"But have we *earned* it?"

Vitalik famously posed this question in late 2017, when the crypto market cap first reached $500 billion.

We're past $1 trillion now. Let's see what has changed in crypto, especially in Ethereum and DeFi, since then.

A thread. 👇

Vitalik famously posed this question in late 2017, when the crypto market cap first reached $500 billion.

We're past $1 trillion now. Let's see what has changed in crypto, especially in Ethereum and DeFi, since then.

A thread. 👇

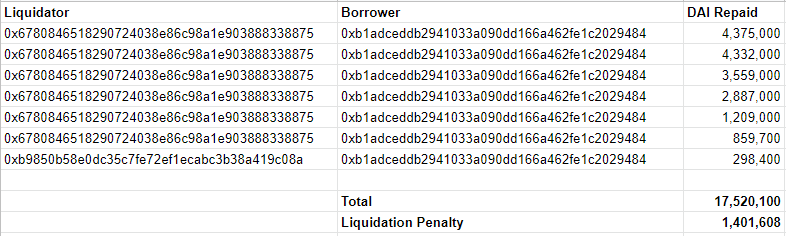

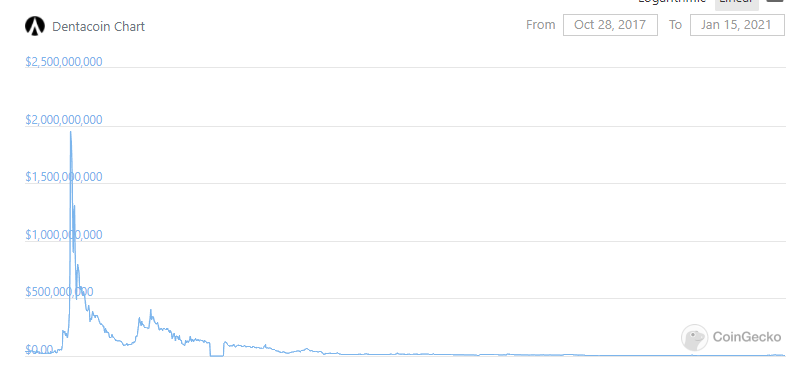

2017 and 2018 were marked by vaporware.

Projects like Dentacoin, which promised, uhhh, great things but had little to show for it, garnered hundreds of millions in value.

Look where they are now.

Literal billions in market cap reduced to ashes. And that's good.

Projects like Dentacoin, which promised, uhhh, great things but had little to show for it, garnered hundreds of millions in value.

Look where they are now.

Literal billions in market cap reduced to ashes. And that's good.

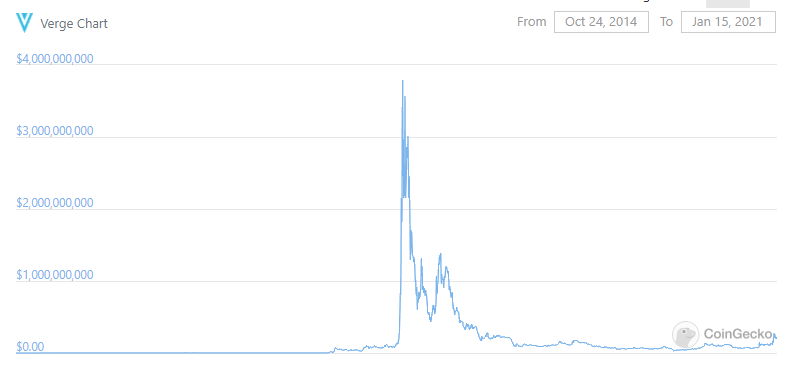

We've seen the capital allocated to these ghost projects seemingly flood toward quality.

Bitcoin dominance currently sits at 67% after bottoming at 33% in January 2018.

Ethereum dominance is also up from its lows.

Projects with big promises and no execution were flushed out.

Bitcoin dominance currently sits at 67% after bottoming at 33% in January 2018.

Ethereum dominance is also up from its lows.

Projects with big promises and no execution were flushed out.

Not all of the vaporware has been flushed out.

Many coins in the top 50 have yet to deliver on promises they made years ago.

But this is changing as coins like AAVE and SNX enter the crypto market's top 20.

Many coins in the top 50 have yet to deliver on promises they made years ago.

But this is changing as coins like AAVE and SNX enter the crypto market's top 20.

Not much has changed about bitcoin on a technical basis, but on a fundamental basis, I think it's stronger than ever.

The confluence of money printing, political uncertainty, and more is driving the need for a scarce reserve asset not controlled by any central party.

The confluence of money printing, political uncertainty, and more is driving the need for a scarce reserve asset not controlled by any central party.

Ethereum, too, is killing it.

While I loved CryptoKitties—and the gambling dApps were cool too—we're now seeing functional platforms used by hundreds of thousands built on Ethereum.

Think Uniswap. Think Aave. And so on.

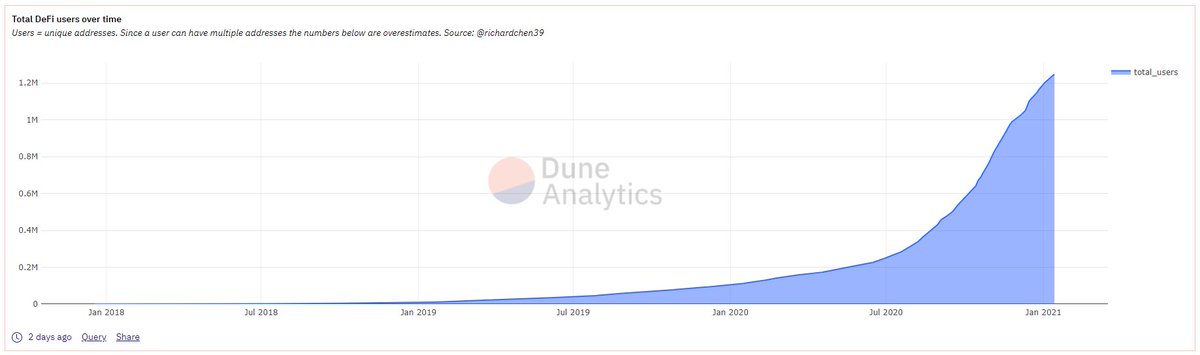

Today, over 1,000,000 unique addresses have used DeFi.

While I loved CryptoKitties—and the gambling dApps were cool too—we're now seeing functional platforms used by hundreds of thousands built on Ethereum.

Think Uniswap. Think Aave. And so on.

Today, over 1,000,000 unique addresses have used DeFi.

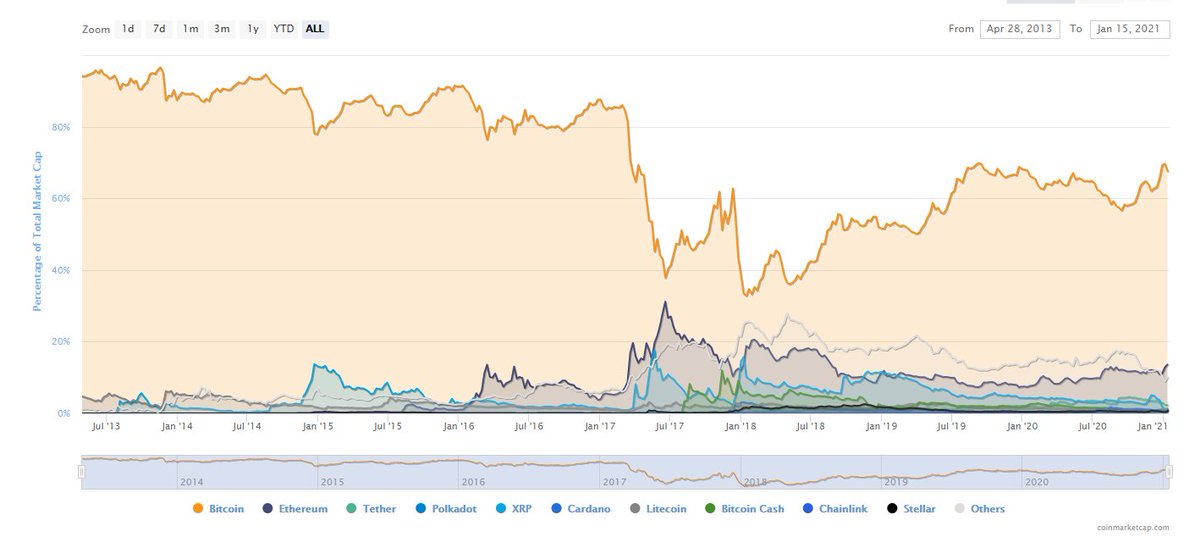

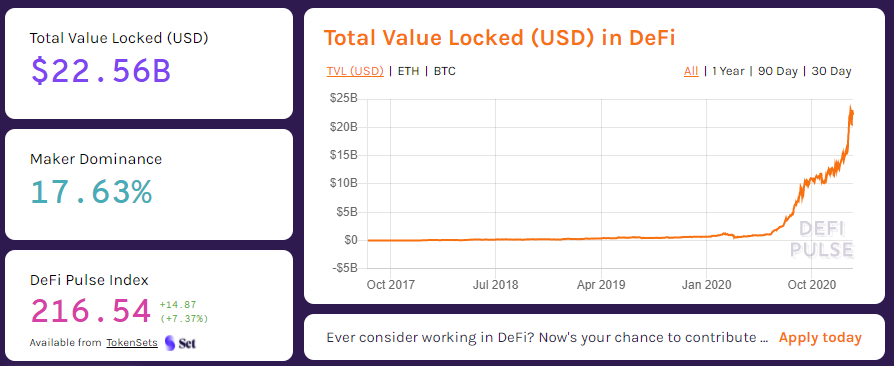

These 1,000,000+ unique addresses have deposited more than $20 billion worth of value into DeFi through the top protocols.

Today, DeFi's total TVL sits at $22.5 billion, up from the ~$50m TVL as of Christmas Day 2017.

That's growth of 49,400%. Not bad.

Today, DeFi's total TVL sits at $22.5 billion, up from the ~$50m TVL as of Christmas Day 2017.

That's growth of 49,400%. Not bad.

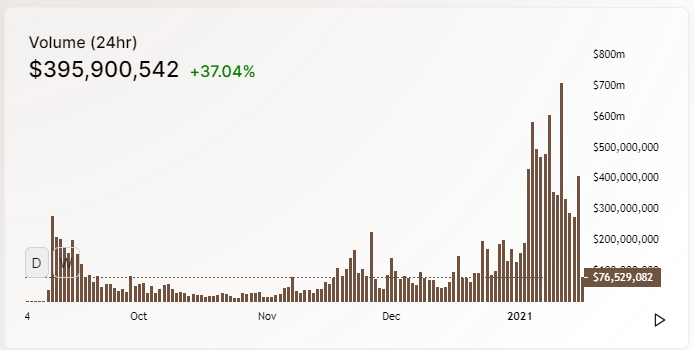

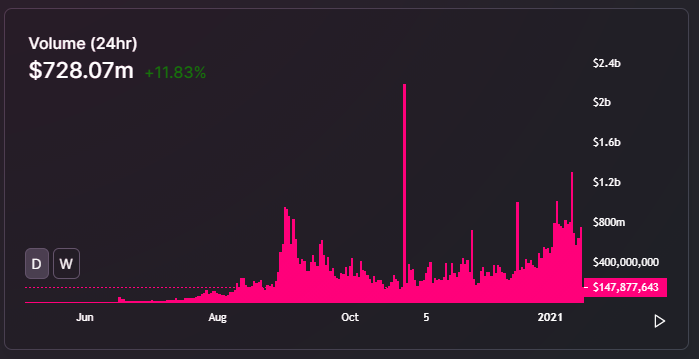

We have also seen Uniswap, SushiSwap, and other DEXs start to rival centralized exchanges.

SushiSwap did $395m in volume today. Uniswap did $728m.

Per @coingecko, Gemini did $275m, Bitflyer did $480m, and KuCoin did $453m.

Gone are the days of clunky DEX experience.

SushiSwap did $395m in volume today. Uniswap did $728m.

Per @coingecko, Gemini did $275m, Bitflyer did $480m, and KuCoin did $453m.

Gone are the days of clunky DEX experience.

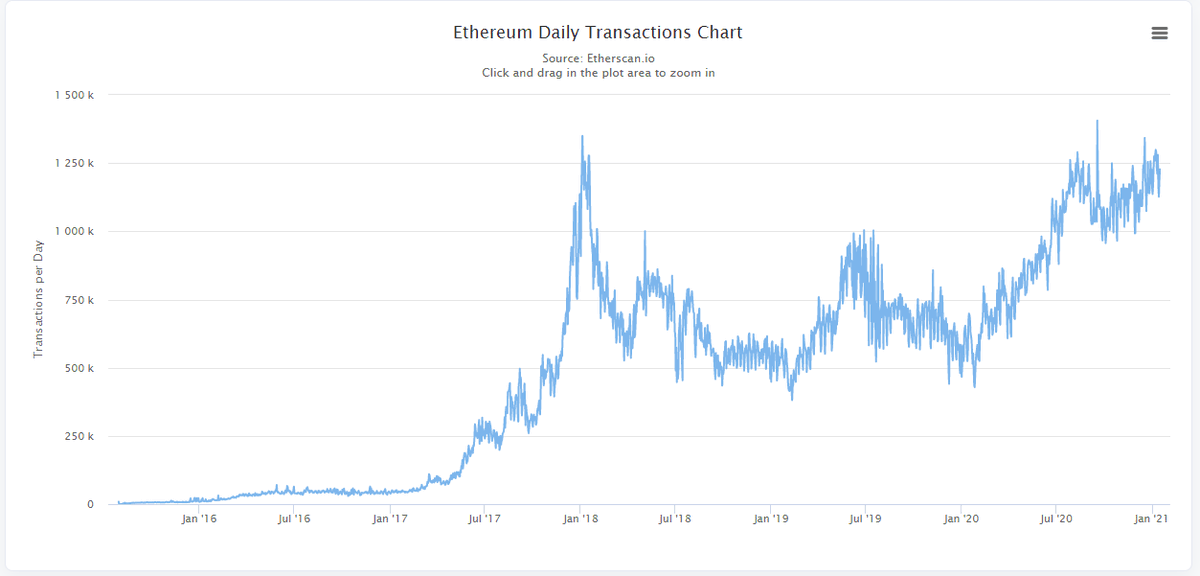

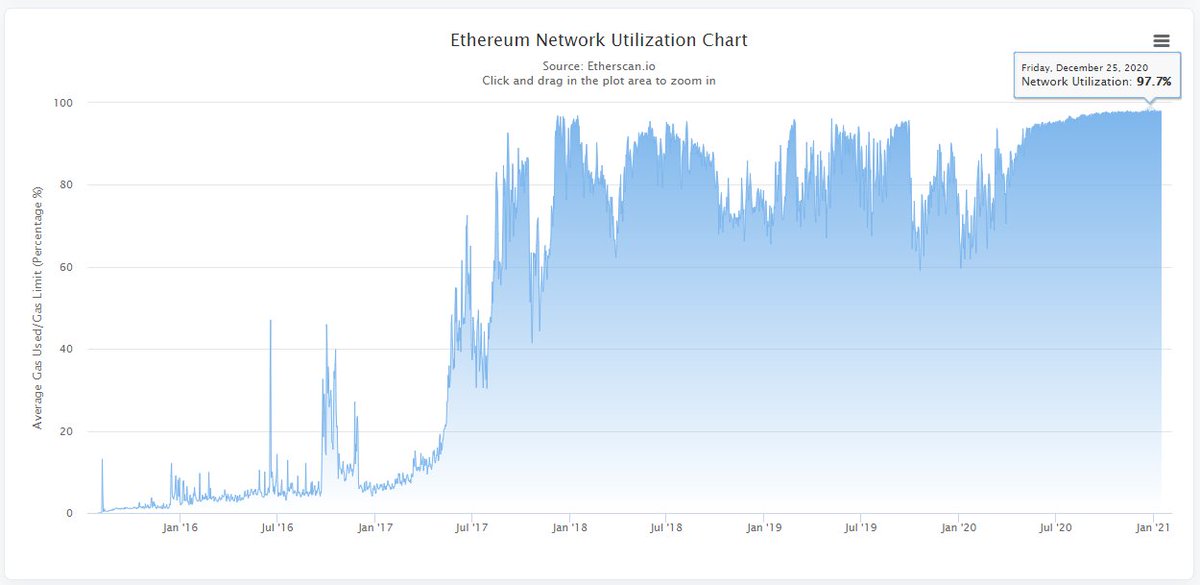

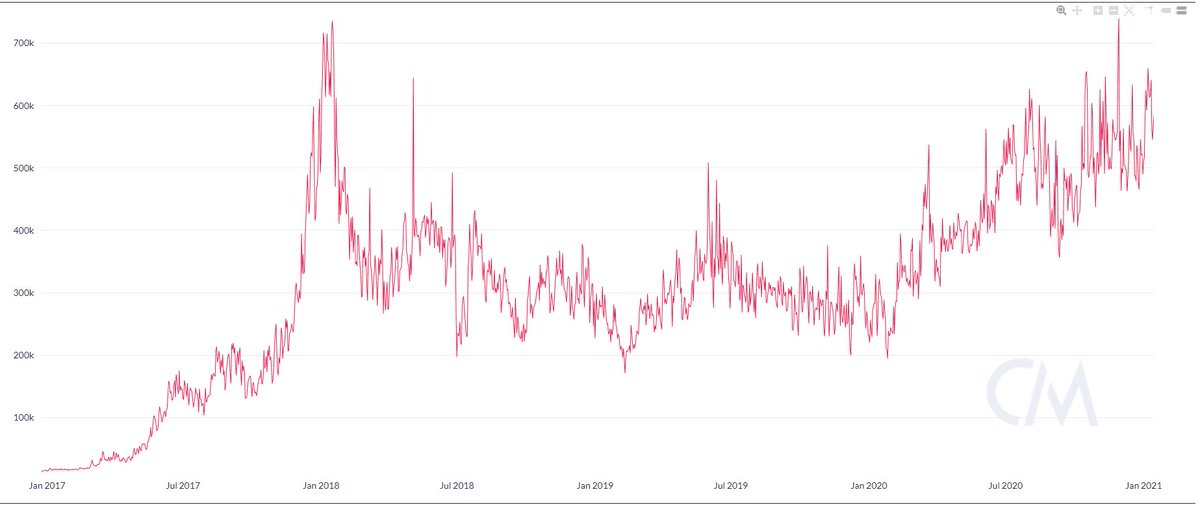

On a blockchain level, the numbers are looking good as well.

Ethereum daily transactions are basically at all-time highs.

Network utilization is consistently above 95%.

The number of active Ethereum addresses is consistently above 500,000.

Ethereum daily transactions are basically at all-time highs.

Network utilization is consistently above 95%.

The number of active Ethereum addresses is consistently above 500,000.

So, do we deserve $1t?

Maybe.

All I know for sure is that we're a lot more deserving than we were in 2017.

Capital is flooding towards quality assets that are proving they have a purpose and viable future. DeFi is at the core of that.

Maybe.

All I know for sure is that we're a lot more deserving than we were in 2017.

Capital is flooding towards quality assets that are proving they have a purpose and viable future. DeFi is at the core of that.

• • •

Missing some Tweet in this thread? You can try to

force a refresh