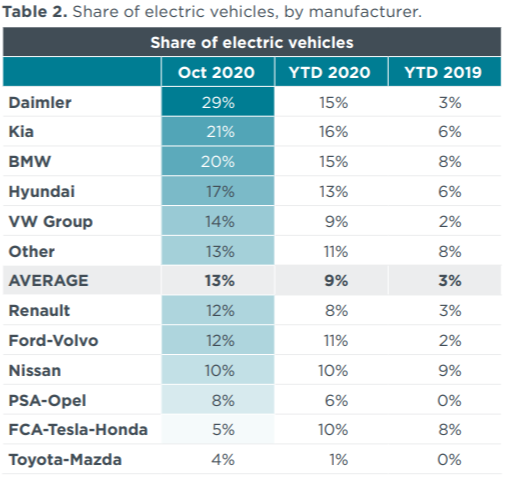

1/ ICCT came out with their October European analysis. Bottom line: Daimler, FCA/Tesla/Honda and VW don't look good, Ford-Volvo not too close while the others are close to the target.

$TSLA $TSLAQ

$TSLA $TSLAQ

2/ However, if you look close enough, October #'s are usually much closer to the targets (that vary by OEM! as their car sizes and other parameters vary too) than yearly averages. Based on that alone, Nov/Dec will help pretty much everone better than average reach targets.

3/ For example, look at Daimler: their share of electrified vehicles has doubled during the year.

Oct figures don't include models like Volvo XC40, Renault Twingo, Fiat 500e, VW ID.4 and others that will add to Nov-Dec data, while most others have a strong EOY push.

Oct figures don't include models like Volvo XC40, Renault Twingo, Fiat 500e, VW ID.4 and others that will add to Nov-Dec data, while most others have a strong EOY push.

4/ And these are BEVs listed above, PHEVs account for an even higher reduction, however, incentives distort the picture country by country.

6/ Overall, FCA with PSA (Stellantis combined) won't need credits from 2021 (although they still have the contract with Tesla in place), VW won't need credits as their MEB platform ramps up, Daimler is electrifying heavily so with EQA and EQB they won't need credits either.

7/ That will leave Tesla with tiny JLR and Honda as potential credit buyers from 2022 (unless the capped super credit distorts the pic too much; but I expect most to be compliant from 2022 based on October actuals and expected 2021 progress).

• • •

Missing some Tweet in this thread? You can try to

force a refresh