Tottenham Hotspur’s 2019/20 financial results covered a season that was disrupted by the COVID-19 pandemic, but they still benefited from the new stadium. The club finished sixth in the Premier League and reached the last 16 in the Champions League. Some thoughts follow #THFC

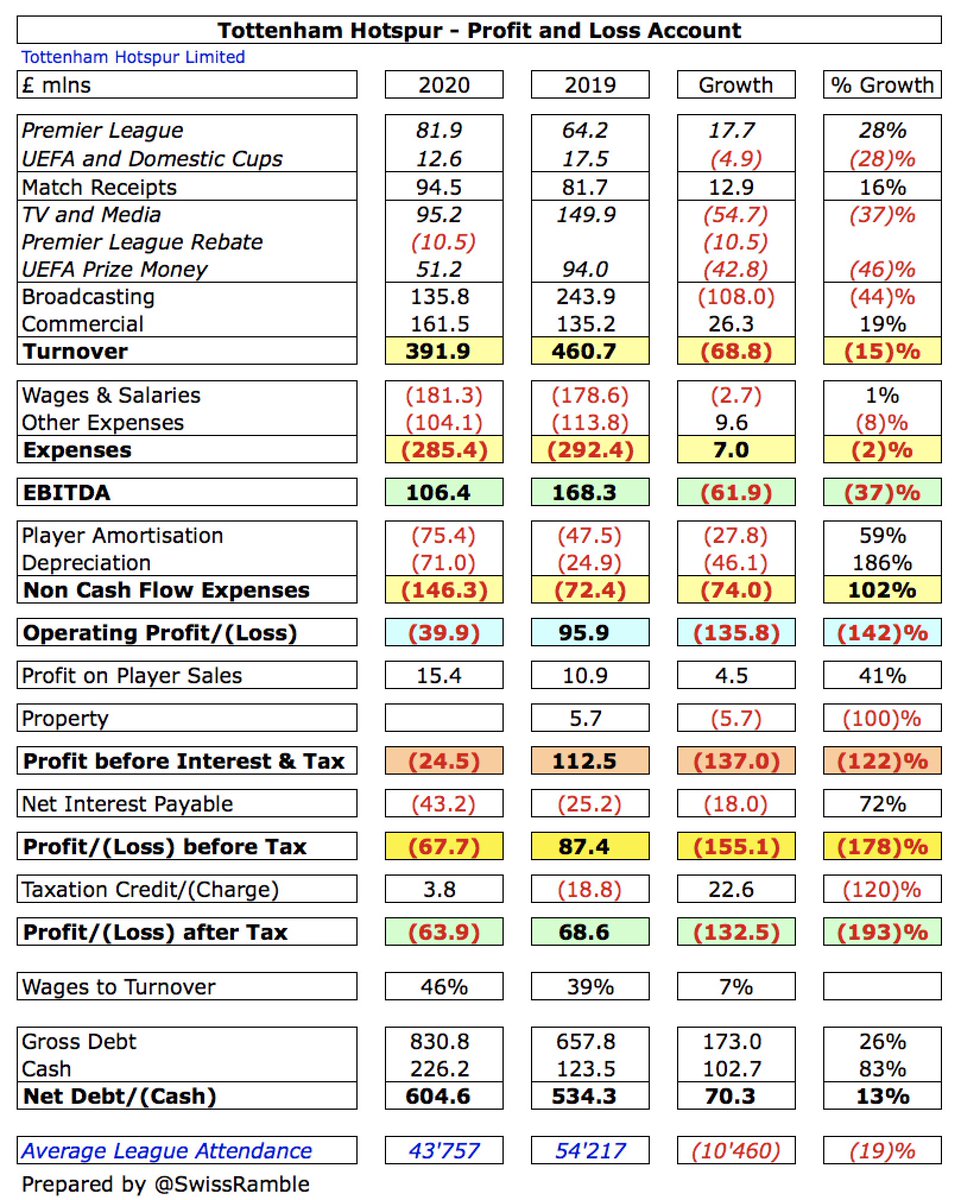

#THFC swung from £87m profit before tax to £68m loss, a deterioration of £155m. Revenue dropped £69m (15%) from club record £461m to £392m (including exceptional £11m TV rebate), while profit on player sales rose £4m to £15m and expenses increased £85m. After tax loss was £64m.

Main driver of #THFC revenue fall is broadcasting, down £108m (44%) to £136m, due to Premier League deferral/rebate and reaching Champions League final prior season. However, new stadium led to growth in match day, up £13m (16%) to £95m, and commercial, up £26m (19%) to £162m.

#THFC wage bill rose £3m (1%) to £182m, while player amortisation surged £28m (59%) from £47m to £75m. However, other expenses decreased £10m (8%) to £104m, partly due to rental paid for the use of Wembley Stadium in the previous season.

Completion of the new #THFC stadium meant a big increase in depreciation, which rose £46m from £25m to £71m. Interest payable up £18m from £25m to £43m: £21m bank interest plus £25m notional interest (per IFRS 16). No repeat of prior year’s £6m profit from property disposals.

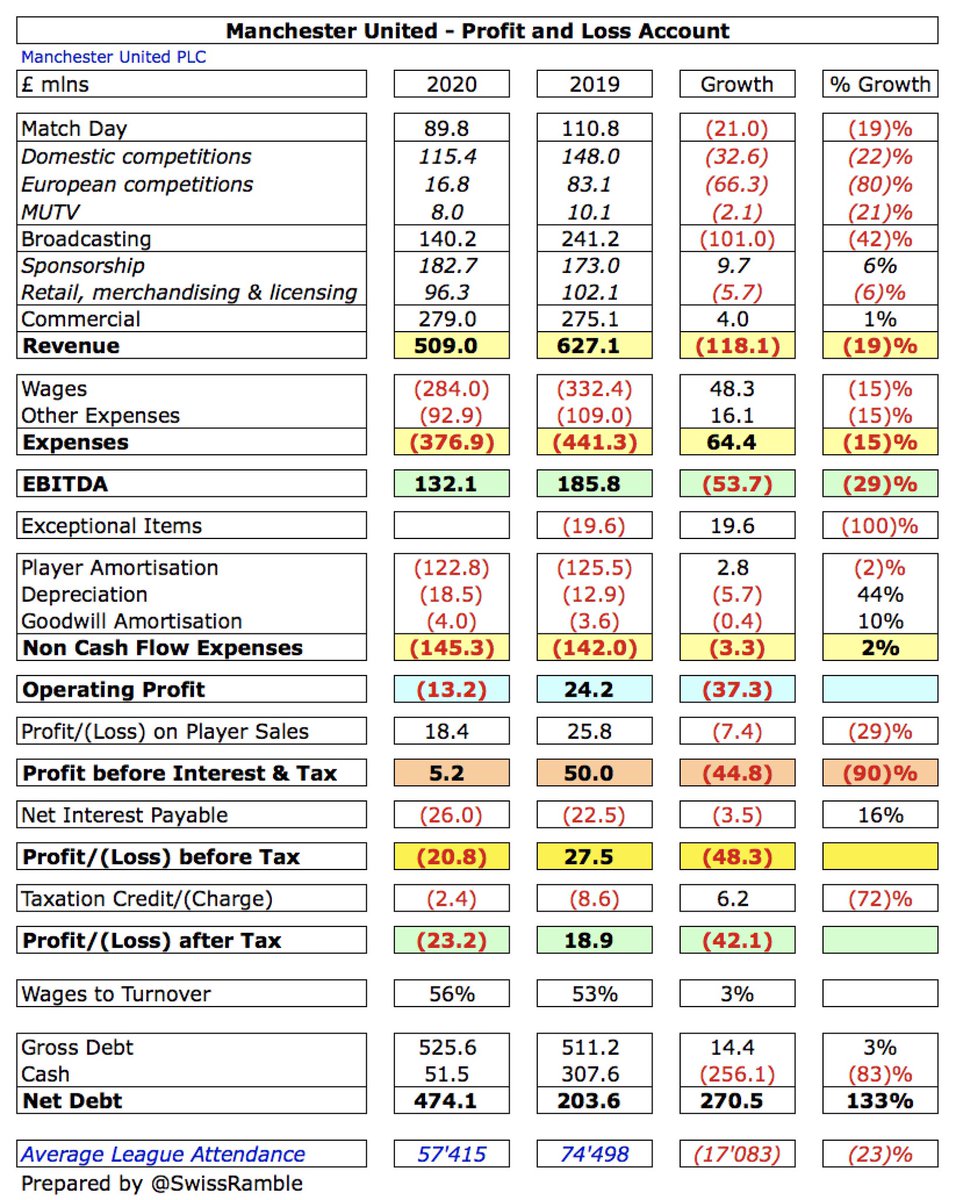

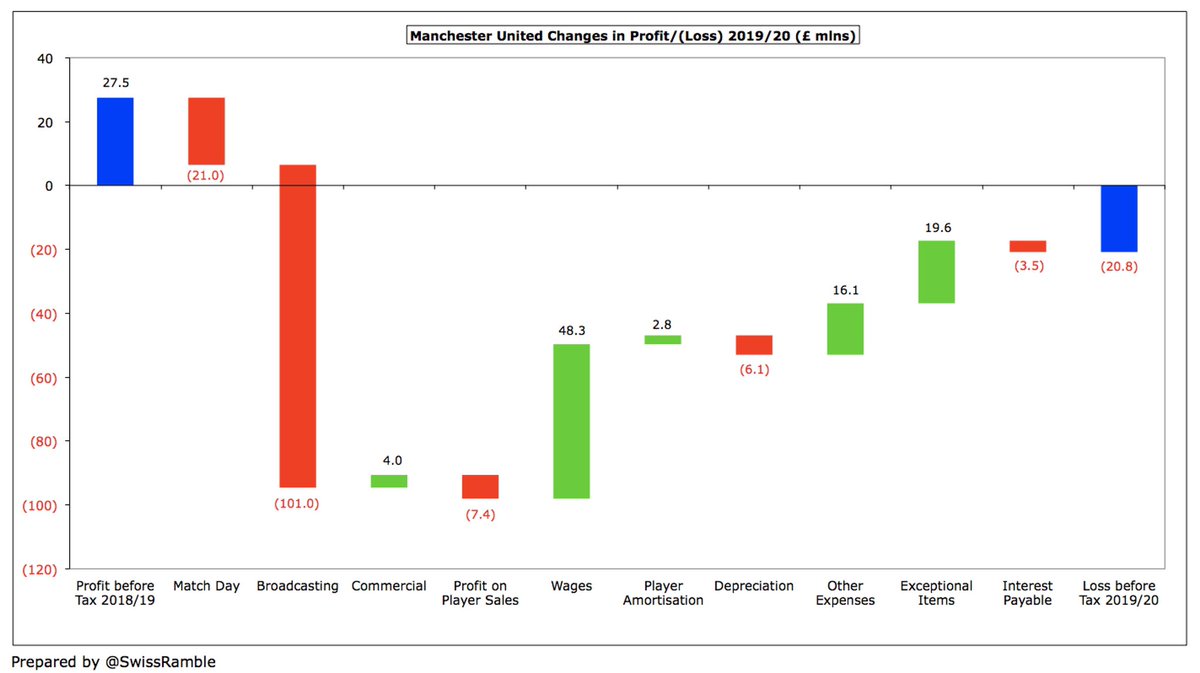

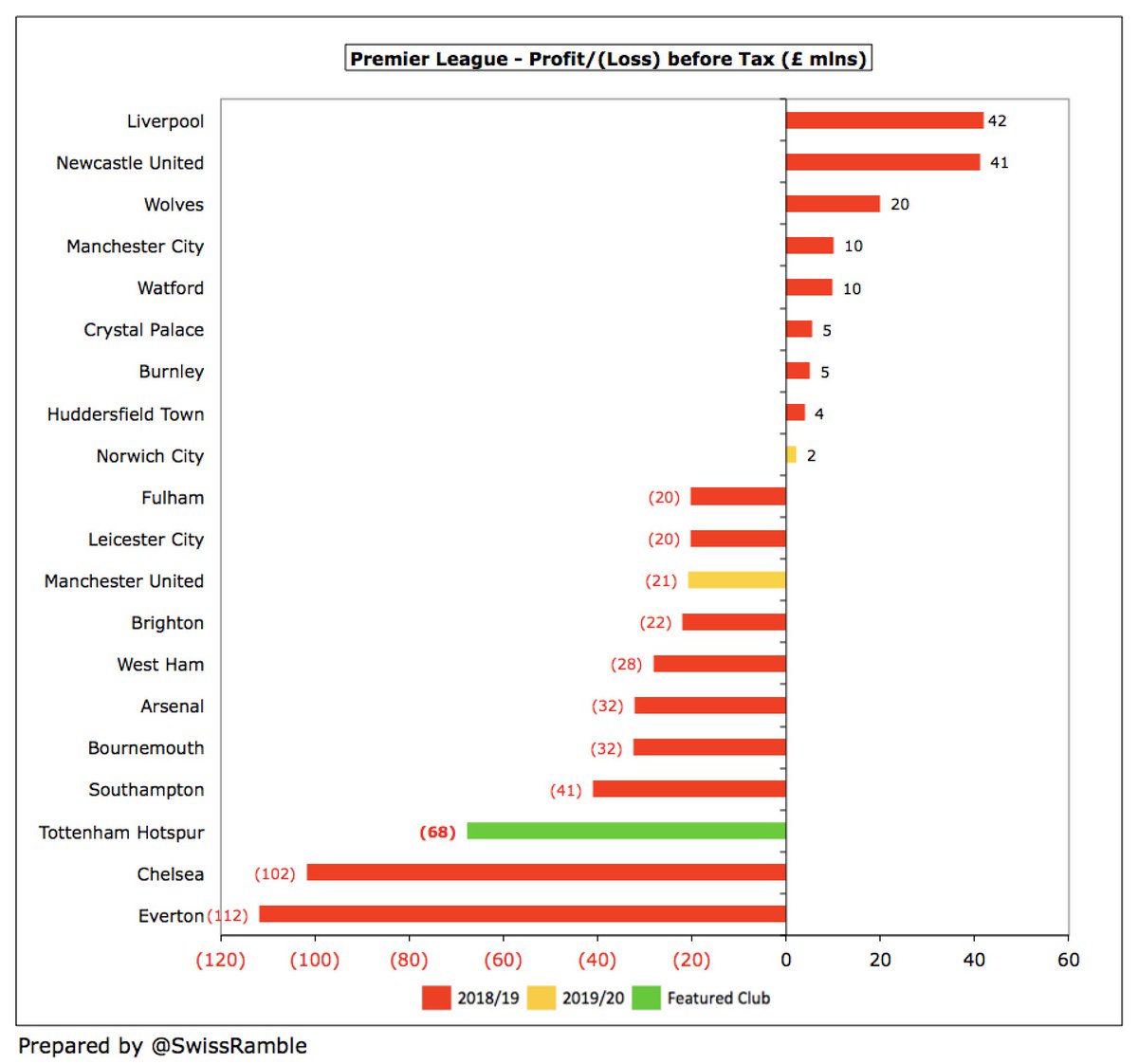

#THFC £68m loss is largest of the 3 Premier League clubs that have published 2019/20 accounts, much higher than #MUFC £21m, and is actually 14th worst ever in the PL. However, all clubs likely to report worse numbers last season, e.g. Spurs had highest £87m profit in 2018/19.

COVID has significantly impacted revenue with some deferred into the 2020/21 accounts, while 5 matches were played behind closed doors, retail stores were closed, stadium tours and conferences were halted for 3 months, and none of the contracted summer events could take place.

In this way, the pandemic has significantly impacted finances in 2019/20 with many leading clubs posting horrific losses, e.g. Roma £184m, Milan £176m, Inter £90m, Barcelona £87m and Juventus £81m. From that perspective, #THFC £64m (after tax) does not seem too bad.

#THFC bottom line only benefited from £15m profit on player sales, albeit up from prior year’s £11m, mainly Christian Eriksen to Inter and Kieran Trippier to Atletico Madrid. This was much lower than some other clubs: #CFC £60m, #LCFC £58m, #CPFC £46m and #LFC £45m.

This is the first year that #THFC have reported a loss since way back in 2012 – and that was only £7m. In the intervening 7 seasons, they have generated an impressive £412m of profits, averaging £59m a year. In 2018 and 2019 alone they delivered a hefty £226m.

Player sales have had a big impact on #THFC figures with £166m coming from this activity in last 5 years, though worth noting they have been profitable even without this in 4 of those years. Club record of £104m came in 2014 from lucrative sale of Gareth Bale to Real Madrid.

To reinforce the point that player sales have been a major part of #THFC financial success, in the 5 years up to 2019 they made a sizeable £172m from this activity, only surpassed by #CFC £332m and #LFC £306m. In contrast, #MCFC and #MUFC made just £147m and £69m respectively.

#THFC EBITDA (Earnings Before Interest, Tax, Depreciation & Amortisation), considered a proxy for cash operating profit, as it strips out player sales and exceptional items, fell from £168m to a still respectable £106m, 4th highest in the Premier League.

At an operating level (i.e. excluding player sales and interest), #THFC made a £40m loss, the first time they have not posted a profit since 2015. In fairness, very few Premier League clubs post operating profits, while Spurs’ £96m in 2018/19 was the highest in Europe.

Despite the £69m fall in 2020, #THFC revenue has still grown by £182m (87%) since 2016 from £210m to £392m, mainly commercial £103m and match day £54m. However, chairman Daniel Levy has estimated revenue loss for current year as an “irrecoverable” £150m if stadium remains closed.

In fact, #THFC have enjoyed the highest percentage revenue growth of the Big Six since 2016. In absolute terms, Spurs’ £182m growth has only been surpassed by #LFC £231m. Furthermore, Spurs have eliminated a £141m deficit against their North London rivals #AFC.

#THFC £392m revenue is now around the same level as #AFC £395m, though the Gunners’ figure is likely to be lower when they publish COVID-impacted 2019/20 accounts. That said, Spurs are still a fair way behind the other leading clubs, e.g. #MUFC were nearly £120m higher.

#THFC £69m revenue decrease in 2019/20 is likely to be replicated elsewhere. Indeed, many European clubs have experienced similar falls: #MUFC £118m, Barcelona £102m, Juventus £77m and Milan £45m. In percentage terms, Spurs’ 15% decline is actually a bit better than average.

Based on 2018/19 revenue, #THFC climbed two places from 10th to 8th in the Deloitte Money League, which ranks clubs globally by revenue. This meant that they were the highest placed club in London that season, having overtaken both #CFC and #AFC.

TV money has driven #THFC revenue growth in recent years, but plunged £108m (44%) from £244m to £136m (domestic £85m, Europe £51m), due to revenue from 7 Premier League games slipping to 2020/21 accounts (plus £11m rebate to broadcasters) and lower Champions League money.

Premier League has not published TV money details, but EPL Handbook has illustrative example based on league place, suggesting gross revenue fell from £145m to £138m (4th to 6th place) less £15m rebate (£11m per #THFC accounts), giving net £123m. Some income deferred to 2020/21.

#THFC earned (estimated) £61m (€69m) after being eliminated in Champions League last 16, much less than prior season’s £90m for reaching the final, comprising €15m participation fee, €19m prize money, €23m UEFA coefficient and €12m TV pool This is before a 16% COVID rebate.

It is worth noting the big financial differences in Europe, e.g. #MUFC reached Europa League semi-final, but only got £25m, while #THFC received £61m in the Champions League, despite only reaching last 16. Therefore, Spurs will see revenue drop this season in the Europa League.

The importance of the Champions League to #THFC revenue growth is clearly evident, as they have received €278m from this competition in the last 4 years, only surpassed by #MCFC €307m. Most tellingly, this is €117m more than #AFC €161m in the same period.

#THFC match day income rose £13m (16%) from £82m to £95m following the move to the new Tottenham Hotspur Stadium (all but 5 games at Wembley prior season), despite 5 home games being played behind closed doors. Split £82m Premier League and £13m Champions League and other cups.

#THFC £95m match day revenue has overtaken #MUFC £90m and is only behind #AFC £96m, which will fall in 2019/20. In fact, based on incredible £5.9m per match for games played with fans, Spurs’ revenue would have been as high as £124m in a normal season (a PL record).

As 5 games were played without fans, #THFC average attendance fell from 54,217 to 43,757, the 4th highest in the Premier League, only below #MUFC 57,415, #AFC 47,589 and #WHUFC 44,134. Spurs’ match day contributed 24% of total revenue, around the same as #AFC.

#THFC splendid new stadium has a 62,000 capacity, though there were lengthy delays and the total cost was £1.2 bln. Nevertheless, it will drive significant revenue growth, while the club is pushing for a £25m naming rights deal (more challenging, due to COVID).

Thanks to the opportunities offered by the new stadium, #THFC commercial revenue rose £27m (19%) from £135m to £162m, even though many events had to be cancelled due to COVID. Has shot up from £59m in 2016 with the highest growth rate of Big Six (albeit from a low base).

#THFC £162m commercial revenue is now £51m higher than #AFC £111m, though Arsenal will rise by around £40m in 2019/20 with new sponsorship deals for Adidas and Emirates. Still way behind #MUFC £279m and #MCFC £227m, though new stadium should help close the gap, e.g. NFL games.

#THFC two major commercial deals increased in last 2 years: (a) AIA shirt sponsorship extended to 2027, up from £35m to £40m; (b) Nike replaced Under Armour in 2018, doubling money from £15m to £30m, running to 2033. However, these long-term deals run the risk of being overtaken.

#THFC wage bill rose slightly (£3m) to £181m. In the last 4 years, revenue has shot up by £182m while wages have only grown £81m, which is testament to Spurs’ ability to keep costs down. Expectation is that other clubs will see wages drop in 2019/20, e.g. #MUFC down £48m.

Even after growth in recent years, #THFC £181m wage bill is still miles behind the rest of the Big Six, who are all at least £100m more than Spurs except for #AFC, who are around £50m higher. In 2018/19 their wages were firmly in the bottom half of European top 20 clubs.

#THFC wages to turnover ratio increased from 39% to 46%, though this is still the lowest (best) in the Premier League, 10% below #MUFC. To highlight how efficient Spurs are, they had the 2nd lowest ratio of the top 20 Money League clubs in 2018/19, e.g. only half of Roma’s 78%.

#THFC chairman Daniel Levy remuneration fell from £7m to £3m, as no repeat of bonus for completing the stadium, so now only 2nd second highest in the Premier League, behind Ed Woodward at #MUFC. He has trousered a cool £34m in last 11 years, though improved Money League ranking.

#THFC depreciation shot up £46m from £25m to £71m, driven by a full year in the new stadium. This is by far the highest charge in the Premier League, over £50m more than #MUFC £19m and #AFC £15m, though worth noting this is a non cash flow expense.

#THFC player amortisation, the annual charge to expense transfer fees over the length of a player’s contract, rose £28m (59%) from £47m to £75m, due to investment in the squad. This has more than doubled from £31m in 2016.

Following this increase, #THFC player amortisation of £75m is 7th highest in England, but still well below the likes of big spending #CFC £168m, #MCFC £127m and #MUFC £123m. Also below #EFC £95m, which highlights Spurs’ relatively low transfer spend.

That said, #THFC player purchases increased from £22m to £136m in 2019/20, including Tanguy Ndombélé from Lyon, Steven Bergwijn from PSV Eindhoven, Ryan Sessegnon from #FFC & Jack Clarke from #LUFC. However, to place this in context, #CFC spent £281m and #LFC £223m in 2018/19.

It is remarkable that #THFC have done so well on the pitch, despite only averaging £35m net spend in the last 5 years (though up from £2m in preceding 5 years). Since these accounts closed, Spurs have spent a net £98m to bring in Lo Celso, Reguilon, Doherty, Höjbjerg and Rodon.

#THFC gross debt rose £173m from £658m to £831m, comprising £633m for the stadium, £175m from the government COVID facility and £23m from Investec for the new training ground. In September 2019 stadium loans were refinanced into long-term maturities (average 23 years) at 2.67%.

#THFC £831m gross debt is by far the highest debt in the Premier League, well ahead of #MUFC £526m and is also the highest in Europe. However, thanks to the government loan, cash increased from £123m to £226m, so net debt was “only” up £71m from £534m to £605m.

#THFC interest payments (as opposed to the accountants’ interest payable in the P&L) fell from £26m to £14m in 2019/20 following the debt refinancing. However, this was still the second highest in the Premier league, only surpassed by #MUFC £20m, but more than #AFC £11m.

There was also significant growth in #THFC transfer debt, up from £88m to £140m, only offset by £26m owed by other clubs, so net £114m payable. This has increased from just £26m in 2015. Gross transfer debt is 3rd highest in Premier League, only behind #LFC £167m and #MUFC £149m.

#THFC generated an impressive £91m cash from operations, but then spent £82m on the new stadium, £59m (net) on new players, £14m interest and £2m tax. This was funded by £168m new loans, thus increasing the cash balance by £103m to £226m.

In the last decade #THFC generated £1.1 bln cash from own operations, but also needed to raise £746m from loans. An incredible £1.4 bln has been invested in the new stadium and training centre, leaving just £93m on players (net), £88m interest and £56m tax. Cash balance up £215m.

Levy warned, “The impact of the pandemic on our revenue is material and could not have come at a worse time, having just completed a £1.2 bln stadium build financed by club resources and long-term debt.” However, these results also underline the potential of the new stadium.

• • •

Missing some Tweet in this thread? You can try to

force a refresh