1/ Now that I’ve reached 4206.9 followers, I thought it’d be time for a *short* historical overview.

I’ve joined Twitter in October of 2018. I had a specific reason in mind regarding $TSLAQ, so I wanted to become part of the community.

$TSLA

I’ve joined Twitter in October of 2018. I had a specific reason in mind regarding $TSLAQ, so I wanted to become part of the community.

$TSLA

2/ But I haven’t planned my presence for long. Hence my handle: I wanted something I couldn’t emotionally relate to. @fly4dat sounded like something even below neutral. Who likes flies anyway? Not even flies do in some cases.

3/ First, I was trying to add value by finding some strange stuff, of which, at that time, have been way more than now.

Lots of speculation about M3 ramp-up, SuX refresh (LOL), and the evergreen scams: FSD, the Semi, the Roadster.

Lots of speculation about M3 ramp-up, SuX refresh (LOL), and the evergreen scams: FSD, the Semi, the Roadster.

4/ Leaf blowers, Teslaquila (yeah, Elon is sometimes late but always delivers! bah), who knows what else.

We've been speculating on real gross margins. That hasn't changed since.

We've been speculating on real gross margins. That hasn't changed since.

5/ I’ve gained a few early followers. The first one was @Polixenes13, but veteran Q like @contrapositiv3, @coverdrive12, @clagasperoni, @o_rust, @contrarianshort, @eventdrivenmgr, @harfangcap, @twainsmustache, @hilinetrail, @pluginfud were among my first followers.

6/ I’ve laughed a lot at the jokes and puns of @ko_strad. @paul91701736 still hasn’t put me on the blocklist.

There are a couple of silent ones like @thebubblebubble, @antonwahlman, but hey, I have silent real life friends too.

There are a couple of silent ones like @thebubblebubble, @antonwahlman, but hey, I have silent real life friends too.

7/ I’ve made some virtual friends too, starting with @deansheikh1, @AlexT18503601, @teslacharts, @montana_skeptic, @mtass7, @scidood . Among them, I’ve learned a LOT from the extremely knowledgeable people like @ortheraboot, @paul_m_huettner, @cppinvest, @boriquagato, @eriksdalen

8/ @almingtoncap, @4xrevenue, @bradmunchen, @jaberwock2, @jcoviedo6, @sascha_p, @davidmarchorn, @PlainSite and @kawasakiKR11, and some whose accounts are private so I won't name them here.

9/ We’ve lost way too many friends on the way. One of the most painful ones is @skabooshka, but there are a lot who have been suspended, got their accounts deleted. Many simply had enough and quit. No wonder, but I'm missing them.

10/ On the other side of the trade, I’ve had decent discussions with @smack_check, @greentheonly, @troyteslike, @ihors3, @mortenlund89, @fmossotto, @nasalahe, @vedaprime, @abledoc, @tilmanwinkler and @tslafanmtl. More bulls worth mentioning are @reflexfunds, @DKurac, @TaylorOgan.

11/ There are way too many good ppl out there to mention, so the above list is very much incomplete. I’ve left out a few because of privacy reasons, and others due to the lack of space on Twitter. Or due to the small brains flies have. Apologies.

12/ I feel I became an integral part of the Q community in 19Q1. During my visit to Miami, it has been my first sighting of an M3. Wow, what an underwhelming experience it was.

13/ I’ve read a lot about panel gaps, paint defects, frozen door handles, but reality was worse than my expectations. Pics with PedroERP:

https://twitter.com/fly4dat/status/1084279859449380864?s=20

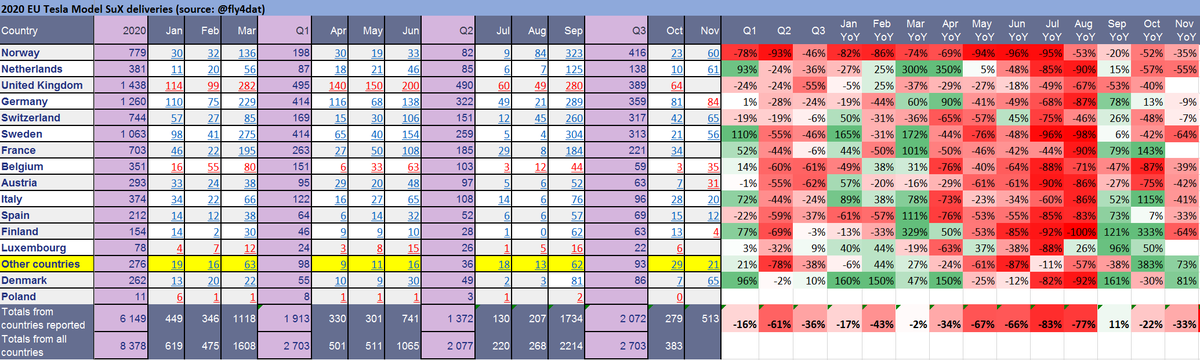

14/ This happened at the same time as the M3 was about to be introduced in Europe. I gave delivery estimates, which were much lower than the typical bull estimate of 50-100k/Q but higher than the typical bear 8-10k estimate:

https://twitter.com/fly4dat/status/1102026591427792896?s=20.

15/ In retrospect, they haven’t delivered all the orders, had a bit of backlog for Q2, and I’m still very happy with that estimate. Had a few nice estimates (Europe and WW) since.

16/ There has been a lot of speculation about my nationality and place of residence. I'm still not ready to disclose it. But curious about your best guess (pls comment "other"!)

17/ What I can tell you is that I'm honored to be followed by one of the wealthiest ppl in my country. I salute him for standing up for his values.

18/ Fun thing is that I also have an IRL friend even often interacting with me who doesn't know who I am. I feel bad. I'll tell he/him/she/her later. He/him/she/her, just to make sure.

19/ Having over 4206.9 followers is a huge thing for a tiny European fly who struggles with his English. But flies are where shit is. And there is a lot of shit here, so I'll stay until it goes away.

20/ And with this, @brodieferguson, my second follow after @skabooshka just followed me back. These 2 guys have been the ones that I've read from a browser before I've regged my first ever Twitter account. Wow.

Okay. So I mustn't have made a typo at the very top of my list. Tagging @orthereaboot again. Sorry.

• • •

Missing some Tweet in this thread? You can try to

force a refresh