Norwich City’s 2019/20 accounts covered a “challenging period” for the club, as they were relegated after just one season in the Premier League and their finances were impacted by the outbreak of COVID-19. Some thoughts in the following thread #NCFC

Despite the impact of the pandemic, #NCFC swung from £39m pre-tax loss in the Championship to £2m profit, thanks to revenue surging £85m from £34m to club record £119m, though competing in the Premier League increased expenses by £46m. After tax went from £33m loss to £2m profit.

#NCFC profit would have been £12.7m higher at £15m without the “significant” impact of COVID-19. Revenue was £10.2m lower, due to rebates to broadcasters £7.1m and season ticket holders £3.1m, while costs were higher after extending the season to July.

As a technical aside, the #NCFC 2019/20 accounts were extended by a month to match the longer Premier League season, so covered a 13 month period. As a result, the 2020/21 accounts will only cover 11 months.

The main driver of #NCFC £86m revenue increase was broadcasting, up £81m to £90m due to much more lucrative Premier League TV deal, though commercial also grew £7m (48%) to £21m, while gate receipts were down £2m (21%) to £7.6m. Profit on player sales fell £0.5m to £1.6m.

#NCFC underlying wage bill rose £38m (74%) from £51m to £89m, but player amortisation/impairment and depreciation fell £1m (9%) to £11m and no repeat of prior year £3.2m onerous contracts provision. Other expenses almost doubled from £10m to £18m and interest up £0.6m to £2.1m.

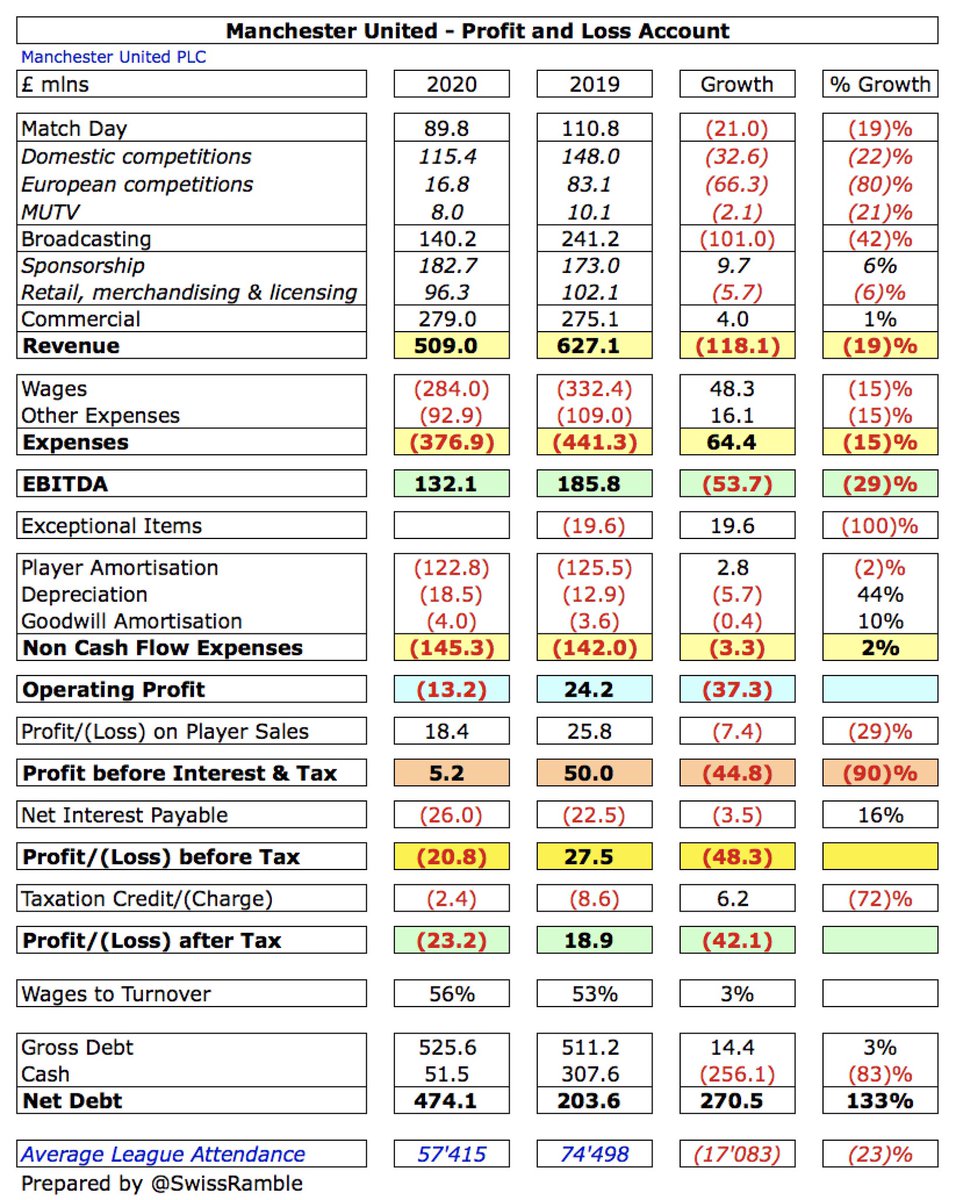

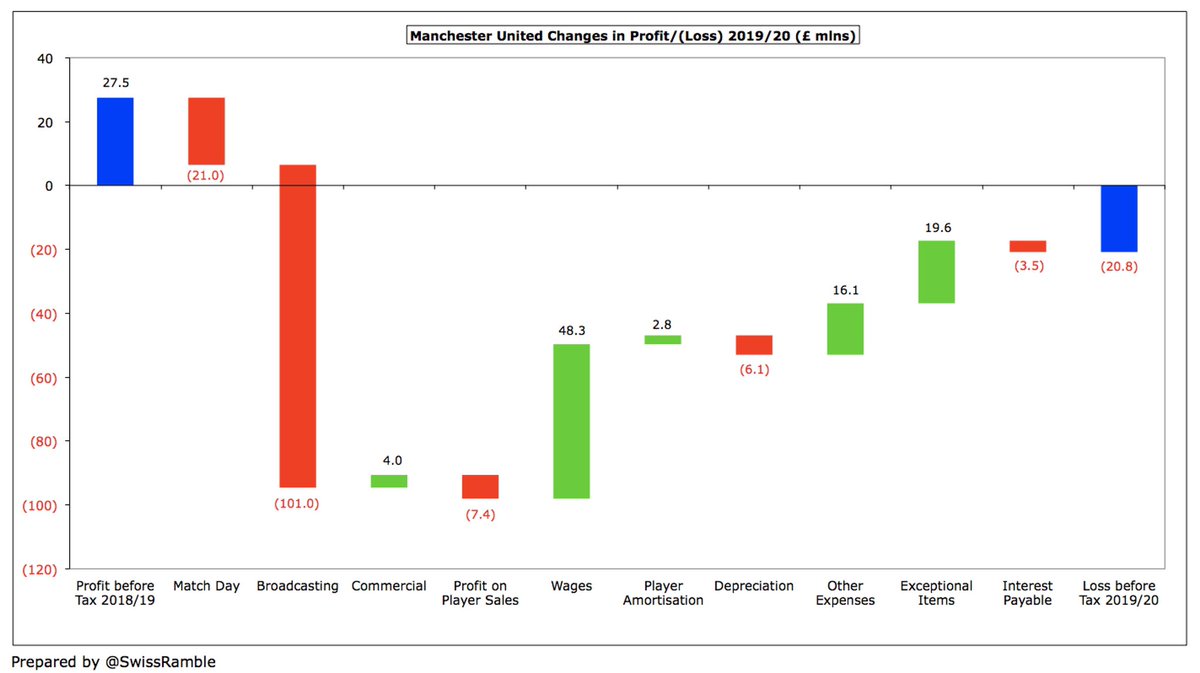

#NCFC £2m profit is not huge, but they have done well, given that #MUFC, the only other club to post 2019/20 accounts to date, lost £21m. Finance Director Anthony Richens: “Despite COVID losses, we can still post a profit, which shows what the Premier League does for the club.”

Furthermore, #NCFC made money despite profit on player sales of only £1.6m, the lowest in the Premier League, as they decided to retain their talented young players. In contrast, they have “realised significant value” this summer with £40m sales of Ben Godfrey and Jamal Lewis.

#NCFC have been profitable in 6 of the last 9 years: they made money in all 5 seasons in the Premier League, but reported losses in 3 of the 4 Championship seasons. The only exception was £18m in 2017/18, due to the significant £48m profit on player sales.

Like most clubs, #NCFC bottom line is very influenced by player sales. These averaged annual profit of £24m between 2015 and 2018, either leading to overall profit or lower losses. The last 2 years have only averaged £2m, but there will be large gains here in 2020/21.

#NCFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered as a proxy for cash operating profit, as it strips out player sales and exceptional items, rose from £(24)m to £14m in the Premier League.

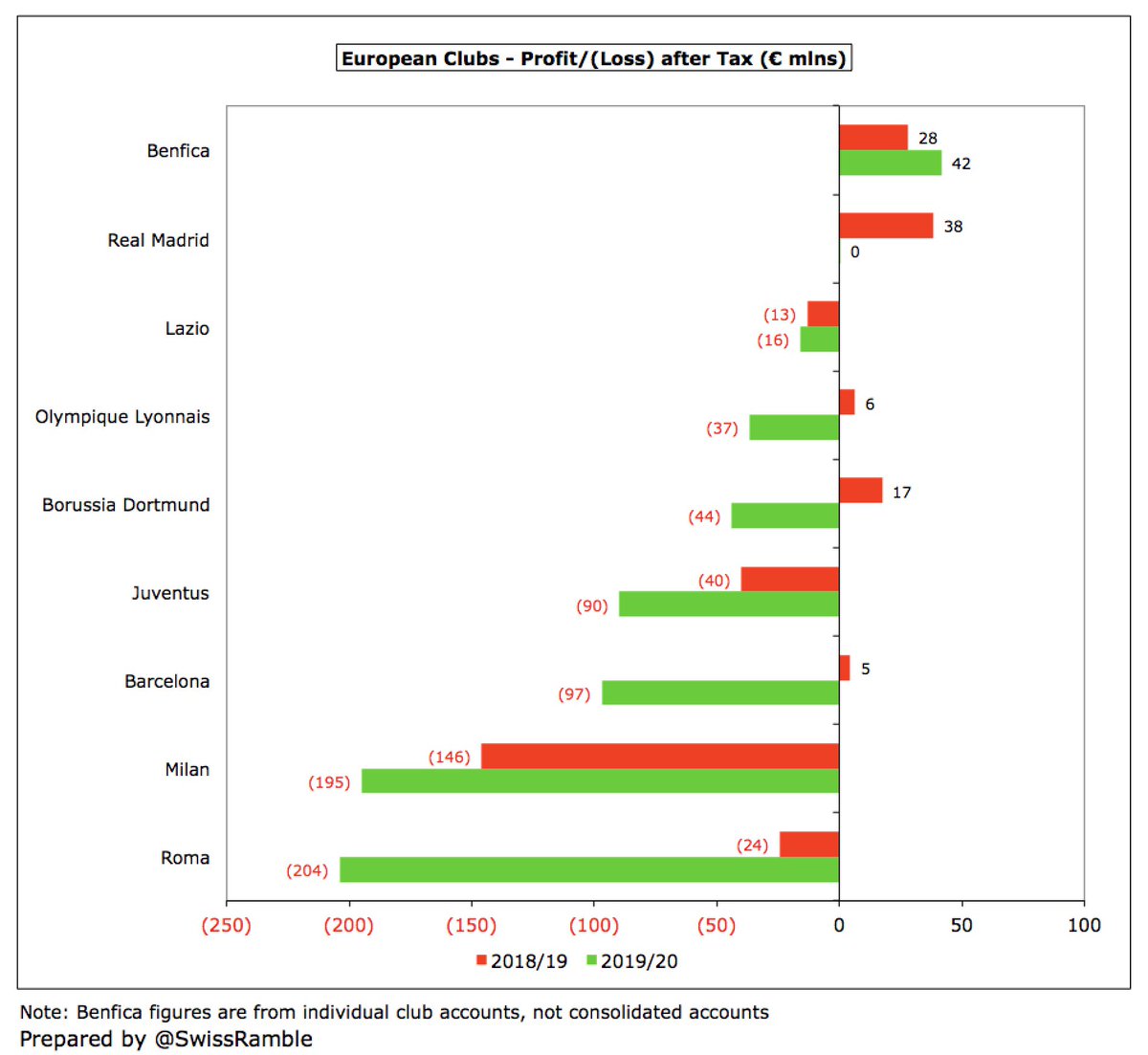

Despite the improvement, #NCFC £14m EBITDA was still one of the lowest in the top flight, though it is likely that other clubs will post lower figures than prior season when they publish their 2019/20 accounts.

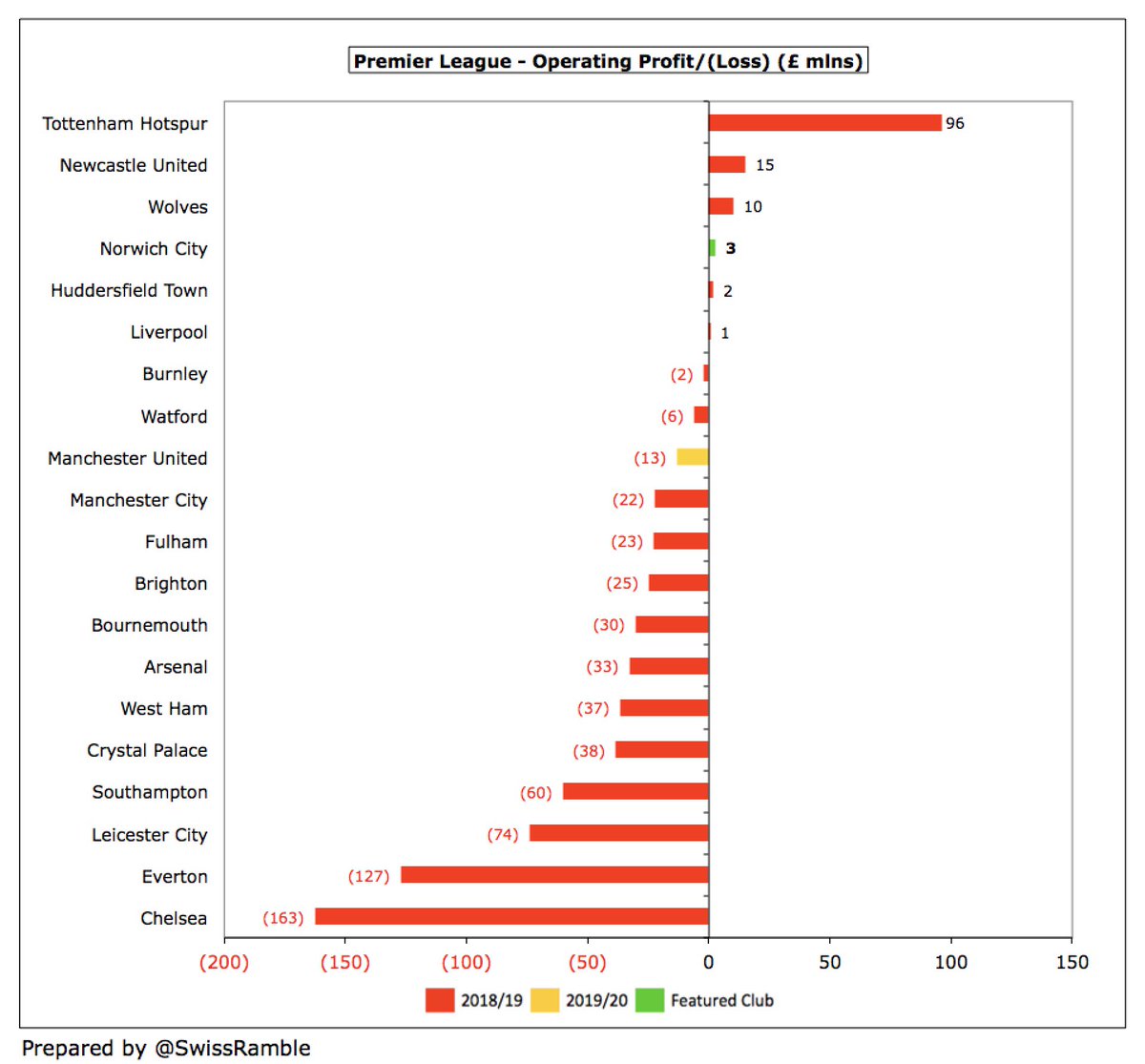

At an operating level (excluding player sales and interest), #NCFC made £3m profit, the first time they have not posted a loss since 2014. Very few Premier League clubs enjoyed operating profits in 2018/19, so Norwich’s small surplus is actually one of the best performances.

#NCFC revenue obviously grew significantly after promotion by £86m to £119m, though this would have been as high as £130m without the £10m COVID impact. It was still £21m (22%) higher than the £98m they generated the last time they were in the Premier League in 2016.

Despite the significant increase, #NCFC £119m revenue was still one of the lowest in the Premier League, though the comparatives for all the clubs except #MUFC are for the 2018/19 season, i.e. before any impact from the pandemic. That said, clearly a huge gap to the Big Six.

#NCFC TV income shot up by £80m from £10m to £90m, the club’s highest ever from this revenue stream. Would have been even higher without £7m rebate paid to broadcasters, due to inferior product (delayed games without fans). As a result, lower than other PL clubs’ 2018/19 figures.

The Premier League has not yet published details of TV money distribution, but the EPL Handbook contains an illustrative example based on league places, suggesting that #NCFC gross revenue was £95m less the £7m rebate, giving a net £88m income.

Even after this rebate, 76% of #NCFC total revenue came from broadcasting, though to be fair this is far from unusual in the top flight In fact, 13 of the clubs in the Premier League earned more than 70% of their total income from TV.

#NCFC TV money will fall following relegation, though will be cushioned to some extent by parachute payment (£43m in 2018/19). Will only receive 2 years (£77m in total), as relegated after one season. Chief Operating Office Ben Kensell described these as “massively important”.

#NCFC gate receipts fell by £2.1m (21%) from £9.7m to £7.6m, the lowest since 2010, as 5 games were played behind closed doors, resulting in £3.1m rebate to season ticket holders. Even without this adverse factor, would have been in bottom half of the Premier League.

As some games were played without fans, #NCFC average attendance fell from 26,017 to 19,913, though this had improved by almost 1,000 to 27,005 before the pandemic struck with the number of season ticket holders up to 20,622.

Obviously all clubs saw their average attendances fall in the COVID-impacted season, but #NCFC were still firmly in the bottom half of the Premier League, only ahead of #CPFC, Burnley, Watford and Bournemouth. Season ticket prices have been frozen for eight years in a row.

Most impressively, #NCFC commercial income rose £7m (48%) from £14m to £21m. as sponsorship increased tripled from £3.4m to £10.3m. Includes £4.6m catering, though not too surprising with Delia Smith as an owner. Very respectable figure compared to similar sized clubs.

Following promotion, #NCFC signed Dafabet as their new shirt sponsor in a deal described as “the most lucrative partnership the club has ever had by some way”, though fee will be lower in Championship. One of 12 new partners signed last summer. The kit suppler remains Errea.

#NCFC underlying wage bill rose by £38m (74%) from £51m to £89m following promotion (previous season included sizeable promotion bonuses), as many players were given new deals. Player contracts have relegation clauses (reportedly 50%), so wages will be much lower in Championship.

Despite the increase, exacerbated by the accounts covering 13 months, #NCFC £89m wage bill was still one of the smallest in the Premier League, so it is perhaps not surprising that they struggled to compete. For some perspective, it was less than a third of #MUFC £284m.

Following the big increase in revenue in the Premier League, #NCFC wages to turnover ratio improved from 152% to 75%, though this was still one of the highest in the Premier League. However, other clubs’ ratios likely to deteriorate when they publish 2019/20 accounts.

None of the #NCFC directors received any remuneration in 2019/20, presumably due to the impact of COVID. In the previous season the highest paid director received £480k.

#NCFC player amortisation, the annual charge to expense transfer fees over a player’s contract, surprisingly fell slightly after promotion to £8.6m, down from the £18.6m peak in 2016. This highlights the club’s limited investment in players.

As a consequence, #NCFC player amortisation of £9m was by far the lowest in the Premier League with the next smallest being £32m. For more context, this is at least £100m below big-spending clubs like #CFC £168m, #MCFC £127m, #MUFC £126m and #LFC £112m.

#NCFC player purchases were £18m, which was the lowest in the Premier League, but higher than Norwich’s spend in the previous two seasons (2017/18 £15m, 2018/19 £10m). Even though few players arrived last year, this included payments on previous purchases contingent on promotion.

It might surprise fans that #NCFC have increased their gross spend in the transfer market in the last 5 years, though the £20m annual average is not that big. They have averaged £1m of net sales in that period, which will increase in 2020/21, thanks to sales of Godfrey and Lewis.

#NCFC gross debt fell from £24m to £14m, including £10.5m bank loan secured on TV money due for repayment in My 2021, £2.3m Canary Bond and £250k from directors to help fund the new training ground. Also includes £1.4m preference shares classified as debt.

#NCFC £14m debt was one of the smallest in the Premier League, much lower than some other clubs, though many of these have taken on debt for new stadiums or training grounds, e.g. #THFC £466m, #MUFC £526m, #EFC £337m#, BHAFC £280m and #AFC £217m.

In addition, #NCFC also owe £8m transfer fees for stage payments on previous purchases, but this is very low compared to other clubs, e.g. #LFC £167m and #MUFC £149m. Worth noting they have to pay up to £45m if certain contractual conditions are met (like promotion).

#NCFC paid £2.5m interest in 2019/20, as their short-term bank loan charged a chunky 5.2%. This was 8th highest in the Premier League and is the largest annual payment that Norwich have made since 2013.

Largely thanks to a big increase in creditors, #NCFC generated £57m cash from operations, supplemented by £3m net player sales and a £10m loan. Spent £6m on infrastructure (£13m in last 2 years) and £2m interest, which meant £62m net cash inflow.

As prior year £20m overdraft was cleared, #NCFC cash balance increased by £42m to £62m, but this is a little misleading, as the club has to repay its short-term £10m loan by May and there is another £18m of deferred tax payments agreed with HMRC during the lockdown.

Since 2012 #NCFC have generated available cash of £126m from operating activities. Most of this (£44m) went on the playing squad, while the club also spent £22m on infrastructure, £10m interest and £10m loan repayments. In addition, cash balance rose £40m.

Unlike many Championship clubs, #NCFC have no FFP concerns, as their £19m loss over the 3-year monitoring period is lower than £61m limit (2 Championship years of £13m, one Premier League year of £35m), even before allowable deductions (£18m) and promotion bonus (£11m).

#NCFC COO Ben Kensell concluded, “We’re very proud of our robust and self-financed model, which is helping us sustain the club in this difficult and challenging financial climate, though there is no escaping that the impact of COVID-19 will be felt for the coming years.”

• • •

Missing some Tweet in this thread? You can try to

force a refresh