1/n

Last week TERI released its flagship report on the prospects for H2 in India.

The full report is here. bit.ly/3poYA2n

At 140 pages, I can't summarize the whole thing in a single thread, but I can do a series of threads.

Today's: H2 in the Indian power sector.

Last week TERI released its flagship report on the prospects for H2 in India.

The full report is here. bit.ly/3poYA2n

At 140 pages, I can't summarize the whole thing in a single thread, but I can do a series of threads.

Today's: H2 in the Indian power sector.

2/n

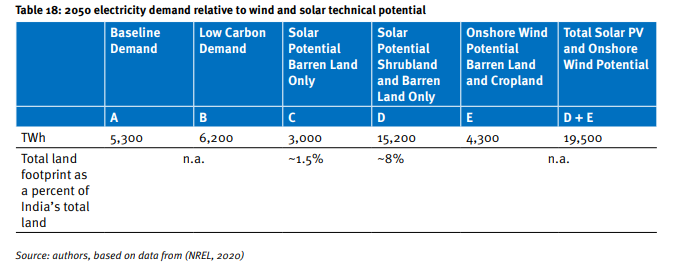

We do a bottom up assessment to 2050 of power demand across all sectors, including direct and indirect electrification (for electrolytic H2 production).

In the low carbon scenario, power demand reaches as much as 6200 TWh by 2050, with almost 1000 TWh of that for H2. 👇

We do a bottom up assessment to 2050 of power demand across all sectors, including direct and indirect electrification (for electrolytic H2 production).

In the low carbon scenario, power demand reaches as much as 6200 TWh by 2050, with almost 1000 TWh of that for H2. 👇

3/n

This would consume a very substantial chunk of India's maximum estimated technical potential for onshore wind and solar PV. 👇

The required rate of supply growth and land footprint may be challenging!

This reinforces the message: direct electrification wherever possible.

This would consume a very substantial chunk of India's maximum estimated technical potential for onshore wind and solar PV. 👇

The required rate of supply growth and land footprint may be challenging!

This reinforces the message: direct electrification wherever possible.

4/n

To asses the role for power-H2-power in system balancing, we ran our hourly model for more than 60 scenarios.

Key message: we don't need long-term seasonal storage of the kind power-H2-power would be suitable for, until RE reaches very high levels.

To asses the role for power-H2-power in system balancing, we ran our hourly model for more than 60 scenarios.

Key message: we don't need long-term seasonal storage of the kind power-H2-power would be suitable for, until RE reaches very high levels.

5/n

There are several reasons for this:

1. Power-H2-power is expensive and inefficient.

2. Until you have high RE, conventional sources provide more cost effective seasonal balancing.

3. The dominant seasonality in India's power system is intraday not inter-season.

There are several reasons for this:

1. Power-H2-power is expensive and inefficient.

2. Until you have high RE, conventional sources provide more cost effective seasonal balancing.

3. The dominant seasonality in India's power system is intraday not inter-season.

6/n

The per unit cost of decarbonizing the last 10-15% of generation with RE is high (~35 Rs/kWh).

This is driven largely by the cost of seasonal storage (although curtailed RE and intraday storage also adds to costs).

Again: H2 in the power system only when necessary!

The per unit cost of decarbonizing the last 10-15% of generation with RE is high (~35 Rs/kWh).

This is driven largely by the cost of seasonal storage (although curtailed RE and intraday storage also adds to costs).

Again: H2 in the power system only when necessary!

7/n

At current costs, a fully decarbonized power system has higher system costs than the present system, largely because of the cost of squeezing out the last 10-20% of generation.

As technology costs fall to 2050, we estimate a fully decarbonized system may be cost effective.

At current costs, a fully decarbonized power system has higher system costs than the present system, largely because of the cost of squeezing out the last 10-20% of generation.

As technology costs fall to 2050, we estimate a fully decarbonized system may be cost effective.

8/n

Power-H2-power is complementary to wind, which introduces the most substantial inter-seasonal variability into the power system (demand is not very seasonal in India).

Low wind and electrolizer costs drive power-H2-power uptake, low solar and li-ion costs inhibit it.

Power-H2-power is complementary to wind, which introduces the most substantial inter-seasonal variability into the power system (demand is not very seasonal in India).

Low wind and electrolizer costs drive power-H2-power uptake, low solar and li-ion costs inhibit it.

9/n

To this extent, intraday li-ion and power-H2-power seasonal storage are - to a degree - substitutes 👇. This is because demand is not particularly seasonal, and the main source of seasonality - wind - depends on how much you build.

To this extent, intraday li-ion and power-H2-power seasonal storage are - to a degree - substitutes 👇. This is because demand is not particularly seasonal, and the main source of seasonality - wind - depends on how much you build.

10/n

To this extent, power system decarbonization in India may depend less on the deployment of seasonal storage than in Northern Europe or North America, where both demand (heating) and supply (wind) have inherent substantial inter-seasonal variability.

To this extent, power system decarbonization in India may depend less on the deployment of seasonal storage than in Northern Europe or North America, where both demand (heating) and supply (wind) have inherent substantial inter-seasonal variability.

11/n

Key take-aways:

1. The rapid baseline growth of demand makes prioritizing H2 even more important. Don't use it where electrification can get the job done!

2. Seasonal storage shouldn't be needed until you reach high RE shares.

Key take-aways:

1. The rapid baseline growth of demand makes prioritizing H2 even more important. Don't use it where electrification can get the job done!

2. Seasonal storage shouldn't be needed until you reach high RE shares.

12/n

3. How much seasonal storage you deploy depends on how much wind you deploy, which in turn depends on the relative economics of solar+li-ion versus wind.

4. With falling costs, a very high RE power system looks attractive in the long-term.

3. How much seasonal storage you deploy depends on how much wind you deploy, which in turn depends on the relative economics of solar+li-ion versus wind.

4. With falling costs, a very high RE power system looks attractive in the long-term.

• • •

Missing some Tweet in this thread? You can try to

force a refresh