Payrolls in November rose a mere +245k. That's the sort of number you might see in a "normal" month, and definitely not what you're hoping for in the snapback from a covid-induced shutdown.

THE RECOVERY IS STALLING.

THE RECOVERY IS STALLING.

Remember, the economy lost 22 million jobs, then gained roughly half of them back.

We still have 10 million fewer jobs than we did in February. Clawing the rest back at +245k per month will take basically forever. If this is the second half of the recovery, it's going to be grim

We still have 10 million fewer jobs than we did in February. Clawing the rest back at +245k per month will take basically forever. If this is the second half of the recovery, it's going to be grim

The dramatic ups and downs of recent months might hide the real story here: The economy is in a deep hole -- as deep as in the darkest days following the financial crisis -- and the recovery is faltering. Barely there. Making no progress. Stalled. Stopped.

The proximate causes of our slowing economy are obvious:

The virus is back, which hobbles the service sector, and stimulus has basically petered out, leaving the economy with little help. It doesn't have to be this way.

The virus is back, which hobbles the service sector, and stimulus has basically petered out, leaving the economy with little help. It doesn't have to be this way.

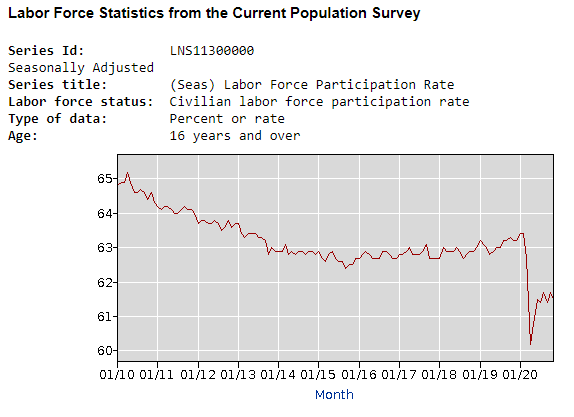

The household survey suggests that employment actually declined (by -74k) last month. So the fall in unemployment from 6.9% to 6.7% largely reflect the fact that an additional 400k people dropped out of the labor force.

And if you think an unemployment rate of 6.7% doesn't sound too bad, realize that this largely reflects millions of people dropping out of the labor force -- millions more than in a typical downturn -- because it's barely safe to leave their houses.

We're already seeing the recessionary impulse from state and local governments cutting back.

- State governments cut -243k jobs in March-May, and now an additional 134k since September.

- Local governments cut -1255k jobs March-May, and -187k since Sept.

And more cuts are ahead.

- State governments cut -243k jobs in March-May, and now an additional 134k since September.

- Local governments cut -1255k jobs March-May, and -187k since Sept.

And more cuts are ahead.

You can't interpret economic numbers separately from the broader public health context. The pandemic changes what one might mean by "good jobs" and "bad jobs."

https://twitter.com/asociologist/status/1334856842875375616

The recovery was always going to be a play in two acts.

The first act was firms re-opening and recalling furloughed workers.

The second act is harder: Millions lost their jobs permanently & there aren't many new opportunities opening up for them.

The second act is a grim slog.

The first act was firms re-opening and recalling furloughed workers.

The second act is harder: Millions lost their jobs permanently & there aren't many new opportunities opening up for them.

The second act is a grim slog.

By @jasonfurman's calculation, the "realistic" unemployment rate -- which adjusts for the unusual decline in participation -- is 8.5%, and is *rising*.

https://twitter.com/jasonfurman/status/1334860207760023552

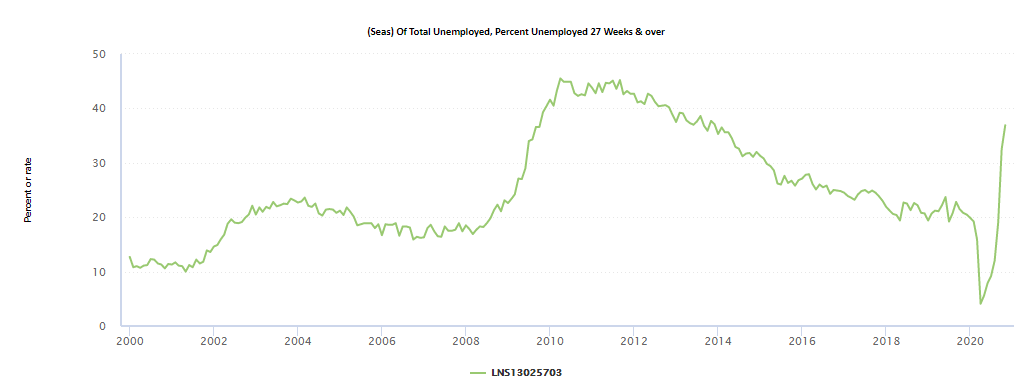

We're at risk of creating more lasting problems: The share of the unemployed who have been jobless >6 months has now risen from 19% in February to 37% in November, and it's rising sharply.

As people lose contact with the labor market, they lose connections, skills, and hope.

As people lose contact with the labor market, they lose connections, skills, and hope.

A wonky nugget: Response rates to the labor market surveys are most of the way back to pre-covid levels, suggesting that perhaps the data are becoming more reliable.

• • •

Missing some Tweet in this thread? You can try to

force a refresh