1/ Ever since my #tether thread, crypto diehards have alleged that Tether printing is just market-driven.

More investors = more demand = more #tether being generated.

There is no strong evidence for this.

In fact, in this thread, I argue the complete opposite. 👇

More investors = more demand = more #tether being generated.

There is no strong evidence for this.

In fact, in this thread, I argue the complete opposite. 👇

2/ The following comes from a paper published in July 2020, with my additional commentary.

onlinelibrary.wiley.com/doi/full/10.11…

onlinelibrary.wiley.com/doi/full/10.11…

3/ [..] large entities have gained centralized control over the vast majority of operations in the cryptocurrency world, such as centralized exchanges that handle the majority of transactions and stable coin issuers that can control the supply of money like a central bank.

4/ These centralized entities operate largely outside the purview of financial regulators and offer varying levels of limited transparency.

5/ [..] operating based on digital stable coins rather than fiat currency further relaxes the need for these entities to establish a legitimate fiat banking relationship.

#Tether, [..] accounts for more #Bitcoin transaction volume than the U.S. dollar (USD).

#Tether, [..] accounts for more #Bitcoin transaction volume than the U.S. dollar (USD).

6/ The objective of #Tether is to facilitate transactions between cryptocurrency exchanges with a rate pegged to the USD. While this could also occur with fiat transactions, Tether is advantageous because many cryptoexchanges have difficulty securing banking relationships.

7/ A currency that can provide a stable store of value, support quick transactions, and potentially allow cryptocurrency exchanges to skirt banking regulations required for traditional deposits has an intuitive appeal.

8/ Like I already said in the previous thread, this might explain why stablecoins such as $USDC have seen very little adoption when compared to #tether.

9/ The paper tests two main hypothesis: whether Tether is “pulled” (demand-driven), or “pushed” (supply-driven).

10/ Under the pulled hypothesis, #Tether is driven by legitimate demand from investors who use Tether as a medium of exchange to enter their fiat capital into the cryptospace because it is digital currency with the stability of the dollar “peg.”

11/ In this case, the price impact of Tether reflects natural market demand.

12/ Alternatively, under the “pushed” hypothesis, Bitfinex prints Tether regardless of the demand from cash investors, and additional supply of Tether can create inflation in the price of Bitcoin that is not due to a genuine capital flow.

13/ In this setting, Tether creators have several potential motives. 👇

First, if the Tether creators, like most early cryptocurrency adopters and exchanges, have large holdings of Bitcoin, they generally profit from the inflation of the cryptocurrency prices.

First, if the Tether creators, like most early cryptocurrency adopters and exchanges, have large holdings of Bitcoin, they generally profit from the inflation of the cryptocurrency prices.

14/ Second, coordinated supply of Tether creates an opportunity to manipulate cryptocurrencies—when prices are falling, the Tether creators can convert their large Tether supply into Bitcoin in a way that pushes Bitcoin up and then sell some Bitcoin back into dollars in a…

15/ …venue with less price impact to replenish Tether reserves.

16/ Finally, if cryptocurrency prices crash, the founders essentially have a put option to default on redeeming Tether, or to potentially experience a “hack” or insufficient reserves where by Tether-related dollars disappear.

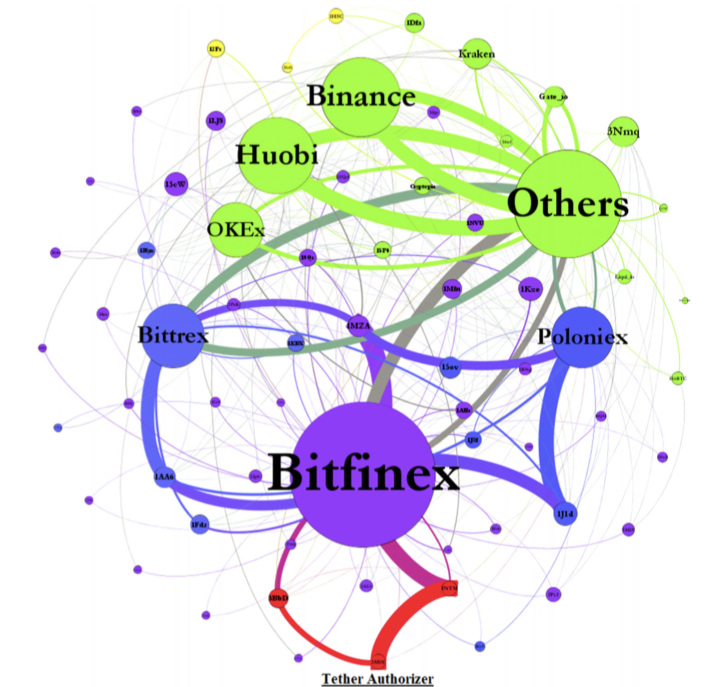

17/ #Tether is authorized, moved to Bitfinex, and then slowly distributed to other Tether-based exchanges, mainly Poloniex and Bittrex.

18/ The graph shows that almost no Tether returns to the Tether issuer to be redeemed, and the major exchange where Tether can be exchanged for USD, Kraken, accounts for only a small proportion of transactions.

19/ [this is] consistent with individuals stating that it is not feasible to move Tether back to Tether Limited to redeem for USD.

20/ We examine the flow of coins identified above to understand whether Tether is pushed or pulled, and the effect of Tether, if any, on Bitcoin prices.

21/ First, following periods of negative Bitcoin returns, Tether flows from Bitfinex to Poloniex and Bittrex, and in exchange, Bitcoin is sent back to Bitfinex.

22/ Second, when there are positive net hourly flows from Bitfinex to Poloniex and Bittrex, Bitcoin prices move up over the next three hours, resulting in predictably high Bitcoin returns.

23/ The price impact is present after periods of negative returns and periods following the printing of Tether, that is, when there is likely an oversupply of Tether in the system.

This phenomenon strongly suggests that the price effect is driven by Tether issuances.

This phenomenon strongly suggests that the price effect is driven by Tether issuances.

24/ Additionally, the price impact is strongly linked to trading of the ONE large player and not to other accounts on Poloniex, Bittrex, or other Tether exchanges.

25/ This one large player or entity either exhibited clairvoyant market timing or exerted an extremely large price impact on Bitcoin that is not observed in the aggregate flows from other smaller traders.

26/ Such trading by this one player is also large enough to induce a statistically and economically strong reversal in Bitcoin prices following negative returns.

27/ Investors hoping to stabilize and drive up the price of an asset might concentrate on certain price thresholds as an anchor or price floor, the idea being that if investors can demonstrate a price floor, then they can induce other traders to purchase.

28/ [..] a large literature demonstrates the importance of price anchoring for a variety of assets. Such an anchor could be of particular importance for cryptocurrency prices, for which the underlying value cannot be gauged through fundamentals.

29/ Additionally, cryptocurrency traders likely engage in technical trading whereby past price movements generate buy and sell signals.

30/ If Tether is used to stabilize market prices during a downturn, one might expect a spike in the flow of Tether around round thresholds, as this might induce other traders, upon observing technical support at the threshold, to purchase as well.

31/ Interestingly, Bitcoin purchases from Bitfinex strongly increase just below multiples of 500.

This pattern is present only in periods following printing of Tether, is being driven by the single large account holder, and is not observed by other exchanges.

This pattern is present only in periods following printing of Tether, is being driven by the single large account holder, and is not observed by other exchanges.

32/ Translation: Bitfinex has people whose entire job is (trying) to manipulate the market at psychological price support levels, in the hopes that the ACTUAL market continues the trend they fraudulently started.

33/ The patterns observed above are consistent with either one large player purchasing Tether with cash at Bitfinex and then exchanging it for Bitcoin, or Tether being printed without cash backup and pushed out through Bitfinex in exchange for Bitcoin.

34/ If Tether is pushed out to other cryptoexchanges rather than demanded by cash investors, then it may not be always fully backed. To show the full reserve, Bitfinex might therefore have to liquidate their Bitcoin reserve to support their end-of-month (EOM) bank statements.

35/ Interestingly, we find a significant negative EOM abnormal return of 6% in the months with strong Tether issuance and no abnormal returns in months when Tether is not issued.

36/ Since these patterns are driven primarily by only a few EOMs with large Tether issuance, we test further and find that the EOM effect is stronger in a value-weighted index of the largest cryptocurrencies and is also present around a publicized mid-month balance statement.…

37/ …Moreover, Bitfinex’s reserve wallets on the blockchain data exhibit large significant balance decreases in days prior to EOMs with large Tether printing.

This pattern is not present in reserve wallets on any other exchanges.

This pattern is not present in reserve wallets on any other exchanges.

38/ Our results are generally consistent with Tether being printed unbacked and pushed out onto the market, which can have an inflationary effect on asset prices.

39/ While other tests do not speak to capital backing, the EOM patterns are inconsistent with the “pulled” hypothesis since they indicate a lack of dollar reserves.

40/ Nevertheless, we further examine a direct implication of the “pulled” hypothesis by testing whether the flows of Tether bear a relation to a proxy for its demand from investors, namely the premium for Tether relative to the USD.

41/ We find little evidence to support this demand-based hypothesis [..] In sum, while we expect that there are some sources of legitimate demand for Tether, they do not appear to dominate the Tether flow patterns observed in the data.

42/ Is the Price Effect Economically Important?

What is the cumulative economic magnitude of the effects of Tether on Bitcoin and other cryptocurrencies?

What is the cumulative economic magnitude of the effects of Tether on Bitcoin and other cryptocurrencies?

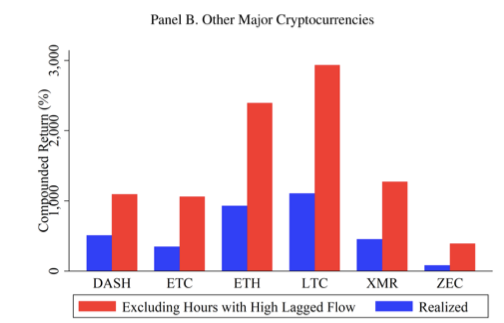

43/ From March 1, 2017 to March 31, 2018, the actual Bitcoin price rose from around $1,191 to $6,929 for a return of 481.8%. In contrast, the price series without the 95 Tether-related hours ends at around $3,555, for an increase of 198.5%.

44/ Hence, the 1% of hours with the strongest lagged Tether flow are associated with 58.8% of the Bitcoin buy-and-hold return over the period.

45/ The percentage of the buy-and-hold return that is attributable to the Tether-related hours ranges from 53% for #Dash to 79% for #Zcash.

Across the six other cryptocurrencies, returns are 64.5% smaller on average when removing the 95 Tether-related flow hours.

Across the six other cryptocurrencies, returns are 64.5% smaller on average when removing the 95 Tether-related flow hours.

46/ What does this mean? That as much as 60% of the "boom" major cryptos experienced would have never happened without fake #tether printing, still returning ~ 200% in case of #Bitcoin, but far below the "fake" ~ 500% return.

47/ In summary: we find that purchases with Tether are timed following market downturns and result in sizable increases in #Bitcoin prices.

48/ The flow is attributable to one entity, clusters below round prices, induces asymmetric autocorrelations in @Bitcoin, and suggests insufficient @Tether reserves before month-ends.

49/ Rather than demand from cash investors, these patterns are most consistent with the supply-based hypothesis of unbacked digital money inflating cryptocurrency prices.

50/ Of course, the difference between the 2017-2018 boom and the 2020 boom is the buying of #bitcoin by institutional investors. This buying is far outweighed by the frantic #tether printing, which moved from ~2B in the '17-'18 boom, to 21B+ in the 2020 (and beyond) boom.

51/ On a final note, I'd like to point out how #tether concerns are being dismissed as "FUD" by most in the crypto industry. Most posts on websites such as Reddit's /r/cryptocurrency gather zero activity and/or replies when #tether is being brought up.

52/ This indicates a high level of bias in wanting to bury any narrative that will make the bubble "pop", as crypto in its current form relies on a constant stream of new investors to allow previous investors to cash out.

53/ I'll take this opportunity to say I personally have "skin in the game", which I find important when discussing these matters. And a potential collapse of the crypto market would not do me (financially) any favors.

54/ Original tether thread here:

https://twitter.com/pat_jane_crypto/status/1344673896675618818?s=21

• • •

Missing some Tweet in this thread? You can try to

force a refresh