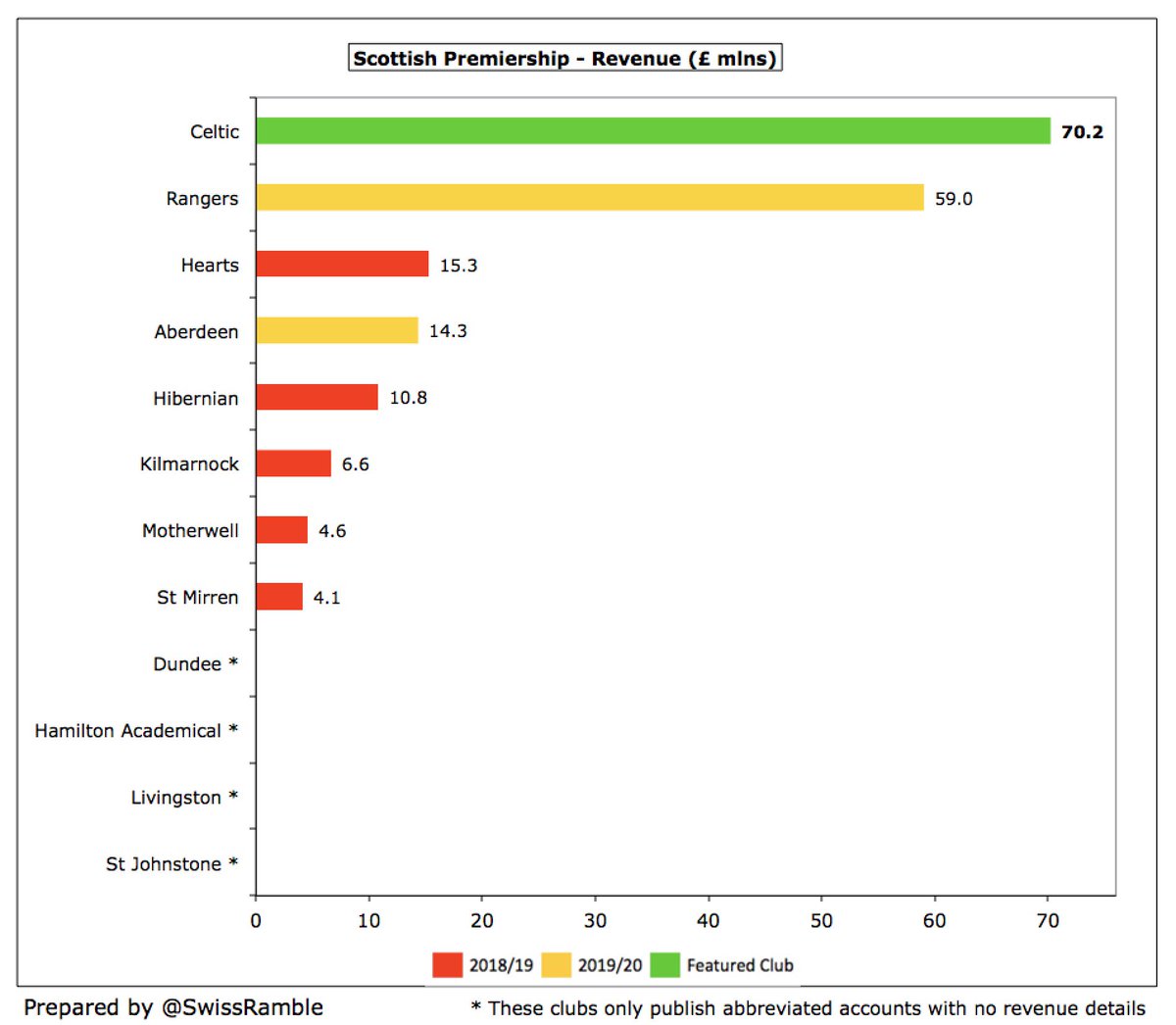

The Old Firm generate significantly more revenue than other Scottish clubs. For example, #CelticFC £70m is more than four times as much as Hearts £15m and Aberdeen £14m, followed by Hibernian £11m, Kilmarnock £7m, Motherwell £5m and St. Mirren £4m.

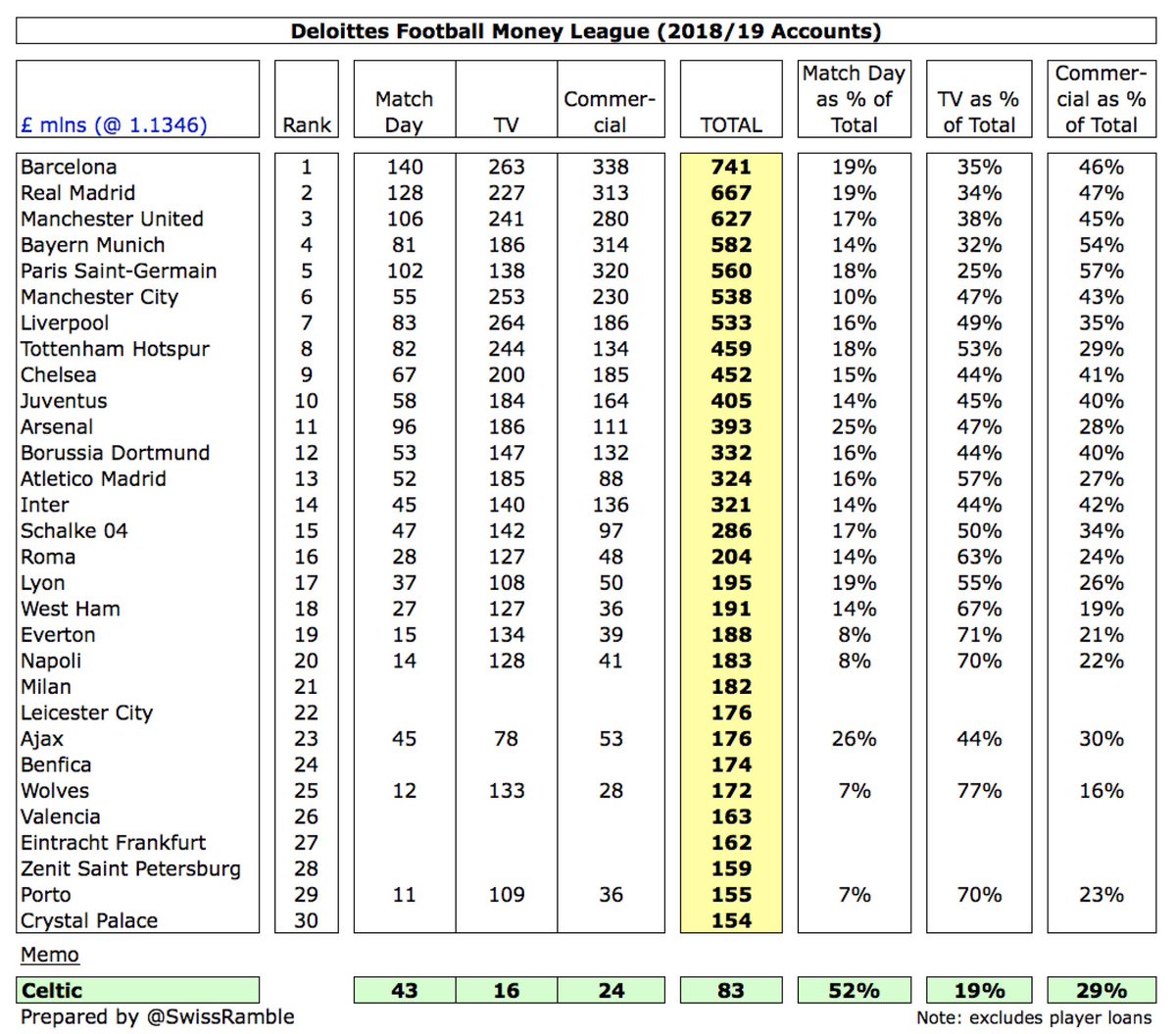

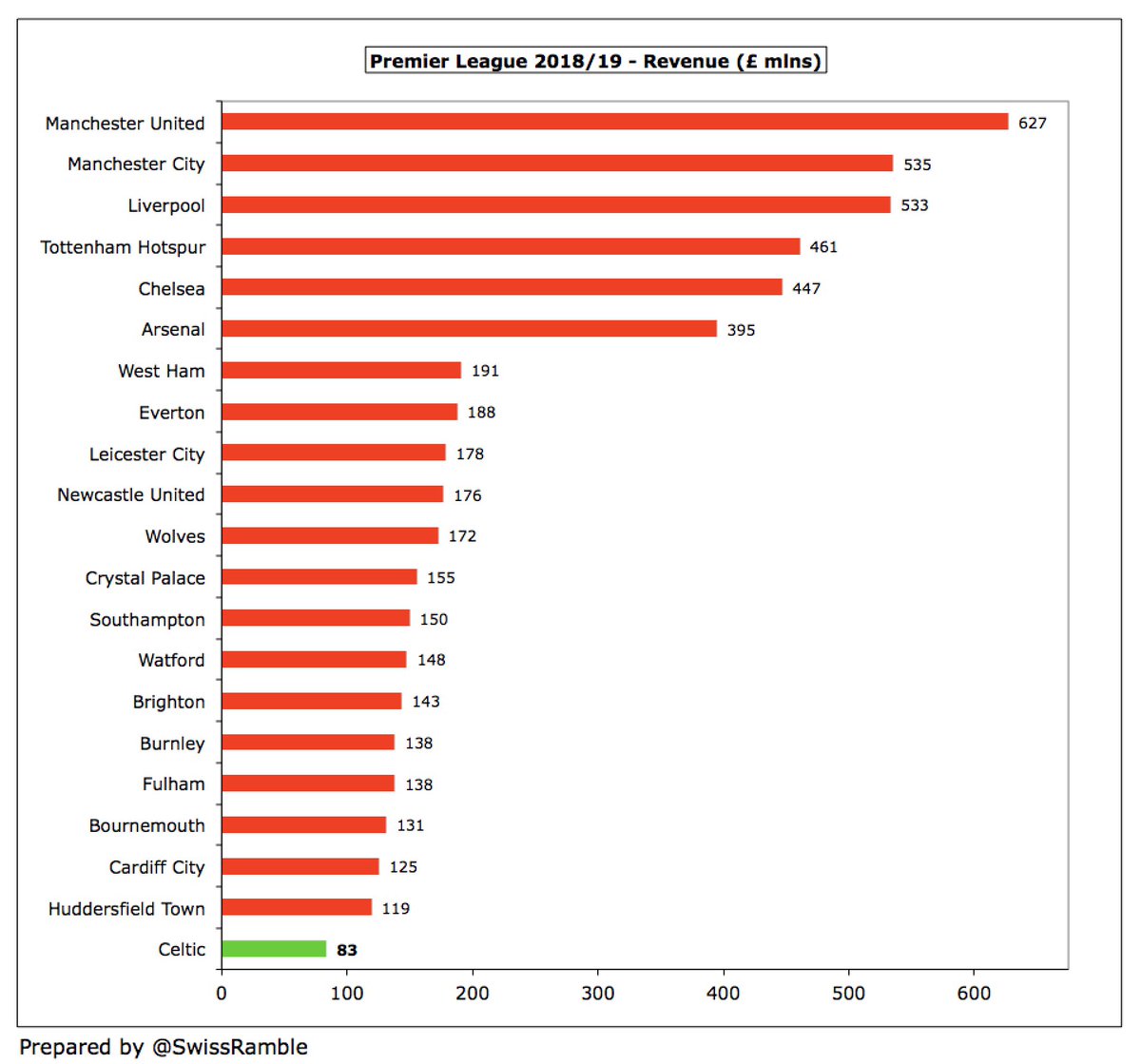

To highlight the magnitude of #CelticFC challenge, their £83m revenue in 2018/19 was around £70 below the £154m required to be in the Top 30 European clubs, as shown in the Deloitte Money League, which ranks clubs globally by revenue.

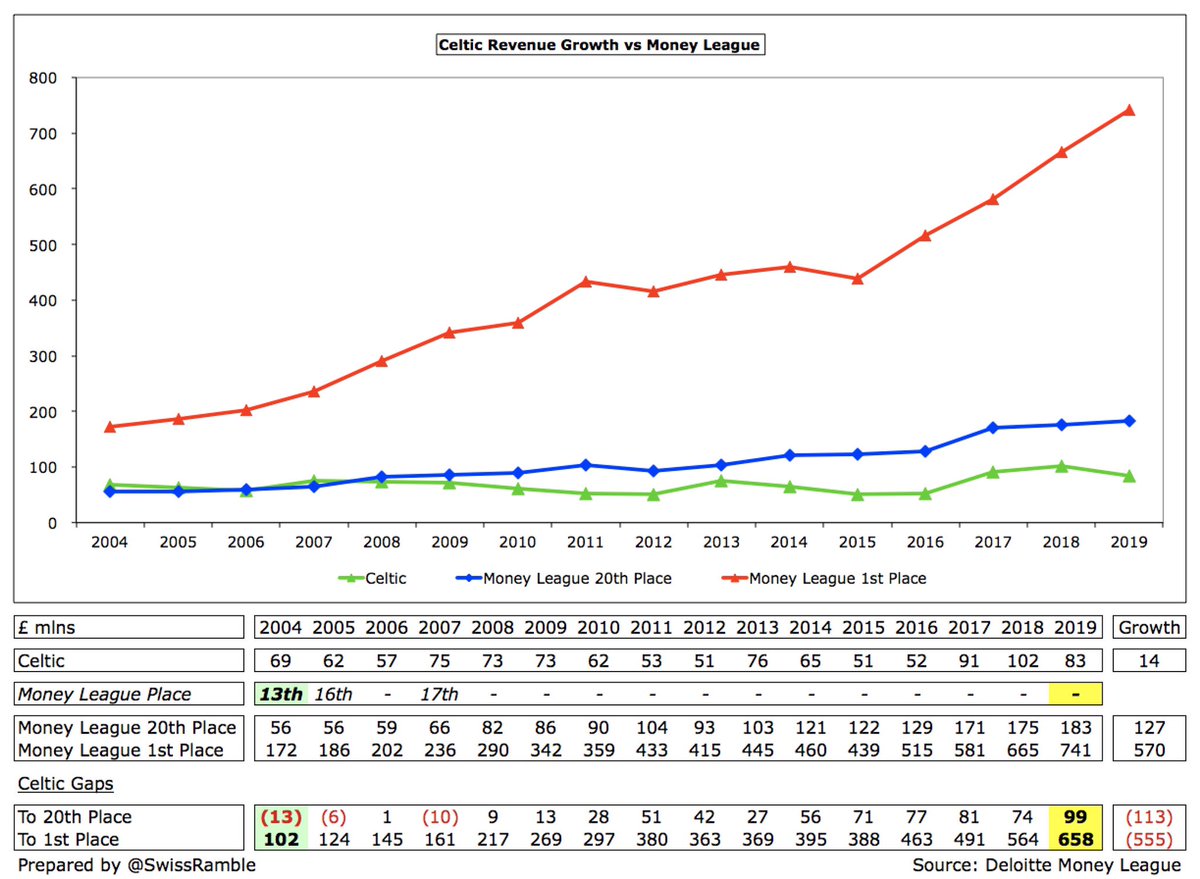

This might seem like a somewhat pointless comparison, but the fact is that in 2004 #CelticFC were placed as high as 13th in the Money League. Since then, their revenue has only grown by £14m, while the club in 20th place has increased by £127m and the top club by £570m.

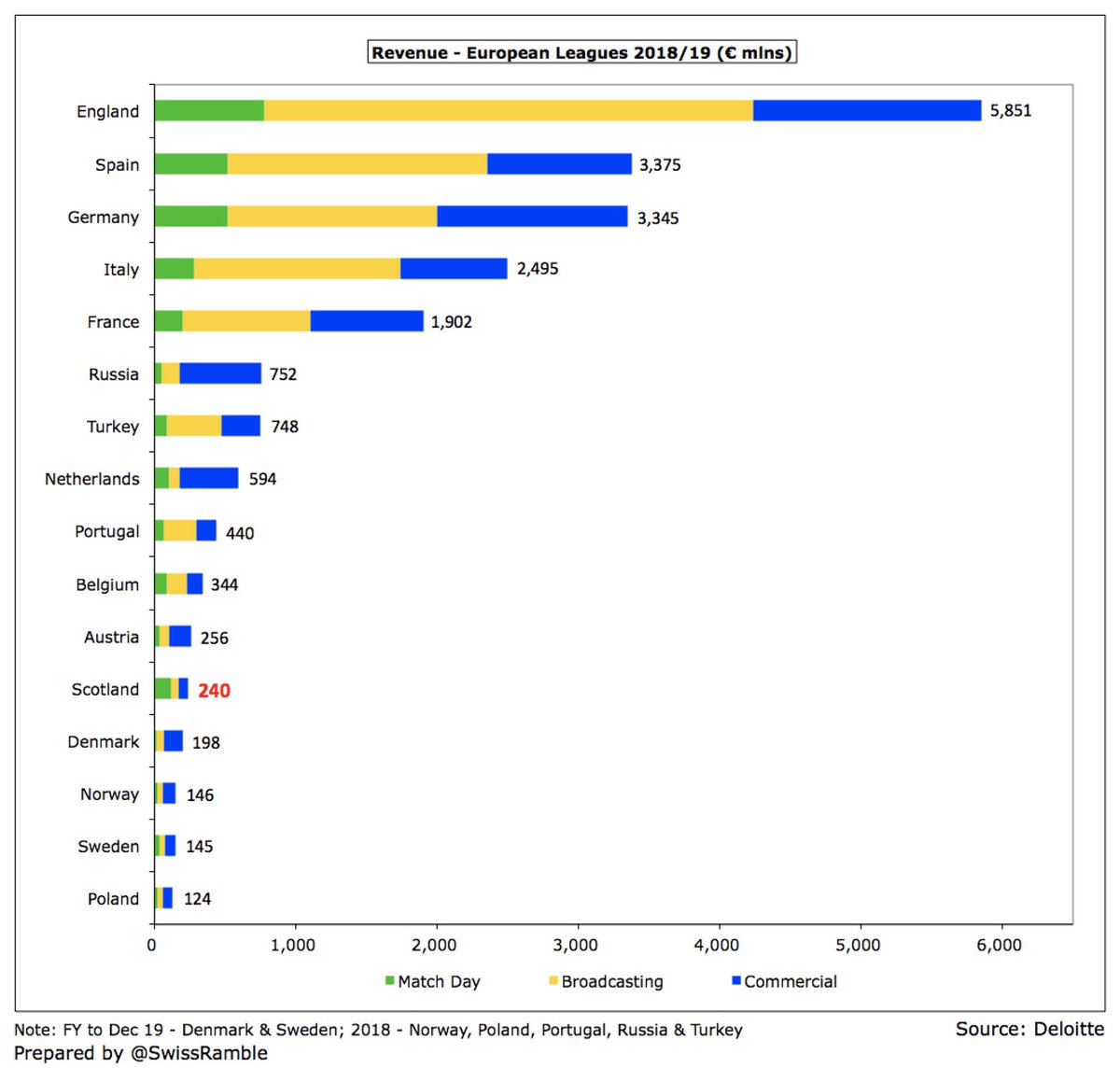

This is at the heart of #CelticFC issue, i.e. they are the proverbial big fish in a small pond. In 2018/19 the Scottish Premiership generated £240m revenue, miles below the likes of England £5.9 bln and Spain £3.4 bln, but also behind Belgium £344m and Austria £256m.

For some more perspective, #CelticFC £83m revenue in 2018/19 was £36m lower than the bottom club in the Premier League, namely Huddersfield Town with £119m.

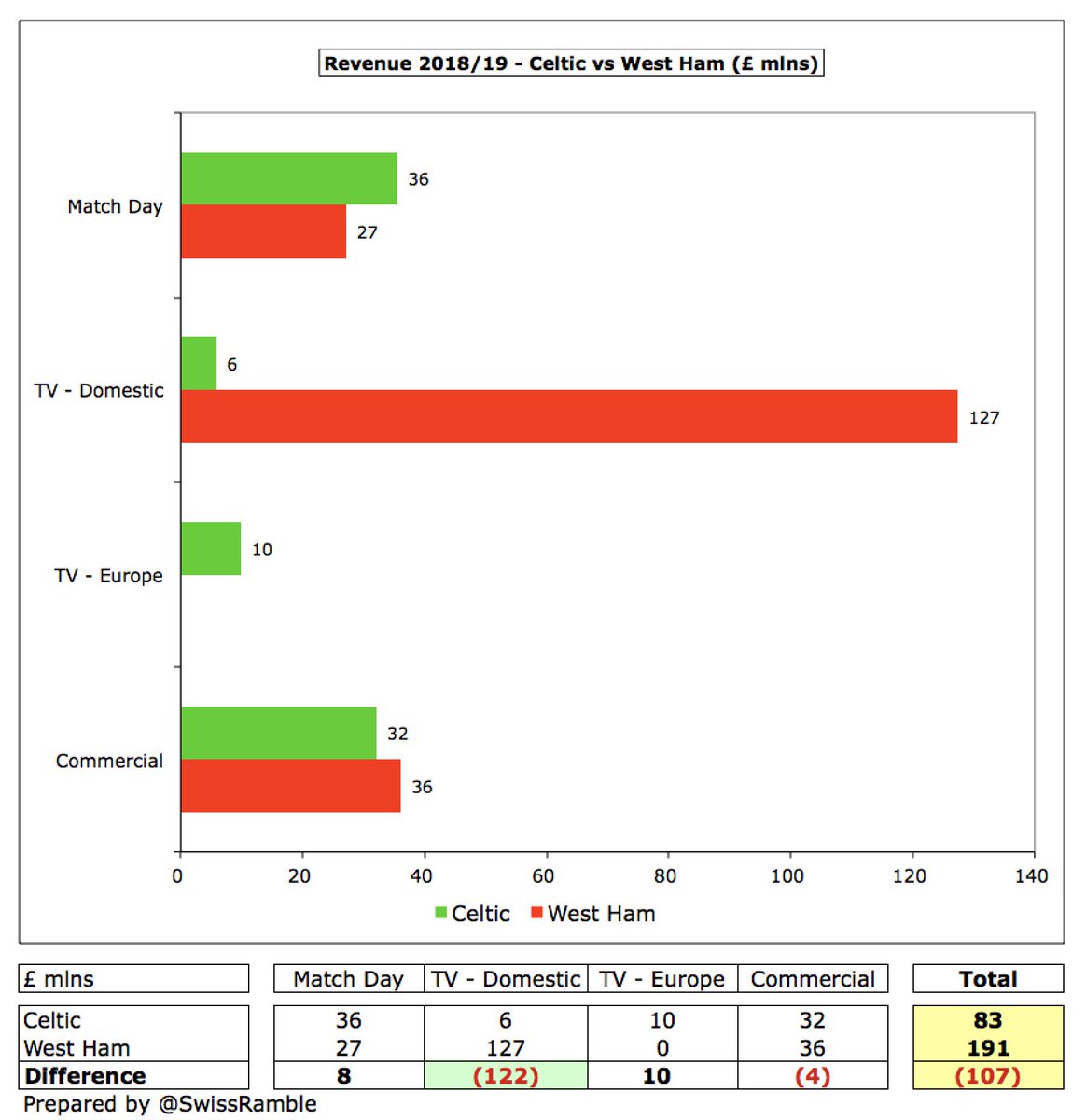

Of course, the comparison is a bit misleading, as English clubs benefit from huge TV money. Comparing #CelticFC with West Ham, match day is £8m higher, commercial is only £4m lower, so the Glaswegians’ revenue would be higher with the same TV deal, placing them 7th in England.

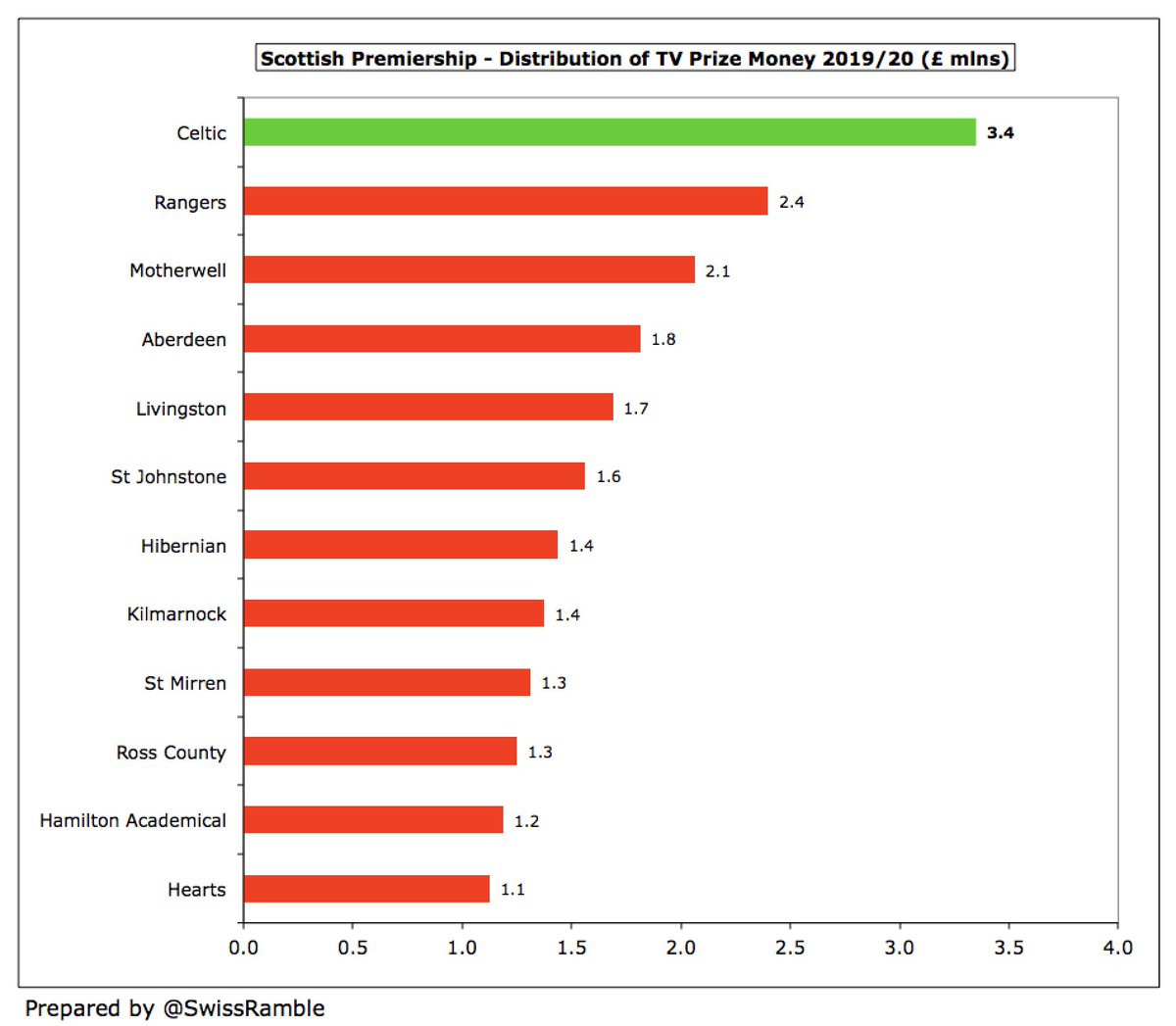

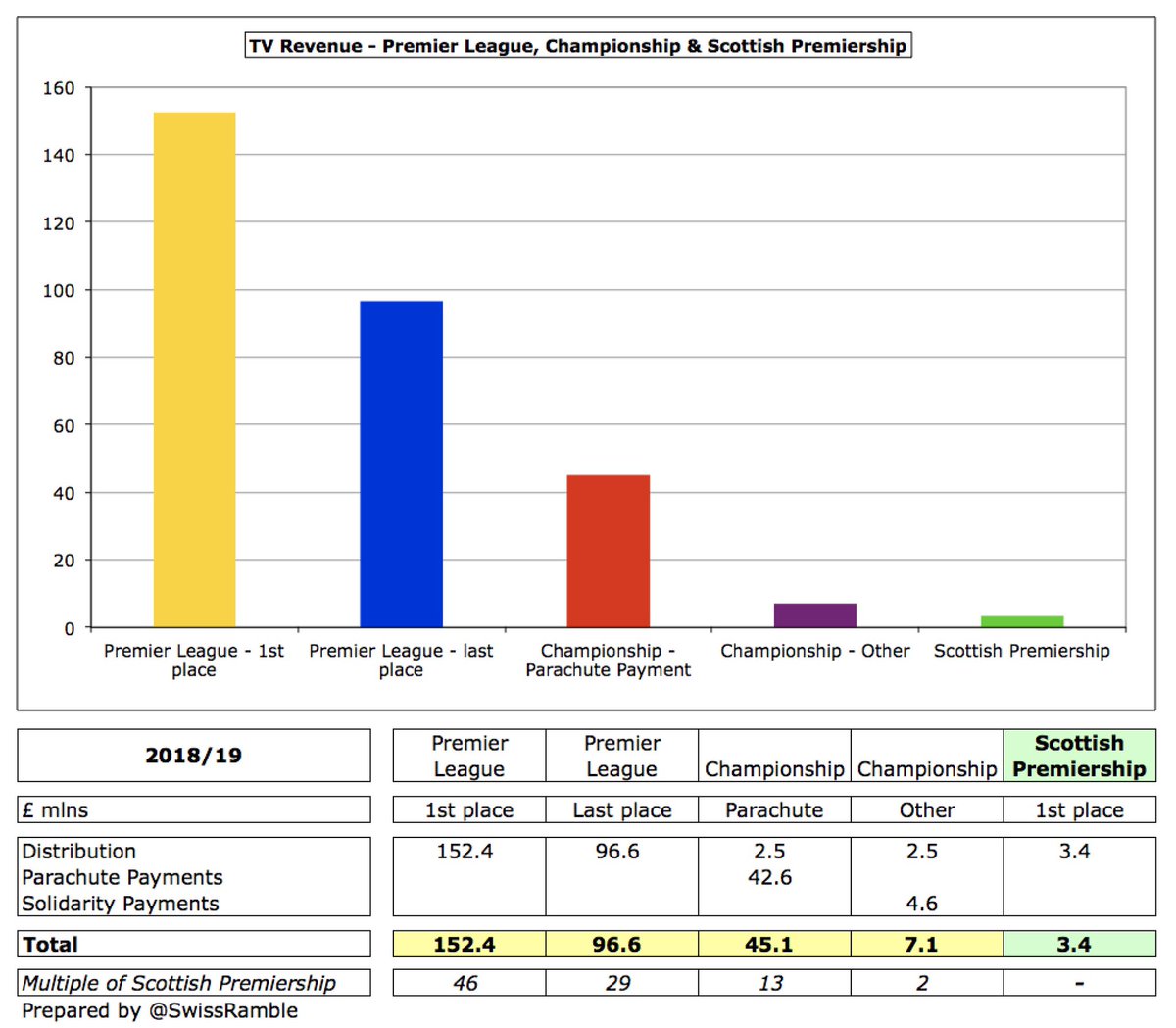

In contrast, Scottish Premiership TV deal is very low, so #CelticFC only received £3.4m for winning the title. To put this into perspective, Premier League winners got £152m, while last place was worth £97m. Even a Championship club (no parachute payments) got twice as much £7m.

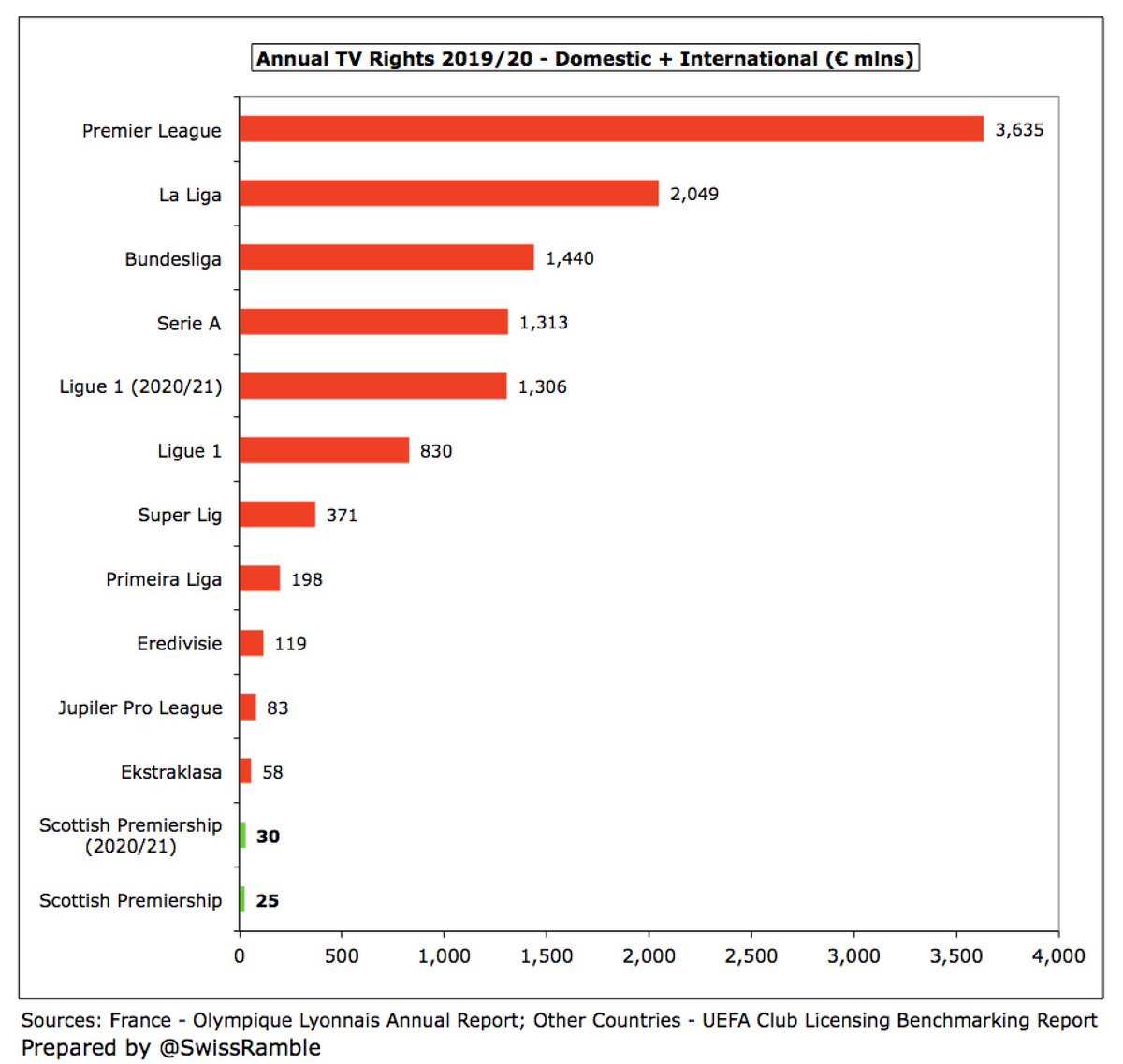

There is a new five-year Scottish Premiership TV deal with Sky Sports worth £30m a year from 2020/21, but this is not really going to move the needle. For example, it’s still only around half of Poland’s Ekstraklasa £58m.

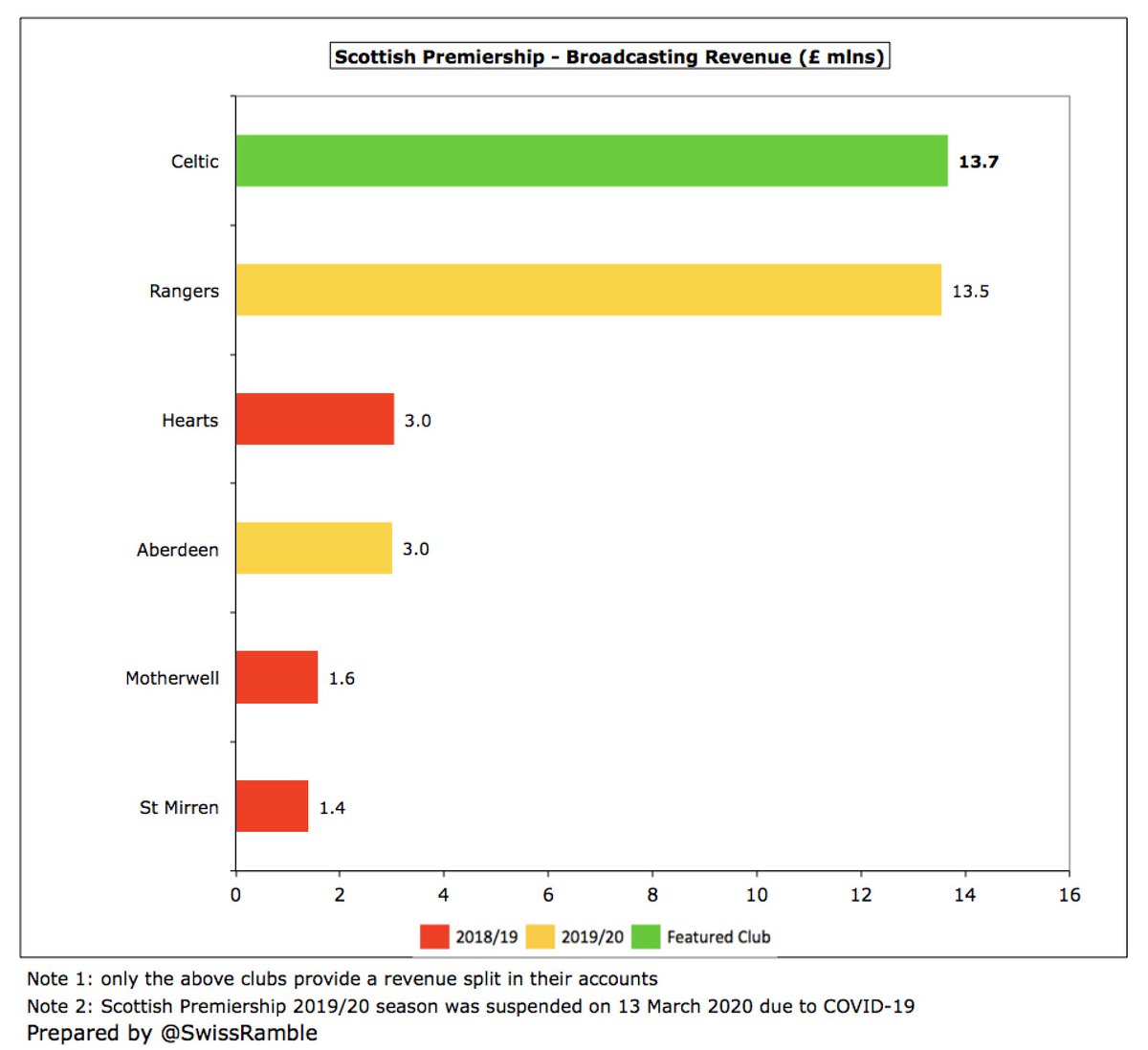

In total, #CelticFC broadcasting revenue fell £2.0m (13%) from £15.7m to £13.7m, just ahead of Rangers £13.5m, then a big gap to Hearts and Aberdeen, both £3.0m. The decrease was due to League being curtailed and Scottish Cup not being completed.

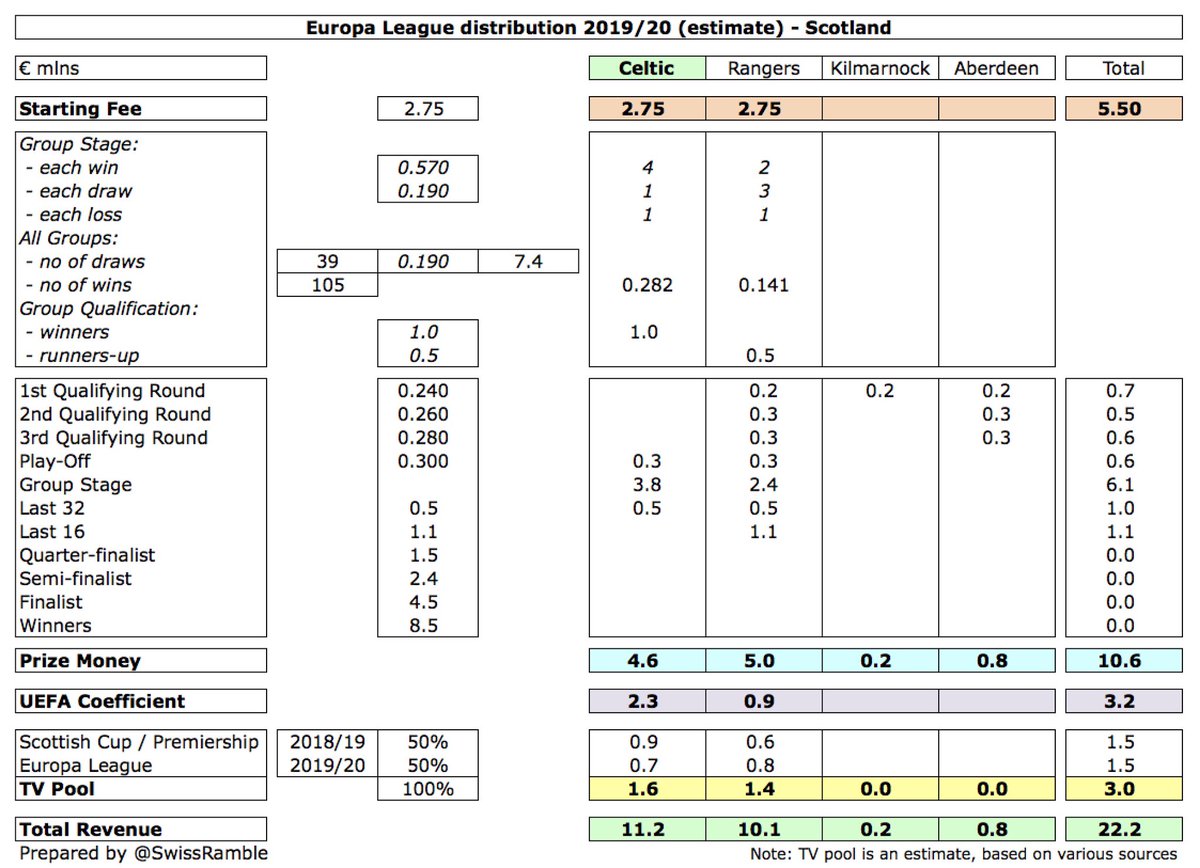

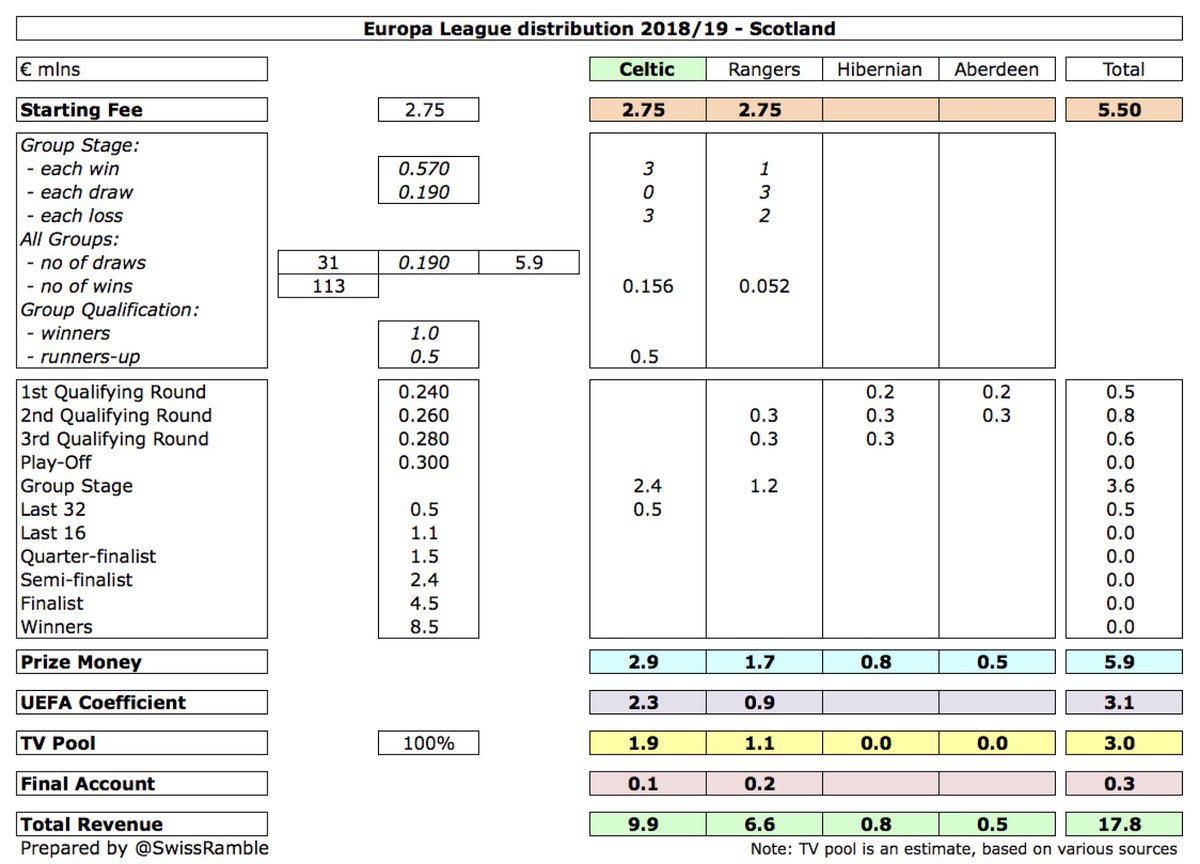

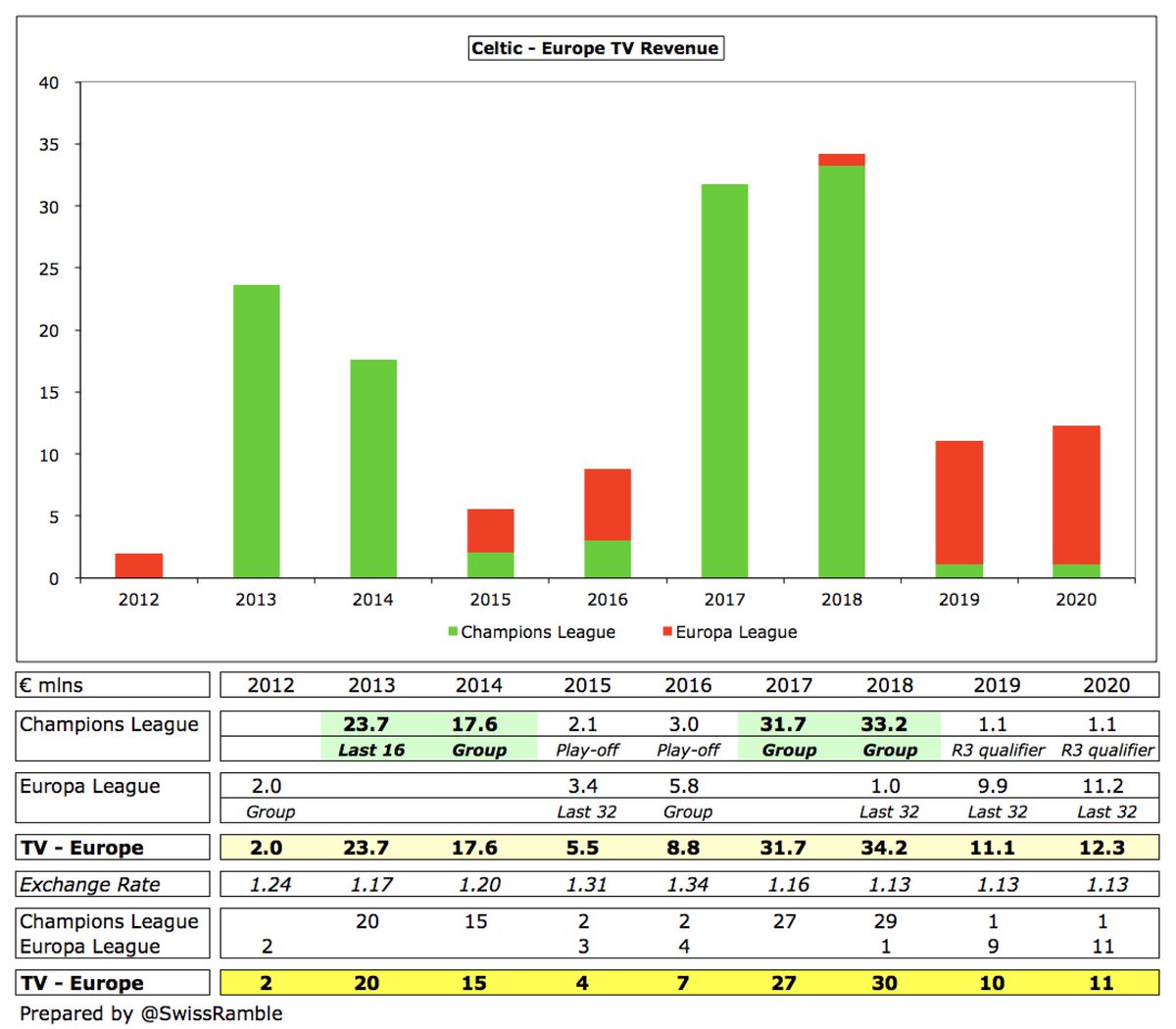

Based on my estimate, #CelticFC earned €11.2m from reaching Europa League last 32, split between starting fee €2.75m, prize money €4.6m, UEFA coefficient €2.3m & TV pool €1.6m. Also received €1.1m for 3 qualifying rounds in Champions League. About the same as prior season.

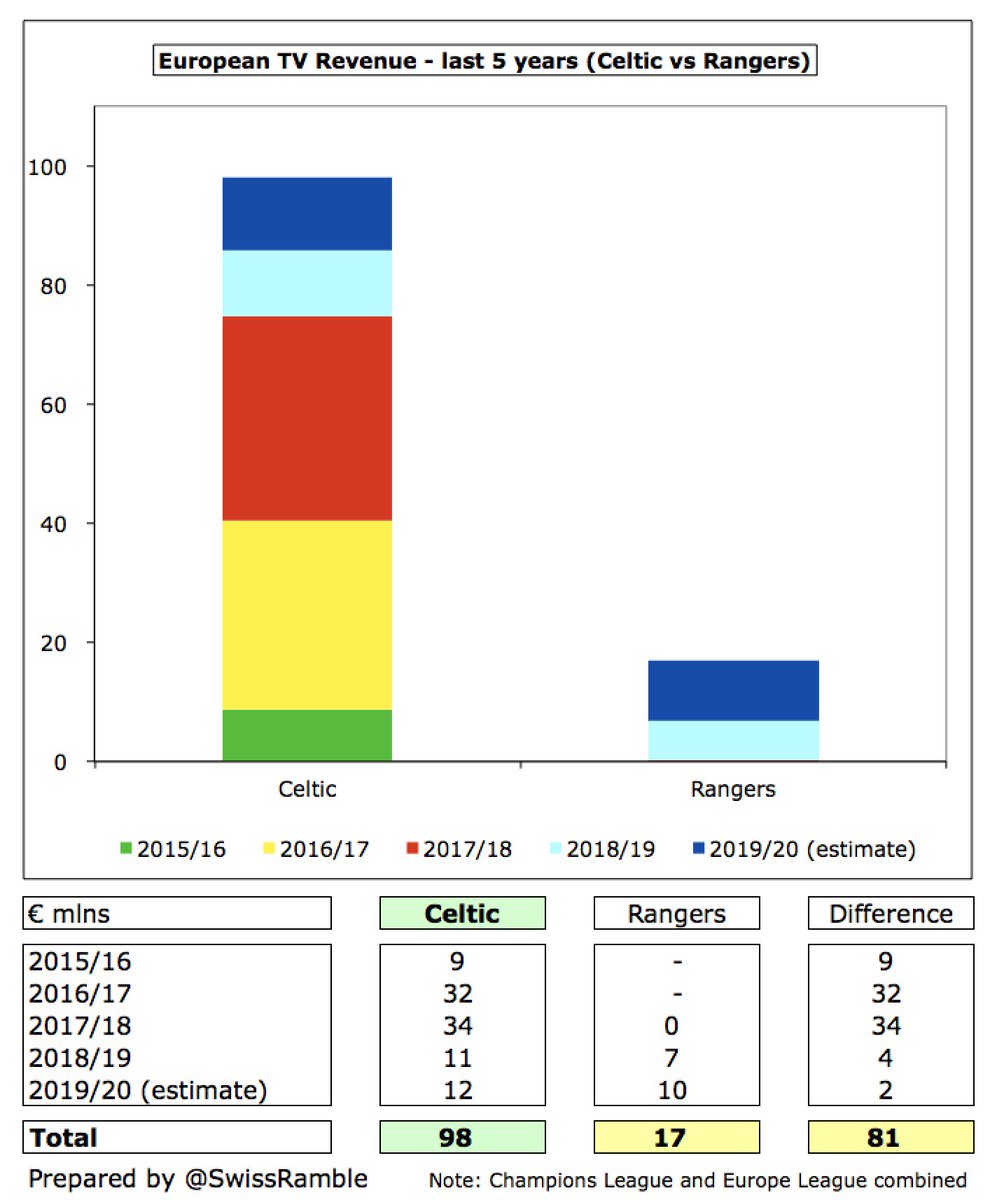

European qualification is extremely important for #CelticFC, who have earned €98m from Europe in last 5 years, almost 5 times as much as Rangers €17m. Champions League is the real differentiator with Celtic getting over €30m in both 2017 & 2018, when they reached group stage.

It is therefore significant that recent good performances in Europe by #CelticFC and Rangers have improved Scotland’s UEFA coefficient, thus almost guaranteeing that the 2021/22 Scottish champions will automatically qualify for the Champions League group stage.

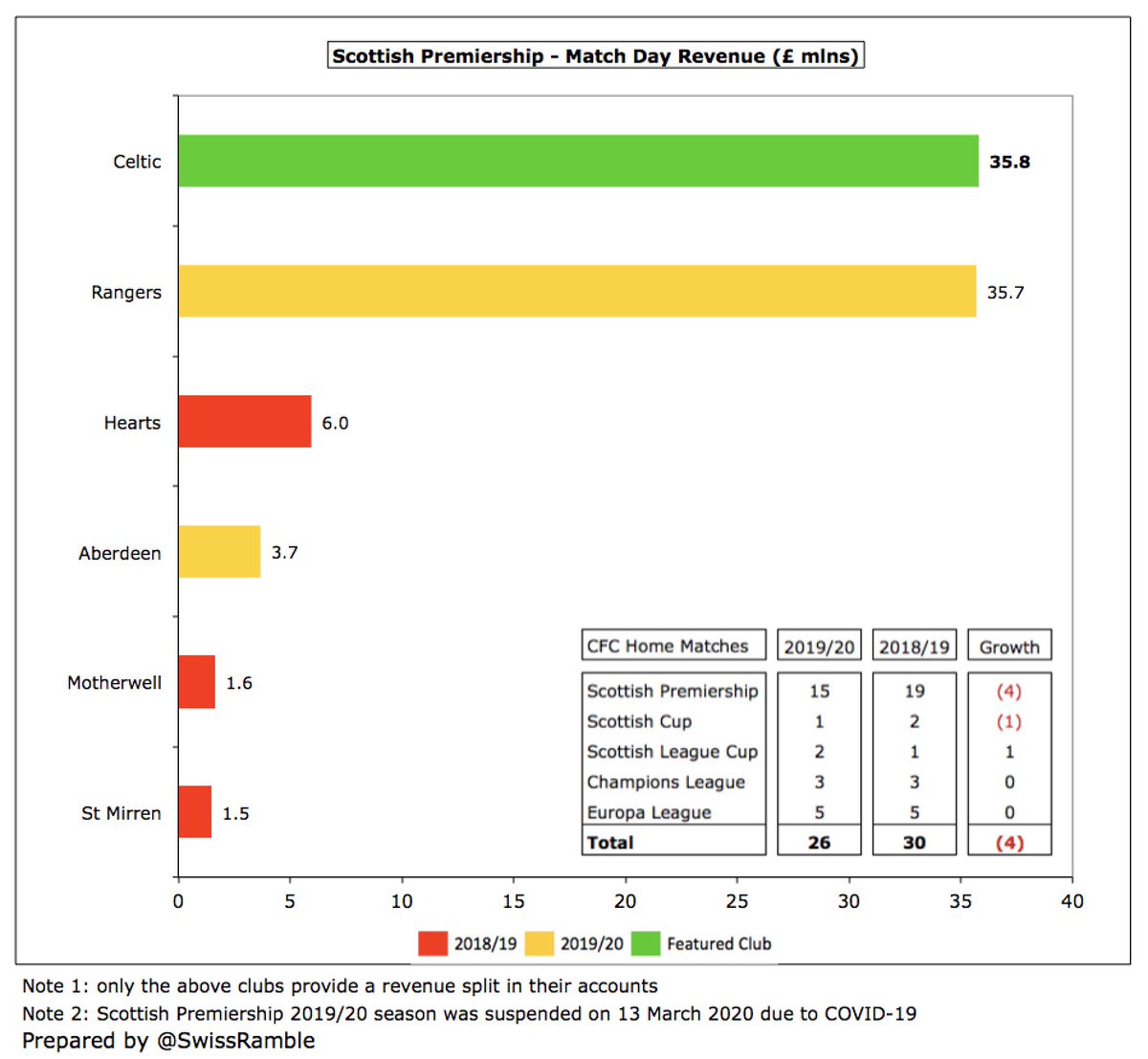

#CelticFC match day income fell £7.5m (17%) from £43.3m to £35.8m, as 4 Premiership home games were not played after the season’s early closure. This was just ahead of Rangers’ £35.7m, then a big drop to Hearts £6.0m and Aberdeen £3.7m.

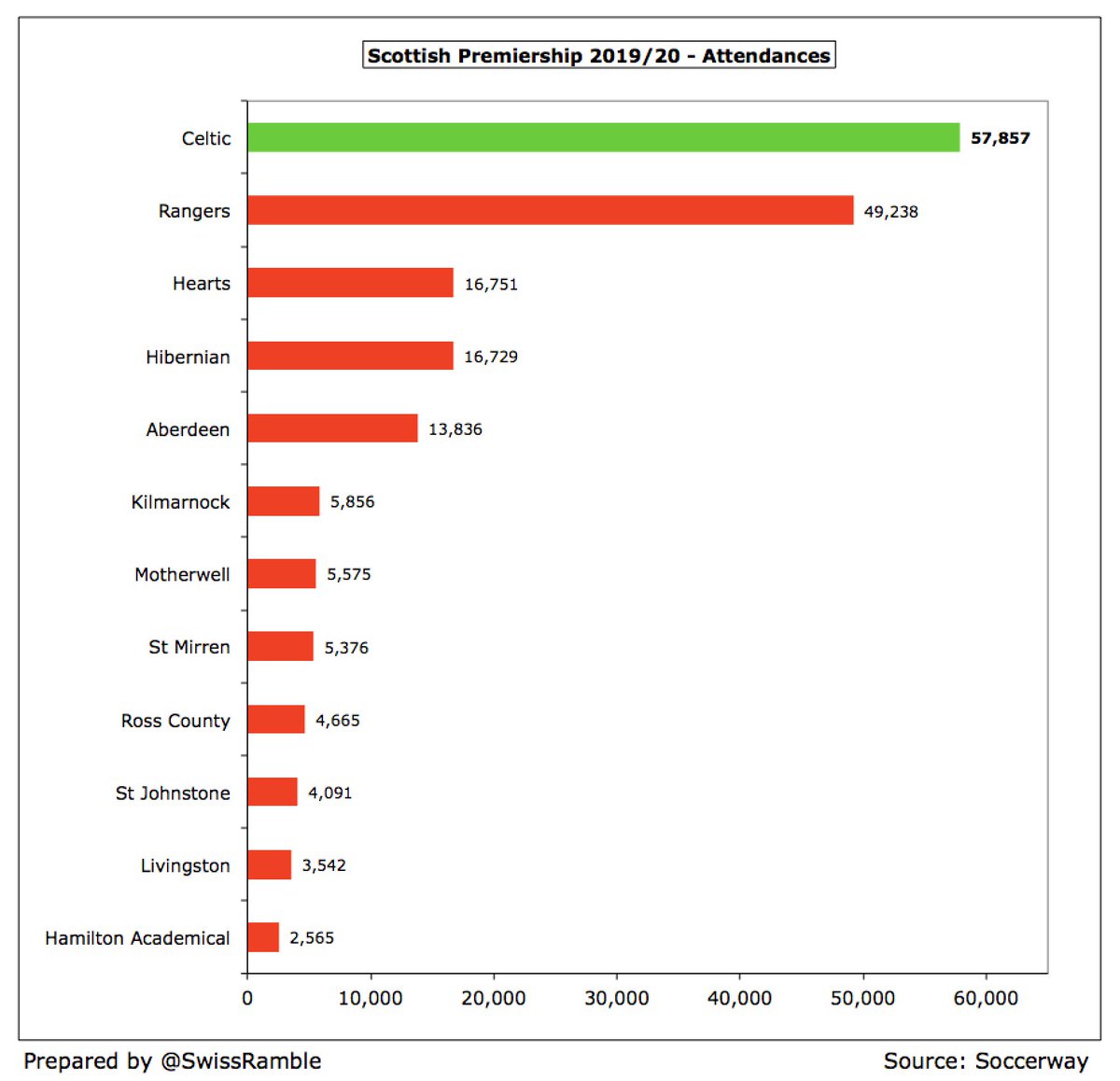

However, #CelticFC average attendance increased from 56,729 to 57,857, nearly 9,000 more than Rangers’ 49,238. This season the fans’ purchase of season tickets despite uncertainty around when they can return to the stadium has “exceeded all expectations”.

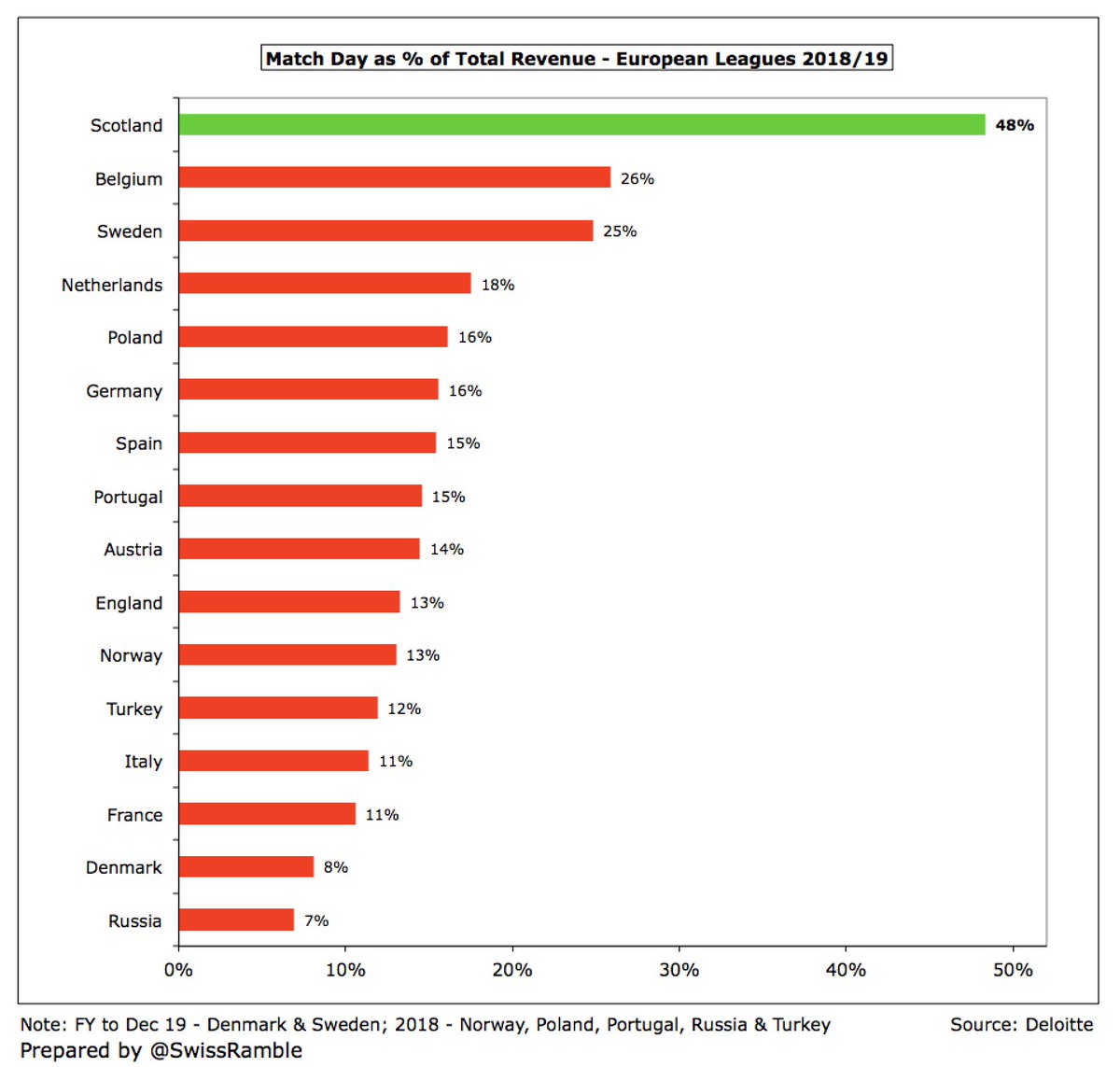

Match day revenue is particularly important for Scottish clubs, given the low TV deal. According to Deloitte, this accounts for an incredible 48% of total revenue in Scotland with the next highest being Belgium 26%. Thus, live streams help “to protect a key income stream”.

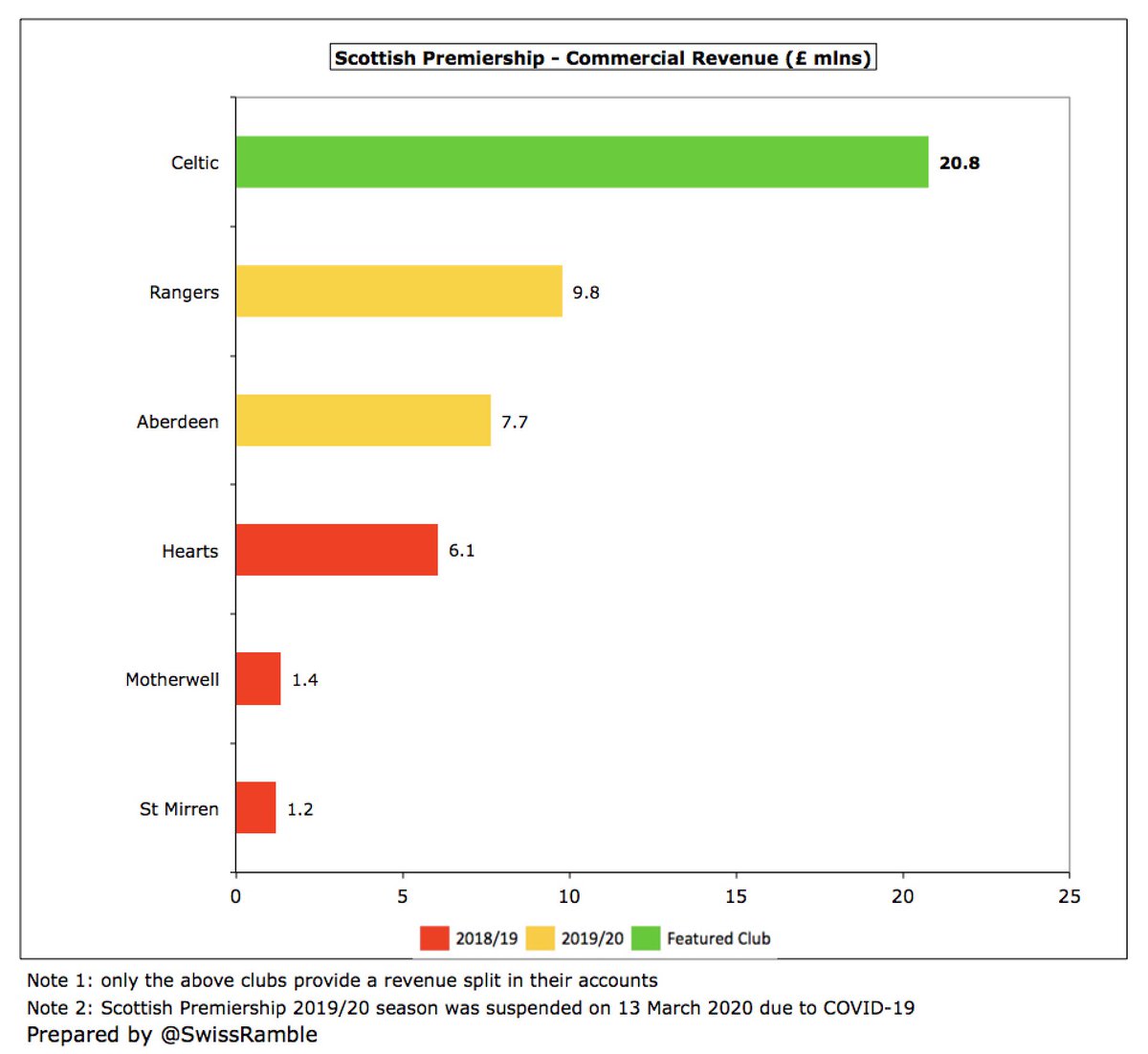

#CelticFC commercial revenue fell £3.6m (15%) from £24.4m to £20.8m, comprising commercial/sponsorship £8.1m, retail and e-commerce £11.2m and other income £1.4m. This is by far the highest in Scotland, well ahead of Rangers £9.8m, Aberdeen £7.7m and Hearts £6.1m.

#CelticFC have a new 5-year kit deal with Adidas from July 2020, described as “the biggest kit sponsorship ever to be announced across Scottish sport”. Similarly, the Dafabet deal runs until 2025 and is “the most lucrative sponsorship agreement in Scottish football history”.

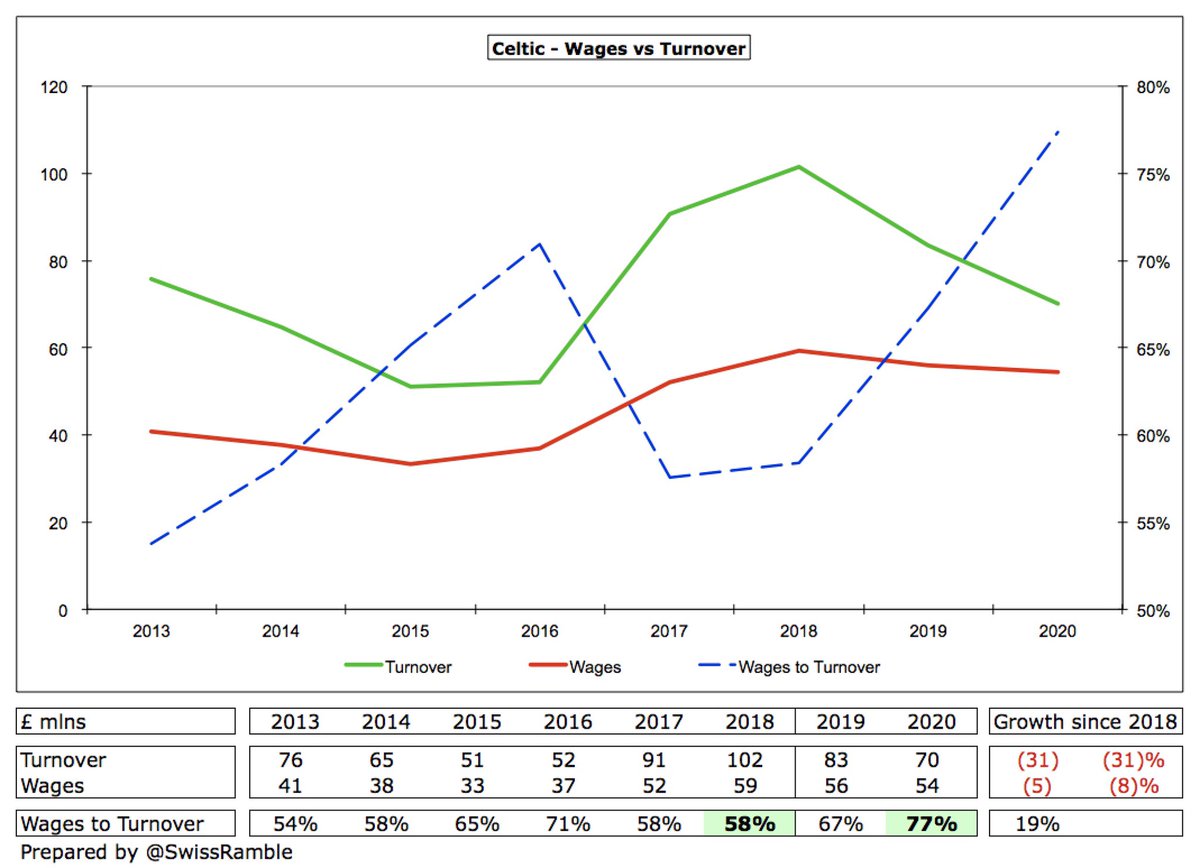

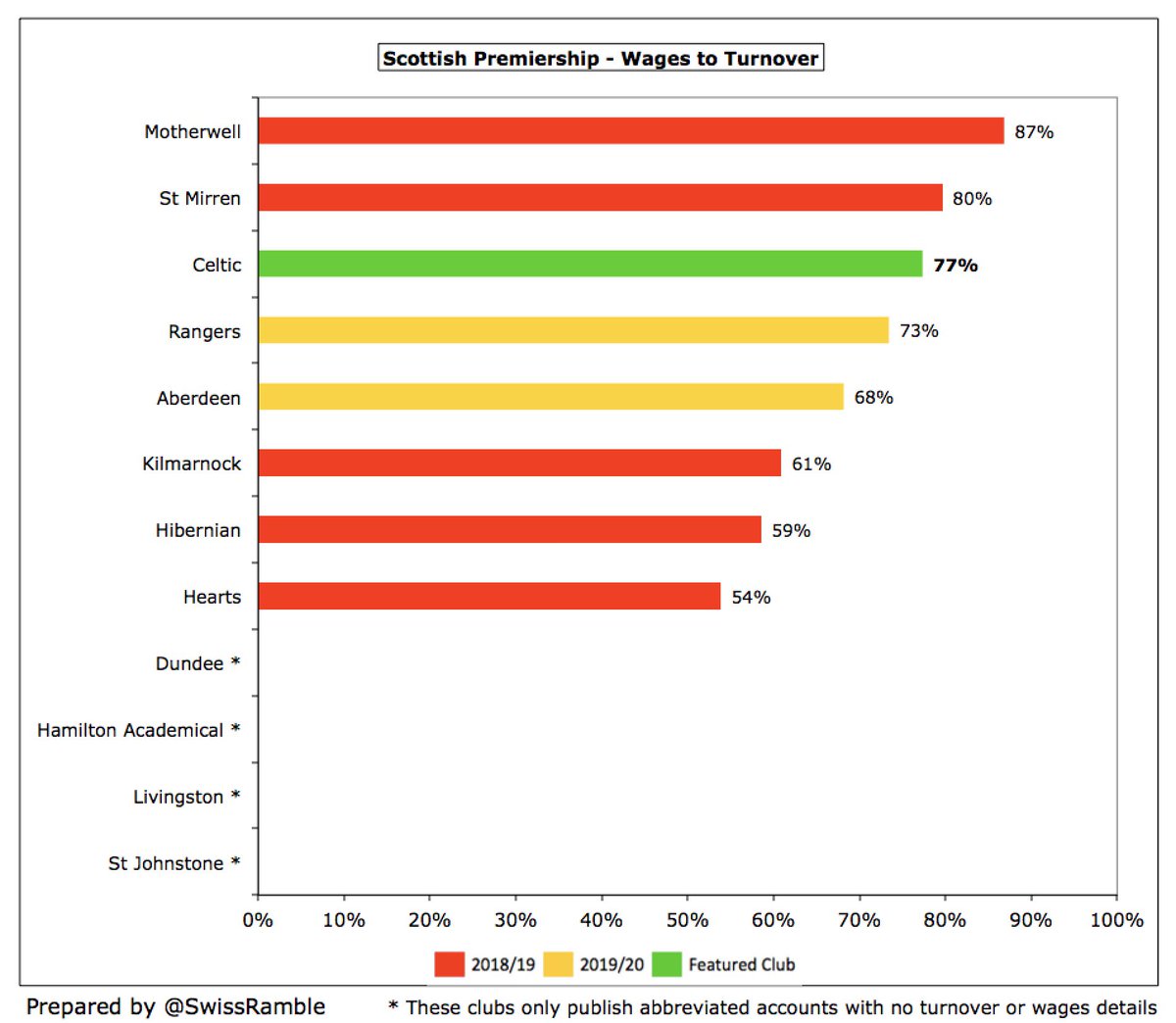

#CelticFC trimmed their wage bill by £1.8m (3%) from £56.1m to £54.3m, so this has fallen by £5m (8%) from the £59m peak in 2018, though revenue fall means the wages to turnover ratio has increased from 58% to 77%.

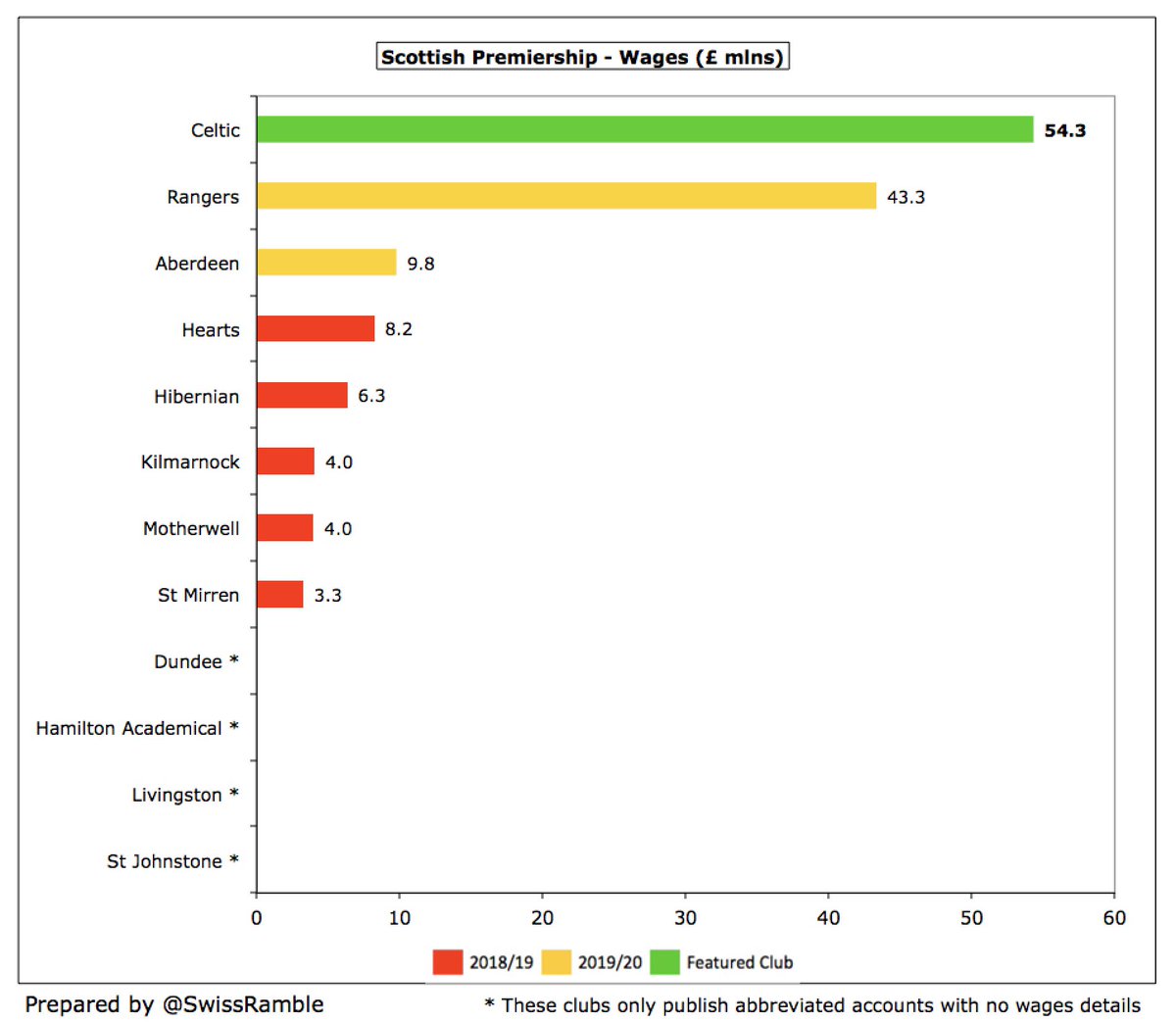

Similar to revenue, Rangers have closed the wages gap to #CelticFC in the last 3 years from £35m in 2018 to £11m in 2020. There remains an abyss between the Old Firm and the other Scottish clubs, e.g. the next highest are Aberdeen £10m, Hearts £8m and Hibernian £6m.

The deterioration of #CelticFC wages to turnover ratio to 77% means that this is the highest of the three Scottish Premiership clubs that have published 2019/20 accounts to date, worse than Rangers 73% and Aberdeen 68%.

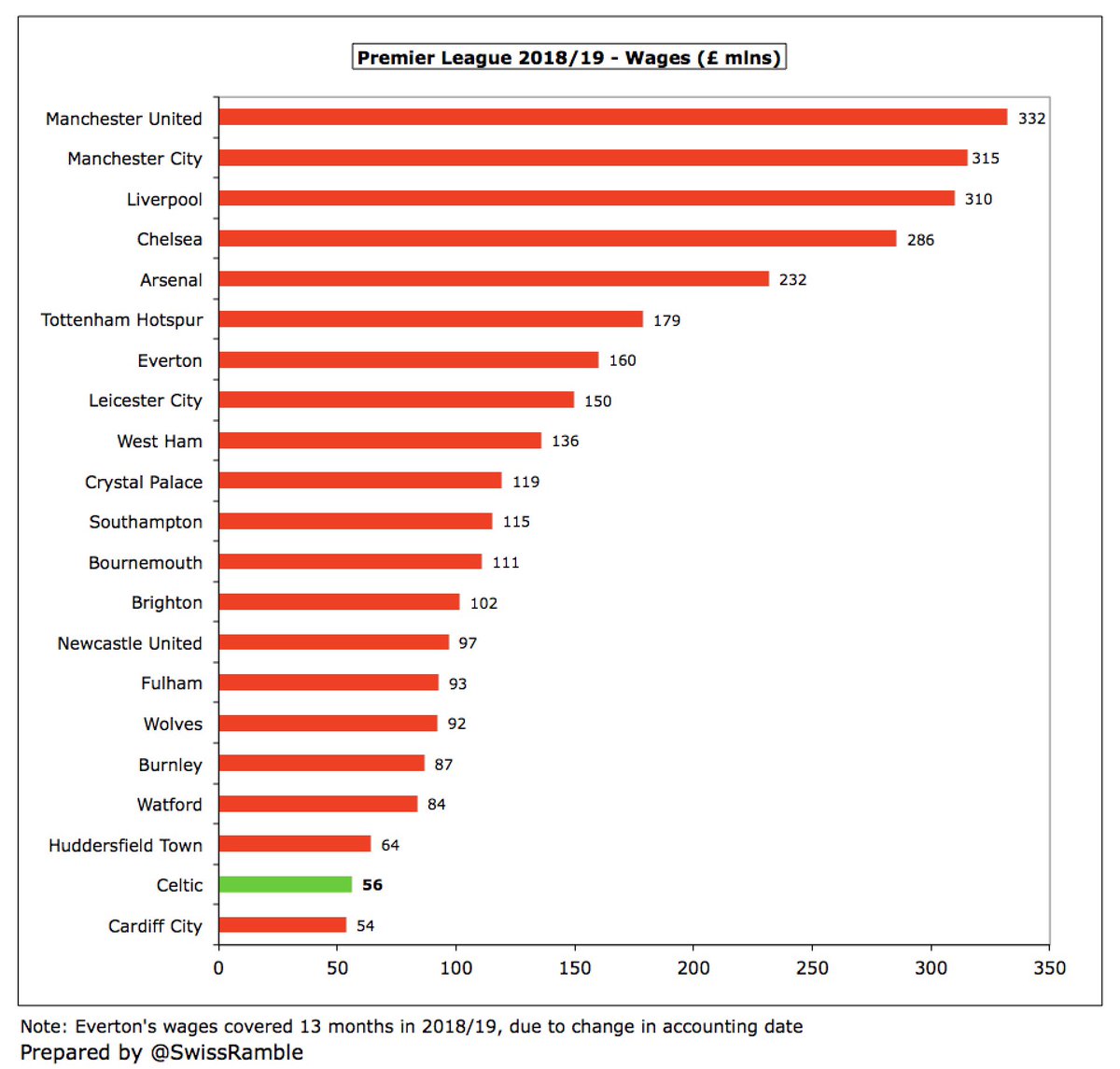

Just for a bit of fun, a comparison with the Premier League shows that #CelticFC £56m wage bill in 2018/19 was lower than every club with the exception of Cardiff City £54m. The English “Big Six” wages were 3-6 times as much (#MUFC £332m, #THFC £179m).

As a result of investment in the squad, #CelticFC player amortisation, the annual cost of writing-off transfer fees, increased by £2.5m (25%) from £9.7m to £12.2m, which means that this expense has more than doubled in just four years from £5.0m in 2016.

As a rule, Scottish clubs do not pay big money to sign players, meaning that their player amortisation charge is normally very low. In fact, #CelticFC and Rangers are the only clubs booking more than £500k a year, though Celtic’s £12.2m is much more than Rangers’ £7.6m.

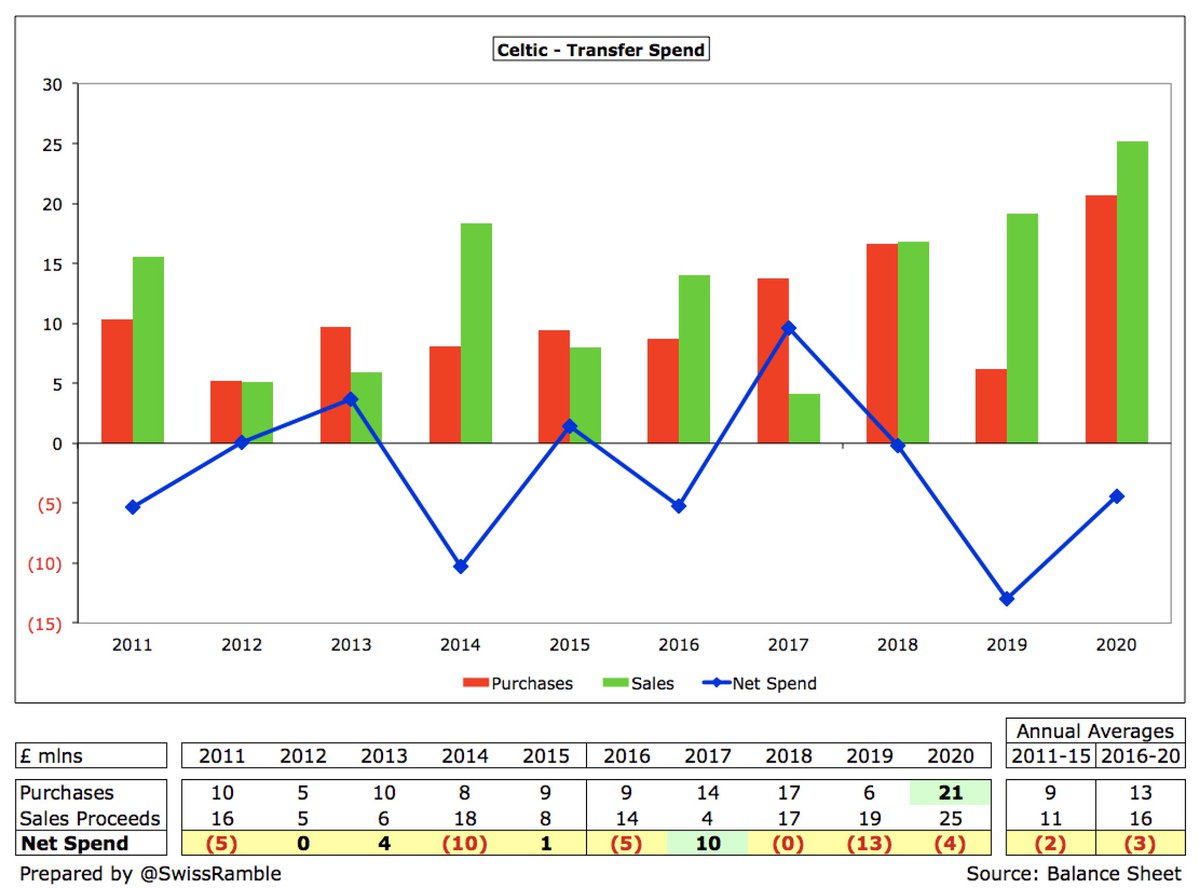

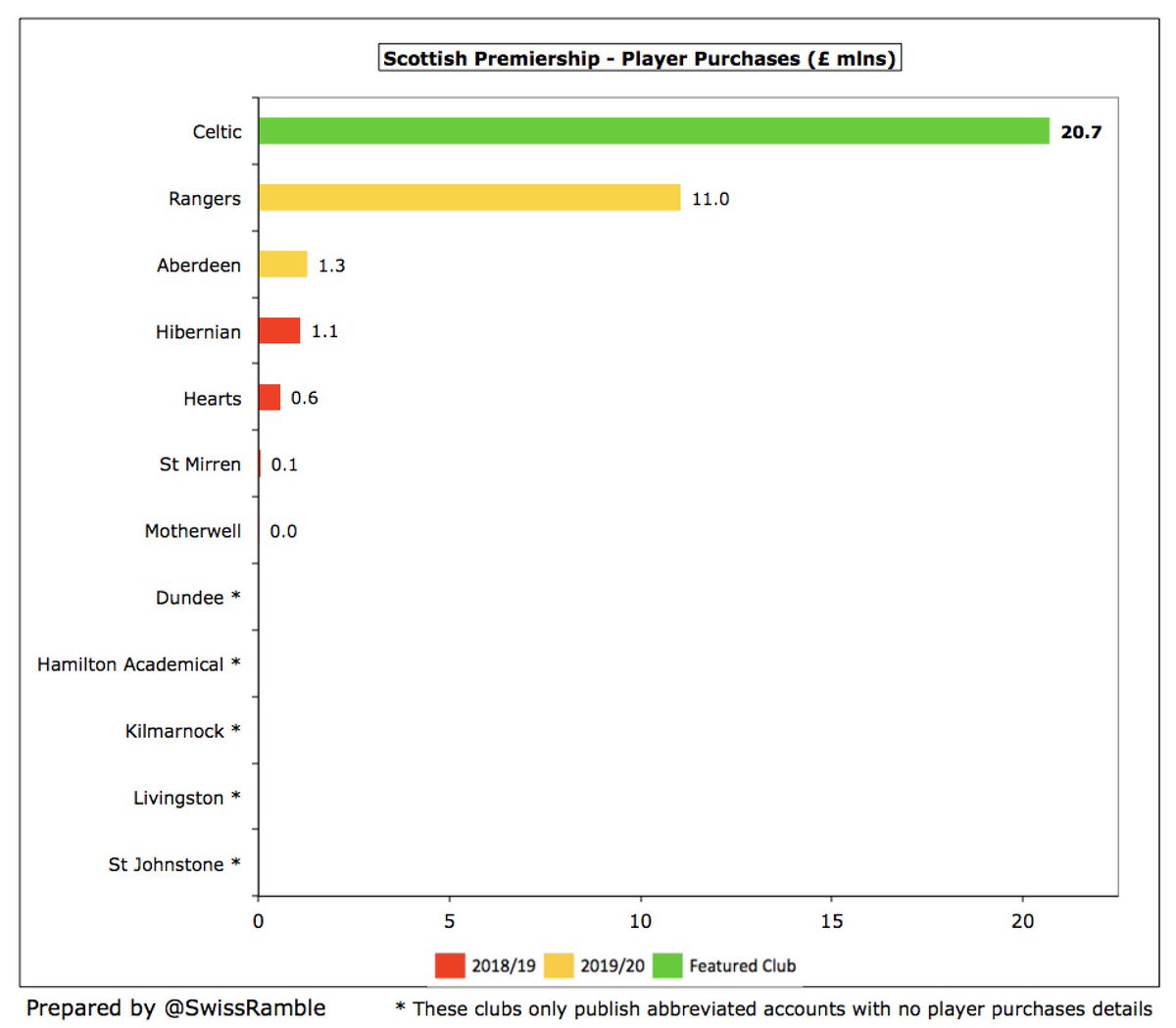

#CelticFC “invested record sums into the playing squad” with £21m on purchases in 2019/20, though they still reported net sales of £4m. The last time the club had net spend was £10m in 2017, though similar sum spent this season.

#CelticFC player purchases of £21m was easily more than the rest of the Scottish Premiership combined (next highest Rangers £11m). Acquisitions included Christopher Julien, Patryk Klimala, Boli Bolingoli, Ismaila Soro and Hatem Abd Elhamed.

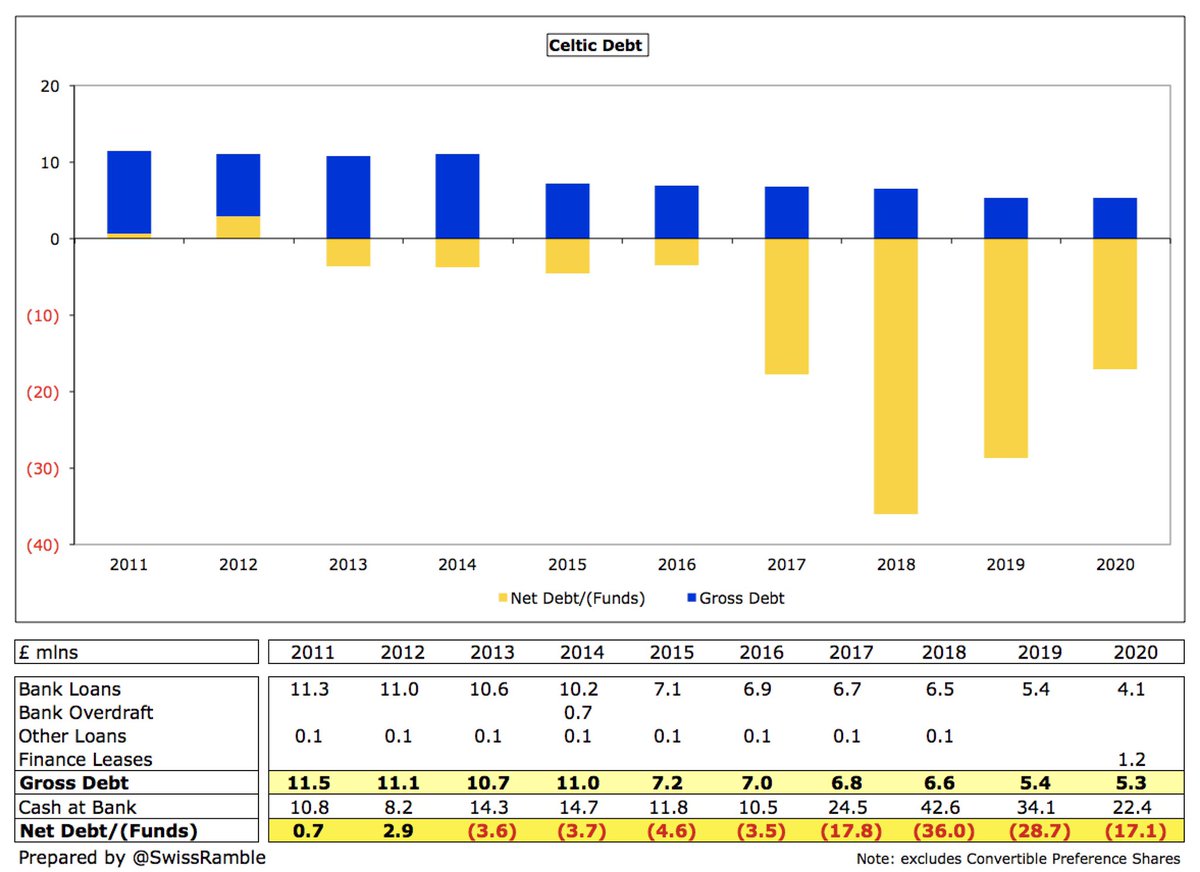

#CelticFC gross debt is only £5.3m with a £22.4m cash balance producing net funds of £17.1m. The debt comprises £4.1m Co-operative bank loans (LIBOR + 3%) plus £1.2m finance leases. Post year-end revolving credit facility was increased from £2m to £13m as a buffer, if required.

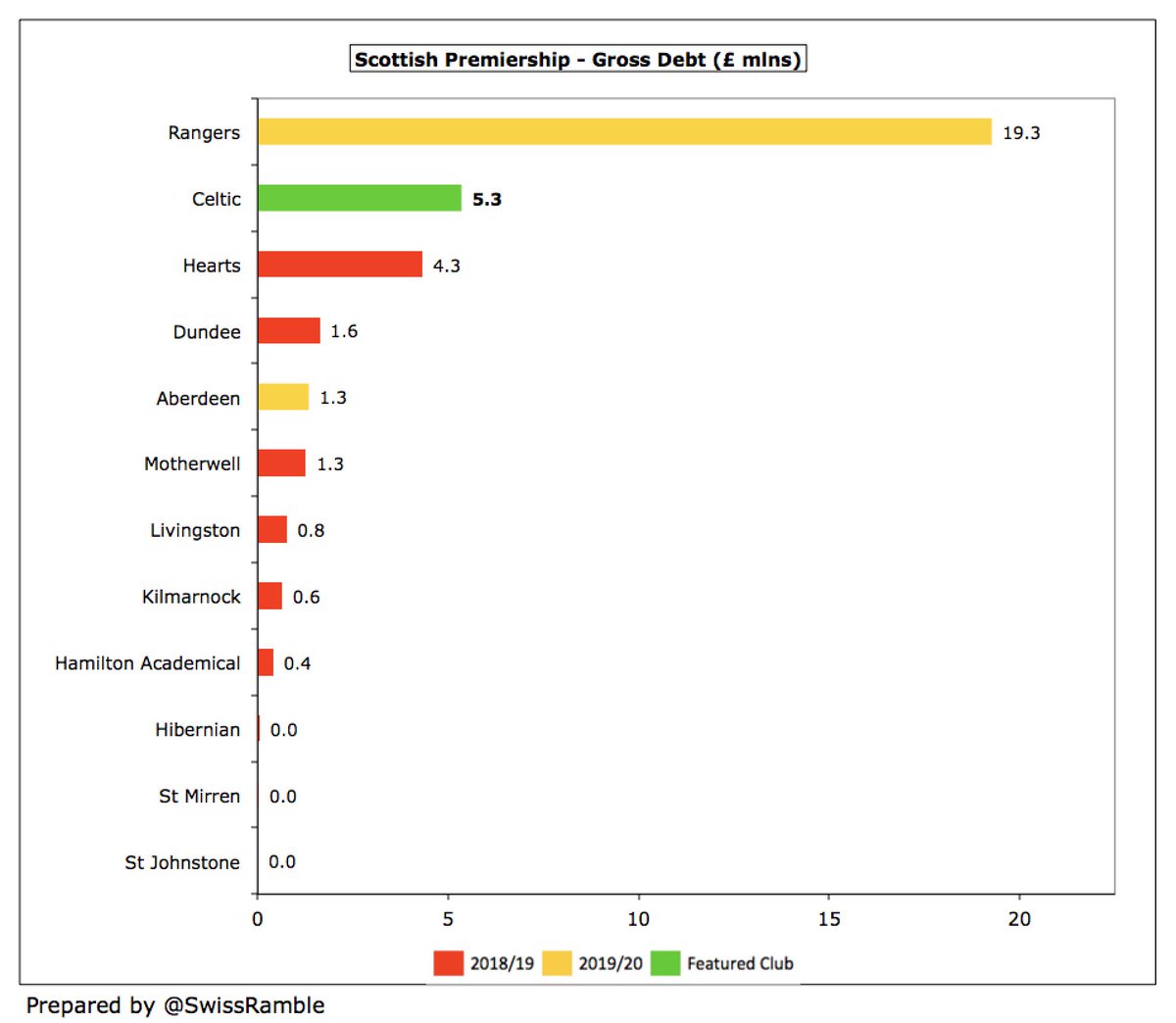

#CelticFC £5.3m debt is second largest in Scotland, but a long way below Rangers £19.3m, which would have been even higher without the club from Ibrox converting £34.3m of loans into shares in last 2 seasons. Note: Celtic’s figures excludes £4.2m convertible preference shares.

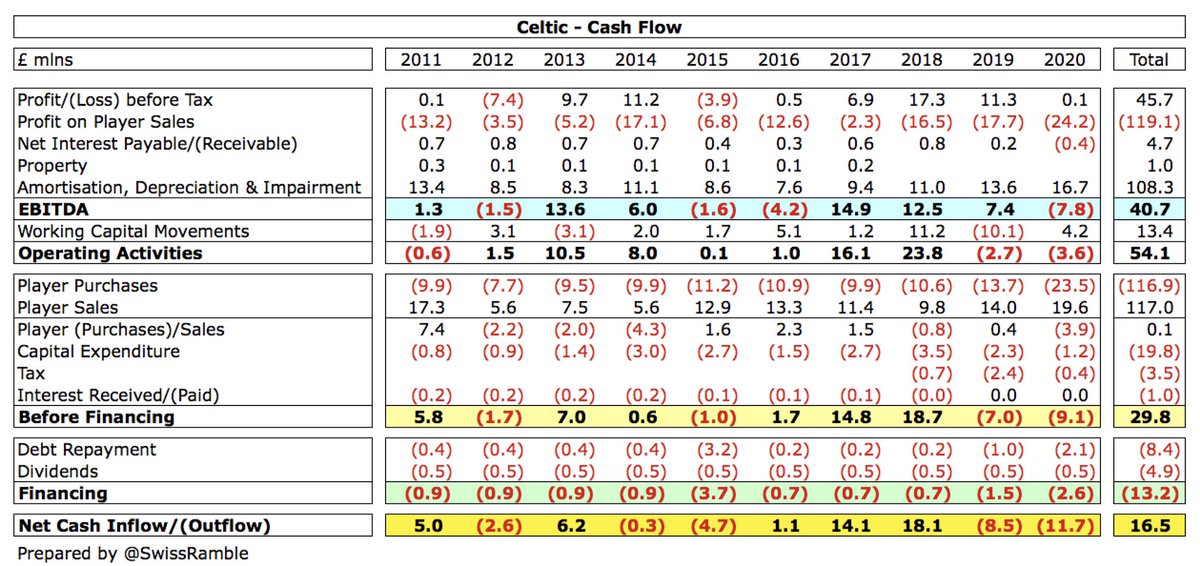

#CelticFC lost £3.6m cash from operating activities in 2019/20, then spent £3.9m (net) on player purchases, £1.2m on in infrastructure and £0.4m tax. They also repaid £2.1m of loans and paid £0.5m dividends on the preference shares, leading to £11.7m net cash outflow.

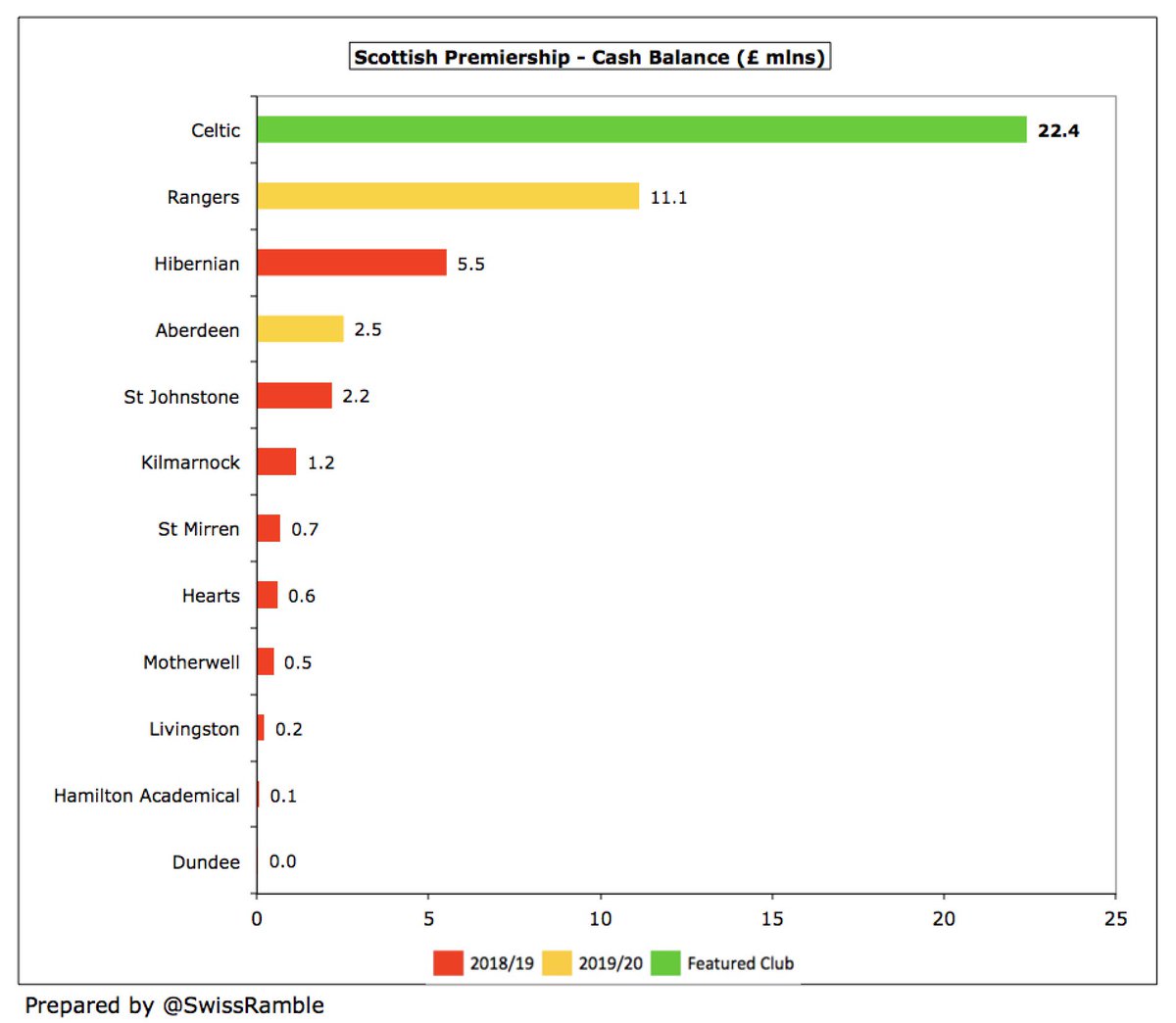

As a result, #CelticFC cash balance dropped from £34.1m to £22.4m, though this was still by far the highest in Scotland, more than double Rangers’ £11.1m.

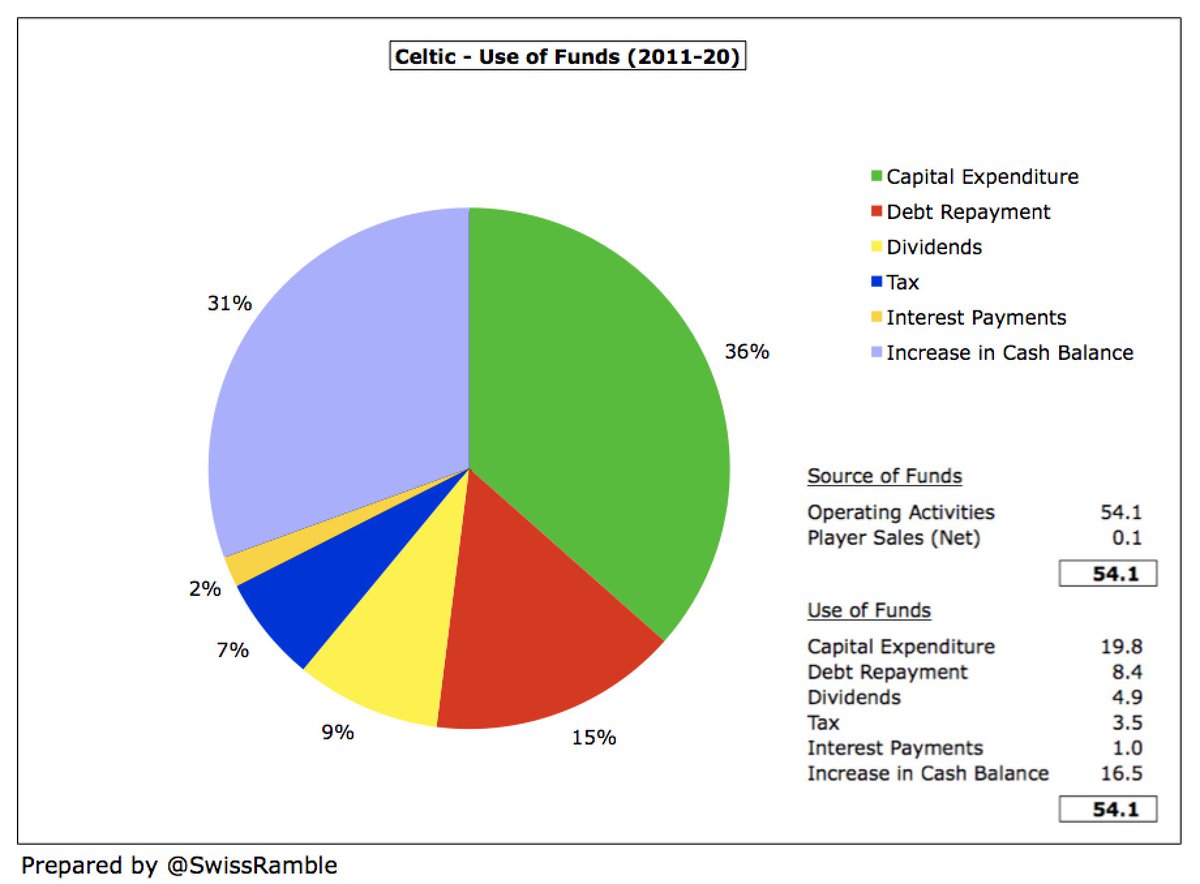

Over the last 10 years #CelticFC have had £54m available cash, entirely generated from their operations. Highest expenditure: infrastructure £20m, debt repayment £8m, dividends £5m, tax £4m and interest £1m. Broke-even on player trading. Bank balance increased by £17m.

This year’s figures will likely see a large loss due to COVID, but #CelticFC “remain committed to the strategy of careful use of our financial resources”. This will probably mean the profitable sale of some of their better players like talented French striker Odsonne Edouard.

• • •

Missing some Tweet in this thread? You can try to

force a refresh