I am going to rant about taxes for a bit because that 2018 FOX interview with Cori Bush has me pissed, at her for not doing her homework and at FOX, Mitt Romney, and all the other tax propagandists who focus solely on federal taxes. Remember Romney's 47% who pay no taxes? A lie.

But it's a lie that goes over well as it comforts and flatters the wealthy by portraying them as the people grossly bearing the burden of paying for everything while 47% are freeloaders. Well, first off, everybody pays into Social Security and Medicare, even the undocumented.

and they will never receive those benefits they pay for. There is a small exception for those who work but earn so little all their taxes are refunded as an Earned Income Tax Credit. They way Republicans scream about EITC you would never know it was originally a GOP plan (Nixon)

But the big lie is how states and local governments tax people. In 45 of the 50 states, poor people pay more of their income in taxes than the wealthy. In some states as much as six times more, so let's look at those states.

Here are the states ranked from the worst to the best. Please note that oh-so-progressive Washington state is the worst state in the entire country. They have no income tax and rely heavily on sales taxes

Here is #Washington - what a mess.

The busboy pays 17.8% and Bill Gates pays 3%

Such progressive values.

The busboy pays 17.8% and Bill Gates pays 3%

Such progressive values.

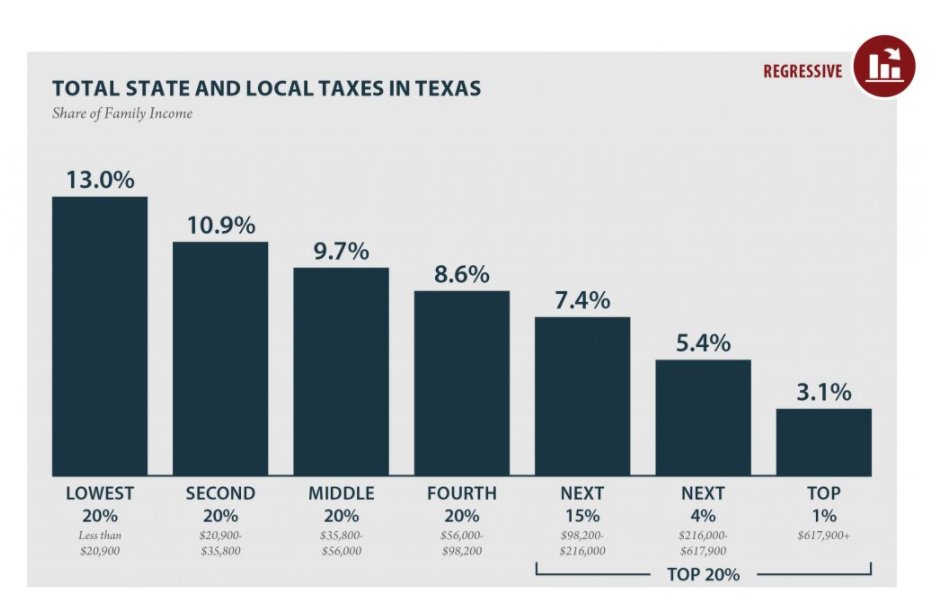

Here is #Texas but don't you really expect Texas to have a horseshit government with a horseshit tax system?

And #Florida, another state with awful government that no one expects to be anything other than bottom of the swamp. I mean, they elected Rick Scott AFTER he defrauded Medicare.

And #SouthDakota is almost as bad a shit sandwich on taxes as it is on COVID

Then #Nevada isn't far behind in the coddle the billionaires game

#Tennessee another not the least bit surprising entry in the stick it to the poor states

#Pennsylvania disappoints me, but it's not the first time.

#Illinois has no excuse for being one of the 10 worst states. None.

#Oklahoma is another one that is not a surprise

#Wyoming brings up the rear, the 10th of 10 shitty states who tax the poor significantly more than they tax the rich or the middle class.

But here's the kicker - almost every state does!

Even #Oregon where there is no sales tax at all and is just shy of being in the top 10 for best tax systems taxes the poor more than any other quintile. 41 and still taxing the poor more.

Even #Oregon where there is no sales tax at all and is just shy of being in the top 10 for best tax systems taxes the poor more than any other quintile. 41 and still taxing the poor more.

#Maryland is the first state that does not tax the poor more than everybody else. More than the rich, yes. But less than the middle class. 42 on the list

and at 43 #Montana - dang the poor pay more again, but overall, more equal but not at all progressive.

44 #NewYork The poor pay a higher effective rate than the richest 1% but the middle that gets the bite.

45 #Maine is getting close to flat, but again, the lowest effective rate is that top 1%

46 #NewJersey is the first that has a fairly progressive effective tax rate overall but the highest taxed are the middle class

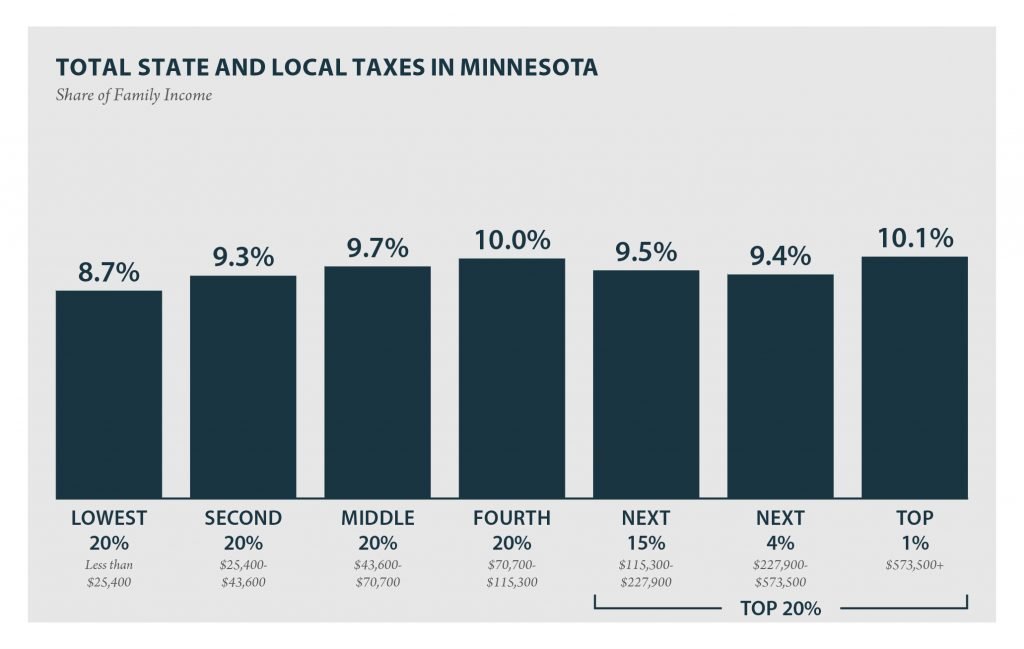

47 #Minnesota is the first state taxing the top 1% the highest rate and it's 47 out of 51.

48 #Deleware - the corporate haven but look at their taxes. The first truly progressive (a very thin margin) but it actually goes up each step of the way.

49 is #Vermont Do you notice how when it's progressive, it's still close to flat but in the terrible ten, it's not even close to flat.

50 is #DistrictofColumbia which is the only reason Oregon is not one of the ten best.

51 and the unequal tax system is #California though the poor pay more than the middle class, but at least there is a real bump for the top 1%

If your state was in the middle 31 - you can find it here. @ITEPtweets releases this report every year and has for as long as I can remember. My org often relied on ITEP when fighting attempts to reduce Oregon's income tax by adding a sales tax.

itep.org/whopays/

itep.org/whopays/

And while we're at it, let's dispense with the "You can't tax the rich enough to fix budget shortfalls, there are not that many of them." George Will said that once on some show and I found myself nodding my head and my Mom snapped, it's not a head tax, it's an income tax

And remember that. It's not how many wealthy there are, it's how much do they make and how much wealth do they have.

• • •

Missing some Tweet in this thread? You can try to

force a refresh