bbntimes.com/en/global-econ…

Open thread @threadreaderapp :

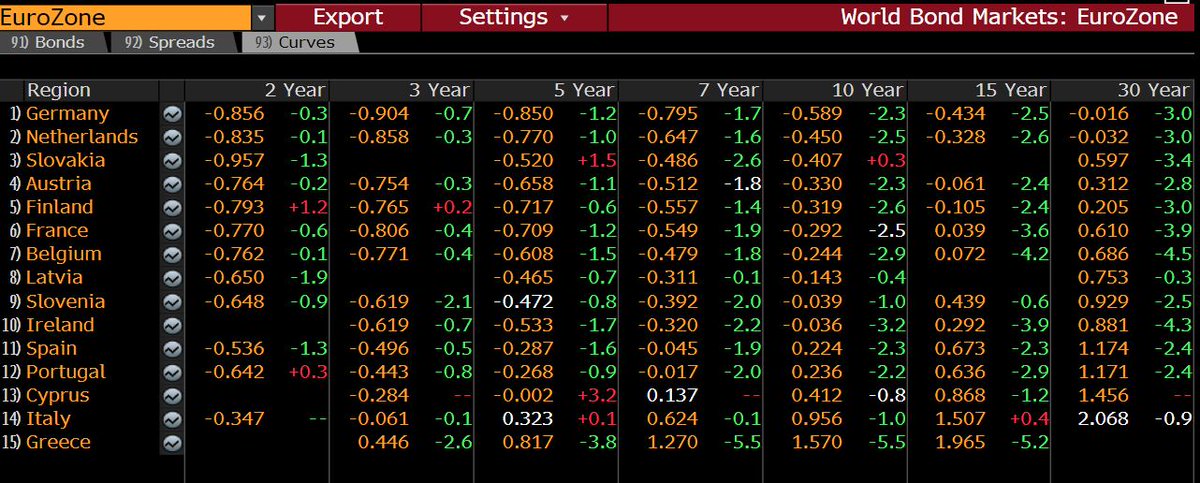

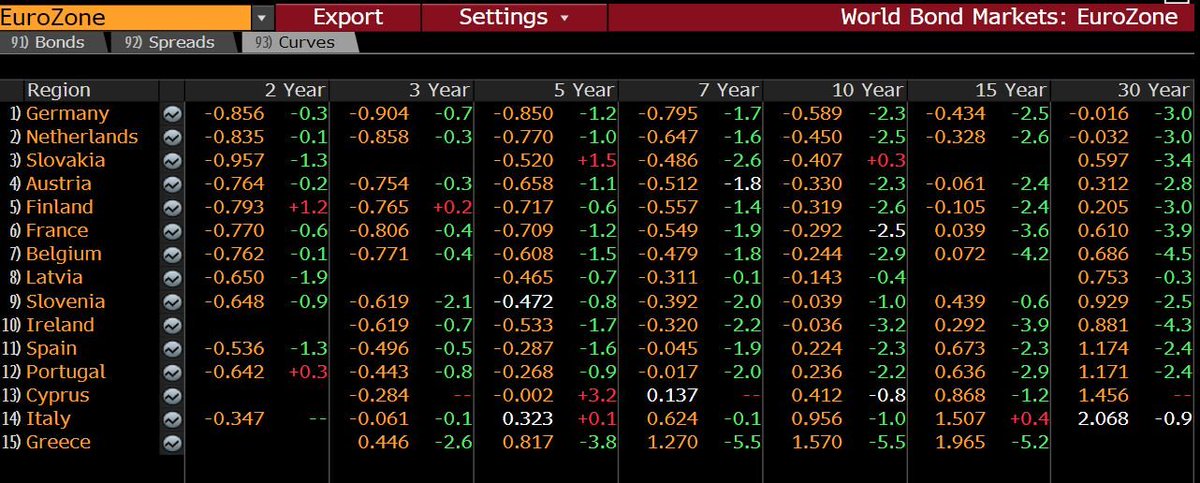

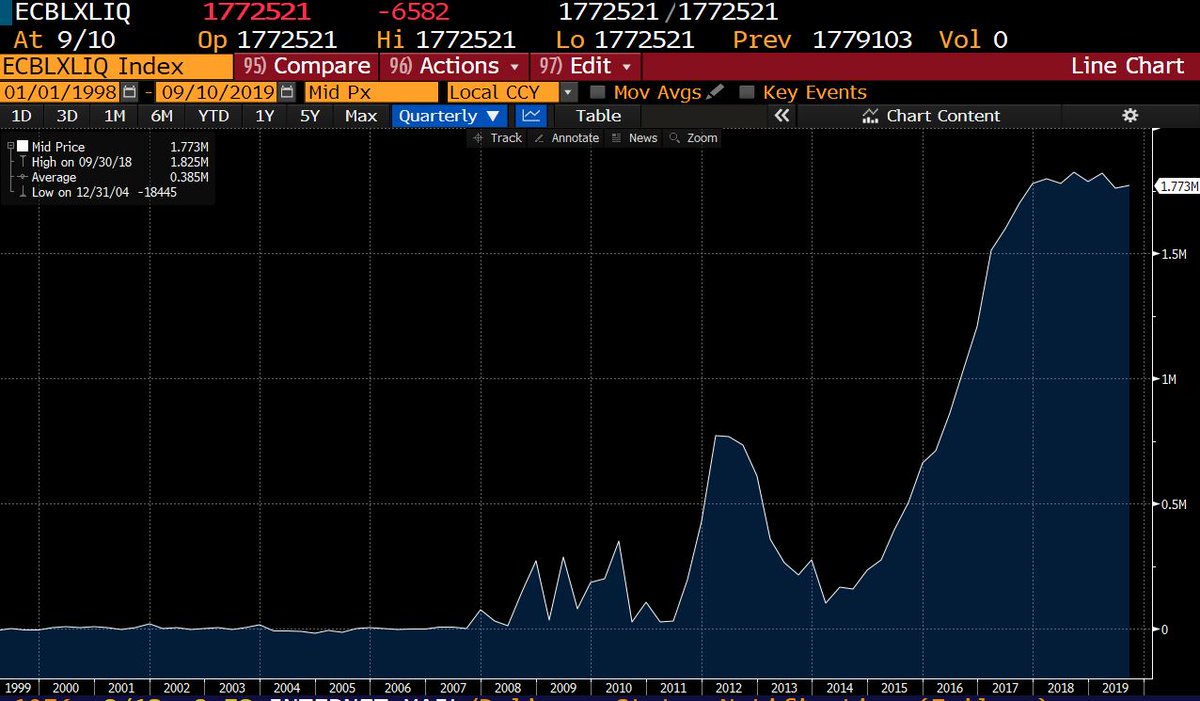

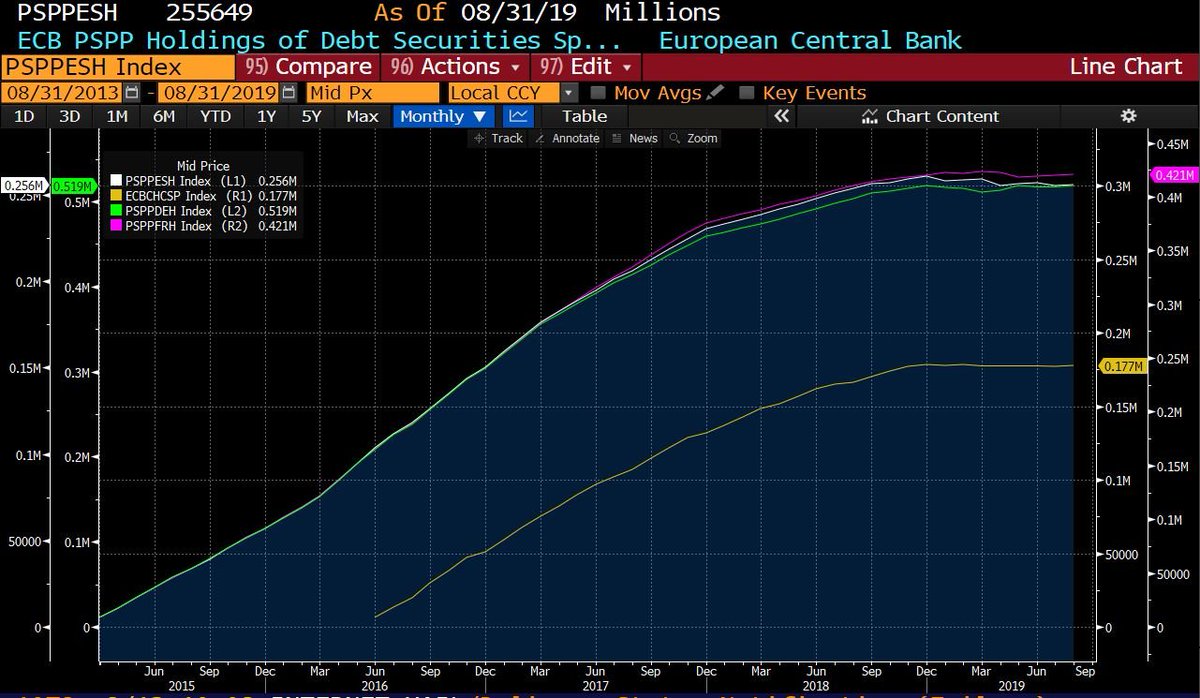

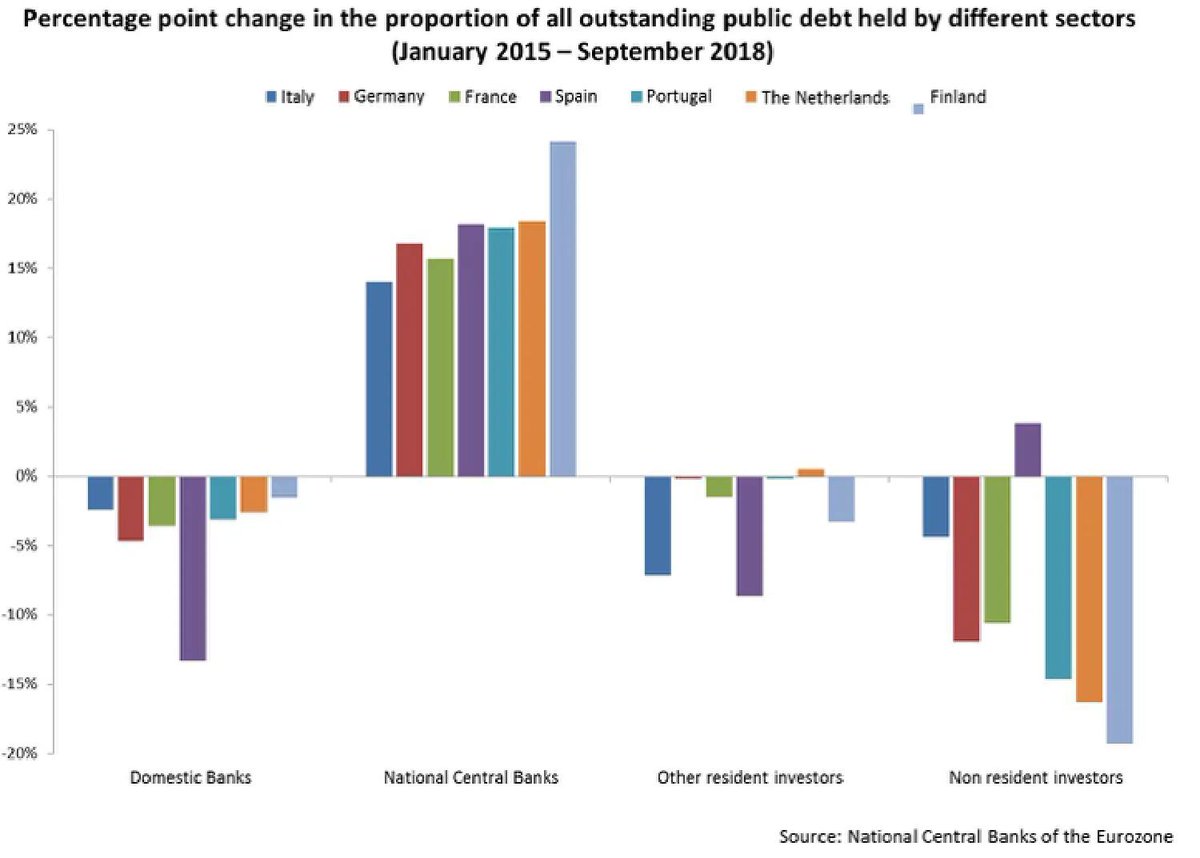

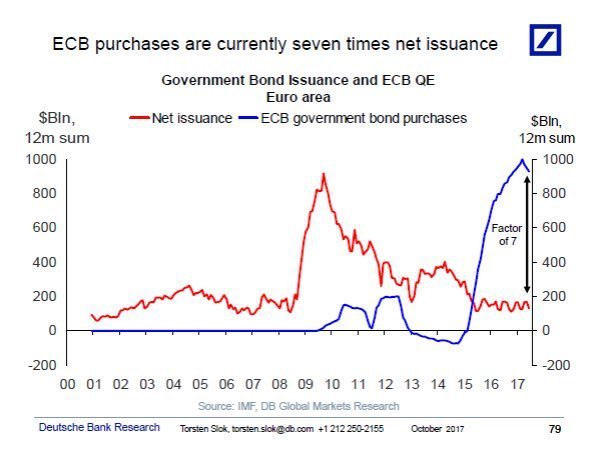

This has saved governments more than 1 trillion euro in interest expenses (handelsblatt.com/today/finance/…)

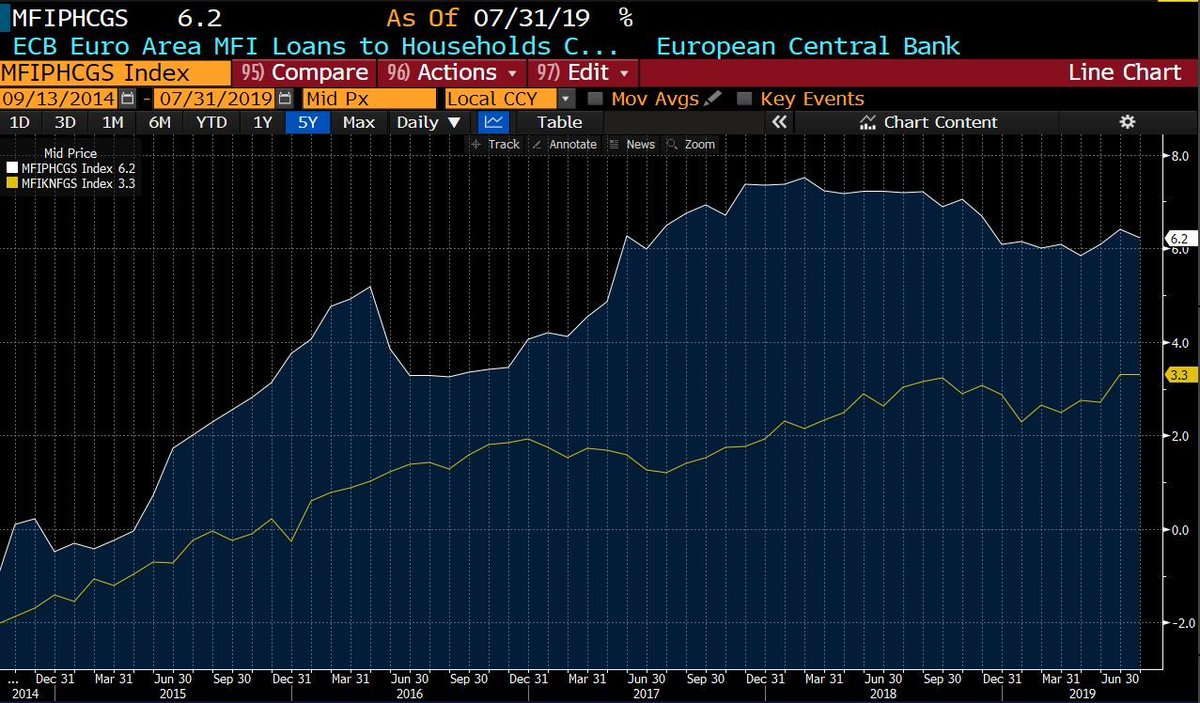

There is no higher solvent credit demand because monetary policy perpetuates overcapacity and zombifies the economy. Share of zombie companies has soared c30% since 2013 (BIS)

The ECB believes the eurozone problem is one of excess saving and lack of demand when it is of excess debt and oversupply.

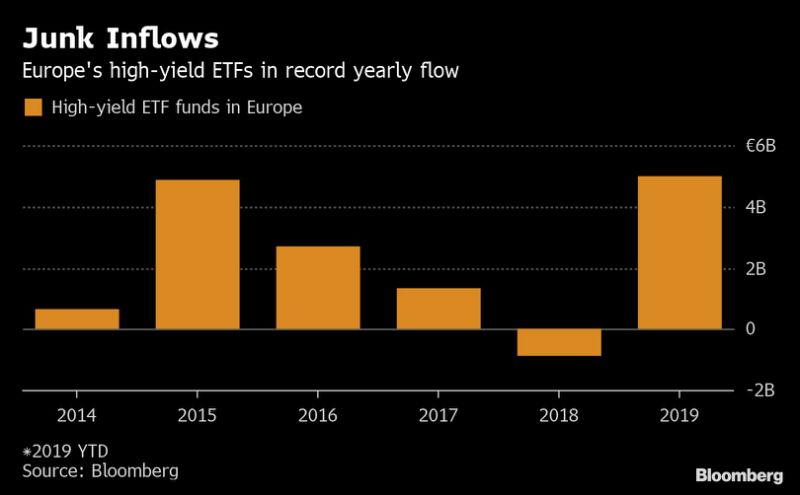

This disguises risk and creates an enormous bubble.

Governments burden the productive private sector with higher taxes and unnecessary regulations, so economic surprise falls despite massive stimulus.

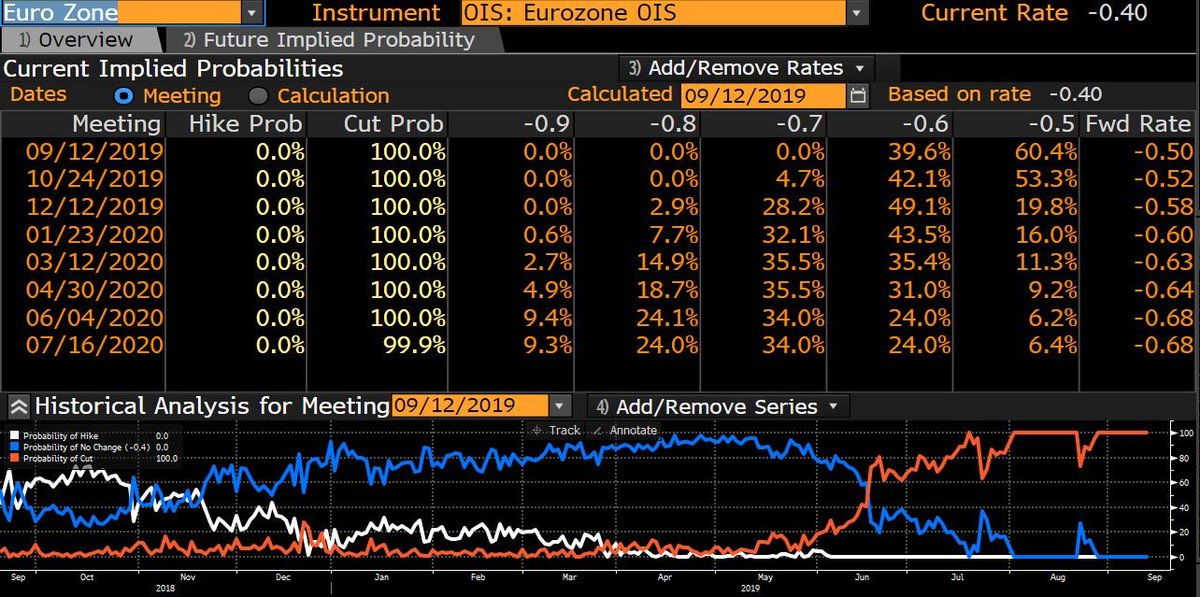

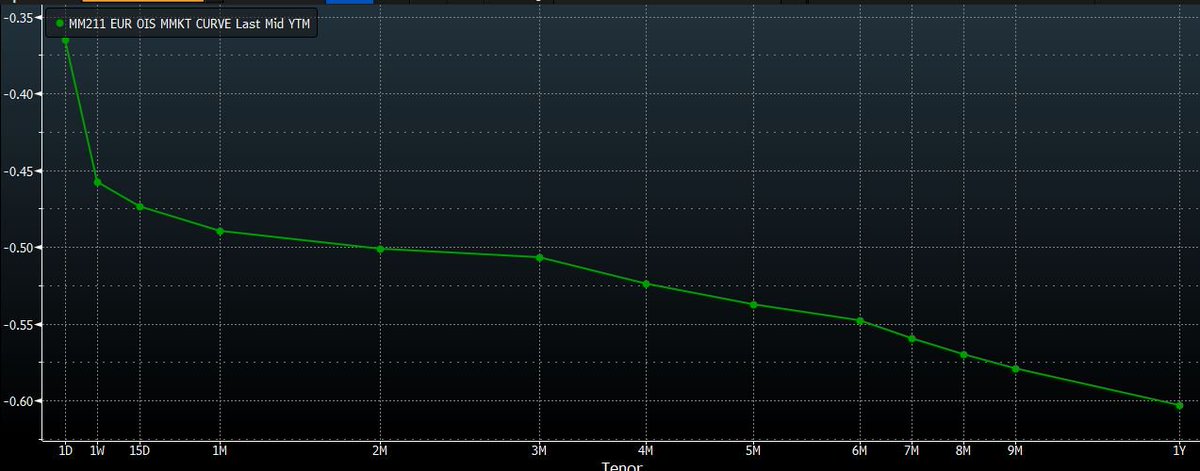

Financial repression leads economic agents to take more risk for lower yields and central banks go from lenders of last resort to enablers of financial bubbles.

#Endofthread

reuters.com/article/eurozo…