1/ The Tether ( $USDT ) controversy and its relation to #Bitcoin ( $BTC ). Join me in exploring why #tether is crypto's dirty little secret, and why #2021 might be the worst year yet (for crypto).

2/ I will use this thread to collect even future events / developments on #tether, so you might want to come back to it later on.

3/ For the uninitiated, #tether is a stablecoin supposedly "backed" 1:1 by real $, yet it has been surrounded by controversy for years over whether or not that is the case, considering the companies behind #tether and Bitfinex never presented an actual audit of their reserves.

4/ In fact, Tether's own lawyer admitted that each $USDT is backed by only 74% cash or "cash equivalents". And this was in 2019, when #tether's marketcap was ~ 5B. bloomberg.com/news/articles/…

5/ Today, at the very end of 2020, $USDT's market cap has breached 20 Billion $. Most of it added towards the second half of the year. Seems like #tether went on a printing spree, similar to the fed's "printer go brrr" meme, as regulators get closer to uncover the scam.

6/ Speaking of regulators, Bitfinex (owned by the same group that owns #tether) is expected to hand over critical loan documents in "the coming weeks" to the NYAG over a 850M$ coverup. coindesk.com/nyag-tether-bi…

7/ In other news, the US Treasury might introduce a bill that makes "stablecoins" securities, leading the SEC to sue Tether. fxstreet.com/cryptocurrenci…

8/ A full timeline, up to sometime in 2019 is available here, for those interested. It's a VERY interesting story.

amycastor.com/2019/01/17/the…

amycastor.com/2019/01/17/the…

9/ So if #tether's own lawyer admitted $USDT is not 1:1, how come people keep using it? Well, since then #tether changed its tune again stating that $USDT is backed by a "combination" of "cash and other assets" that make it backed 1:1 to USD (🤦♂️ ).

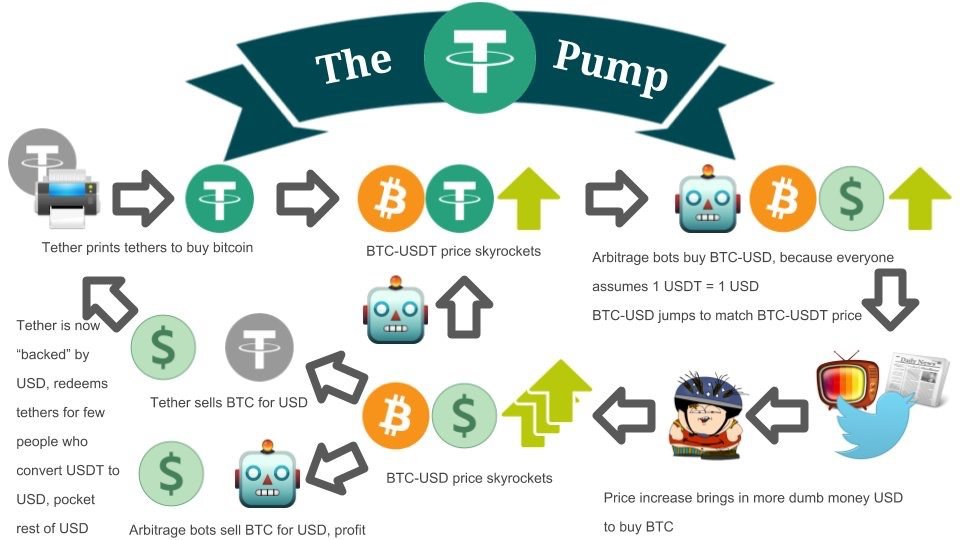

10/ $USDT is majorly responsible for the current #Bitcoin (and crypto in general) bullmarket. In fact, if it weren't for #tether's printing, we wouldn't be having $BTC at near 30k. The correlations between Tether's printing and BTC price is undeniable and documented for years.

11/ One should ask how come the great majority of #tether's supply was printed in the last few months of 2020, when the legal noose keeps tightening? Is it a coincidence that in this time period $BTC also reached almost 30k $? I think not.

12/ The crypto enthusiasts laugh and meme about the FED's "printing", touting #Bitcoin as an alternative - "hard money" - yet they turn a complete blind eye to #tether and @bitfinex's own printing.

https://twitter.com/zeroshorts/status/1343613266921095169?s=20

13/ Most in the crypto industry believe that even if #tether dies, nothing major would happen to #Bitcoin or crypto in general, as now we have plenty of "more reliable" stablecoins.

14/ Yet traders keep overwhelmingly using $USDT over any other stablecoin, probably because, like David Gerard states "I suspect the other stablecoins are just a bit too regulated for the gamblers. Tether is functionally unregulated."

15/ In fact, #bitcoin / #tether volumes are now magnitudes greater than actual $BTC/$USD volumes. I also doubt this isn't the case for any other crypto that has a $USDT pairing.

https://twitter.com/KaikoData/status/1334901157802766338?s=20

16/ "[..]the whole crypto industry depends on Tether staying up. #Tether is Too Big To Fail.

17/ The purpose of the crypto industry, and all its little service sub-industries, is to generate a narrative that will maintain and enhance the flow of actual dollars from suckers, and keep the party going [..]"

18/ This comes from this excellent David Gerard article: davidgerard.co.uk/blockchain/202…

19/ Have you asked yourself why the STABLE act is made to be such a "big bad wolf" in the crypto industry? It's because it will require stablecoin issuers to become banks... which #tether - being in a legal noose - has 0% chance of getting.

20/ So if the #tether party stops, what then? Well, see here:

https://twitter.com/pat_jane_crypto/status/1344619098995634178

21/ For those that think "nothing will happen" as #tether's marketcap would just go to the other stablecoins, think again. The tether crisis will spread to other stablecoins sparking a major liquidity squeeze.

22/ As the price of #Bitcoin collapses exchanges will close down because they can’t handle the large volume of withdrawal. Like the good Amy Castor put it:

23/ "Essentially, [tether] it’s keeping the entire BTC market afloat. If Tether were to get the Liberty Reserve treatment, the price of #bitcoin is unlikely to ever recover."

amycastor.com/2020/12/14/new…

OK, so what then, what are we supposed to do? 👇👇👇

amycastor.com/2020/12/14/new…

OK, so what then, what are we supposed to do? 👇👇👇

24/ Know that the #tether story WILL implode, it's a just a matter of time. Considering the amount of $USDT being printed, we probably have little time left before the whole thing collapses. Are you going to be left holding the bag?

25/ Remember that #crypto regulations are coming in just a few weeks:

https://twitter.com/BabaCugs/status/1334858676092481537?s=20

26/ "So Pat, I will just hold $USDC or $BUSD, I'll be good right?". NO! When the $USDT ponzi collapses, ALL other stablecoins will lose credibility or will experience a liquidity squeeze, rendering them VERY expensive.

27/ Your best bet will be either owning tokenized #gold or an algorithmic stablecoin (though they are not mature enough). An alternative might be minting $xUSD (via $XHV @HavenXHV) or simply hold cash.

28/ "We've had #tether FUD for years, I would have missed out on lots of $$$ if I believed any of it... why would I listen now?". Well, Madoff’s scheme went on for 15 years also, attracting institutional money (sounds similar?) before collapsing.

29/ But realize that what you're doing is betting on NOT being the LAST sucker waiting in line to cash out your paper gains. How confident are you on your ability to perfectly time your exit before it's too late?

30/ I might have forgot to mention the 1.4T (that's trillion! ) RICO case against @bitfinex. classaction.org/news/bitfinex-…

31/ I don’t know why people think the US government will allow a foreign 3rd party to mint 1:1 US dollars when the right to print dollars, crypto or otherwise, belongs to the US government.

32/ I don’t know why people think “they haven’t done anything yet” ever could possibly mean that nothing will happen in the future, especially when court dates are set.

33/ I don’t know why people think “the United States has no jurisdiction,” when history proves how that has never once stopped them before. I don’t know why people favor listening to their emotions rather than a logical assessment of the situation and potential hypotheticals.

35/ Shortly after this thread, @Tether_to tweets this.

Coincidence?

I don't think so ;-)

Coincidence?

I don't think so ;-)

https://twitter.com/Tether_to/status/1344743570465558537?s=20

36/ For the #defi advocates throwing $DAI or $DUSD or $yUSD around as alternatives, please check out what makes up those "decentralized" coins. They are a basket of centralized coins (which include $USDT). If $USDT collapses, they all lose their peg.

37/ Of course, holding them is still less risky than directly holding $USDT. So if you currently have $USDT, a level-up in safety would be to go into $DAI or $yUSD, though of course this is a half-assed solution.

38/ Doesn't look like much of the recent #tether explosion is "on the books"...

https://twitter.com/ExkrementKoin/status/1338662619180371973?s=20

39/ "#Tether should introduce the cryptocurrency community to the concept of systemic risk: after something is infrastructure, it gets into EVERYTHING. When you withdrawal the infrastructure suddenly, a bunch of things break all at once...

40/ ...even ones that don’t look exposed, because of the transitive nature of the dependency graph. Where is Tether critical, load-bearing infrastructure? Lots of places...

41/ It represents the liquidity for many altcoins. It is the unit of account and the internal reserve of many of the less-banked exchanges. It very probably functions as the credit supply which keeps liquidity in the system."

42/ This comes from the excellent article by @patio11 on the whole #tether scandal. Suggest you to read every bit of it. kalzumeus.com/2019/10/28/tet…

43/ What @patio11 didn't mention is how deep $USDT's integration is in #defi. It's literally everywhere, part of every other "ETF"-like stablecoin. When #tether goes, much of #defi goes away with it.

44/ Here's a recent #tether write-up with implications for #defi

cryptobreakdown.substack.com/p/tether-lawsu…

cryptobreakdown.substack.com/p/tether-lawsu…

45/ Here's a thread I made debunking the theory that more #tether printing is due to increased genuine demand from investors:

https://twitter.com/pat_jane_crypto/status/1346118494115524609?s=20

46/ and here's a new trade made by someone else with some more juicy information I didn't get into.

https://twitter.com/JacobOracle/status/1346133062204198917

47/ Key Excerpts and Commentary from NYAG/Tether Court Transcript

Thanks @Florian82231831

bennettftomlin.com/2019/05/21/key…

Thanks @Florian82231831

bennettftomlin.com/2019/05/21/key…

Here's a better resolution: postimg.cc/47KBTh1L

50/ Here's @ahcastor 's comments and transcriptions of the recent #tether podcast. As expected, it's a nothing burger, and tether keeps covering it's ass.

amycastor.com/2021/01/10/tet…

amycastor.com/2021/01/10/tet…

51/ Deltec, the bank that finances #TetherScam, revealed having bought bitcoin for their client at ~ 9k. Any guess who that client is?

https://twitter.com/lenne0816/status/1349818949249204238?s=21

52/ Here's an official article:

https://twitter.com/coindesk/status/1349852454465261568?s=21

53/ One of the best (recent) articles I came across regarding the #TetherScam.

I've attached some select screenshots that seemed pretty important.

crypto-anonymous-2021.medium.com/the-bit-short-…

I've attached some select screenshots that seemed pretty important.

crypto-anonymous-2021.medium.com/the-bit-short-…

54/ As we know, if #tether were legit, no exchange would NOT want to have it trading on their own platform, as it constitutes 70% of the buying activity for bitcoin and many other cryptocurrencies.

Yet, Coinbase and Bitstamp don't support #tether. THEY KNOW it's too risky.

Yet, Coinbase and Bitstamp don't support #tether. THEY KNOW it's too risky.

55/ #Tether has coincidentally issued more #tether as their legal trouble intensified. After their last appeal was dismissed, they started printing at a furious pace.

56/ What's #tether's Achilles' heel? @krakenfx. Kraken is the only place where you can exchange $USDT for actual USD.

If you convert enough of your $USDT, you will force the peg to break and all hell runs loose.

Please read the entire article! It's golden.

If you convert enough of your $USDT, you will force the peg to break and all hell runs loose.

Please read the entire article! It's golden.

• • •

Missing some Tweet in this thread? You can try to

force a refresh