Update output gap nonsense: My new column shows rising fiscal consolidation pressures in 🇩🇪 caused by new Commission estimates. Data thread: according to the Commission, German potential output will fall by €77 billion in 2021 compared to pre-Corona /1

wiiw.ac.at/n-470.html

wiiw.ac.at/n-470.html

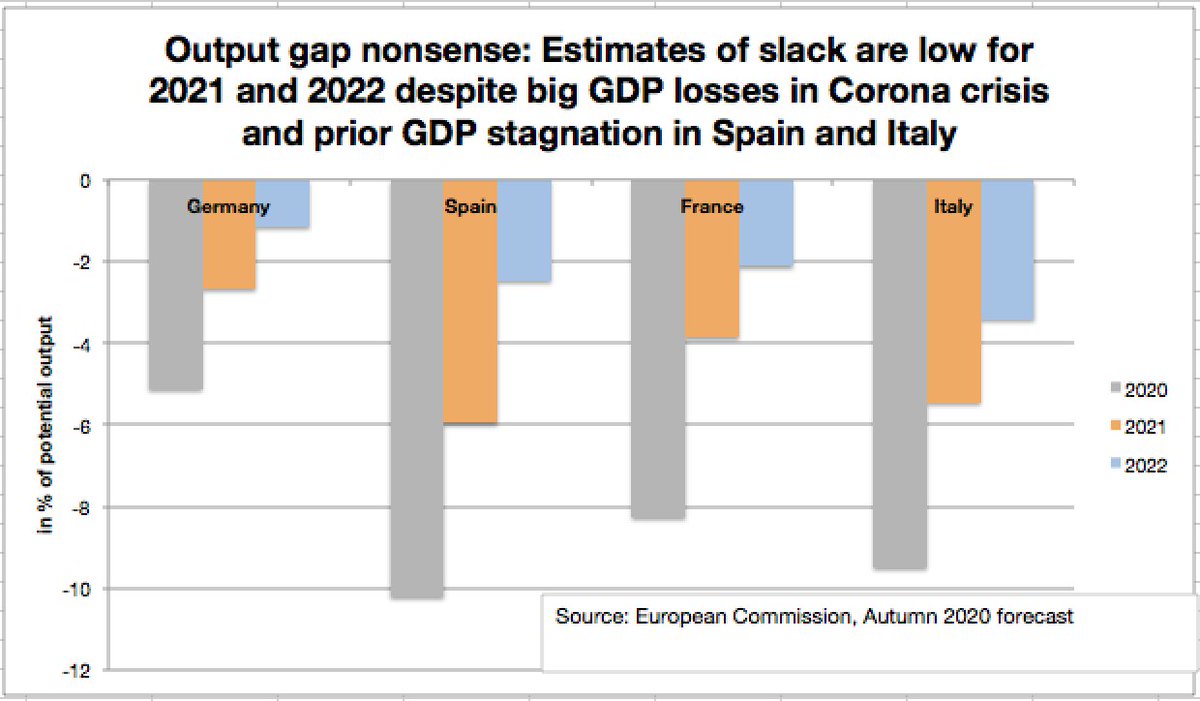

This results in a downward revision in estimates of economic slack in 🇩🇪: The output gap in 2021 falls in the official Commission forecast to -2.7% in 2021. In view of the strong corona downturn this is implausible! Without the downward revision, the output gap would be -4.9% /2

As a result, the estimate of the "structural" budget deficit for the coming year increases by 1.2 % of GDP. About €42 billion of the fiscal deficit forecast is suddenly no longer attributed to economic weakness, but is considered "structural" /3

Corona is a temporary shock. But this does not justify that we already revise potential output downwards for the years to come. We do not know the long-term effects, and it is self-defeating to rely on pro-cyclical estimates of potential output. /4

Even if we knew for sure that there are factors pushing potential output down in the coming years, would this justify a restrictive fiscal policy that would exacerbate the problems even further? No. Fiscal policy will be essential in promoting recovery. /5

Important: Medium-term goals in EU fiscal rules are limits of the "structural" deficit. If the rules are reactivated, fiscal consolidation pressure will increase significantly. This threatens to prevent effective economic policy, which is essential for successful recovery /6

The above-mentioned revisions are pro-cyclical and are largely due to problems with the statistical filters used in the Commission model. We know problems with crisis-driven estimates from other €countries from the times of the Euro crisis /7

jakob-kapeller.org/images/pubs/20…

jakob-kapeller.org/images/pubs/20…

Should the economic situation in Germany deteriorate compared to the current forecast, further downward revisions in potential output must also to be expected beyond 2021, which will successively further restrict the scope for fiscal policy action. /8

There is a risk of negative feedback effects if downward revisions in potential output require stronger fiscal consolidation, undermine economic recovery and ultimately have a negative impact on debt sustainability. @AntonioFatas /9

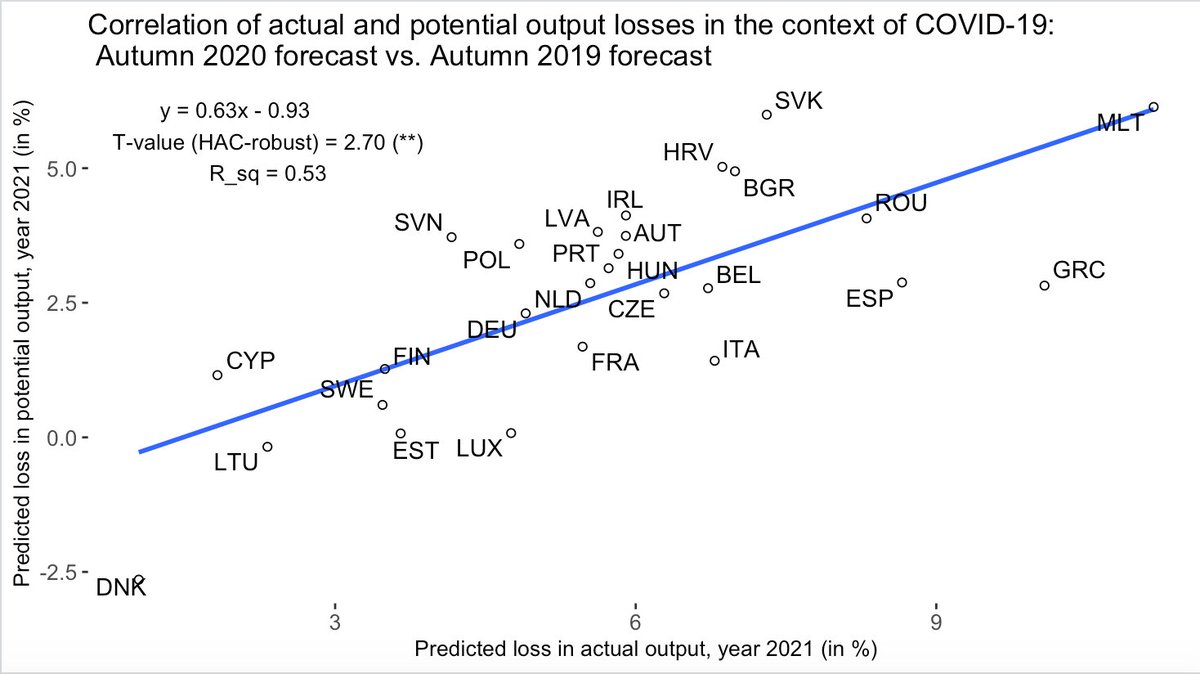

Of course, not only Germany is affected. In its autumn 2020 forecast the Commission systematically lowered its forecast of potential output to a larger extent for countries that are predicted to suffer a larger loss of GDP (compared to before Corona) (procyclicality!). /10

Estimates using the Commission model represent an even more binding requirement in the national German "debt brake" than at the EU level.

It is high time that German policy-makers push for more reasonable estimates of the structural deficit! /end

It is high time that German policy-makers push for more reasonable estimates of the structural deficit! /end

• • •

Missing some Tweet in this thread? You can try to

force a refresh