This is pretty fascinating. @0x_b1 is attempting to purchase votes on a controversial Compound proposal.

DeFi is totally permissionless, so this is totally within what is "allowed."

For those that want more context on what exactly is going on here, here's a quick thread.

👇

DeFi is totally permissionless, so this is totally within what is "allowed."

For those that want more context on what exactly is going on here, here's a quick thread.

👇

In November, the price of DAI on Coinbase spiked to around $1.30.

As Compound uses Coinbase as a pair for its oracle, users borrowing DAI and with low health ratios (often leveraged COMP farmers) saw their positions go underwater.

In total, 85,220,000 DAI was repaid.

As Compound uses Coinbase as a pair for its oracle, users borrowing DAI and with low health ratios (often leveraged COMP farmers) saw their positions go underwater.

In total, 85,220,000 DAI was repaid.

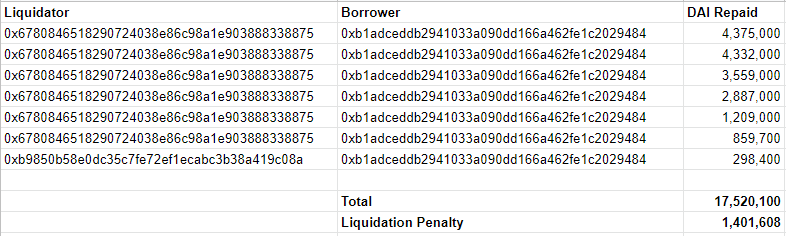

0xb1, in particular, was repaid 17,520,100 DAI.

The 8% liquidation penalty meant that 0xb1 "lost" around $1.4 million from their original deposit.

Prop 32 suggested that those affected by this liquidation event (some argue it was erroneous) should be compensated with COMP.

The 8% liquidation penalty meant that 0xb1 "lost" around $1.4 million from their original deposit.

Prop 32 suggested that those affected by this liquidation event (some argue it was erroneous) should be compensated with COMP.

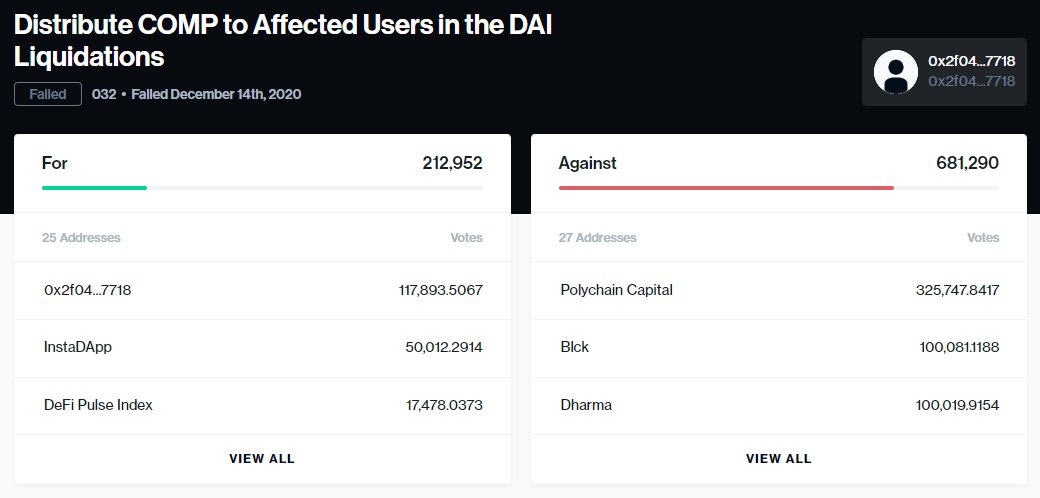

Prop 32 failed to pass (212,000 votes to 681,290 votes).

"For" included InstaDApp (which allows users to easily boot up leveraged DAI farms), DeFi Pulse Index, Kain, MonetSupply.

"Against" included Polychain, Argent, Dharma, Pantera Capital, ConsenSys, Calvin Liu of Compound.

"For" included InstaDApp (which allows users to easily boot up leveraged DAI farms), DeFi Pulse Index, Kain, MonetSupply.

"Against" included Polychain, Argent, Dharma, Pantera Capital, ConsenSys, Calvin Liu of Compound.

0xb1 is now proposing that someone should reintroduce the Prop, and says they will pay those who vote "For" 50% of their COMP (~$700,000/3,333 COMP) on a pro-rata basis.

Assuming "Fors" succeed and have the minimum quorum (200,001), each vote would be entitled to $0.285 in COMP.

Assuming "Fors" succeed and have the minimum quorum (200,001), each vote would be entitled to $0.285 in COMP.

Interested to see if this will happen.

An address needs more than 100,000 COMP in voting power to propose formal governance actions.

Alternatively, users with 100 COMP can deploy an Autonomous Proposal that needs to reach 100,000 votes to become a formal proposal.

An address needs more than 100,000 COMP in voting power to propose formal governance actions.

Alternatively, users with 100 COMP can deploy an Autonomous Proposal that needs to reach 100,000 votes to become a formal proposal.

• • •

Missing some Tweet in this thread? You can try to

force a refresh