Trickle and then a deluge 👇

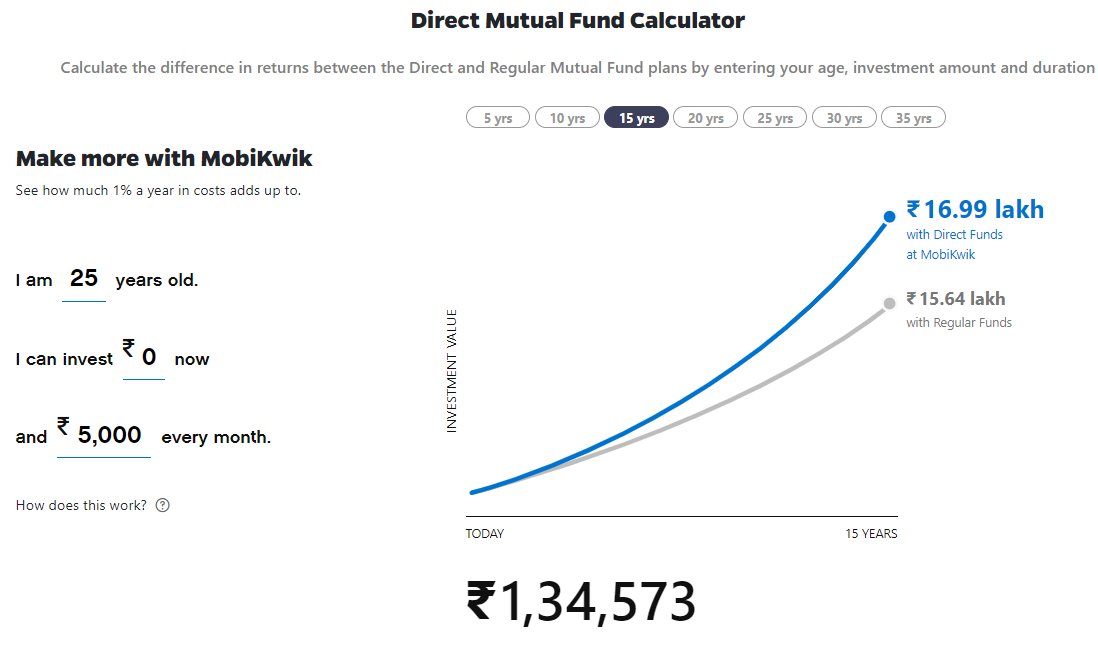

Slow but steady growth in index fund AUM. for all those people crying about then, there's about 1.5 lakh cr in large funds and just 12000 cr index funds for comparison. Excluding g the EPFO ETF allocations.

Slow but steady growth in index fund AUM. for all those people crying about then, there's about 1.5 lakh cr in large funds and just 12000 cr index funds for comparison. Excluding g the EPFO ETF allocations.

https://twitter.com/KalpenParekh/status/1351225929981456385

I don't think this number will dramatically change until we have a mega market crash. Crashes are the only things that seem to remind investors how most actively managed mutual funds are useless.

It took 2008 for Index fund/ETF adoption to see a hockey stick growth globally. And it will the same here. Given the steady rise since 2014, most investors have seen some green in their portfolios which means they haven't looked closely at the performance they're getting.

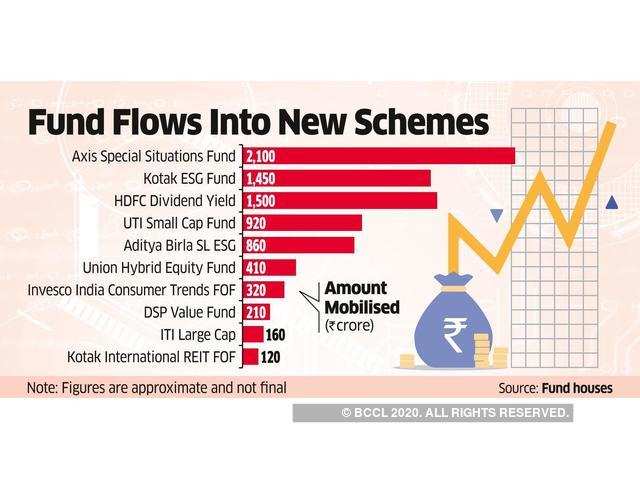

But the other issue is that every AMC is now filing to launch index funds and ETFs seemingly undercutting the other. This will be a net negative. These people seem to be launching these funds because they've done well.

And this good performance of index funds will reverse. This might mean that these guys will again abandon these products like ugly ducklings and we'll see another batch of terribly managed index funds and ETFs that track poorly.

Next thing. There have been 7 straight months of net outflows in mutual funds. And is this market party stops, this will get uglier. If active focussed AMCs aren't taking in enough fees money, will the low expense ratios on index funds continue?

We're already seeing AMCs raise expense ratios across most of the debt fund categories. Select AMCs have raised on equity funds. Only a matter of time before equity expense ratios rise too.

https://twitter.com/PrashantmET/status/1350812913485836288?s=20

Lastly, if you hate index funds a d are a salaried employee, congrats you're an index fund investor in your EPF, 😂

Just so we're clear at 12000 cores nobody cares about index funds and ETFs. Without advisors to push them, this won't change in a hurry. Nothing makes a product popular like a 80bps commission. Unfortunately index funds are below poverty to line to pay high commissions

• • •

Missing some Tweet in this thread? You can try to

force a refresh