1. If you are reluctant to commit to any uptrend, (or for that matter even in a downtrend), yet, have to create a position, then consider bullish butterfly as your go to strategy.

Below is an example I have created for #bhartiairtel

Below is an example I have created for #bhartiairtel

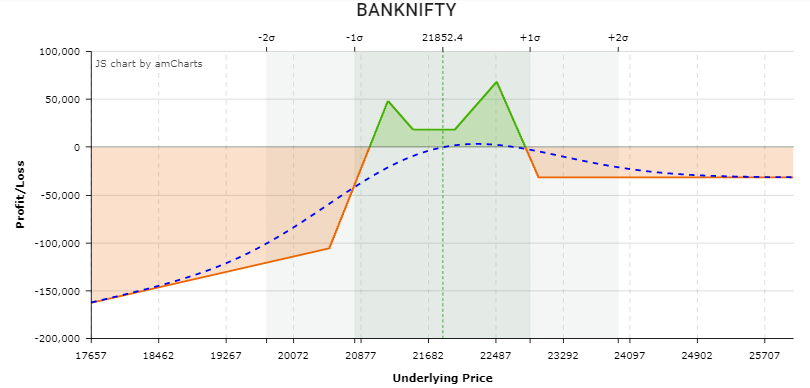

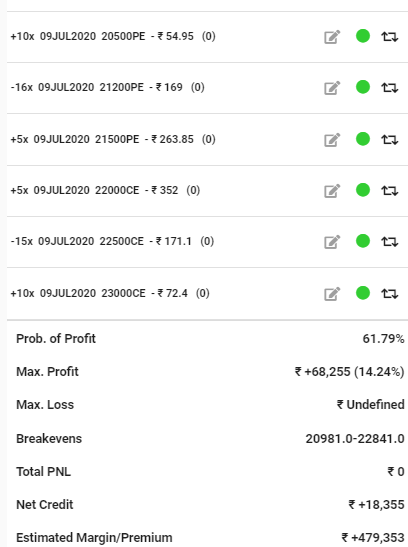

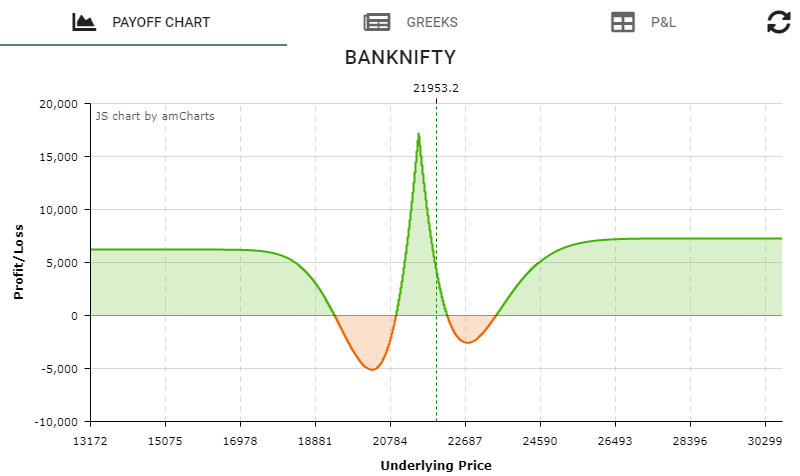

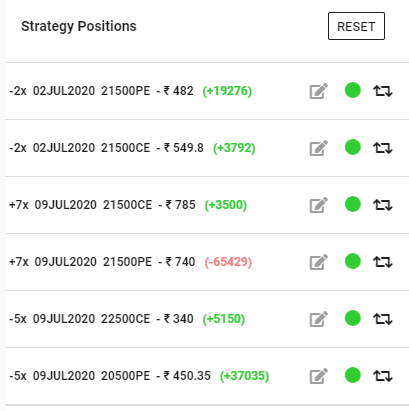

3. Benefits:

a. Low capital requirement (1.3L)

b. Risk limited (~4k)

c. High Max profit potential (32.8K)

Chart is strong but has rallied alot. View is it would find strong resistance around 500 but may not fall much.

Is there any other strategy you think can be used here?

a. Low capital requirement (1.3L)

b. Risk limited (~4k)

c. High Max profit potential (32.8K)

Chart is strong but has rallied alot. View is it would find strong resistance around 500 but may not fall much.

Is there any other strategy you think can be used here?

4. One need not wait till expiry to make a decent return on this strategy. Theta decay is small but will be consistent. Over the next 15 days or so, if price stays in 480-520bracket, decay would easily give 5-7% on capital.

That would be decent on all count.

That would be decent on all count.

5. How slow it will add to your account? Lets see.

Given we are reluctantly bullish on this counter, main aim is to protect capital if we are wrong. A 5% fall from here over next 20 days wud lead to a loss of approx 1% capital while in the most favorable scenario, we'd be up 5%.

Given we are reluctantly bullish on this counter, main aim is to protect capital if we are wrong. A 5% fall from here over next 20 days wud lead to a loss of approx 1% capital while in the most favorable scenario, we'd be up 5%.

6. Not considering beyond 20 days as physical settlement norms kick in. However, you can safely hold beyond 20 days also if price is below 480. If its higher, convert it into a regular butterfly to avoid higher margin requirements. 2 days of additional decay would double profits.

• • •

Missing some Tweet in this thread? You can try to

force a refresh