The ECB dangerous bubble in five charts. Thread:

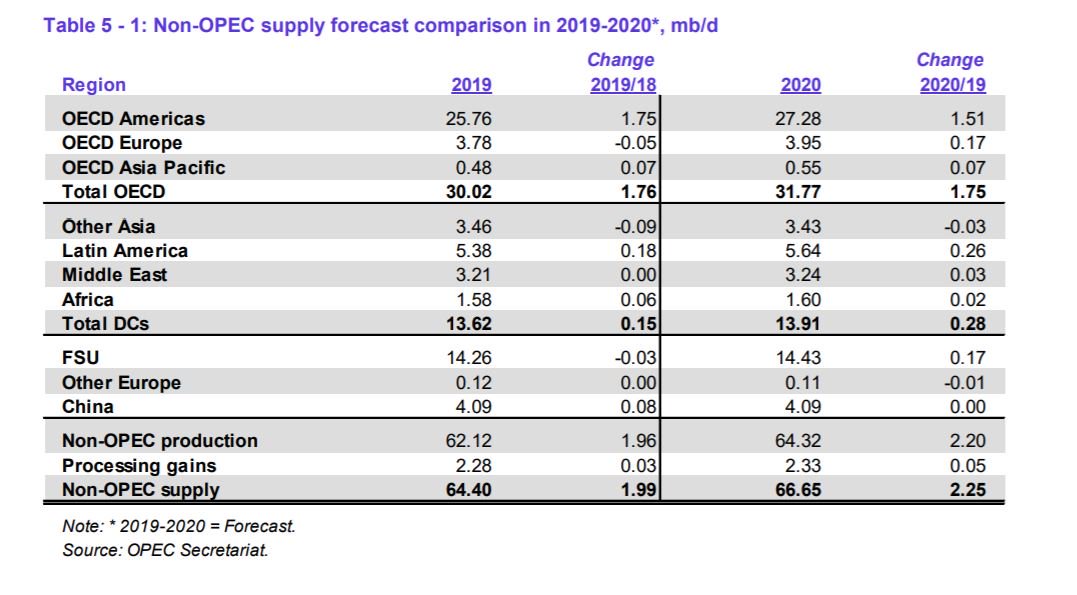

1) Excess Liquidity soars to €3.4 trillion

A problem of solvency is not solved with more liquidity

1) Excess Liquidity soars to €3.4 trillion

A problem of solvency is not solved with more liquidity

The most aggressive monetary policy with one of the poorest results:

2) The ECB balance sheet is almost twice the Fed's vs GDP

2) The ECB balance sheet is almost twice the Fed's vs GDP

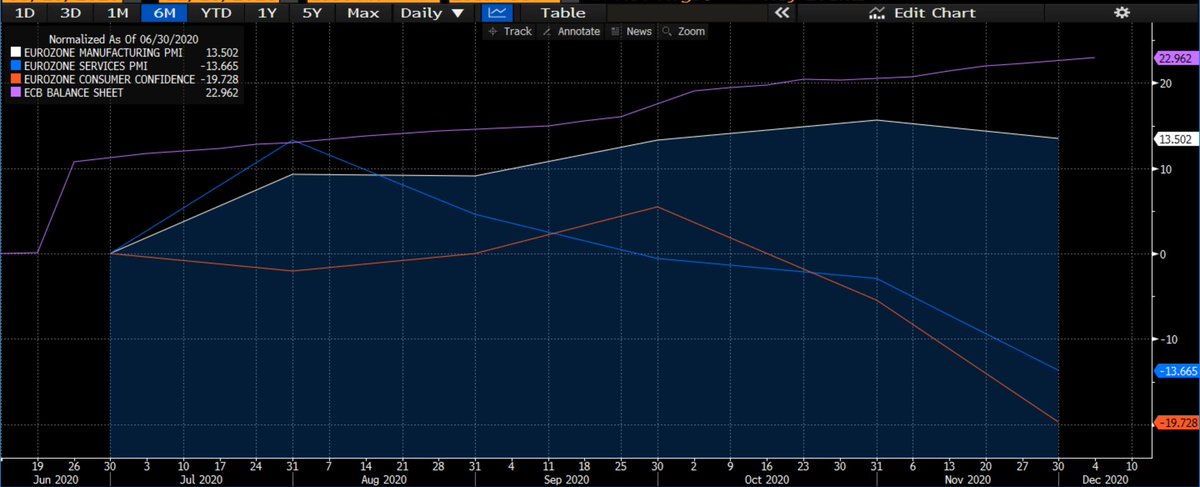

Massive monetary intervention for diminishing returns:

3) The ECB balance sheet vs Economic Activity. Eurozone Manufacturing and Service Sectors PMI and Eurozone consumer confidence

3) The ECB balance sheet vs Economic Activity. Eurozone Manufacturing and Service Sectors PMI and Eurozone consumer confidence

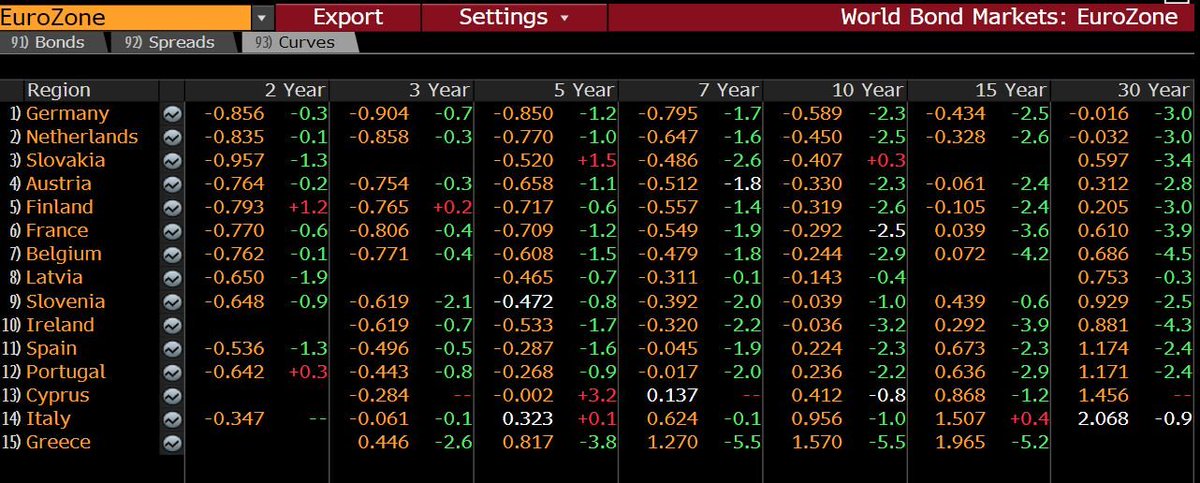

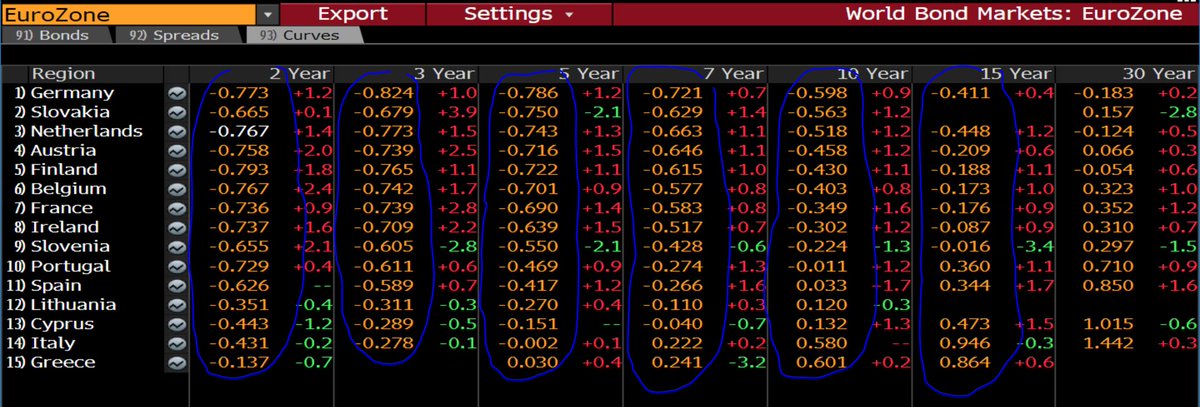

Almost insolvent eurozone sovereign countries financing themselves at negative rates, a perverse incentive to increase debt and ignore structural imbalances.

4) A policy designed to give time to make structural reforms becomes an excuse to avoid them.

4) A policy designed to give time to make structural reforms becomes an excuse to avoid them.

A massive bond bubble with a very poor impact on equities.

5) ECB's policy, designed to be temporary, has become permanent and accelerated while equities' impact is negligible.

End thread @threader_app

5) ECB's policy, designed to be temporary, has become permanent and accelerated while equities' impact is negligible.

End thread @threader_app

• • •

Missing some Tweet in this thread? You can try to

force a refresh