BREAKING: #Tesla misses its yearly delivery forecast by 500,450 units maybe, 450 units definitely & its Robotaxi forecast by at least 1,000,001 units.

1/

$TSLA $TSLAQ

businessinsider.com/elon-musk-hedg…

1/

$TSLA $TSLAQ

businessinsider.com/elon-musk-hedg…

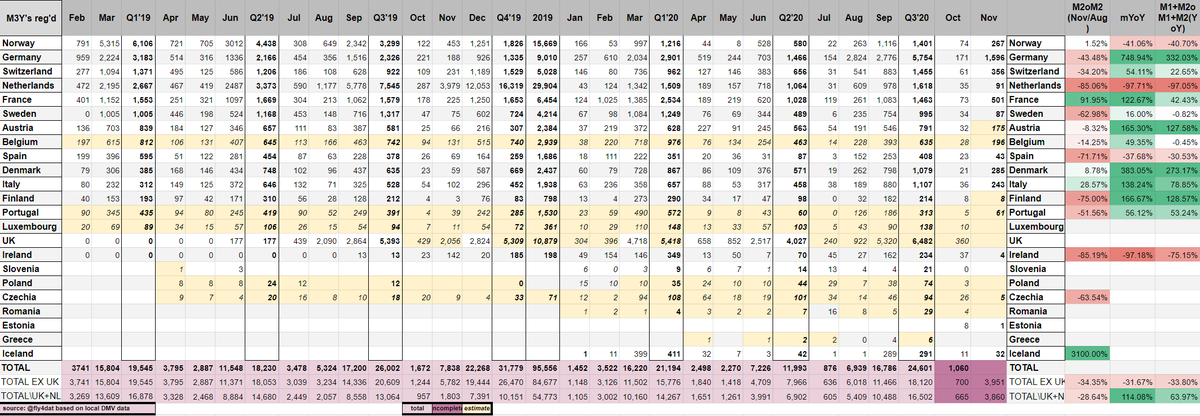

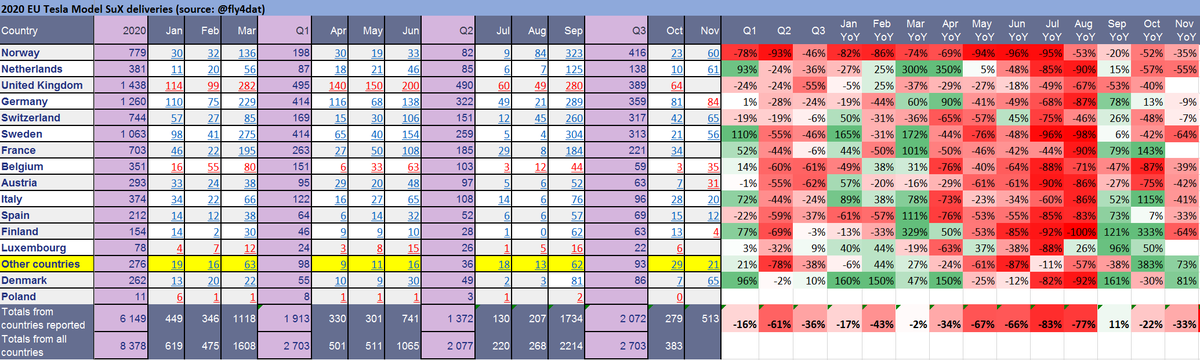

2/ Tesla has made 12.5k more Model 3's than it has sold in 2020, even after having started the year with ample inventory. #Tesla isn't production constrained, it's demand constrained.

$TSLA $TSLAQ

$TSLA $TSLAQ

3/ #Tesla had at least 635k stated production capacity, accounting for shutdowns (and a bit more). We know that in reality, Shanghai made more than stated capacity. That's 80% utilization. Skoda runs at 120%. $TSLA isn't production constrained, it's demand constrained.

$TSLAQ

$TSLAQ

4/ #Tesla has cut prices more times than I can count just to slightly miss the several times revised, last time in July stated targets. By July, in fact April, the pandemic should have been over according to the CEO, so it shouldn't have affected anything

https://twitter.com/StultusVox/status/1345382695153623046?s=20

5/ #Tesla has missed its Robotaxi guidance by at least 1,000,001 units.

The status of Robotaxis fluctuates more heavily than COVID symptoms in more severe cases.

The status of Robotaxis fluctuates more heavily than COVID symptoms in more severe cases.

https://twitter.com/fly4dat/status/1295265926221365248?s=20

6/ What doesn't fluctuate: most analysts, bulls and journalists cheer results of the car-maker that's valued more than all non-Chinese car-makers combined but Toyota, despite making half as many cars as Subaru, for a mkt cap/car of $1,380M, that's 151 times more than VW's.

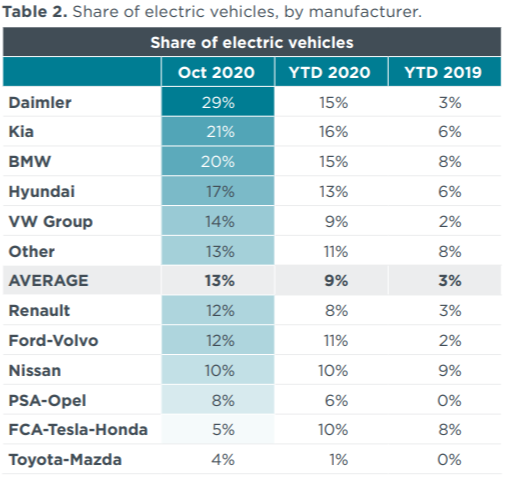

7/ VW sold more than half as many BEVs as #Tesla in Q4, has an installed BEV capacity of ~1.2M/yr, will likely beat $TSLA in 2021 in BEVs (or get dangerously close), and another ~10M ICE cars and a few hundred thousand trucks, buses and motorbikes come as a bonus for 1/7 $TSLAQ.

8/ After $TSLA's SP increasing by 740% in 2020, one would think investors shall be cautious. But the EV bubble shows that there is still some space for Tesla to improve as Chinese rivals are far ahead in mkt cap/car sold.

9/ To sum up, after my substantial short losses on #Tesla, I've finally learned how to play this game, and developed a method to accurately predict $TSLA's share price. Trade carefully, $TSLAQ.

https://twitter.com/fly4dat/status/1344806178484875266?s=20

• • •

Missing some Tweet in this thread? You can try to

force a refresh