The Economist argues: the fiscal stance should depend on the unemployment rate: "pledge not to tighten fiscal policy actively until the economy has crossed a defined threshold". Implementing this in the EU would be revolutionary. A thread: /1

economist.com/leaders/2020/1…

economist.com/leaders/2020/1…

Interestingly, the origins of cycle-sensitive budgeting lie in a Keynesian approach to fiscal policy. In its original sense, cycle-sensitive budgeting was tailored to contribute to the engineering of full employment /2

ineteconomics.org/research/resea…

ineteconomics.org/research/resea…

The concept was first proposed by Gunnar Myrdal, who wanted to allow the Swedish government to balance the budget over the entire business cycle, which was supposed to promote a fiscal policy capable of smoothening cyclical swings in the economy /3

The concept of cycle-sensitive budgeting gained importance when it was incorporated into fiscal programs in the New Deal era of the 1940s, where it helped popularize Keynesian thinking. /4

In this original sense, cycle-sensitive budgeting was tailored to contribute to the engineering of full employment, and the corresponding ‘High-Employment-Budgets’ were built upon politically agreed target levels of unemployment. /5

Tax rates and public expenditures were set to yield small surpluses if the target was reached, so that automatic stabilizers (e.g. unemployment benefits, income taxes) would lead to deliberate deficits if the target unemployment rate was surpassed. /6

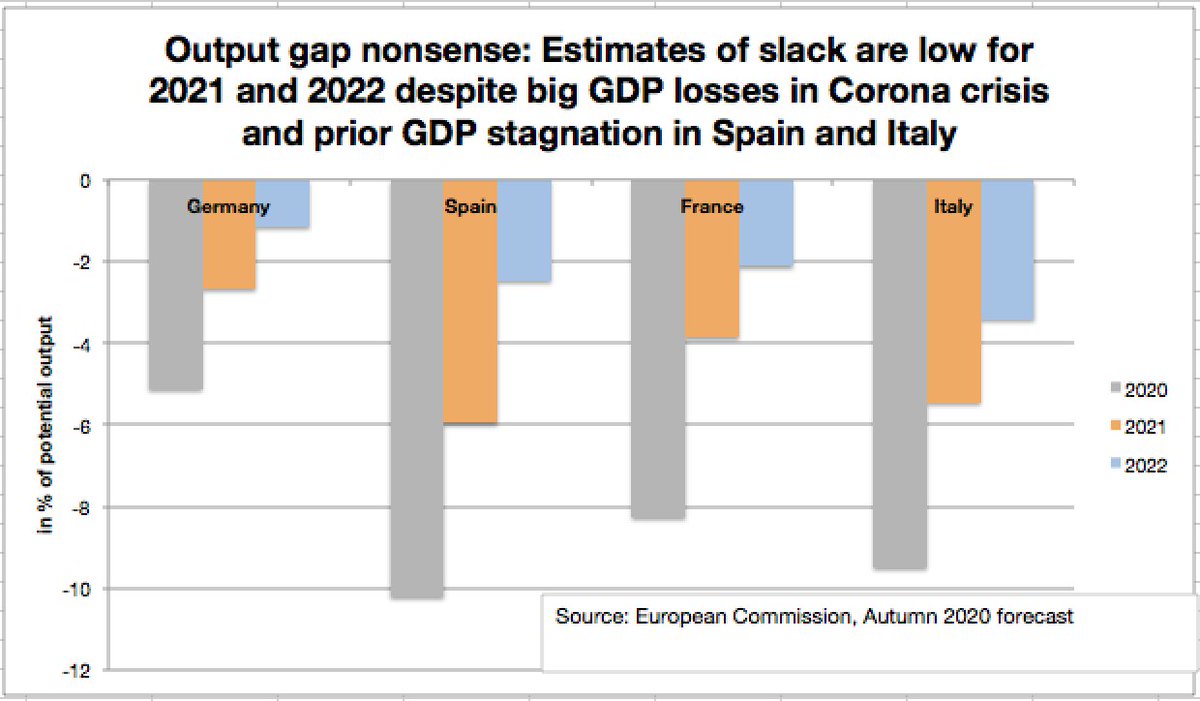

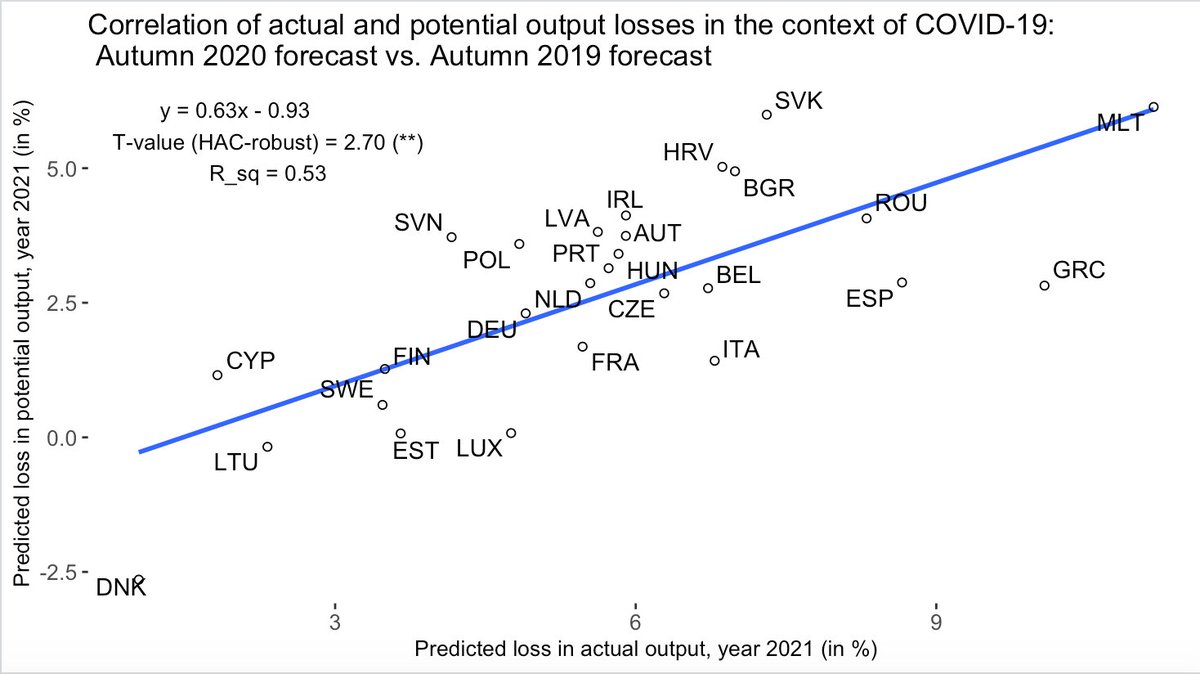

In the mid1970s, neoclassical macroeconomics put forward the central proposition about the ineffectiveness of expansionary fiscal policies (the Lucas Critique), which promoted more of a policy focus on controlling inflation rather than employment. /7

This move towards emphasizing inflation and fiscal deficits represented a major change in the goals of economic policy. Cycle-sensitive budgeting, as employed today in the EU's fiscal rules, focuses on the cyclically-adjusted balance (CAB). /8

researchgate.net/publication/33…

researchgate.net/publication/33…

In theory, the cyclically-adjusted balance represents the budget balance that would materialize if all cyclical fluctuations were absent (and, hence, potential output would equal actual output). /9

The idea embedded in the EU's fiscal rules today is to balance the budget over the business cycle, not to make the fiscal stance dependent on the situation on the labour markets. The results of this approach are arguably not very good: /10

jakob-kapeller.org/images/pubs/20…

jakob-kapeller.org/images/pubs/20…

Anything along the lines as proposed in the piece by The Economist would be a major break with the current approach of what the main policy targets of fiscal policy should be - and, therefore, revolutionary.

• • •

Missing some Tweet in this thread? You can try to

force a refresh