It is difficult to change a 10-year trend.

Long-term expectations do not change as frequently as daily market fluctuations would make it seem.

A quick update on Treasury rates through the lens of the DKW model

*As of Dec. 31*

1/

Long-term expectations do not change as frequently as daily market fluctuations would make it seem.

A quick update on Treasury rates through the lens of the DKW model

*As of Dec. 31*

1/

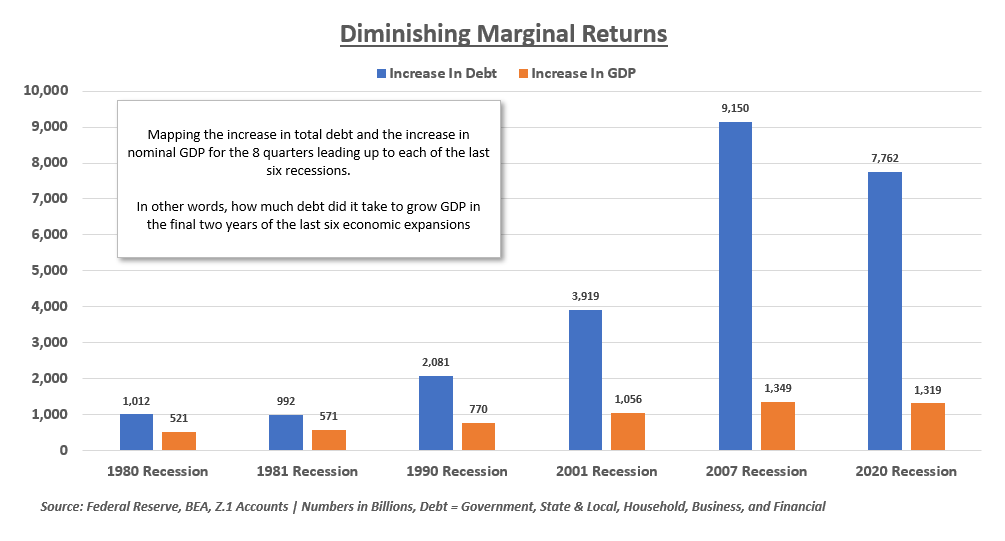

In previous threads, I made the distinction between long-term secular trends in growth and inflation and shorter-term (2-6 quarters) trends in nGDP growth

2/

https://twitter.com/EPBResearch/status/1346101439756570625?s=20

2/

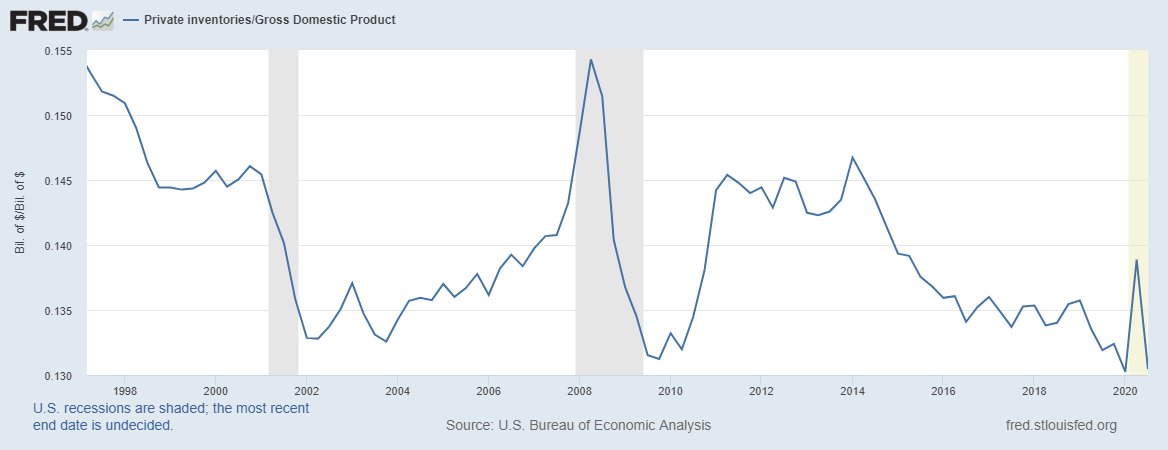

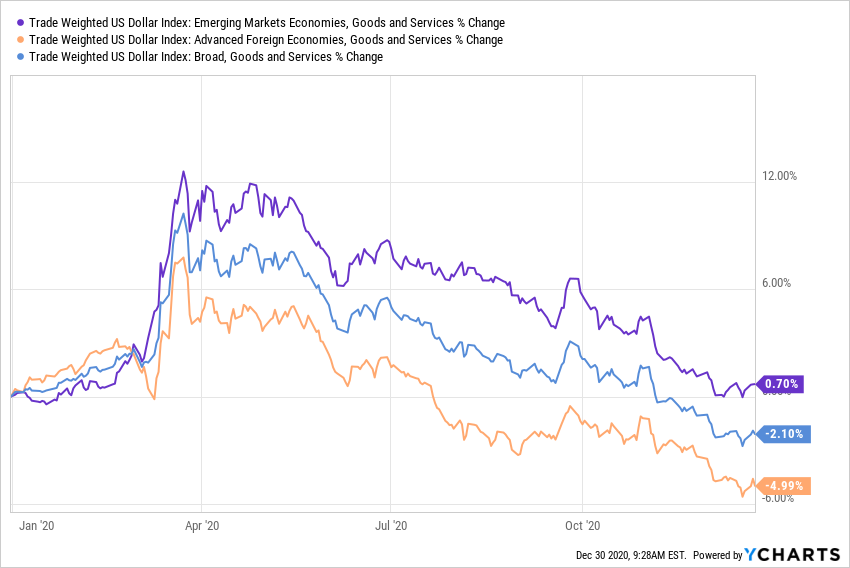

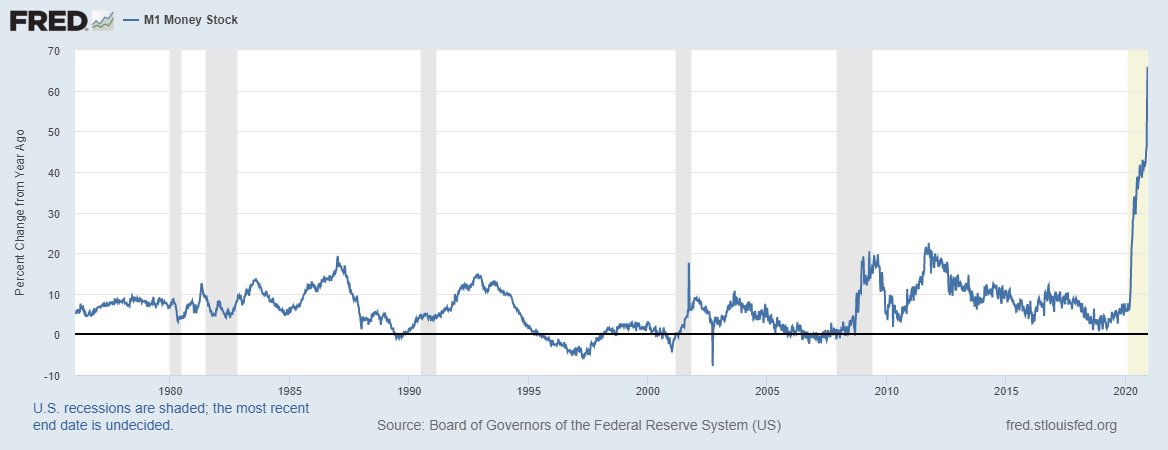

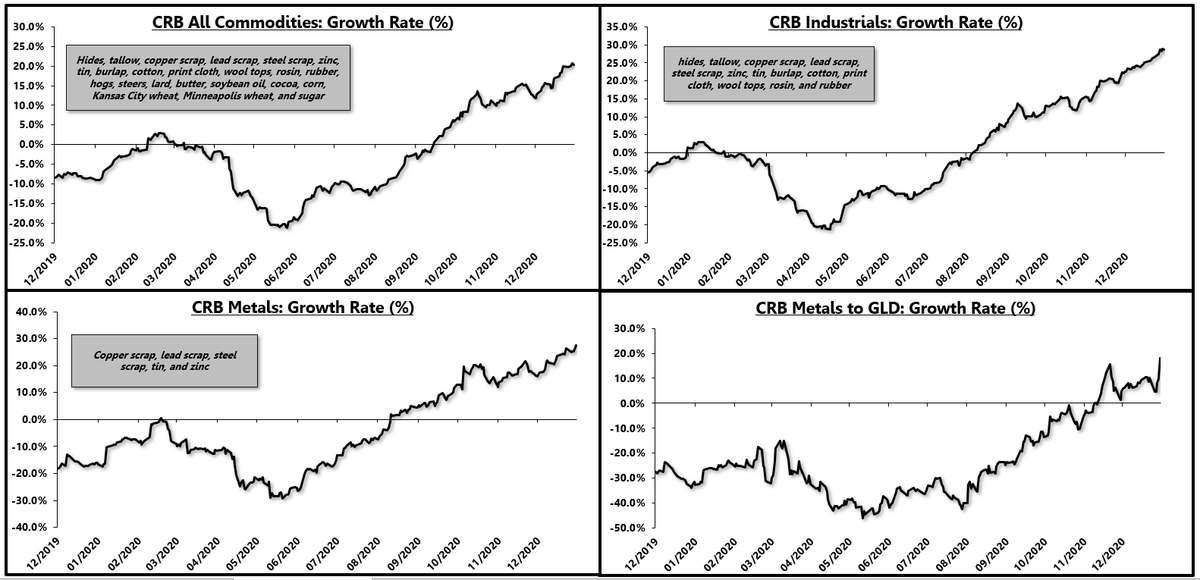

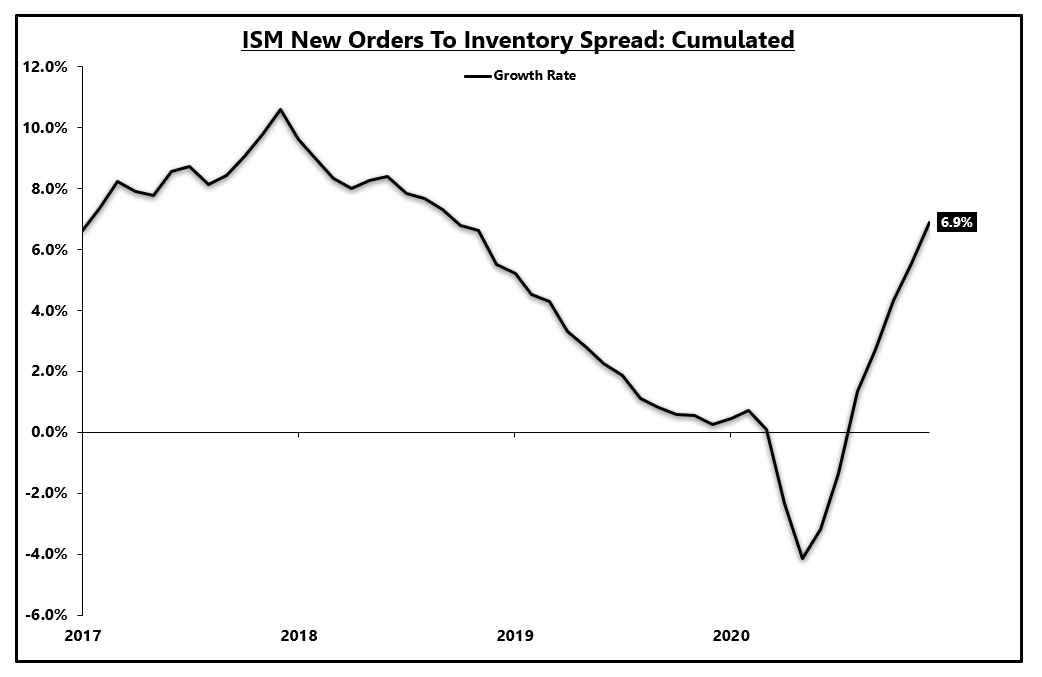

Right now, the long-term trends are unaltered because long-term trends just don't change that fast but we have a very strong cyclical upturn in the economy, centered primarily on the shift to goods consumption bolstering the manufacturing sector and industrial commodities.

3/

3/

As long as the industrial sector continues to roar, TSY rates will have an upward bias as rates generally follow the trend in nGDP growth

A 10yr TSY has longterm expectations embedded in the rate so several qrters, while important, won't necessarily change the longterm trend

4/

A 10yr TSY has longterm expectations embedded in the rate so several qrters, while important, won't necessarily change the longterm trend

4/

This is confirmed by the Dec update to the DKW model which breaks down *actual* inflation expectations, the expected real short-term rate (real growth), term premium, liquidity premium etc.

The DKW model is one of many models that is useful but has many limitations.

5/

The DKW model is one of many models that is useful but has many limitations.

5/

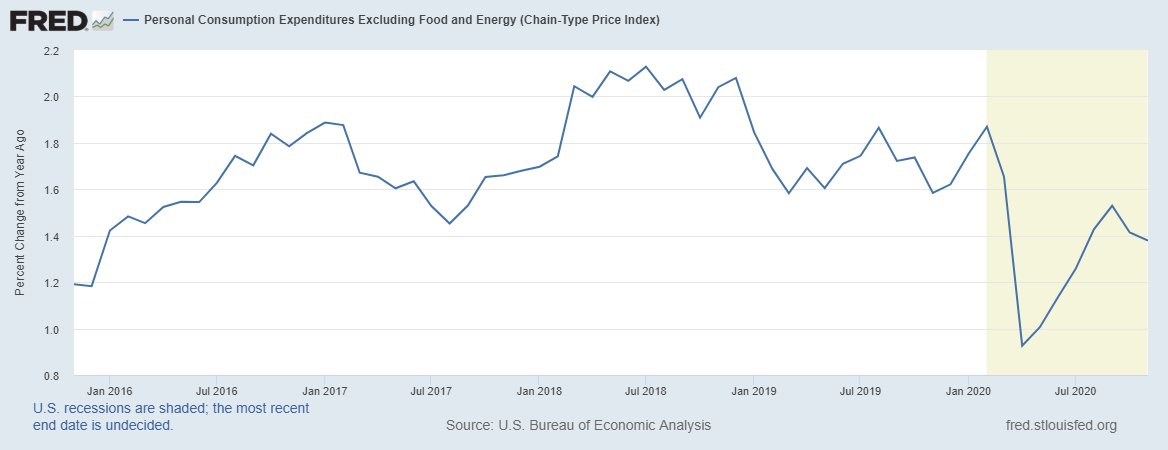

As of Dec 31, according to the DKW model, inflation expectations are directionally rising, in line with the industrial upturn, but have only increase ~12bps from the summer low.

It is hard to alter a long-term trend with just a couple of quarters.

6/

It is hard to alter a long-term trend with just a couple of quarters.

6/

Real growth expectations remain on the floor in the DKW model as (again) a transitory upturn in growth won't alter the 10-year average rate of growth all that much.

7/

7/

So what is causing the bulk of the move in Treasury rates?

The real term premium.

Expectations for massive fiscal spending rightfully won't alter the economy's long-term growth prospects but do place extra risk on duration in the near term.

8/

The real term premium.

Expectations for massive fiscal spending rightfully won't alter the economy's long-term growth prospects but do place extra risk on duration in the near term.

8/

Adding actual inflation expectations and the real ST rate expectations gives what I call the "fundamental" drivers of TSY rates which have increased cumulatively about 14bps since the summer.

This makes sense with the trend in nGDP growth.

9/

This makes sense with the trend in nGDP growth.

9/

In short, the long-term trends that have caused TSY rates to decline for decades are still in place.

Weaker growth and lower inflation over the long-run will depress the risk-free rate.

In the short-term (2-6 quarters), you have to follow the direction in nGDP growth.

10/

Weaker growth and lower inflation over the long-run will depress the risk-free rate.

In the short-term (2-6 quarters), you have to follow the direction in nGDP growth.

10/

Once this manufacturing upturn starts to fade (no signs yet) TSYs will be a great buy again as the next cyclical downturn in the economy will push the long-end to the zero-bound.

11/11

11/11

@R_Perli has more timely updates on this model and can perhaps shed some light on the January move in rates so far.

• • •

Missing some Tweet in this thread? You can try to

force a refresh